Revenue

Klarna reported total revenue of $2.43B in the first nine months of 2025 ($903M in Q3, $823M in Q2, $701M in Q1), up 24% year-over-year. Q3 2025 revenue of $903M represented 26% YoY growth, with GMV reaching $32.7B (+23% YoY) and 114 million active customers (+32% YoY). The company posted a net loss of $95M in Q3 and a net loss of $53M in Q2 (including a $24M charge for office space reduction). Klarna reported adjusted operating income of $29M in Q2 2025, marking its fifth consecutive quarter of operational profitability. Q1 2025 reported a net loss of $99M.

For full-year 2024, Klarna generated $2.81B in revenue, up 24% year-over-year. GMV reached $105B in 2024, a 14% increase from 2023 ($92B GMV). Klarna delivered $21M in net profit for 2024 (0.7% margin) while posting a $121M operating loss. Consumer credit losses rose to ~$495M (~17.6% of revenue). U.S. revenue reached roughly $850M in 2024 (+39% YoY), making the U.S. Klarna's largest market. Take rate expanded to ~2.7% in 2024 as revenue growth outpaced GMV, driven by a mix shift toward financing/late fees and growth in ads & merchant services.

Klarna achieved profitability in Q4 2023, reporting net income of $155M—the first since 2019. Operating losses for 2023 fell to $395M (down 76% from $1.65B in 2022). Consumer credit loss rate improved to 0.78% in Q4 2023 (from 0.96% in Q4 2022). In Q2 2025, Klarna reported provision for credit losses of 0.56% as a percentage of GMV. Realized losses were 0.45% of GMV in Q2 2025 (down from 0.48% in Q2 2024), and 0.44% of GMV in Q3 2025. Subsequent full-year 2024 results reflect higher absolute credit losses alongside rising U.S. mix.

Klarna reported 111 million active consumers and 790,000 merchants as of Q2 2025, growing to 850,000 merchants by Q3 2025. The company provided Q4 2025 revenue guidance of $1.065B–$1.080B and GMV guidance of $37.5B–$38.5B.

Valuation & Funding

In September 2025, Klarna completed its IPO on the New York Stock Exchange under ticker "KLAR," raising $1.4B at a $15B opening valuation. The company initially priced 34.3 million shares at $40 (above the indicated $35-$37 range), with shares opening at $52 before settling at $45.82 on the first day of trading. The majority of shares sold were from existing investors, with Sequoia Capital remaining Klarna's largest shareholder at nearly 23%.

As a private company, Klarna assembled a little over $3.7B of private equity capital—early growth money from DST Global and General Atlantic, a U.S.-expansion round led by Dragoneer in 2019, a 2020 round from Silver Lake with GIC and BlackRock, a $31B step-up in March 2021, a $45.6B peak via SoftBank Vision Fund 2 that June, and an $800M recap in July 2022 at a $6.7B valuation.

Notable backers across rounds include Sequoia Capital, Silver Lake, SoftBank Vision Fund 2, Dragoneer, DST Global, General Atlantic, GIC, BlackRock, Commonwealth Bank of Australia, Visa, and H&M.

Beyond equity, Klarna has recently augmented funding with a €1.4B warehouse facility from Santander (executed August 2025, backed by German receivables) and a U.S. forward-flow program with Nelnet to purchase up to $26B of Pay in 4 receivables over the multi-year program life (announced August 2025).

Product

Founded in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson while students at the Stockholm School of Economics, Klarna found initial product-market fit with Swedish online electronics retailers, offering a "pay after delivery" option that increased conversion rates by 20-30%. By 2010, Klarna was processing 40% of all Swedish online payments, demonstrating strong market penetration.

Klarna offers the ability to pay for purchases with 4 biweekly interest-free payments, increasing merchant conversion rates. The core product offering consists of five payment options:

- Pay Now: Immediate, one-time payment

- Pay in 30 days: Full payment within 30 days

- Pay in 3: Three interest-free installments over 60 days

- Pay in 4: Four interest-free installments over 6 weeks

- Financing: 6 to 36 monthly installments with interest

Klarna's platform integrates with e-commerce websites, replacing traditional checkouts. It uses AI-driven credit checks to instantly approve purchases, allowing customers to buy items with minimal friction. For merchants, Klarna assumes all credit risk, paying them upfront while managing customer payments.

The company's growth has been impressive, with GMV increasing to $92 billion in 2023, a 17% year-over-year growth. Early cohort data showed purchase frequency increasing from 10x in year 2 to 20x by year 7, indicating strong customer retention. By 2019, 70% of GMV came from repeat customers.

Since its early days, Klarna has significantly expanded its product offerings beyond BNPL services:

Klarna Card: A physical Visa card that brings Klarna's payment options to in-store purchases. The card has achieved rapid adoption, reaching 4 million sign-ups by Q3 2025.

Klarna App: A comprehensive shopping platform with features like price drop notifications, delivery tracking, and carbon footprint insights.

AI Shopping Assistant: An AI-powered tool that helps users find products and compare prices across multiple retailers.

Klarna Ads / Retail Media: Higher-margin merchant services that contribute to take-rate expansion.

AI Customer Support: Klarna has deployed an AI assistant powered by OpenAI that handled 2.3 million conversations—about two-thirds of customer service chats—in its first month (early 2024), doing work equivalent to 700 full-time agents and contributing an estimated $40M in profit improvement for 2024. The AI now handles work equivalent to about 850 human agents (as of February 2025). Klarna is repositioning human support as a premium "VIP treatment" tier and testing an "Uber-like" staffing model that recruits customer-support workers from its own user base.

Agentic Product Protocol: An open standard that makes 100M+ products instantly discoverable by AI agents. The protocol enables machine-readable product data and inventory to flow directly into agent interfaces, improving search and conversion. It covers 100M+ products and 400M prices across 12 markets, creating a distribution layer for merchants across AI-native channels.

KlarnaUSD Stablecoin: Klarna is launching a U.S. dollar-backed stablecoin in 2026 to reduce costs for consumers and merchants. The stablecoin will be issued via Stripe-owned Bridge using the "Open Issuance" framework and run on the Tempo blockchain co-developed by Stripe and Paradigm, with testnet live in 2025 and mainnet targeted for 2026.

Klarna's expansion beyond Sweden has been challenging but ultimately successful. Despite near-bankruptcy during early entry into Germany due to differing credit models, the company adapted quickly and captured 10% of German e-commerce transactions. This resilience and ability to localize its offering have been key to Klarna's continued growth and current position as a leading global fintech player.

Klarna has made significant strides in penetrating the United States market, which has become a key focus for the company's growth strategy, through partnerships with local retailers as well as the launch of Klarna Plus, a subscription service that reached 100,000 subscribers in the US shortly after its introduction in 2024.

Business Model

Klarna monetizes in three primary ways:

- BNPL: merchants pay a variable fee of up to 5.99%. Consumers make three or four equal repayments, with the first due at the time of purchase and the rest at fortnightly or monthly intervals.

- Pay in 30 Days: merchants pay a variable fee of up to 5.99%. Customers pay no interest if they pay in full within 30 days.

- Financing: the merchant pays a variable fee of up to 3.29%. Consumers can choose the term of their loan, and they will pay interest accordingly.

Klarna drives traffic to merchants and boosts conversion. In return, merchants pay 3 – 6% on GMV as commission to Klarna.

When shoppers pay with Klarna's BNPL or Pay in 30 days, Klarna pays retailers the full transaction amount less 3 - 6% merchant commission. Klarna absorbs the transaction processing fees and chargeback costs for retailers. All credit default risks from the shoppers are also transferred to Klarna.

For every $100 GMV, Klarna makes $1.55 net transaction margin. Source: company data and Sacra estimates.

Klarna's net transaction margin is the merchant fee it collects less the variable costs associated with facilitating the sale.

The key variable costs in the business are:

- Processing fees paid to Visa, Mastercard and Stripe

- Borrowing costs reflect that Klarna has to fund the gap between paying the merchant and collecting from consumers who would take up to 2 months to repay

- Bad debt expenses as it is essentially providing credit to the shopper and would inevitably experience some defaults

This business model is working capital intensive given that it pays retailers upfront, and only collects from the consumers over 6 to 8 weeks. During its first Christmas season, Klarna faced a funding mismatch with its retailers requiring upfront payments, and its customers having 30 days to repay.

Today, Klarna funds receivables primarily with consumer deposits (~$9.5B at YE 2024), supplemented by forward-flow and securitization; deposit interest expense has risen with rates (from ~$63M in 2022 to ~$343M in 2024).

Klarna has an active U.S. forward-flow program (up to ~$26B of Pay in 4 receivables) and uses securitization/synthetic risk transfer (with ~$867M securitized loans reported off-balance sheet as of 2024). Note: Klarna's reported "transaction margin" excludes credit losses and certain marketing rebates, which investors should adjust for when assessing unit economics.

The short-duration nature of BNPL provides a significant advantage to traditional credit providers because higher capital velocity means higher asset turnover, therefore, higher return on capital.

The average duration of Klarna's credit portfolio is ~40 days. This means the company can recycle its capital 9 times per year (365 days / 40 days = 9.125). Assuming 1.5% net transaction margin and 30% pre-tax margin, each $100 would generate $100 x 1.5% x 30% margin x 9 loans per year = $4.

Klarna has also built a membership business offering four tiers—Core, Plus, Premium, and Max—that bundle various financial and lifestyle benefits. The program reached 100,000 subscribers in the U.S. shortly after launch in 2024. The Premium ($19.99/month) and Max ($44.99/month) tiers bundle airport lounge access, travel protection, cashback, and lifestyle subscriptions, provided in partnership with WebBank alongside the Klarna Card. This positions Klarna's banking products within a debit-first, membership-driven model that diversifies revenue beyond transaction fees.

Competition

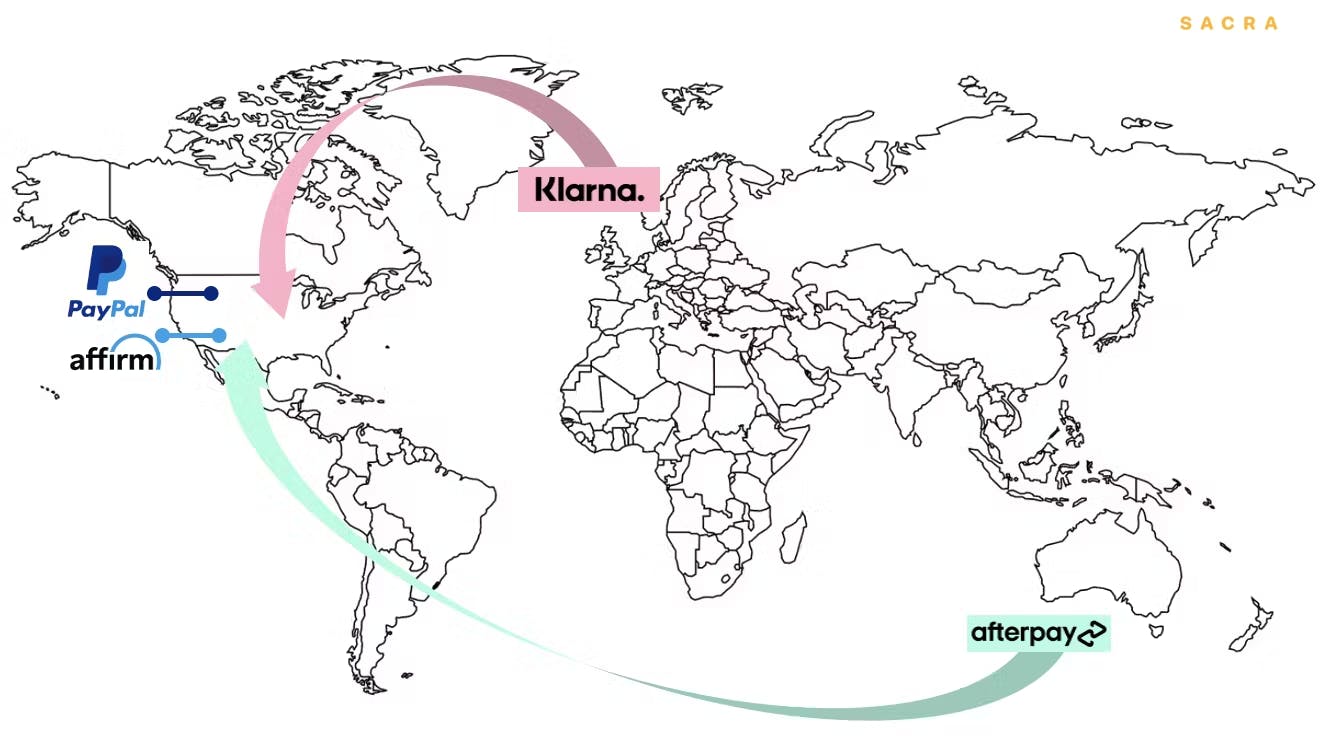

After serving the European market for more than a decade, most of Klarna’s future growth will have to come from international markets.

Competition is converging: Both Klarna and Afterpay are looking for their future growth in the US, home market to PayPal and Affirm.

Klarna has competitors in every meaningful geography, highly localized network effects at best, and the biggest threat to their continued existence—PayPal—has a massive scale advantage in their biggest untapped market—the United States. And with the launch of PayPal’s BNPL product, this $300B behemoth is now countering Klarna, Afterpay and Affirm head on.

BNPL companies

Klarna's primary competition comes from other BNPL providers like Affirm and Afterpay. These companies offer similar short-term, interest-free installment payment options at checkout. Affirm, founded by PayPal co-founder Max Levchin, has gained traction in the U.S. market with 800 merchant partners.

Afterpay, particularly strong in Australia, has also expanded globally. Klarna differentiates itself through its larger merchant network (250,000+ partners) and its pivot towards becoming a comprehensive shopping app.

Unlike some competitors, Klarna offers multiple payment options beyond just installments, including immediate payment and longer-term financing. The company's strong presence in Europe, particularly in Nordic countries where BNPL adoption is highest, gives it a solid base for expansion.

Payment processors

Klarna also competes with established players like PayPal, credit card companies, and traditional banks. PayPal, with its massive user base and PayPal Credit offering, poses a significant threat. PayPal's BNPL product gained 3 million users within two quarters of launch, leveraging its existing relationships with 54% of online merchants.

Credit card companies are also entering the installment payment space, often with lower merchant fees. Klarna counters by positioning itself as a more modern, user-friendly alternative, particularly appealing to younger consumers. Its focus on becoming a comprehensive shopping destination, rather than just a payment method, sets it apart from traditional financial services.

Fintechs

A growing ecosystem of fintech startups is challenging various aspects of Klarna's business. Companies like Lithic and Highnote compete in card issuing, while Ramp and Brex offer corporate card solutions.

These point solutions often provide more specialized features in their niche. Klarna's strategy involves building a more comprehensive platform, integrating services like budgeting tools and a shopping app. This approach aims to increase user engagement and provide value beyond just facilitating payments. However, it also puts Klarna in competition with e-commerce platforms and even search engines for product discovery.

TAM Expansion

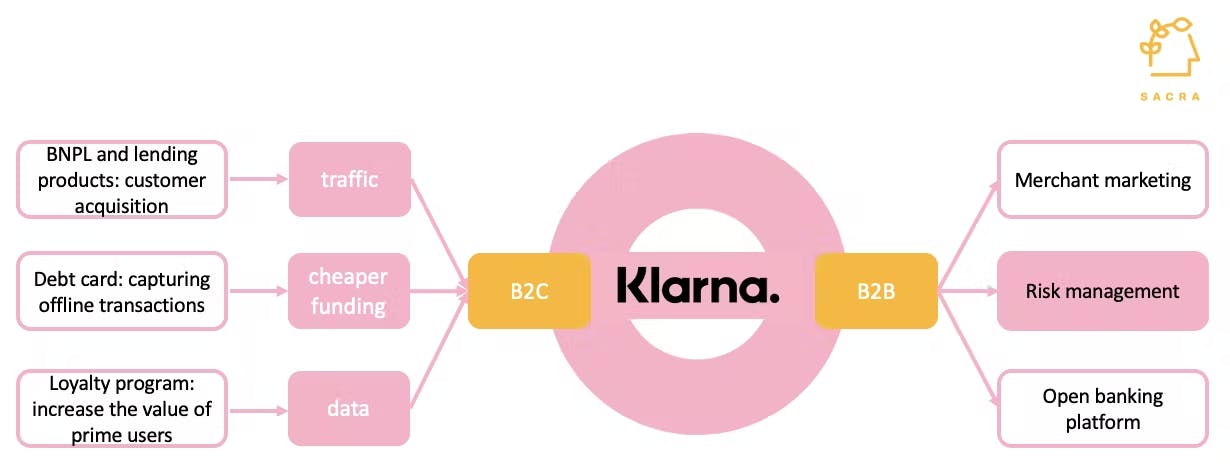

Traditional financial institutions structure products first and acquire customers second. In contrast, Klarna uses BNPL as a customer acquisition tool to gain users.

Instead of a pure consumer lending product, Klarna has the vision of morphing into a combination of D2C shopping app, merchant marketing and consumer financing.

D2C shopping

Klarna accumulates billions of SKUs worth of transaction data every year, building two advantages:

1. Its in-house credit risk assessment models can improve as its transaction and repayment history deepens

2. The retailer and shopper data it collects offers insight into consumer purchasing decisions, creating the foundation for other adjacent services

Traditional financial institutions structure products first and acquire customers second. In contrast, Klarna uses BNPL as a customer acquisition tool to gain users. Instead of a pure consumer lending product, Klarna has the vision of morphing into a combination of D2C shopping app, merchant marketing and consumer financing.

Counter positioning: Klarna acquires consumers through its BNPL and lending products. As it accumulates traffic, cheaper funding and data, it provides data analytics and infrastructure to its B2B partners.

To differentiate itself from a commodity market of BNPL providers, Klarna continues to add more use cases, such as debit cards to capture offline transactions, loyalty cards to incentivize spending and UGC wishlist to drive app engagement.

It hopes to become the merchants’ preferred marketing platform by bringing more leads. It hopes to become top of mind for consumers so instead of a BNPL provider, Klarna would curate more discovery on its platform and drive more traffic to retailers.

Merchant marketing

With its significant transaction flow, Klarna could be able to provide more cohort behaviors to merchants to support its marketing campaign and drive more traffic.

Higher incremental growth for retailers can justify merchant commissions paid to Klarna.

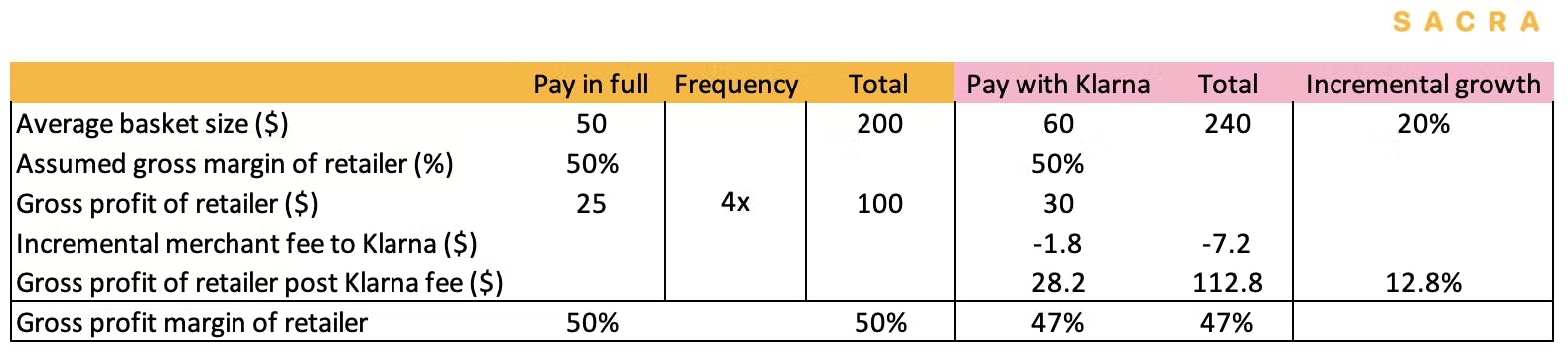

Assuming a retailer has a 50% gross margin, without Klarna, a consumer may be placing four separate orders at a ticket size of $50 each. These would generate $200 GMV in total and a gross profit of $100.

With Klarna, if we assume the conversion rate improves by 20%, this results in the retailer generating a 13% uplift in gross profit despite paying Klarna a merchant fee and realizing a lower gross profit on the sale.

Improving data analytics capabilities should lay the foundation for Klarna to help retailers to personalize marketing campaigns, use reward programs to drive frequency of purchase and improve conversion rates. This would differentiate Klarna from a commoditized BNPL provider to a lead generator. As Klarna converts more transactions, it could become a preferred option for both merchants and consumers. This would gain consumer loyalty.

In November 2025, BNPL usage in the U.S. reached 91.5 million users, with 25% financing groceries

Open Banking

Klarna’s infrastructure is scalable. Klarna acquired Sofort (aka Pay now with Klarna) in 2014. Sofort allows consumers to pay directly from their own online bank account. In 2019, Klarna launched its Open Banking platform. By 2021, this platform integrated with more than 6000 European banks through a single Access to Account API in line with the Payment Services Directive (PSD2).

Open Banking is in its infancy and the current adoption is low. Nevertheless, it has the potential to lower Klarna’s cost basis by cutting out Visa and Mastercard with payments initiated directly from consumers’ bank accounts and sent to merchants’ accounts.

This would significantly improve net transaction margin because a 1% saving in processing fees would drop directly to the bottom line.

By building towards an online financial ecosystem, Klarna could not only overcome the intense competition in BNPL but also drive user engagement and cross-sell potential. An engaged customer base built on top of a comprehensive financial service and lifestyle ecosystem could help Klarna to become the layer 2 infrastructure of retail.

Risks

1. Regulatory backlash: As a pioneer in the Buy Now, Pay Later (BNPL) space, Klarna faces increasing scrutiny from financial regulators concerned about consumer debt. Stricter regulations could force Klarna to significantly alter its business model, potentially reducing its appeal to both merchants and consumers.

2. Data privacy concerns: Klarna's business model relies heavily on collecting and analyzing consumer data to make credit decisions and personalize shopping experiences, and as data privacy regulations tighten globally and consumers become more privacy-conscious, Klarna may face challenges in maintaining its current level of data collection and usage.

3. U.S. expansion risk: Loss rates in the U.S. are rising faster than in Europe; competition from Affirm, PayPal and Apple Pay-enabled installments is intense.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.