Revenue

$600.00M

2023

Valuation

$9.50B

2021

Funding

$921.54M

2023

Growth Rate (y/y)

33%

2024

Revenue

Sacra estimates that Gusto generated $600M of revenue in 2023, up 33% from $450M in 2022.

Gusto's revenue is primarily derived from subscription-based payroll and HR services, with pricing tiers ranging from a free contractor-only plan to premium enterprise options. The company charges on a per-employee, per-month basis, with additional fees for features such as next-day direct deposit, advanced compliance tools, and benefits administration.

Growth in newer product offerings has been notable. The company's 401(k) services grew 50% year-over-year in 2024, while Gusto Money, its financial services product, expanded 140% year-over-year. The customer base increased from 300,000 direct SMB customers and 700,000 via partners in August 2024 to over 400,000 direct customers by March 2025.

Valuation & Funding

Gusto completed a tender offer in July 2025 that valued the company at $9.3B.

The company's most recent primary funding was a Series E extension of approximately $55M in May 2022, led by T. Rowe Price. The main Series E round closed in August 2021 with participation from Fidelity Management & Research, Generation Investment Management, Sands Capital, and Durable Capital Partners.

Earlier funding rounds included investments from General Catalyst, Emergence Capital, Dragoneer Investment Group, Kleiner Perkins, and Y Combinator. Gusto has raised over $746M in total funding across all rounds since its founding.

Product

Gusto operates as a centralized system for managing employment tasks at small and medium-sized businesses. Instead of relying on separate tools for payroll, time tracking, health insurance, and contractor payments, business owners use a single dashboard to handle all employment-related functions.

The payroll engine automates tax calculations and filings across all 50 states, generates W-2 and 1099 forms, and processes direct deposits. Payroll on AutoPilot runs automatically after setup, while unlimited off-cycle runs accommodate bonuses and reimbursements without additional fees.

For workforce management, employees track hours via browser, mobile app, or kiosk, with recorded hours integrated directly into payroll calculations. Managers create shift schedules using a drag-and-drop interface and receive compliance alerts for break rules and overtime regulations.

The platform includes HR tools such as offer letter templates, electronic I-9 and W-4 processing, document automation, and performance review systems. Gusto Compliance tracks state-specific requirements, including anti-harassment training and pay frequency rules, and sends automated alerts to maintain compliance.

Benefits administration supports health, dental, vision, and workers compensation plans nationwide, with HSA, FSA, and commuter benefits offered through partnerships. The contractor payment system supports domestic 1099 workers and enables payments to contractors in over 120 countries, including currency conversion and tax form collection.

Business Model

Gusto operates a subscription SaaS model with per-employee-per-month pricing across multiple tiers. The business uses a B2B go-to-market approach, targeting small and medium-sized businesses directly and through partner channels such as accountants and financial institutions.

Revenue grows in proportion to customer employee count and feature adoption, rather than through seat-based licensing. Customers pay monthly or annual subscriptions that include core payroll processing, with premium tiers offering features such as next-day direct deposit, advanced reporting, and enhanced compliance tools.

The company generates recurring revenue by bundling complementary services with its core payroll function. Benefits administration, time tracking, HR tools, and compliance monitoring create switching costs and contribute to expansion revenue as businesses scale and adopt additional services.

Gusto Embedded offers white-label payroll APIs to banks and vertical SaaS companies, establishing a B2B2C channel that reaches customers without requiring direct sales efforts. This embedded strategy utilizes partner distribution while retaining Gusto's technology infrastructure and regulatory compliance capabilities.

The business model supports organic growth as customers increase employee headcount and adopt additional services. Compliance requirements and the complexity of multi-state payroll create high switching costs, while the integration of payroll, benefits, and HR data strengthens customer retention.

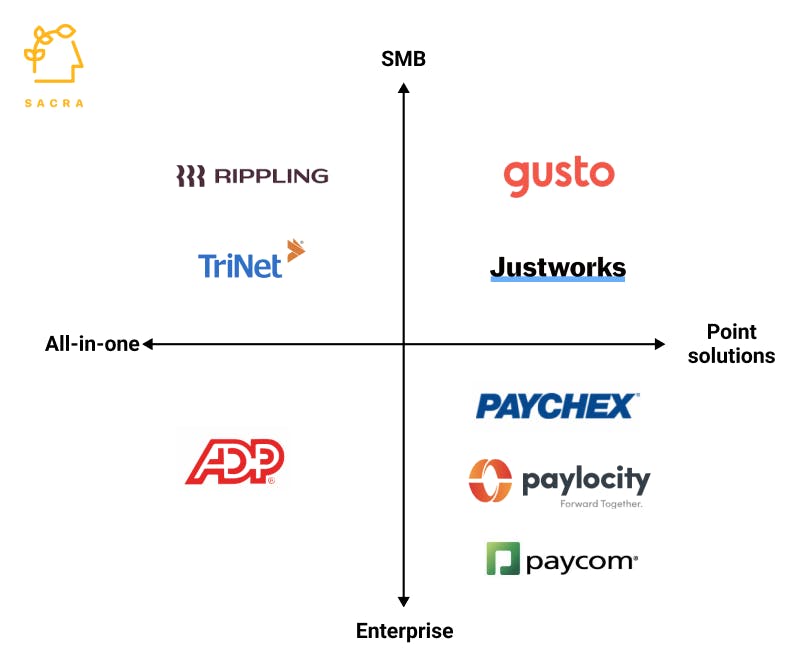

Competition

Incumbent payroll providers

ADP RUN serves over 900,000 small business customers and competes on usability through AI-driven features such as natural language chat and payroll anomaly detection. Paychex acquired Paycor for $4.1 billion to enhance its end-to-end HCM capabilities, utilizing its 745,000-client dataset to develop AI benchmarking tools.

Intuit QuickBooks Payroll leverages its accounting software customer base for cross-selling and incorporates AI error detection and automated 1099 processing. Its integration with QuickBooks accounting creates a competitive advantage by combining existing customer relationships with data synchronization.

Modern integrated suites

Rippling operates in 80 countries for employer-of-record services and markets itself as a unified system for global and domestic payroll. The platform combines IT management, spend controls, and HR functions into a single interface, competing on the breadth of its capabilities.

Paylocity introduced spend management features through its Airbase integration, expanding beyond HR into finance functions. This move into adjacent back-office areas directly challenges Gusto's efforts to grow its financial services offerings.

Contractor and global specialists

Deel and Remote specialize in international contractor payments and employer-of-record services, targeting the expanding remote work and global hiring market. These platforms focus on cross-border compliance and multi-currency payments, areas where traditional payroll providers have been slower to adapt.

TAM Expansion

Retirement and financial services

The acquisition of Guideline integrates 401(k) and IRA administration directly into Gusto's offerings, enabling the bundling of retirement services with payroll and benefits. State-level auto-IRA mandates, now active in 19 states, introduce regulatory requirements that expand the total addressable market for retirement administration services.

Gusto Money offers business banking and financial services, generating additional revenue streams from existing payroll customers. The integration of payroll processing with business banking creates opportunities to offer lending, cash management, and other financial products.

Embedded payroll expansion

Gusto Embedded allows banks and vertical SaaS platforms to incorporate white-label payroll services into their existing products. For example, Chase Payment Solutions can provide payroll services to its merchant customers without developing the necessary infrastructure internally.

This embedded model extends Gusto's reach to businesses that would not otherwise engage with the company directly, increasing the addressable market through partner distribution. Each integration offers access to thousands of potential customers within specific industries or banking networks.

Compliance and AI services

Gusto Compliance includes a paid module for ongoing labor law monitoring and state-mandated training requirements, addressing the $6 billion HR compliance outsourcing market. The AI assistant Gus delivers natural language payroll support and benefits recommendations, creating opportunities to introduce premium AI-powered features.

These offerings expand beyond standard payroll processing into higher-value advisory and automation services. As AI adoption grows within HR technology, Gusto can monetize advanced decision-support and personalization capabilities.

Risks

Scaling an ops-heavy core business: Payroll products like Gusto are operations heavy, and therefore the quality of the customer experience is partly dependent on the specific representatives that a team ends up dealing with. This poses a risk to Gusto’s ambitions to scale, because it’s difficult to scale a consistent user experience for an ops-heavy business.

Commoditization of payroll: Vertical SaaS products and other adjacent companies to Gusto can use API rails from the likes of Check (backed by Stripe; valuation: $725M), Pinwheel (backed by Coatue; valuation: $500M) and Atomic to integrate payroll and back-office functionalities just as they use BaaS startups like Bond, Lithic and Highnote to integrate card issuing and various fintech features.

Economic sensitivity: Small and medium-sized businesses tend to reduce headcount during economic downturns, directly affecting Gusto's per-employee revenue model. A recession could lead to lower employee counts among customers and heightened price sensitivity, creating downward pressure on both revenue growth and pricing across Gusto's customer base.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.