Revenue

$27.00M

2023

Funding

$1.00M

2023

Valuation & Funding

Sacra estimates Kissflow's true valuation at about $400M, based on the assumption of a roughly 15x EV to sales multiple.

Fellow enterprise no/low-code app builder Unqork last raised at a $2B valuation, with an EV to sales multiple of 15x—similar to where other enterprise no-code companies were valued at the time, such as Appian at 11x and privately held Mendix at 15x.

Kissflow has currently raised a total of $1M in a seed round led by Indian Angel Network.

Product

Kissflow is a low/no-code platform for workflow automation in the enterprise. Instead of targeting either non-technical or technical users, Kissflow aims to satisfy the needs of both by incorporating a no-code platform that lets business users build apps via drag-and-drop while also helping development teams build apps using custom code.

Kissflow focuses on solving problems in the "middle-office" where existing company-wide software suites like CRMs and ERPs do not live.

For example, a bank using Kissflow might use it to automate processes around how to handle the exception case of needing an executive signature on a loan greater than $500K. Instead of that request being manually sent by one member of the team to another via email, with Kissflow, an internal CRUD app might be spun up where an executive can be automatically notified about the request and approve it right from that internal app's graphical user interface (GUI).

Business Model

Most of Kissflow's revenue is from SaaS subscription fees, which start at $1,500 for business customers and grow based on factors like how complex the applications that a business has built are, and whether they need special features like external users, private clusters, or industry compliance like HIPAA and GDPR.

Competition

By 2025, more than 70% of new applications made by enterprises are expected to use low/no-code, compared to 25% today. Three factors are driving this rise in low/no-code platforms:

Lack of developers: There aren't enough developers to fulfill the demand, with the US estimated to be short of 1.4M developers.

High spend: Companies spend millions of dollars annually to maintain legacy codebases, wasting developer bandwidth.

Evolution of programming: A natural evolution of programming from low-level coding languages to high-level coding languages to IDEs/frameworks to no-code tools, good enough to make full-stack apps.

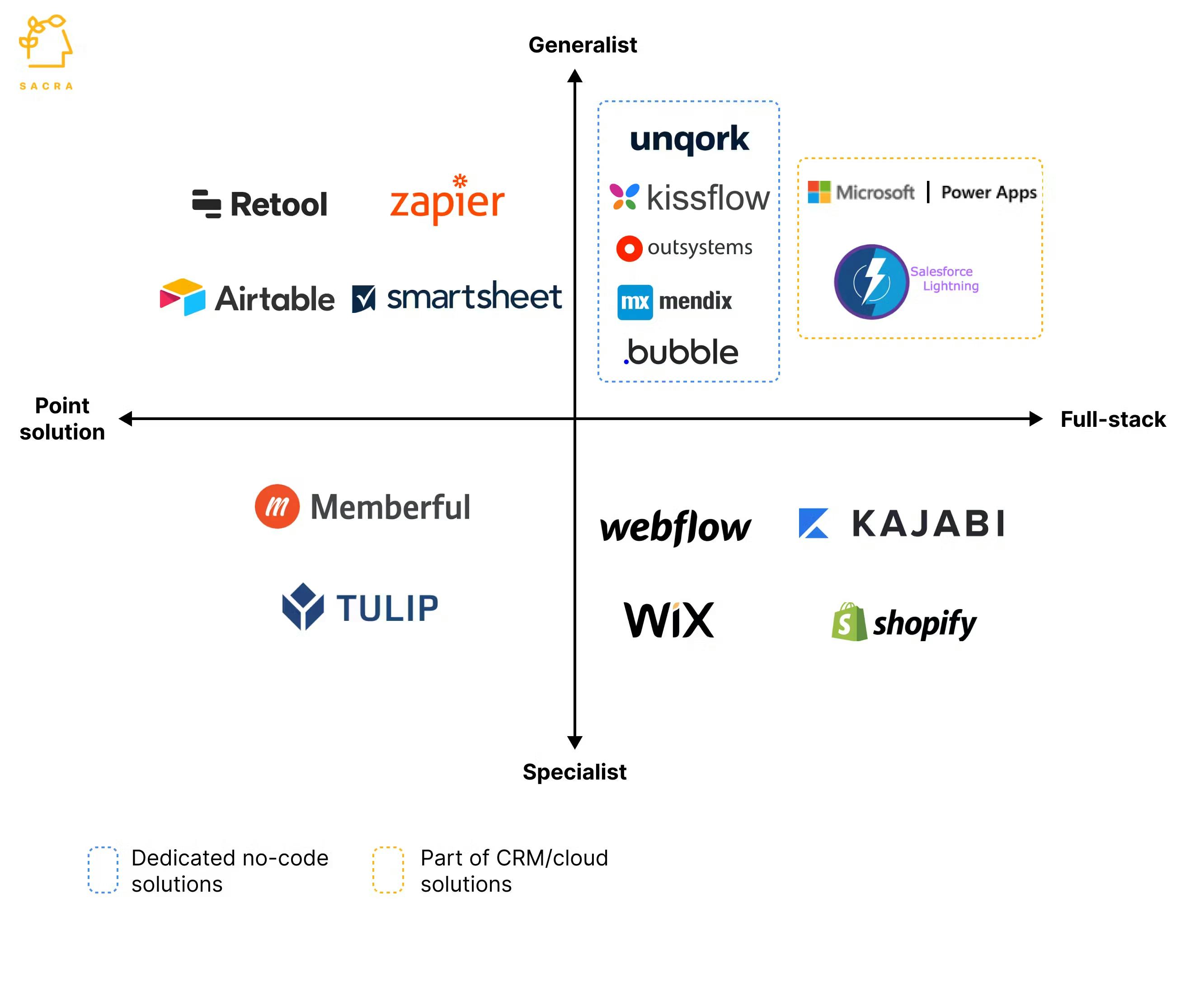

When it comes to building full-stack enterprise-grade applications, Kissflow competes with three main types of players: dedicated low/no-code platforms such as Mendix, Unqork, and Outsystems; CRM/cloud providers that bundle low/no-code development platforms with their offering such as Microsoft and Salesforce; and specialized solutions such as Webflow and Wix that companies use for developing web portals.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.