Revenue

$95.00M

2025

Valuation

$500.00M

2024

Funding

$69.00M

2024

Revenue

Sacra estimates that HeyGen hit $95 million in annual recurring revenue (ARR) in September 2025, up from $57.5M at the end of 2024.

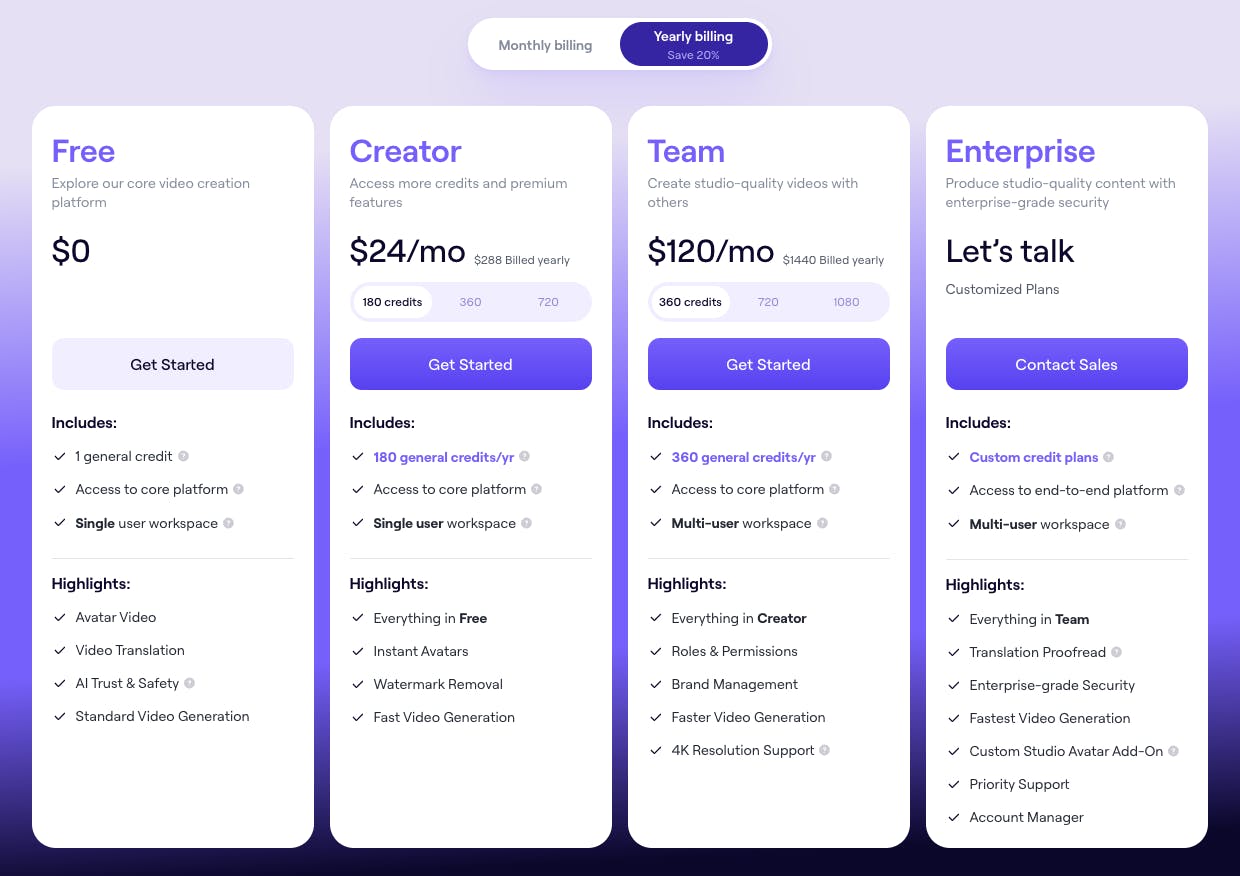

HeyGen monetizes on a subscription‑SaaS model with a credit/minute meter for generation and translation. Self‑serve plans start in the sub‑$50 range and scale through Creator and Team tiers, while Enterprise contracts unlock higher throughput, SSO/security, custom avatars, and API access for streaming avatars.

Credits fund minutes of avatar video, voice cloning, and multilingual lip‑sync translation; usage beyond plan quotas bills via add‑ons or tier upgrades.

By March 2023, HeyGen's ARR had reached $1 million, doubling to $2 million by May 2023 and hitting $3 million by July 2023.

Valuation & Funding

HeyGen was valued at $500 million following its Series A funding round in 2023. The company has raised a total of $74 million to date, with its most recent round being a $60 million Series A led by Benchmark.

Key investors in HeyGen include Benchmark, Bond Capital, and Thrive Capital. Notable venture firms Conviction Partners and SV Angel have also participated in the company's funding rounds.

Product

As AI collapsed the time and cost to create video content from weeks and $10,000+ per video to minutes and $24/month, HeyGen positioned itself as the democratized alternative to enterprise-focused Synthesia—targeting individual creators, SMBs, and mid-market companies with a freemium model and unlimited video generation on paid plans, rather than metered credits.

The platform offers four core product lines that span the AI video creation workflow:

Video Avatars allow users to create photorealistic AI avatars from short video clips (2+ minutes of footage) or photos, which then speak any text script in over 175 languages.

Video Translation localizes existing video content with realistic lip-sync dubbing and voice cloning, addressing the pain point where companies historically spent $50,000 and 3 months to translate content into 10 languages.

Personalized Videos enable data-driven campaigns at scale, inserting variables like recipient names and company logos to generate thousands of unique videos.

Interactive Avatars power real-time conversational experiences via API, enabling virtual support agents, sales assistants, and live video chatbots with sub-second latency through WebSocket streaming.

HeyGen's product strategy hinges on speed-to-value and ease of use—the platform launched "Instant Avatar" in November 2023, compressing avatar creation from days to 5 minutes using smartphone footage, and shipped Avatar 3.0 in 2024 with emotional expression understanding, synchronized body language, and even singing capabilities.

The interface mimics consumer video editors like CapCut rather than professional tools like Premiere Pro, with drag-and-drop templates, one-click translations, and AI script assistance that lowers the barrier for non-technical users who just need to create training videos or social media content quickly.

Strategic integrations extend HeyGen's reach beyond its own platform: partnerships with Canva (150M monthly active users) embed HeyGen avatars into Canva's video editor via plugin, HubSpot integration auto-generates personalized videos within marketing workflows, and ChatGPT plugin access brings avatar generation into conversational AI contexts—all expanding distribution without requiring users to adopt HeyGen's standalone platform.

Business Model

HeyGen monetizes high-velocity video creation through tiered subscriptions with unlimited generation rather than strict usage-based credits—a strategic departure from Synthesia's metered approach that appeals to customers who want predictable costs and high output volume.

The pricing ladder starts with a Free tier (3 videos per month, 10-second max length, HeyGen watermark) designed for viral acquisition, then climbs to Creator at $24/month (unlimited videos up to 30 minutes each, 5 minutes/month of Avatar IV photo-to-video, custom avatar slots, voice cloning), Team at $39/seat/month (minimum 2 seats, same video limits plus workspace collaboration, brand kits, and priority processing), and Enterprise with custom pricing (studio-quality avatars, advanced security, dedicated support, 3+ Interactive Avatar slots at $500 each annually).

This unlimited model contrasts sharply with credit-based competitors: where Synthesia charges ~$1,167 credits per video generation (roughly $0.15-0.20 per minute after subscription fees), HeyGen's $24/month Creator plan allows theoretically infinite 30-second social clips, making it attractive for high-frequency use cases like daily social media content or A/B testing dozens of ad variants—though HeyGen caps individual video length at 30 minutes to prevent abuse.

The business model achieves differentiation through channel strategy and customer segmentation: HeyGen pursued a product-led growth flywheel with prominent watermarks on free videos (driving viral coefficients above 3.0), grassroots adoption through YouTube and TikTok creators, and a 20% affiliate commission program managed by Affiverse Agency—contrasting with Synthesia's enterprise-first motion targeting Fortune 100 companies with $2,000-10,000/month contracts and dedicated sales teams.

API monetization adds a parallel revenue stream: HeyGen offers API plans starting at $99/month for 100 credits (~500 minutes of Interactive Avatar streaming), with Scale at $330/month for 660 credits and Enterprise custom pricing, charging 0.5 credits per 30-second video avatar generation and 0.2 credits per minute of real-time streaming—creating opportunities to white-label avatar generation into platforms like Reply.io (which integrated HeyGen Interactive Avatars for conversational chatbots) and Icon.me (which resells HeyGen avatars for UGC advertising).

Gross margins face compression as underlying model costs commoditize—HeyGen relies on ElevenLabs for voice synthesis and licenses OpenAI's real-time voice API for Interactive Avatars, meaning margin depends on negotiating favorable rates from infrastructure providers while charging enough subscription revenue to cover pass-through costs plus overhead, with profitability achieved in Q2 2023 suggesting operating margins around 20% despite the unlimited offering.

Competition

The AI video market is bifurcating along whether products serve marketers (who need hosting, analytics & lead capture) or developers (who need APIs, SDKs & webhooks) and whether they're focused on generating net-new content or editing & distributing it, creating four battlegrounds: avatar generators (Synthesia at $146M ARR, HeyGen at $95M ARR in September 2025), video AI APIs (Tavus at $8M ARR, D-ID with 280K developers), AI-native editors (Descript at $55M ARR), and hosting platforms (Vimeo at $450M revenue, Wistia at ~$70M ARR).

Direct avatar platform competition

Synthesia ($146M ARR, $2.1B valuation, 70% of Fortune 100 customers) represents HeyGen's primary competitor but serves a fundamentally different customer segment.

Synthesia targets enterprise with 70% of revenue from large accounts paying $2,000-10,000/month, offers studio-quality custom avatars requiring professional footage and weeks of processing, and emphasizes security features (SOC 2, GDPR, content moderation, audit logs) that large organizations demand for compliance.

HeyGen counters by moving faster on product innovation (shipped Instant Avatar in 5 minutes vs. Synthesia's multi-day process), pricing 50-75% lower ($24-39/month vs. Synthesia's $89+ Creator tier), and targeting prosumers and SMBs willing to accept slightly lower avatar quality in exchange for speed and affordability.

D-ID (200M videos generated, 280K developers, API-first positioning) carved out the developer infrastructure layer by focusing exclusively on API distribution rather than building end-user SaaS—powering MyHeritage's DeepNostalgia (22M animations in 10 days) and white-label integrations into platforms that want avatar features without building models in-house.

HeyGen initially competed head-to-head for SaaS users but increasingly overlaps as it launched API plans in May 2025, creating tension between serving direct customers and potentially competing with API clients who resell HeyGen's technology.

Tavus ($8M ARR, YC-backed) differentiated by specializing in real-time conversational video agents with deep customization and branching logic for interactive experiences like sales roleplays and virtual job interviews—positioning as the "research company" building the best replica models rather than a full-featured creative suite, though HeyGen's Interactive Avatar launch in 2024 directly challenged this niche with its own real-time streaming API.

Platform aggregators and incumbents

Canva ($3.3B ARR, 150M monthly active users) poses the most existential threat by bundling HeyGen avatars into its all-in-one creative platform via plugin—allowing Canva's massive user base to access avatar generation for $14.99/month Canva Pro subscriptions rather than paying separate $24+/month HeyGen fees.

This distribution advantage mirrors how Microsoft bundled Teams to challenge Slack, with Canva able to cross-subsidize video features using revenue from graphic design subscriptions while HeyGen must standalone-monetize every customer.

Adobe (30M Creative Cloud subscribers, Firefly Video native integration, $10M strategic investment in Synthesia in April 2025) and Google (Veo in Workspace Vids, YouTube integration) are integrating AI video generation into existing workflows where professionals already spend 40+ hours per week, reducing switching costs to near-zero.

Adobe's exploratory acquisition talks with Synthesia at $3B valuation (ultimately abandoned over price disagreements) signal that incumbents view AI avatars as features to bolt onto creative suites rather than standalone platforms worth premium multiples.

Horizontal video editors adding AI

Descript ($55M ARR growing 75% YoY, formerly audio/video editing via transcript) added text-to-video avatar generation in 2024, allowing users to start from written scripts and generate draft videos with illustrated-style avatars (deliberately avoiding uncanny valley by appearing hand-drawn rather than photorealistic).

This positions Descript to capture users at the beginning of their video workflow—writing scripts in Descript, generating avatar placeholders, then refining with editing tools—versus HeyGen which requires users to already have scripts prepared before entering the platform.

CapCut (ByteDance, 200M+ mobile users, free pricing) and DaVinci Resolve are incorporating AI generation through partnerships and native development, potentially capturing casual creators before they consider paid AI video platforms—CapCut's zero-cost entry and mobile-first distribution create formidable wedges into Gen Z creators who may only graduate to HeyGen after exhausting free options.

Vertical-specific avatar platforms

Icon.me (founded 2025, backed by Founders Fund) targets UGC advertising specifically, licensing real content creators' likenesses and offering $0.99 per ad generation for brands that need dozens of product testimonial variants—undercutting HeyGen's $24/month subscription for users who only need occasional UGC-style clips.

TAM Expansion

Enterprise penetration and security hardening

While HeyGen achieved profitability serving SMBs and individual creators, the company is now climbing upmarket toward Synthesia's Fortune 100 territory—hiring executives from Asana (CMO Dave King as Chief Business Officer), HubSpot (CTO Rong Yan), and Match Group/Meta (Lavanya Poreddy as Head of Trust & Safety) signals preparation for enterprise sales cycles requiring SOC 2 compliance, SSO/SCIM, role-based permissions, and audit logs.

The $60M Series A from Benchmark in June 2024 (valuing the company at $500M) provides runway to build dedicated sales engineering and customer success teams rather than relying purely on product-led growth, with the HubSpot partnership (announced April 2025) offering embedded distribution into marketing automation workflows that enterprise buyers already use.

Institutional customers demand content governance that HeyGen's current moderation can't yet match—Synthesia scans every frame for brand guideline compliance, watermark detection, and IP infringement before allowing exports, while HeyGen relies primarily on human review of avatar creation consent videos.

Building automated compliance screening, fine-tunable brand models trained on customer assets (ensuring consistent logo placement, color accuracy, style guide adherence), and private cloud deployment options would address the 41% of companies now using AI in video production who need quality control at scale across thousands of videos monthly.

Interactive avatar monetization and use case expansion

HeyGen's Interactive Avatar product (launched 2024, API-first with real-time WebSocket streaming) remains early-stage but represents massive whitespace opportunity—conversational video agents that handle customer support calls, conduct live product demos, and run virtual sales meetings could capture budgets currently spent on call center labor ($35/hour human agents vs. $0.20/minute streaming avatar costs).

Reply.io's integration (growing follower count by 200K and saving 3 hours per video over 10 months using CEO digital twin) proves demand exists, though HeyGen must solve latency (currently cannot support 4K due to streaming constraints), emotional intelligence (detecting viewer frustration or confusion to adjust responses), and session management (default 2-minute timeouts drain API credits if developers don't implement custom logic).

The convergence of Interactive Avatars with CRM and marketing automation creates closed-loop workflows: imagine HubSpot automatically generating personalized video sales follow-ups using Interactive Avatars that answer prospect questions in real-time, then log conversation data back into HubSpot for lead scoring—moving beyond static video assets toward dynamic, adaptive content that evolves based on viewer behavior. Vidyard's Video Sales Agent (which triggers video workflows based on marketing automation events) demonstrates this direction, though current implementations lack true interactivity and personalization.

Geographic expansion and localization infrastructure

Translation into 175+ languages positions HeyGen for international growth, though the company's current go-to-market concentrates in Western markets (banned in China, focused on US/Europe).

Trivago's use case—cutting video production time 50% by localizing TV advertisements across 30 markets—proves ROI for global brands, yet HeyGen lacks native support for right-to-left languages, regional dialect fine-tuning, and cultural adaptation of visual elements beyond voice dubbing.

Building specialized models for underserved languages (e.g., Southeast Asian markets, African languages, Middle Eastern dialects) and partnerships with local agencies to handle cultural localization could unlock demand from enterprises expanding into emerging markets without $100K+ budgets for traditional translation services.

Vertical-specific templates and industry customization

HeyGen's 53+ ready-to-use templates provide starting points but lack deep vertical customization—healthcare videos need HIPAA-compliant workflows and medical terminology accuracy, financial services require disclaimers and regulatory disclosures, real estate needs property visualization integration, and education demands accessibility features (auto-captioning, audio descriptions, adjustable playback speeds).

Packaging industry-specific avatar libraries (e.g., diverse medical professionals, financial advisors, teachers), pre-built compliance frameworks, and workflow templates for common use cases (patient education, investment updates, property tours, online lectures) would accelerate adoption in regulated industries hesitant to adopt generic AI tools.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.