Valuation

$1.70B

2024

Funding

$251.00M

2024

Product

H2O.ai was founded in 2012 by Sri Ambati to democratize artificial intelligence and machine learning for enterprises.

H2O.ai found product-market fit as an open-source machine learning platform for data scientists and developers who needed industrial-strength ML capabilities without building everything from scratch. The company gained early traction with financial services firms like Capital One and Wells Fargo who needed to run machine learning at scale.

The core H2O platform allows data scientists to build and deploy machine learning models using popular programming languages like R and Python. Users can run complex algorithms like deep learning, random forests, and gradient boosting on large datasets distributed across computer clusters. The platform handles the heavy lifting of parallel processing and memory management, letting data scientists focus on model development.

Over time, H2O.ai expanded its product line to include Driverless AI, which automates the end-to-end machine learning process for non-technical users. This allows business analysts to build ML models without deep data science expertise. The company also offers Sparkling Water for Apache Spark integration and H2O Wave for creating AI applications.

The platform is particularly valuable for enterprises running large-scale ML operations, like banks detecting fraud patterns or insurance companies predicting risk across millions of policies. H2O.ai's tools enable both sophisticated data scientists and business users to leverage AI capabilities within their existing workflows.

Business Model

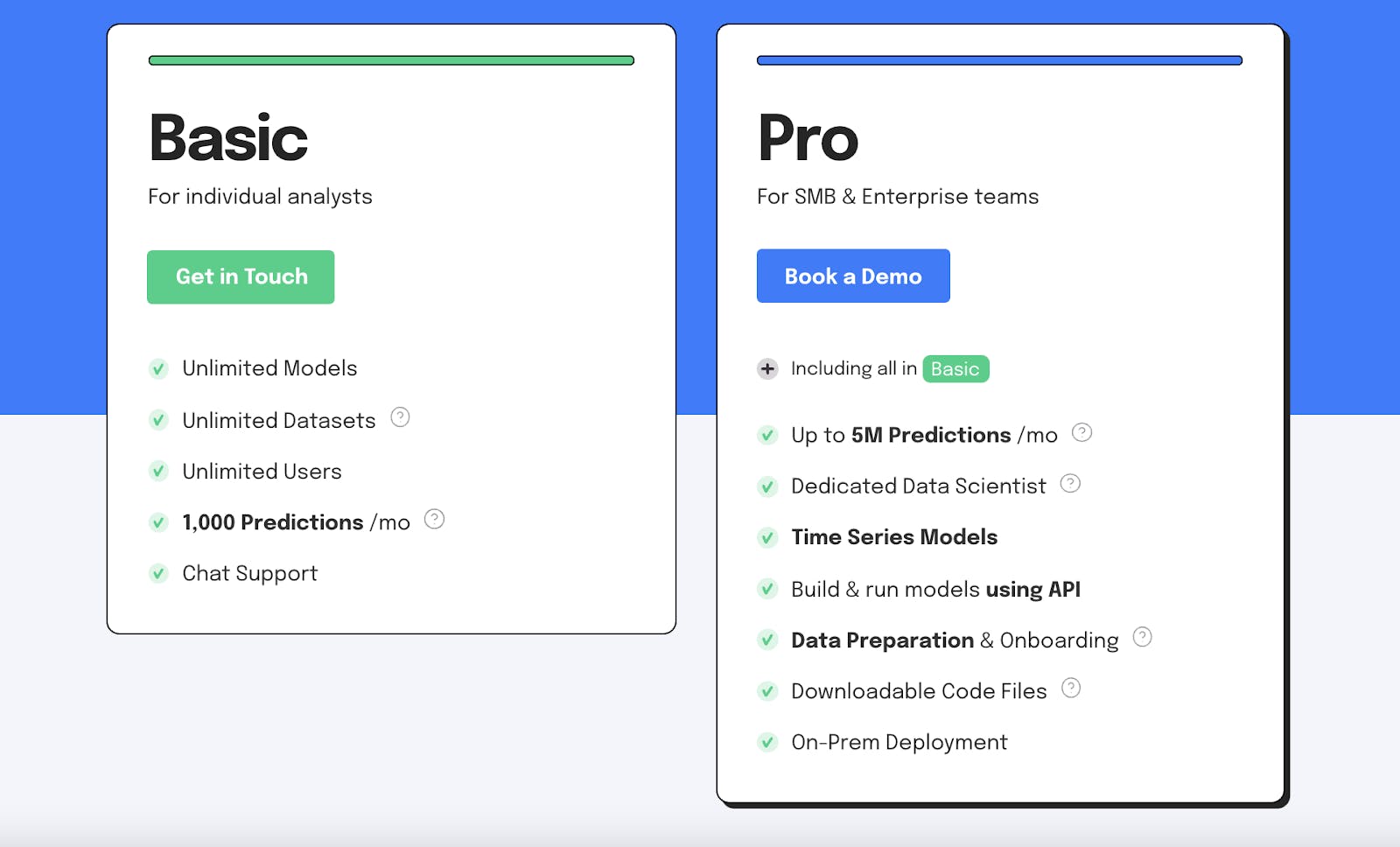

H2O.ai operates a hybrid open-source/enterprise SaaS model focused on making artificial intelligence and machine learning accessible to businesses of all sizes. The company offers a free open-source platform with core ML capabilities while generating revenue through premium enterprise subscriptions and its flagship H2O.ai AI Cloud platform.

The enterprise offering starts at $6,900 annually for basic features and support, while the more comprehensive H2O.ai AI Cloud platform requires a minimum commitment of $200,000 (four units at $50,000 each). This tiered approach allows H2O.ai to capture value across different customer segments, from small teams to major enterprises like Capital One, Wells Fargo, and Kaiser Permanente.

The company's competitive advantage stems from its unique position bridging open-source and enterprise needs. By maintaining a robust open-source community of over 20,000 enterprises and 100,000 data scientists, H2O.ai creates a powerful funnel for enterprise conversions. The platform's ability to automate complex machine learning workflows through products like Driverless AI reduces the technical expertise required to implement AI solutions, expanding the addressable market beyond traditional data science teams. Strategic partnerships with major cloud providers and hardware manufacturers like NVIDIA further strengthen H2O.ai's market position and distribution capabilities.

Competition

H2O.ai operates in the enterprise AI and machine learning platform market, which includes both established tech giants and specialized ML infrastructure providers.

Large platform providers

Major cloud providers like Microsoft Azure, Google Cloud Platform, and AWS offer integrated machine learning services as part of their broader cloud platforms. These companies bundle AI capabilities with their existing infrastructure services, targeting enterprises already using their cloud environments. IBM has also entered this space through its acquisition of Revolution Analytics, focusing on enterprise R integration.

Specialized ML platform companies

DataRobot and Databricks compete directly in the automated machine learning space, offering platforms that help enterprises build and deploy ML models. DataRobot focuses on automated model building for business users, while Databricks emphasizes a more technical approach built around Apache Spark. TIBCO has carved out a position by re-implementing R for enterprise use cases, focusing on statistical computing integration with existing business intelligence tools.

Open source ecosystem

The market includes several open-source focused companies like Anaconda and RStudio that provide enterprise support and tooling around popular data science frameworks. These companies typically monetize through enterprise support contracts and commercial add-ons to their open-source cores. MapR has taken a similar approach in the Hadoop ecosystem, addressing enterprise requirements through proprietary enhancements to open-source technologies.

A key trend is the increasing focus on automated machine learning capabilities, with platforms working to simplify AI deployment for non-technical users while maintaining the depth required by data scientists. The market is also seeing convergence between traditional statistical computing tools like R and modern deep learning frameworks.

TAM Expansion

H2O.ai has tailwinds from the democratization of AI and enterprise automation, with opportunities to expand into adjacent markets like industry-specific AI solutions and automated machine learning platforms.

Enterprise AI adoption

The enterprise AI market represents a massive opportunity as companies across industries rush to implement AI capabilities. H2O.ai's open-source roots and focus on making AI accessible positions them well to capture this growth. Their expansion from pure open-source to enterprise products like Driverless AI demonstrates their ability to monetize through value-added services while maintaining community goodwill.

Vertical-specific solutions

H2O.ai has already gained significant traction in financial services, with about 40% of current revenues coming from this sector. The company can leverage this domain expertise to build specialized AI solutions for other regulated industries like healthcare and insurance. Their work with Kaiser Permanente on ICU prediction models shows the potential for high-value, industry-specific applications.

Automated ML platforms

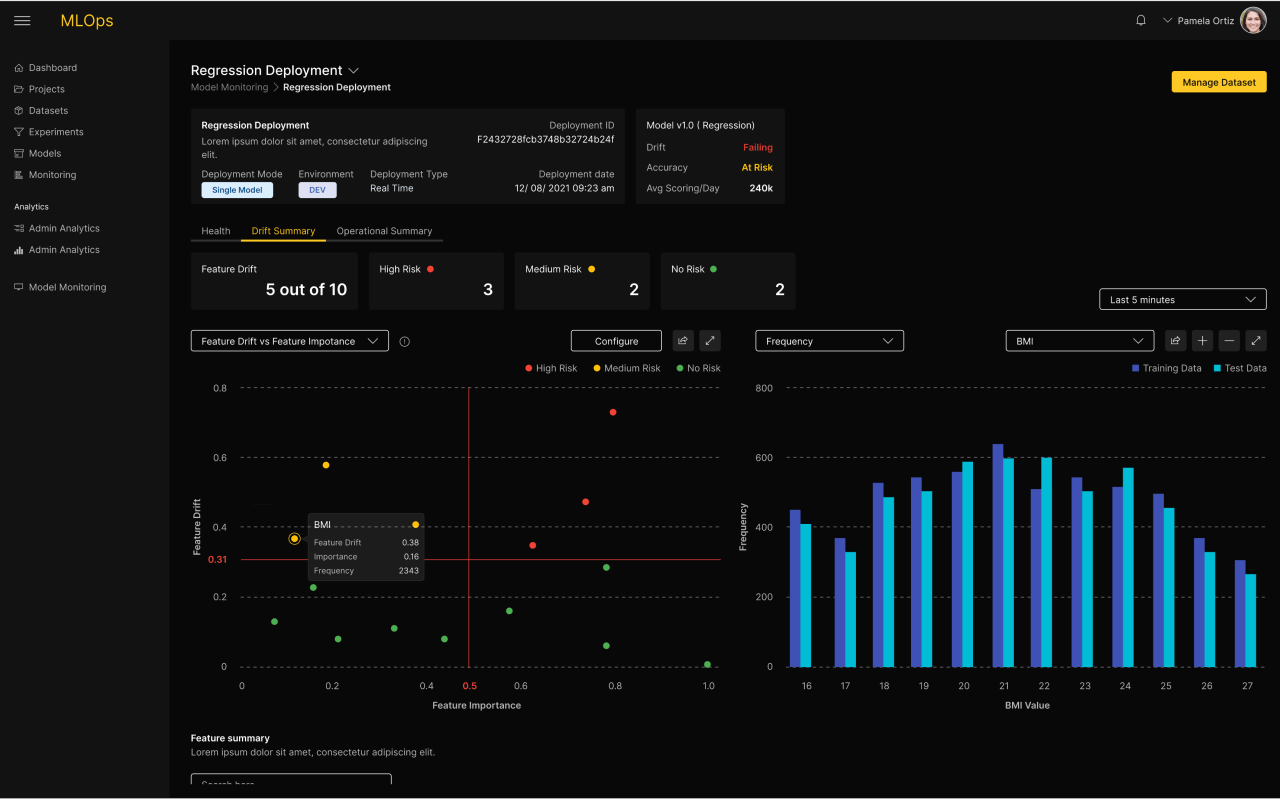

The shortage of AI talent creates an opportunity for H2O.ai to expand their automated machine learning capabilities. Their Driverless AI platform, which automates complex ML workflows, could evolve into a comprehensive enterprise AI operating system. This would allow companies without large data science teams to implement sophisticated AI solutions. The platform approach also creates recurring revenue through subscriptions and enables expansion into adjacent capabilities like model monitoring, governance, and deployment automation.

The company's $1.7B valuation suggests investors see potential for H2O.ai to become a major enterprise AI platform, similar to how Snowflake emerged as the leader in cloud data warehousing. Their combination of open-source roots, enterprise focus, and automated capabilities provides multiple paths to capture value in the rapidly growing AI market.

Risks

Open source commoditization: H2O.ai's core platform is open source, creating a constant tension between maintaining community goodwill and monetizing enterprise features. The company must carefully balance which capabilities to keep proprietary versus contribute to the open codebase, risking either community abandonment or revenue erosion. Their enterprise products like Driverless AI could face pressure if the open source community develops similar automated ML capabilities.

AI platform consolidation: As major cloud providers and tech giants expand their ML/AI offerings, H2O.ai risks being squeezed out despite its current enterprise relationships. Microsoft, Google, and Amazon are integrating AI capabilities directly into their cloud platforms, potentially eliminating the need for separate ML solutions. Enterprise customers may prefer consolidated vendors over best-of-breed tools.

Data science talent retention: H2O.ai's competitive advantage relies heavily on their concentration of elite data scientists and Kaggle Grandmasters. The intense competition for AI talent, especially from tech giants with deeper pockets, threatens their ability to maintain this technical edge. Loss of key technical talent could slow innovation and erode their position as a leading ML platform provider.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.