Revenue

$13.00M

2024

Valuation

$700.00M

2024

Funding

$161.10M

2024

Growth Rate (y/y)

2,046%

2023

Revenue

Sacra estimates Hebbia hit $13M in annual recurring revenue (ARR) as of June 2024, representing approximately 15x growth over the previous 18 months. The company's revenue grew from approximately $900K ARR in December 2022 to $10M ARR by December 2023, before reaching its current level.

Revenue is primarily generated through enterprise software subscriptions, with pricing reportedly comparable to annual Bloomberg Terminal subscriptions.

Hebbia has achieved particularly strong penetration in financial services, notably claiming that 33% of the top global asset managers by AUM are customers. Key clients include American Industrial Partners, Oak Hill Advisors, and Charlesbank in private equity, as well as strategic firms like Centerview Partners. The company has also expanded into government sectors, securing the US Air Force as a client.

Valuation & Funding

Hebbia was valued at $700 million during its Series B funding round in July 2024, led by Andreessen Horowitz. The company has raised a total of $161.1 million across four funding rounds, with the Series B accounting for $130 million. Key investors include Andreessen Horowitz, Index Ventures, Google Ventures, and Peter Thiel.

Based on reported ARR of $13 million as of June 2024, the $700 million valuation represents approximately 54x revenue multiple. The company achieved 15x revenue growth over the 18 months preceding its Series B raise.

Product

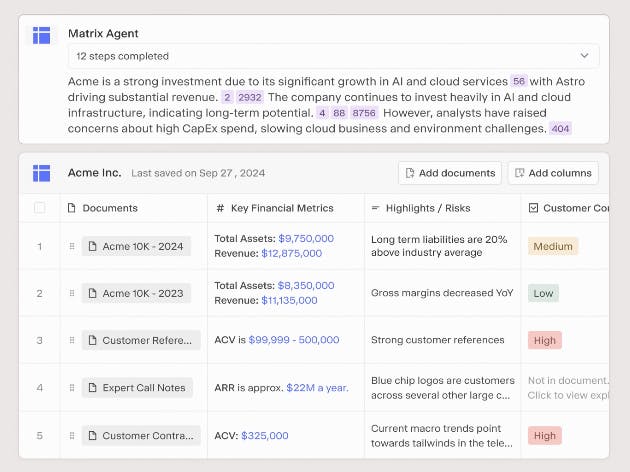

Hebbia’s flagship platform, Matrix, is a tabular “data‑grid” interface that sits on top of a proprietary agent framework and a technique the company calls iterative source decomposition (ISD).

Together, these let power users run multi‑step reasoning across full documents—contracts, filings, models, transcripts—without chunking constraints or manual prompt chains.

Users drop thousands of files from SharePoint, VDRs, CRMs, broker research, or premium data providers into Hebbia; Matrix then decomposes questions into parallel sub‑tasks, orchestrates those tasks across best‑fit models, and writes results back into the grid in near‑real‑time.

Because many financiers and lawyers already work in spreadsheets, the grid acts as both an analysis surface and an agent configuration layer: any column, row, or cell can trigger downstream automations such as generating diligence memos, red‑line summaries, pitch decks, or meeting‑prep briefs.

Teams can start from out‑of‑the‑box templates—e.g., “credit‑agreement abstractor” or “VDR screener”—or drag‑and‑drop an existing deliverable (a PDF memo, slide deck, etc.) for Hebbia to auto‑create a reusable agent that reproduces that output on new data.

The company positions Matrix less as a chat assistant and more as an embedded workflow engine: it federates retrieval across internal and third‑party systems, reasons over both content and metadata to pinpoint relevant passages, exposes full citation trails for auditability, and supports role‑based access control, SSO, and detailed activity logs required by regulated industries.

Hebbia has expanded from retrieval into end-to-end workflow automation. In June 2025, it rolled out a redesigned Matrix UI with a multi-agent system for retrieval, grounding, and verification inside its spreadsheet interface. In July 2025, Hebbia acquired FlashDocs to add document-to-draft generation for legal and financial use cases.

Business Model

Hebbia is a subscription SaaS company that sells AI-powered document analysis software primarily to financial institutions, law firms, and government agencies.

Professional costs $10,000/seat/year for unlimited reasoning, agent building, advanced integrations (PitchBook, CapIQ, broker research), and workflow automation. These “power” seats are typically held by senior analysts, associates, or partners who design and maintain agents for the firm.

Lite costs $3,000–$3,500/seat/yr for users who consume outputs, run predefined agents, and perform deep search over enterprise data without editing the underlying workflows.

Deals usually start with a handful of Professional seats in high‑stakes verticals—private equity, credit, M&A advisory, and complex litigation—then expand via Lite seats to adjacent teams (e.g., corporate finance, IR, in‑house counsel).

To accelerate adoption, Hebbia bundles a forward‑deployed engagement team of ex‑bankers and lawyers who configure templates, map data sources, and handle change‑management—functioning as an in‑house Accenture‑style services layer that reduces time‑to‑value and drives land‑and‑expand.

The focus on revenue‑critical workflows allows Hebbia to command Bloomberg‑level pricing while sustaining 100%+ ARR growth and >90% gross retention among top asset managers, banks, and law firms.

The company’s long‑term expansion thesis is that once Professional users have embedded agents into daily processes, Lite seats proliferate across the enterprise, creating a durable, high‑margin annuity stream anchored by deep workflow integration rather than generic search.

Competition

Hebbia operates in a market that includes enterprise search platforms, AI-powered document analysis tools, and knowledge management systems, with competition coming from both established enterprise software providers and newer AI-focused startups.

Traditional enterprise search providers like Microsoft SharePoint Search, Elastic Enterprise Search, and Coveo offer robust security controls and integration capabilities but generally lack sophisticated AI features.

Glean, valued at $4.6B, has emerged as a direct competitor with its AI-powered enterprise search platform that connects to various enterprise applications. Glean has achieved stronger market penetration, reaching $75M ARR in early 2024 compared to Hebbia's $13.7M, and focuses on broader enterprise adoption across industries rather than Hebbia's initial focus on financial services.

Both companies emphasize security and permissions management, though Glean has built deeper integrations with enterprise systems.

AI-Enabled Document Analysis

Large cloud providers are increasingly offering enterprise-ready AI services that compete with aspects of Hebbia's offering.

Microsoft's Azure ChatGPT playground provides a secure environment for document analysis within the widely-adopted Azure ecosystem.

Databricks offers Lakehouse IQ for enterprise knowledge management, while Dataiku's Answers product helps companies build customized LLM and RAG-powered retrieval engines. These solutions benefit from existing enterprise relationships and integration with core systems, though they typically lack Hebbia's specialized features for financial analysis and document comparison.

Emerging AI Infrastructure

A new category of companies is emerging to provide the underlying infrastructure for AI-powered enterprise applications.

Companies like Anthropic and OpenAI offer large language models with expanding context windows that could potentially reduce the need for specialized information retrieval systems.

Meanwhile, vector database providers like Pinecone and Chroma enable companies to build their own RAG-based search solutions. Hebbia has positioned itself against this approach, claiming RAG fails to answer real-world questions effectively and promoting its alternative search capability that uses parallel processing and mimics human problem-solving.

TAM Expansion

Hebbia has tailwinds from the rapid proliferation of enterprise SaaS applications and growing demand for AI-powered workplace tools, with opportunities to expand into adjacent markets like enterprise knowledge management, workflow automation, and intelligent workplace assistants.

Enterprise Search and Knowledge Management

The core enterprise search market that Hebbia currently serves represents just a fraction of their total opportunity.

As organizations increasingly struggle with fragmented knowledge across hundreds of SaaS applications, Hebbia's ability to unify and make this information accessible positions them to expand into broader knowledge management.

Their deep integrations with enterprise systems and sophisticated permissions management create strong barriers to entry, while their AI capabilities enable them to move beyond simple search into areas like automated documentation, knowledge base creation, and institutional memory preservation.

AI-Powered Workplace Assistant

Hebbia's evolution from search tool to AI-powered workplace assistant represents their largest growth vector. Their unique position - having access to and understanding of enterprise data across systems - enables them to build increasingly sophisticated AI assistants that can handle complex workplace tasks.

Beyond just finding information, Hebbia could expand into meeting summarization, email management, project tracking, and automated workflow creation. This positions them to capture share in the emerging enterprise AI assistant market, estimated to reach $40B+ by 2027.

What makes Hebbia's expansion potential particularly compelling is their data advantage. Every search query and interaction helps train their models to better understand organizational context and user intent.

This creates a flywheel effect - as more companies adopt Hebbia, their AI becomes smarter, making their product more valuable and harder to replicate. Their expansion strategy appears focused on leveraging this advantage to build an end-to-end platform for enterprise knowledge work, rather than just point solutions for specific use cases.

Risks

Three critical risks facing Hebbia:

1. Pilot Revenue Vulnerability: The company's rapid revenue growth (15x over 18 months) appears heavily driven by financial institutions piloting AI tools. With limited organizational maturity around AI procurement, much of Hebbia's current $13.7M ARR likely represents pilot contracts rather than committed long-term usage.

As enterprises move past initial AI experimentation and demand clearer ROI metrics, Hebbia could face challenges converting pilots to sustained enterprise deployments, potentially leading to significant revenue volatility.

2. Commoditization of Core Technology: Hebbia's early differentiation came from enabling non-technical users to analyze large document sets.

However, rapid advances in LLM context windows (like GPT-4's expanded capacity) and enterprise-ready offerings from cloud providers (Azure's ChatGPT playground, Databricks Lakehouse IQ) are eroding this advantage. The company's high pricing (comparable to Bloomberg Terminal subscriptions) may become harder to justify as basic document analysis capabilities become commoditized.

3. Product-Market Misalignment: While Hebbia claims 90% market penetration among top PE firms, user feedback suggests their product may be overshooting market needs. Forum posts indicate the software can be buggy and doesn't add significant value beyond baseline GPT-4 capabilities.

This disconnect between Hebbia's sophisticated feature set and actual user requirements could limit expansion beyond initial pilot deployments, especially given the premium pricing.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.