Revenue

$20.00M

2023

Valuation

$615.00M

2024

Funding

$92.20M

2024

Growth Rate (y/y)

100%

2023

Revenue

Sacra estimates Hightouch hit $20M in annual recurring revenue (ARR) at the end of 2023, up from $10M at the end of 2022, representing growth of 100% year-over-year.

Hightouch's customer base has grown in tandem with its revenue, increasing from 4 customers in early 2021 to nearly 1000 by October 2022.

Valuation & Funding

Hightouch is currently valued at $615M as of 2024. The company has raised a total of $92.3M across 6 funding rounds, with its most recent Series C round of $38M completed in July 2023. Key investors include Bain Capital Ventures, ICONIQ Growth, and Databricks Ventures. The company reported $20M in annual recurring revenue for 2023, doubling from $10M in 2022.

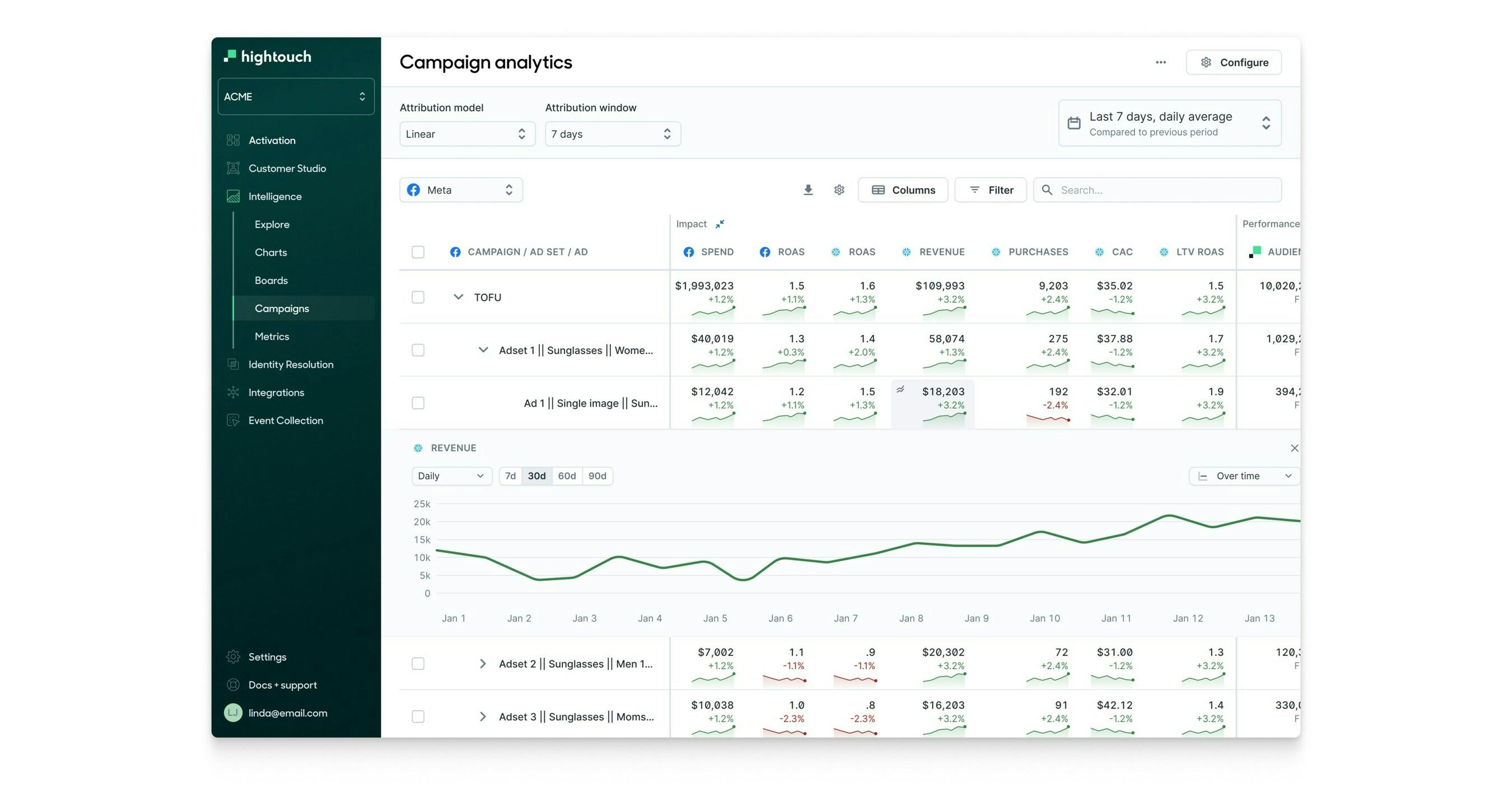

Product

Hightouch, founded in 2018 by Kashish Gupta, Josh Curl, and Tejas Manohar in San Francisco, initially focused on a travel booking Slackbot. Following a pivot due to COVID-19 in 2020, the team developed reverse ETL technology to sync data from warehouses to SaaS tools.

The company found product-market fit in February 2021 by enabling SQL-based data syncing from warehouses to SaaS tools without requiring engineering resources. This approach resonated particularly well with data teams at B2B SaaS companies. Hightouch's schema-agnostic platform allowed customers to use existing data models without conforming to preset schemas, significantly reducing implementation time from months to days.

Key features of Hightouch's product include:

1. Reverse ETL: Allows users to write SQL queries to move data from warehouses to various SaaS tools.

2. 220+ connectors: Supports a wide range of data sources and destinations.

3. Visual audience builder: Enables non-technical users to create customer segments without SQL knowledge.

4. Identity resolution: Helps companies unify customer data across multiple sources.

5. Real-time syncing: Ensures data is up-to-date across all connected platforms.

Business Model

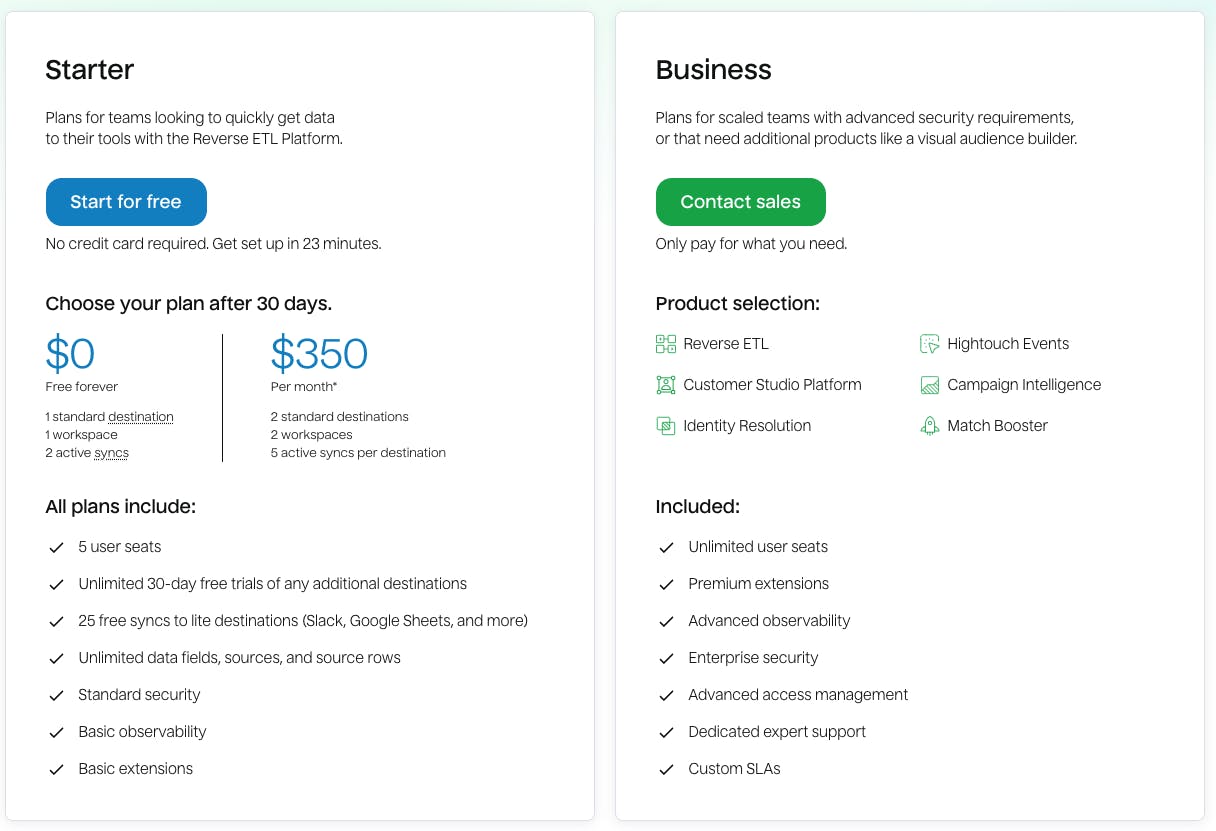

Hightouch is a subscription SaaS company that provides a data activation platform, enabling businesses to sync data from their data warehouses to various SaaS tools and operational systems.

The company's core revenue stream comes from tiered subscription plans based on the number of destinations (i.e., SaaS tools) a customer needs to sync data to, with pricing starting at $350/month for the starter plan and scaling up to custom pricing for enterprise customers.

Hightouch employs a land-and-expand strategy, often starting with a single use case or department within a company and then growing as other teams recognize the value of the platform. The company's self-serve capabilities for non-technical users, such as marketers, further drive this expansion by enabling wider adoption across organizations without requiring additional IT support.

A critical aspect of Hightouch's business model is its focus on being schema-agnostic, allowing it to work with a wide range of data structures and use cases. This flexibility has enabled Hightouch to serve diverse clients across industries and company sizes, from startups to large enterprises like Warner Music Group and PetSmart.

Competition

Hightouch competes in the data integration and customer data platform (CDP) space, with its primary offering being reverse ETL and data activation solutions. The competitive landscape can be divided into three main categories: reverse ETL specialists, traditional CDPs, and point-to-point integration platforms.

Reverse ETL

In this category, Hightouch's main competitor is Census, which also focuses on reverse ETL capabilities. Both companies enable businesses to sync data from data warehouses to various SaaS applications.

Census has raised significant funding, including a $60 million Series B in 2022, indicating strong investor interest in this space. Hightouch differentiates itself through its schema-agnostic approach, allowing customers to work with any data structure without conforming to predefined models. This flexibility has been particularly appealing to enterprises with complex data ecosystems.

Traditional CDPs

Hightouch positions itself as an alternative to traditional CDPs like Segment, which typically require data to be stored in their proprietary systems. Hightouch's approach of leveraging existing data warehouses as the central data repository has resonated with companies looking to avoid data duplication and maintain control over their data infrastructure.

This strategy has been particularly effective with large enterprises like Warner Music Group, who chose Hightouch over a traditional CDP after a three-year evaluation process.

Point-to-Point Integration Platforms

Tools like Zapier, Tray.io, and Workato offer integration capabilities that can sometimes overlap with Hightouch's functionality.

However, Hightouch distinguishes itself by focusing specifically on data warehouse integrations and providing more robust data transformation capabilities. The company's recent launch of an identity resolution product further sets it apart, addressing a critical need for many enterprises to unify customer data across multiple sources.

TAM Expansion

Hightouch has tailwinds from the growing adoption of cloud data warehouses and the increasing demand for data activation. It has the opportunity to grow and expand into adjacent markets like customer data platforms (CDPs), marketing automation, and advanced analytics.

Data Warehouse Adoption and Data Activation

The rapid adoption of cloud data warehouses like Snowflake, Google BigQuery, and Amazon Redshift is a key tailwind for Hightouch. As more companies centralize their data in these warehouses, the need to activate this data across various business applications grows.

Hightouch's reverse ETL technology is well-positioned to capitalize on this trend, enabling companies to sync data from their warehouses to SaaS tools used by sales, marketing, and product teams.

Hightouch can expand its offerings by developing more advanced data transformation capabilities within its platform.

This could include features for data cleansing, normalization, and enrichment, positioning Hightouch as a more comprehensive data management solution. By enhancing its data preparation capabilities, Hightouch could capture a larger share of the data integration market, estimated to reach $19.6 billion by 2026.

Customer Data Platform (CDP) Market

Hightouch has the potential to expand into the CDP market, which is projected to grow to $15.3 billion by 2026. The company's existing infrastructure for syncing customer data across systems provides a strong foundation for building CDP-like capabilities. By leveraging its schema-agnostic approach and adding features like identity resolution and audience segmentation, Hightouch could offer a more flexible and cost-effective alternative to traditional CDPs.

This expansion would allow Hightouch to tap into the growing demand for unified customer data platforms, particularly among mid-market and enterprise companies that already have data warehouses in place. The company's recent launch of the Customer 360 Toolkit, including identity resolution features, demonstrates its move in this direction.

Marketing Automation and Analytics

As Hightouch continues to serve marketing teams with data activation capabilities, there's an opportunity to expand into adjacent areas of marketing technology. By developing features for campaign management, multi-channel orchestration, and performance analytics, Hightouch could position itself as a comprehensive marketing operations platform.

This expansion would allow Hightouch to capture a larger share of marketing technology budgets, competing with established players in the marketing automation space. The company's existing integrations with various marketing tools and its deep understanding of customer data flows provide a strong foundation for building more advanced marketing capabilities.

By expanding into these adjacent markets, Hightouch has the potential to significantly increase its total addressable market and position itself as a central player in the modern data stack.

Risks

1. Market Consolidation: As the reverse ETL and data activation space matures, larger players like Snowflake or Databricks could build native reverse ETL capabilities into their platforms.

This could commoditize Hightouch's core offering and squeeze margins. To mitigate this, Hightouch needs to continue innovating beyond basic reverse ETL to provide unique value, such as their new identity resolution product.

2. Data Privacy Concerns: Hightouch's business model relies on companies being willing to move sensitive customer data between systems. Increasing data privacy regulations or high-profile data breaches could make companies more hesitant to use third-party data activation tools.

Hightouch's schema-agnostic approach and focus on not storing customer data helps mitigate this risk, but they need to maintain a strong security posture.

3. Overextension of Product Scope: As Hightouch expands from reverse ETL into areas like identity resolution and audience building, they risk losing focus and competing with more specialized tools.

This could dilute their core value proposition and stretch engineering resources thin. To succeed, Hightouch must carefully prioritize which adjacent products truly complement their data activation vision versus chasing every customer request.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.