Revenue

$200.00M

2023

Valuation

$2.00B

2024

Funding

$342.20M

2024

Growth Rate (y/y)

38%

2023

Valuation & Funding

Iterable is valued at $2 billion as of 2024.

Based on 2021 data, when the company had $115M in revenue and a $2 billion valuation, Iterable traded at a 17.4x revenue multiple.

The company has raised $342.9 million across 10 funding rounds, with backing from prominent investors including Silver Lake, Viking Global Investors, and CRV. The investor roster also includes strategic partners like Capital One Ventures and Adams Street Partners.

Product

Iterable is an enterprise cross-channel marketing automation platform that lets users build personalized customer engagement campaigns across email, SMS, push notifications, in-and app messages.

Ex-Twitter engineer Justin Zhu and ex-Googler Andrew Boni started Iterable in 2013 after seeing the challenges that marketers were having building personalized email campaigns.

At the time, most email marketers were sending "batch and blast" campaigns—only big, sophisticated brands with the resources to invest in marketing engineering were running personalized campaigns to people based on e.g. their past purchases or interests.

Iterable found product-market fit with a simple tool for startups that gave them an email marketing layer on top of their existing product analytics deployment, from Segment to Mixpanel.

Within Iterable, marketers could easily use the existing customer data they were collecting to set up automatic email campaigns and A/B test different kinds of messaging.

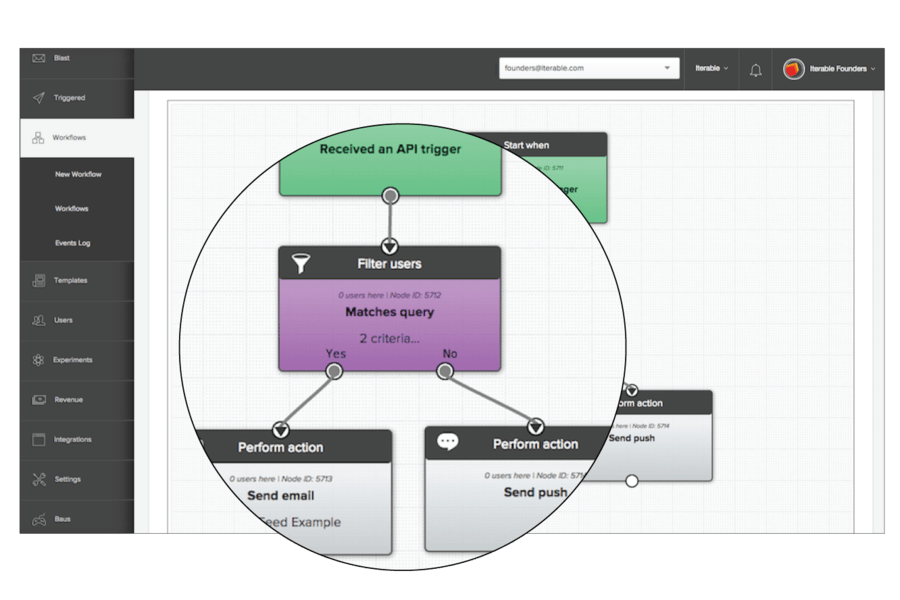

Key features of Iterable today include: (1) Visual workflow builder to design multi-step campaigns without coding, (2) Real-time behavioral data ingestion from SDKs, APIs, and data warehouses, and (3) AI-powered optimization for send time, channel, and content personalization.

Business Model

Iterable generates revenue primarily through subscriptions, with some amount of professional services and usage-based revenue from usage of its messaging channels.

Subscription

Customers pay a recurring subscription fee, typically annually or monthly, to access Iterable's platform and services. Fees start at a minimum of $500 per month, and scale up based a number of factors: (1) Number of customer profiles or users, (2) Volume of messages sent, (3) Number of data sources integrated, and (4) Additional product functionality or services utilized

As customers grow their business and customer base, their usage of Iterable's platform increases, resulting in higher subscription fees over time.

Professional services

In addition to subscription revenue, Iterable generates revenue from professional services related to the implementation, configuration, and training for its platform. These services are billed on a time and materials basis.

Usage-based

Iterable also earns a portion of revenue from transaction-based fees for messaging channels like SMS, where fees are charged based on the volume of messages sent through those channels.

Competition

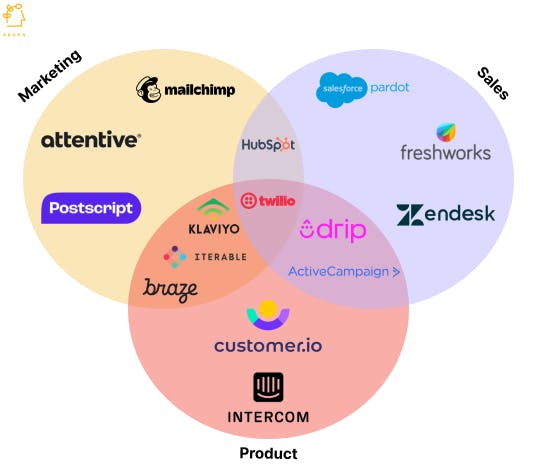

In the marketing automation and customer engagement space, Iterable competes with companies like Attentive, Braze, Customer.io, Klaviyo, and others.

Marketing platforms

Attentive: A SMS-focused platform that lets brands create personalized messaging by using behavioral data for segmentation. Attentive's focus on SMS and email means that it doesn't offer the same breadth of channels as Iterable.

Marketing-product platforms

Braze: A leading customer engagement platform that enables relevant and personalized experiences across channels like email, mobile, web, etc. Braze is particularly strong in mobile marketing automation.

Klaviyo: An email marketing automation platform popular among ecommerce businesses for its native integrations with platforms like Shopify.

Product platforms

Customer.io: A data-driven marketing platform focused on triggered messaging campaigns based on customer behaviors and real-time data integration. Platforms like Customer.io index on being flexible for technical growth teams to tweak to create customized messages, whereas Iterable focuses on providing the best-fit solution for marketing and product teams.

CRMs

Large enterprise CRM platforms like Salesforce Marketing Cloud and Adobe Campaign also offer customer journey orchestration and marketing automation features that overlap with Iterable's offerings.

TAM Expansion

Customer data platform (CDP)

Over the last few years, many of Iterable's key product releases have hinged on making it easier to bring customer data into Iterable and make it useful—via smart imports from a cloud data warehouse, better tooling for marketers to use that data, and tooling for teams to add custom fields into their customer profiles.

Iterable's expansion into customer data management aligns with what we're seeing in the rest of the martech, salestech, and product analytics stack under the threat of the center of gravity of customer data shifting to the data warehouse: SaaS platforms like Salesforce and Amplitude are building direct integrations so customers can pull data from and push data to Snowflake.

An increasing amount of value is now accruing to the "fat data layer" made up of the CRM, CDP and the data warehouse, in contrast to 10~ years ago where most value in SaaS accrued at the workflow layer. We’ve gone from tools like Mailchimp with their thin, native, siloed CRMs to tools like Iterable and Klaviyo with their own in-built CDPs and integrations into other tools and the data warehouse.

International expansion

Iterable launched its first international office in London in 2019, adding onto their San Francisco headquarters and two satellite offices in New York and Denver. Continued international expansion represents a significant growth opportunity for Iterable, even if the United States is likely to contribute the majority of their revenue—at Salesforce, for example, the Americas represent 70% of revenue, with Europe contributing the next-highest percentage.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.