Revenue

$46.00M

2023

Valuation

$2.00B

2024

Funding

$180.94M

2024

Growth Rate (y/y)

10%

2023

Revenue

Sacra estimates that Instabase hit $46M ARR in 2023, up 10% year-over-year, serving about 45 enterprise customers across banking, insurance, and healthcare with their hybrid consulting-software model for an average contract value of $1.02M.

Compare to “Instabase of defense” Palantir (NYSE: PLTR) at $2.2B ARR, up 20%, with about 500 customers for ACV of $4.4M, and enterprise AI platform C3 AI (NYSE: AI) at $313M ARR, up 18%, with 287 customers for ACV of $1.09M.

Valuation & Funding

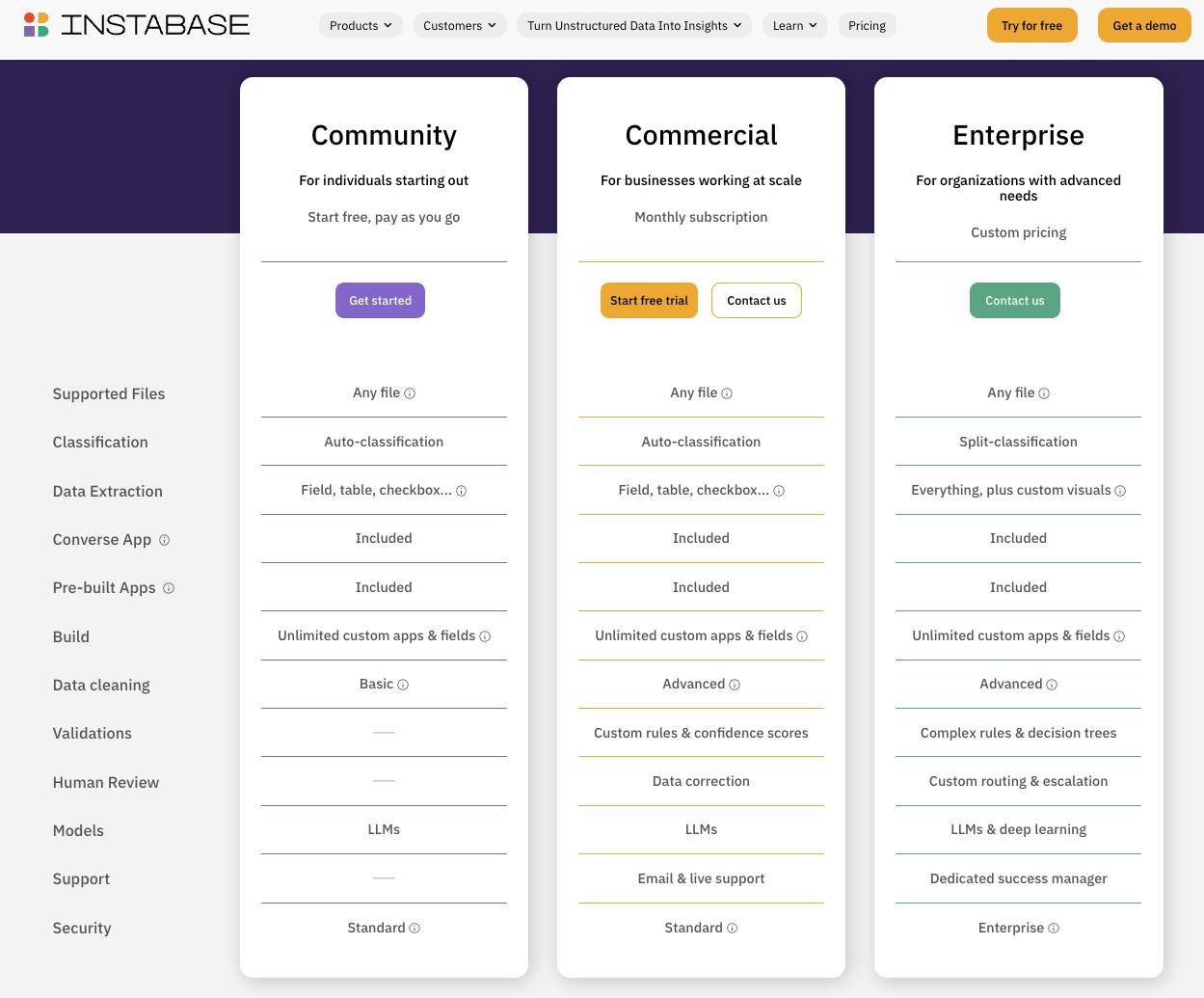

Instabase is valued at $2B as of its 2023 Series C, with participation from Andreessen Horowitz and New Enterprise Associates. Instabase's $2B valuation in 2023 represented a 43.5x multiple on its $46M revenue in 2023. Instabase has raised $180.94M in total funding across multiple rounds, with backing from prominent investors including Tribe Capital, Greylock Partners, and Spark Capital. Their investor base also includes strategic partners like Standard Chartered Ventures.

Product

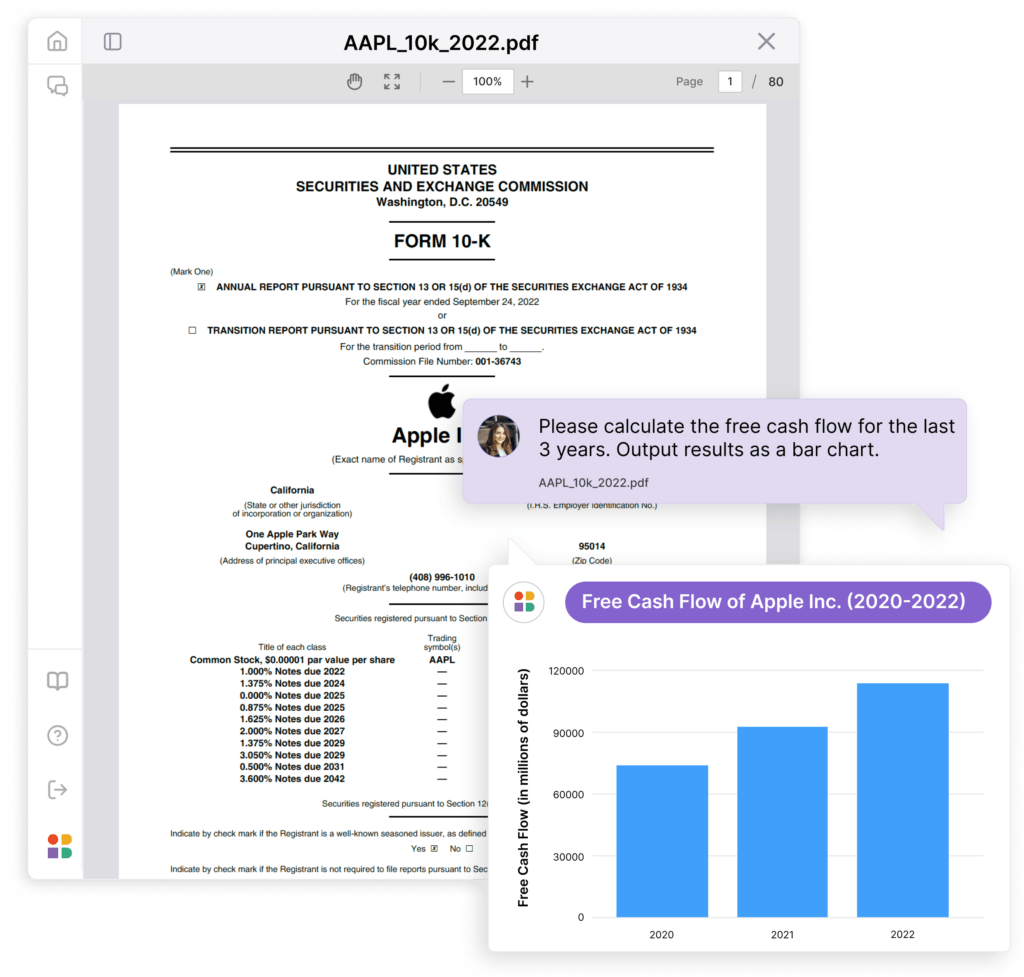

Instabase found product-market fit using optical character recognition (OCR) and their own ML language model to help banks turn stacks of paystubs, bank statements, and IDs into structured data and build workflows for credit and KYC checks around it.

After 2 years, Instabase had a handful of startup customers paying $2,000/month—in 2018, they signed Standard Chartered (LSE: STAN) to a $1.5M contract, fired their startup customers, brought on 3 more banks, and hit $5M ARR by the end of 2019.

Over time, Instabase has expanded its capabilities to become an end-to-end solution for intelligent document processing and workflow automation.

In addition to OCR, the platform now leverages computer vision, natural language processing (NLP), and more recently, large language models (LLMs) to extract key data points from a wide variety of document types. This extracted data can then be used to automate complex business processes through Instabase's low-code workflow builder.

A key differentiator for Instabase is its ability to handle unstructured data across different formats and modalities. Whether it's a scanned PDF, a mobile photo of a driver's license, or even handwritten notes, Instabase can process it and convert it into structured, machine-readable data. This flexibility allows Instabase to automate processes that have traditionally been manual and paper-based.

In November 2025, Instabase introduced AI runtime 2.0 with agent mode in AI Hub. Agent mode uses next-generation models for higher extraction accuracy and can autogenerate classes and up to 20 fields from uploaded documents. Existing automation projects can move from legacy mode to agent mode, with runtime upgrades managed per tenant environment.

In November 2025, Instabase introduced Case Management to handle complex, multi-document business workflows. The capability centralizes review and resolution across related documents, adding structured oversight for human-in-the-loop processes. It supports end-to-end automation by coordinating multi-step actions and validations across packets of documents within AI Hub.

Business Model

Instabase employs a hybrid business model that combines elements of both software-as-a-service (SaaS) and professional services.

The company's primary revenue stream comes from enterprise contracts, where large organizations like banks, insurance companies, and hospitals pay for access to the Instabase platform and its suite of intelligent document processing and workflow automation capabilities.

These contracts are typically multi-year deals with high annual contract values (ACV), reflecting the critical nature of the digitization initiatives that Instabase enables—and the fact that many customers are willing to pay more to switch off incumbent providers like IBM Watson.

For example, Standard Chartered, one of Instabase's early flagship customers, signed a $1.5M annual contract in 2018, replacing a legacy IBM Watson installation that cost $1.2M per year. As Instabase has expanded its product capabilities and proven its value, it has been able to consistently grow its ACV and land larger enterprise-wide deployments.

In its early days, Instabase offered a self-serve product priced at $2,000 per month, which attracted a number of startup customers. However, as the company began to target larger enterprise deals, it significantly raised its prices and shifted to a more high-touch sales model.

Today, Instabase's contracts are typically priced based on the volume of documents processed and the complexity of the workflows automated, with customers paying millions of dollars per year for the platform.

Competition

RPA incumbents

While not directly competitive, the two leading robotic process automation (RPA) vendors—UiPath and Automation Anywhere—are developing functionalities that bring them closer to Instabase's core value of processing unstructured text into data and applying workflows to it.

UiPath has over 10,000 customers globally and its platform combines RPA with AI/ML and process mining capabilities, with strong adoption in sectors like banking, insurance, healthcare and government.

UiPath Document Understanding allows it to extract, interpret, and process data from PDFs and handwriting, with integration into UiPath Studio which allows end-users to create automatic actions from that data in a no-code, drag-and-drop interface.

Automation Anywhere's comparable feature, Document Automation, enables business users to automatically process documents and extract data using pre-trained models—and then take action on that data or send it into a system of record like a CRM or ERP.

Startups

Instabase faces competition from a number of startups working on document processing like Hyperscience, Rossum, and Docugami.

Hyperscience, which has raised over $100 million, offers an end-to-end platform for document processing and workflow automation. It has seen adoption from enterprise customers across industries. However, Instabase appears to have deeper penetration and a stronger track record with large financial institutions and insurers.

Rossum has gained some traction, particularly in Europe, with customers like Siemens, Bosch and EvoLogics using its platform. However, its overall enterprise penetration and deal sizes seem to be smaller compared to Instabase based on available information.

Docugami is an earlier stage startup that is also targeting document processing use cases, but it has yet to demonstrate the same level of enterprise adoption as Instabase.

LLMs

The rise of large language models (LLMs) like OpenAI's GPT-4 and Anthropic's Claude could pose a threat to Instabase's core value proposition of extracting structured data from unstructured documents.

LLMs have demonstrated remarkable capabilities in natural language understanding and processing, which allows them to directly parse and extract key information from documents with minimal upfront training or annotation.

But while GPT-4 provides the core building blocks for companies to build apps that can process unstructured data, Instabase differentiates itself by providing a vertically integrated solution that is purpose-built for these kinds of enterprise document workflows.

By combining GPT-4 with its own proprietary models, pre-built connectors, and workflow automation tools, Instabase offers a more seamless and tailored experience for enterprise users looking to quickly build and deploy AI-powered applications.

TAM Expansion

Going wall-to-wall to grow ARPU

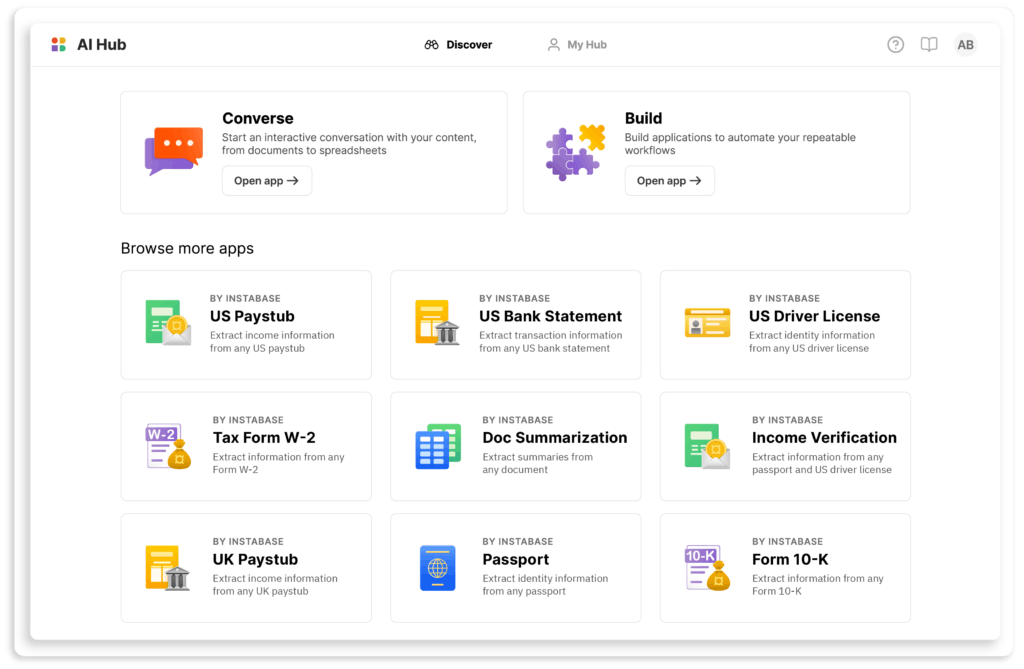

Instabase's AI Hub product, launched in 2023, represents an opportunity for the company to increase its penetration within existing enterprise customers and drive higher average revenue per user (ARPU).

AI Hub provides a suite of AI-powered tools for document understanding, data extraction, and content generation, all accessible through a user-friendly interface that allows non-technical users to leverage advanced AI capabilities.

By making AI more accessible and easier to use, AI Hub enables Instabase to expand beyond its traditional user base of developers and data scientists and reach a much broader audience within an organization. Business users across departments like finance, HR, legal, and operations can now directly use Instabase to automate their own document-centric workflows, without relying on technical teams for support.

This self-serve model has the potential to significantly increase the number of seats and use cases within existing customers, as more users discover the power of AI to streamline their day-to-day tasks.

Horizontal expansion into new use cases

In addition to growing within existing customers, Instabase is also expanding horizontally into new use cases and industries.

While the company initially focused on financial services applications like credit checks and loan underwriting, the flexibility of its platform allows it to address a wide range of document-centric processes across industries.

For example, Instabase can help insurance companies automate claims processing by extracting key data points from claim forms, medical records, and other supporting documents.

In healthcare, Instabase can streamline patient onboarding and medical record digitization.

In legal services, Instabase can assist with contract analysis, due diligence, and discovery by processing and extracting insights from large volumes of legal documents.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.