Revenue

$350.00M

2025

Valuation

$5.00B

2025

Funding

$520.00M

2025

Growth Rate (y/y)

25%

2024

Revenue

Click here to access our Sacra dataset.

Sacra estimates that Icertis hit $300M in annual recurring revenue (ARR) at the end of 2024, with the company describing itself as "approaching $350 million" in ARR as of August 2025.

The company serves over 250 global enterprise customers, with more than 30% of the Fortune 100 utilizing its platform. Average revenue per customer is estimated at $1.1M to $1.4M, indicating a focus on large enterprise contracts rather than mid-market volume growth.

Revenue is primarily derived from subscription fees for the Icertis Contract Intelligence platform. Additional revenue streams include AI-powered modules such as Copilots, applications for negotiation and analytics, and the Vera AI suite introduced in 2025.

Valuation & Funding

As of February 2025, Icertis is exploring a potential sale that could value the company at up to $5 billion, with Goldman Sachs advising on the transaction and buyout firms showing preliminary interest.

Icertis was valued at approximately $5 billion in 2021 when SoftBank's Vision Fund II invested by purchasing shares from Eight Roads Ventures. This represented a significant increase from its $2.8 billion valuation from its $80 million Series F round in March 2021, led by B Capital Group.

SAP made a strategic investment in early 2022, taking a minority stake when the company was valued at about 22x forward revenue on $225M ARR at the time.

The company raised $50 million in March 2025, which it said would be used to pay down outstanding debt. Prior to this, Icertis raised $150 million in October 2022 structured as convertible debt from Silicon Valley Bank. The company has raised over $520 million in total funding.

Product

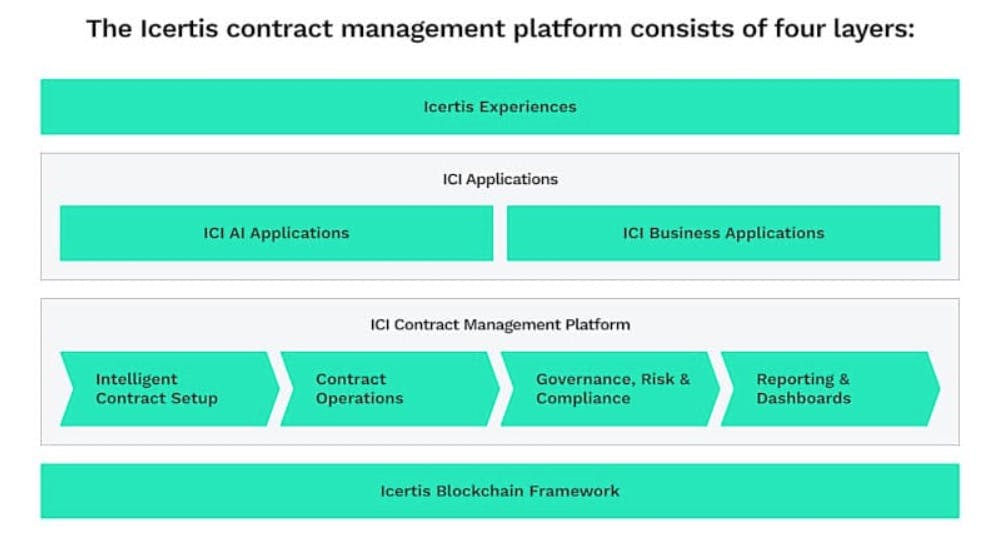

Icertis provides an enterprise-grade contract management platform that handles the entire lifecycle of corporate agreements, from creation to renewal or termination. When a company needs to create a new contract – whether it's a sales agreement, supplier agreement, NDA, or employee contract – users start in the Icertis Contract Intelligence (ICI) platform by selecting from pre-approved templates tailored to their business units and contract types.

Legal teams can build these templates with standardized clauses that ensure compliance, while providing flexibility where needed.

The system routes new contracts through configured approval workflows based on contract value, risk level, or other parameters. For example, a $1M supplier agreement might need VP-level approval, while a routine NDA might only need manager sign-off.

During the negotiation phase, counterparties can share and redline documents directly in the platform, with all changes tracked and version history maintained. The platform integrates with e-signature tools like DocuSign to finalize agreements.

Post-signature, Icertis doesn't just store contracts as static PDFs – it transforms them into structured data assets. The system automatically extracts key information like deadlines, renewal dates, price tiers, and obligations, then sends alerts to relevant stakeholders.

For instance, procurement teams get notifications 90 days before supplier contracts auto-renew, allowing time to renegotiate or terminate if needed. Sales teams receive alerts when customers approach volume thresholds that trigger pricing discounts.

Icertis's differentiator is its AI-powered intelligence layer. The platform can analyze thousands of contracts to identify risky clauses, flag compliance issues, or spot opportunities for cost savings. During the 2022 inflation spike, companies used Icertis to quickly find which supplier contracts had inflation-indexed pricing versus fixed rates.

When regulations change (like GDPR or new sanctions), the system can scan all agreements to find which ones need updating. In 2023, Icertis added "Copilots" – generative AI assistants that can draft contracts, answer questions about obligations, summarize complex agreements, and spot deviations from standard language.

The platform integrates with surrounding enterprise systems like SAP, Salesforce, Microsoft Dynamics, and Oracle – allowing contract data to flow seamlessly into procurement, CRM, and ERP systems. Sales teams can initiate contracts directly from Salesforce opportunities, while purchase orders in procurement systems automatically reference the correct supplier agreements. This connected approach gives executives real-time visibility into their contractual relationships, turning what was once a legal filing cabinet into a strategic business asset.

Business Model

Icertis operates a premium-tier enterprise SaaS business, selling multi-year subscription licenses to its contract management platform. The company targets Global 2000 enterprises with complex contracting needs across multiple departments and geographies, deliberately positioning itself as the sophisticated, enterprise-grade solution rather than a more affordable mid-market option.

This strategy reflects in its pricing, which analysts note runs approximately 34% higher than industry averages for contract lifecycle management software.

The company's pricing structure combines seat-based and volume-based models: customers pay for user access (legal teams, procurement officers, sales operations) plus factors like the number of contracts managed and premium modules activated.

While exact figures aren't public, enterprise contracts likely range from several hundred thousand to millions of dollars annually for large global deployments. This pricing approach allows Icertis to maintain gross margins typical of enterprise software platforms (approximately 70-80%), supporting its heavy investments in AI development and customer success.

Icertis delivers value through a direct enterprise sales motion, employing experienced B2B software sales teams targeting specific verticals like financial services, healthcare, and manufacturing. The sales cycle is typically lengthy (6-12 months) given the mission-critical nature of contracts and the multiple stakeholders involved. Once implemented, however, Icertis becomes deeply embedded in customer workflows, creating strong retention and expansion opportunities – over half of Icertis customers expanded their contracts in 2021 alone.

Icertis has developed a robust partner ecosystem as a go-to-market multiplier. Its strategic relationship with SAP – formalized when SAP took a minority stake in 2022 – created a powerful channel into SAP's massive enterprise install base.

Under this arrangement, SAP's sales team actively co-sells Icertis as the preferred CLM solution alongside SAP's ERP and procurement software, rather than pushing SAP's own more basic contract modules. Similar partnerships exist with Microsoft (where Icertis is built on Azure and integrates deeply with Microsoft's business applications) and global consulting firms that implement Icertis as part of digital transformation initiatives.

Competition

Enterprise CLM specialists

Icertis competes directly with several well-funded CLM specialists targeting the same enterprise market. DocuSign CLM leverages its dominance in e-signatures to cross-sell contract management, creating a powerful sales channel into its massive customer base.

While DocuSign's CLM solution is strongest in pre-signature workflows and document assembly, it lacks Icertis's depth in post-signature analytics and obligation management. Ironclad, valued at $3.2 billion in 2022, emphasizes user experience and modern design, particularly appealing to legal departments—though Icertis counters with deeper enterprise integrations and broader use-case coverage.

SirionLabs, backed by Sequoia Capital, specializes in post-signature contract performance management and obligation tracking, a direct challenge to one of Icertis's core value propositions. Conga (which merged with Apttus) leverages its native Salesforce integration to capture deals within that ecosystem, though it lacks Icertis's platform-agnostic approach.

Legacy ERP and document management solutions

Many enterprises Icertis targets already use basic contract management modules embedded within larger enterprise platforms.

Oracle Contract Lifecycle Management, part of Oracle E-Business Suite, offers integrated contract management for Oracle ERP customers, though with less sophisticated AI capabilities and analytics than Icertis.

Before partnering with Icertis, SAP offered its own Ariba Contracts and SAP CLM solutions, which still compete at the lower end of the market. Traditional document management systems like OpenText and even SharePoint serve as "good enough" solutions for companies focused primarily on document storage rather than intelligent contract management.

These incumbents benefit from their existing deep integration with core enterprise systems, though they typically lack the specialized contract intelligence features that differentiate Icertis.

Emerging AI-native challengers

A new wave of AI-focused contract management startups threatens to disrupt Icertis's technological edge.

Evisort, founded by Harvard Law and MIT researchers, emphasizes its proprietary AI trained specifically for legal document analysis, potentially challenging Icertis's AI capabilities.

LinkSquares targets legal teams with specialized contract analytics and reporting, focusing on quick deployment and practical insights rather than comprehensive workflow management.

Newer entrants like BRM ($21.6M raised, Caffeinated Capital) are building AI-native solutions for specific aspects of procurement and contract management. These specialized players compete for budget dollars and mindshare, even if they don't offer Icertis's full feature set. While Icertis has invested heavily in AI, including its 2023 launch of generative AI "Copilots," these nimble startups could potentially innovate faster in specific AI use cases, forcing Icertis to continuously reinvest to maintain its technological advantage.

TAM Expansion

Rising regulatory and compliance complexity

Increasing global regulatory complexity is dramatically expanding Icertis's addressable market as companies struggle to maintain compliance across jurisdictions.

New data privacy laws like GDPR in Europe, CCPA in California, and similar regulations sprouting worldwide require companies to implement consistent privacy terms across all contracts. Environmental, Social, and Governance (ESG) mandates force organizations to audit supplier agreements for sustainability commitments and ethical standards, tasks impossible to scale manually.

Trade restrictions and sanctions (like those against Russia) require immediate contract reviews to prevent violations, with penalties reaching millions of dollars. In this environment, contract management has transformed from a legal convenience to a business necessity, opening new market segments previously unwilling to invest in dedicated CLM solutions. Icertis is capitalizing on this trend by embedding compliance-specific features and reporting into its platform, such as automatic term identification and risk scoring.

This shift toward "compliance as a feature" could expand Icertis's target market from its current $20 billion to MGI Research's projected $30 billion by 2027, particularly as mid-market companies that previously made do with basic document management now face the same compliance burdens as enterprises.

Industry-specific solution expansion

Icertis is systematically targeting vertical-specific contract requirements to expand its addressable market beyond general enterprise CLM. For life sciences and pharmaceuticals, Icertis has built clinical trial agreement templates and FDA compliance monitoring, addressing specialized regulatory requirements that general-purpose CLM solutions miss.

In financial services, the platform offers specialized modules for ISDA agreements, loan documentation, and built-in reference data from sources like LIBOR alternatives. For government contractors, Icertis has developed FedRAMP-compliant hosting and specialized workflows for managing complex public sector procurement requirements.

This vertical-focused approach lets Icertis command premium pricing for specialized value while creating moats against horizontal competitors lacking industry depth. By building these industry-specific overlays on top of its core platform, Icertis can efficiently enter verticals that previously used specialized point solutions, potentially doubling its serviceable market without proportional R&D costs.

The "wave of industry-first vertical solutions" Icertis has been rolling out effectively transforms the product from horizontal infrastructure into specialized business applications, justifying higher per-user pricing and expanding wallet share within existing accounts.

AI-powered expansion beyond contract management

Icertis is leveraging AI to expand beyond traditional CLM into adjacent enterprise workflows that interact with contracts.

By connecting contract data to surrounding business systems (procurement, CRM, ERP), Icertis can surface contractual insights directly within transaction workflows. For procurement teams, the platform identifies negotiation opportunities like consolidating vendors or aligning payment terms. In sales operations, AI flags upsell opportunities based on contract utilization data or upcoming renewals.

For finance, the system reconciles invoices against contractual terms to prevent overpayment. These expanded capabilities position Icertis to capture spending previously allocated to procurement intelligence, revenue optimization, and financial compliance tools. The 2023 launch of "Icertis Copilots," generative AI assistants for contract management, accelerates this expansion by making contract insights accessible to business users beyond legal and procurement teams.

This business intelligence layer could eventually position Icertis as the "system of record" for commercial relationships broadly, rather than just a contract repository. By evolving from managing documents to optimizing the entire commercial relationship lifecycle, Icertis could potentially expand its per-customer revenue potential by 3-5x while addressing a much larger portion of the estimated $30 billion market for contract intelligence solutions.

Risks

SAP relationship dependency: Icertis has positioned its strategic partnership with SAP (which includes SAP taking a minority stake) as a key growth driver, but this creates asymmetric risk if SAP's strategy shifts. SAP could eventually decide to build its own more robust CLM capabilities, deprioritize Icertis in its sales motion, or even acquire a competitor, leaving Icertis overexposed to a single go-to-market channel that could rapidly diminish.

AI commoditization: While Icertis has invested heavily in contract AI capabilities, including its 2023 "Copilots" generative AI assistants, the rapid democratization of AI threatens to erode this differentiation. As foundation models like GPT-4 and open-source alternatives make sophisticated contract analysis accessible to smaller competitors at minimal cost, Icertis's premium pricing may become harder to justify against lower-cost alternatives with comparable AI features.

Enterprise implementation complexity: Icertis's positioning as a comprehensive, enterprise-grade solution results in implementation cycles that can stretch 6-12 months for large customers, creating vulnerability to nimbler competitors. As newer contract management vendors develop plug-and-play solutions with faster time-to-value, enterprise buyers may increasingly favor "good enough" solutions that can be deployed in weeks rather than committing to multi-month, high-six-figure Icertis implementations.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.