Revenue

$12.18M

2024

Valuation

$100.00M

2021

Funding

$16.10M

2021

Growth Rate (y/y)

88%

2023

Revenue

Sacra estimates that Gumroad hit $21M in revenue in 2023, up 96% from $11M in 2022.

Gumroad's pricing change from a 3.5-8.5% variable take rate to a flat 10% take rate on GMV in early 2023 near doubled monthly revenue from $1M to $1.8M and flipped them from burning cash (-$1M net in 2022) to generating $9M in net profit for 2023.

Valuation & Funding

Gumroad was valued at $100M as of 2021. Based on 2021 revenue of $10.97M and a $100M valuation, the company traded at an 9.1x revenue multiple. The company has raised $16.46M in total funding across 6 rounds. Notable investors include Naval Ravikant, Max Levchin, and Collab+Currency, with additional participation from SV Angel and Jason Fried.

Product

Gumroad is a creator marketplace and platform for creators to host and sell products directly to their customers.

Launched in 2011 as a way to easily share and sell digital downloads, Gumroad today supports more than 18 product categories, including animations, e-books and digital music as well as physical products and Patreon-like memberships.

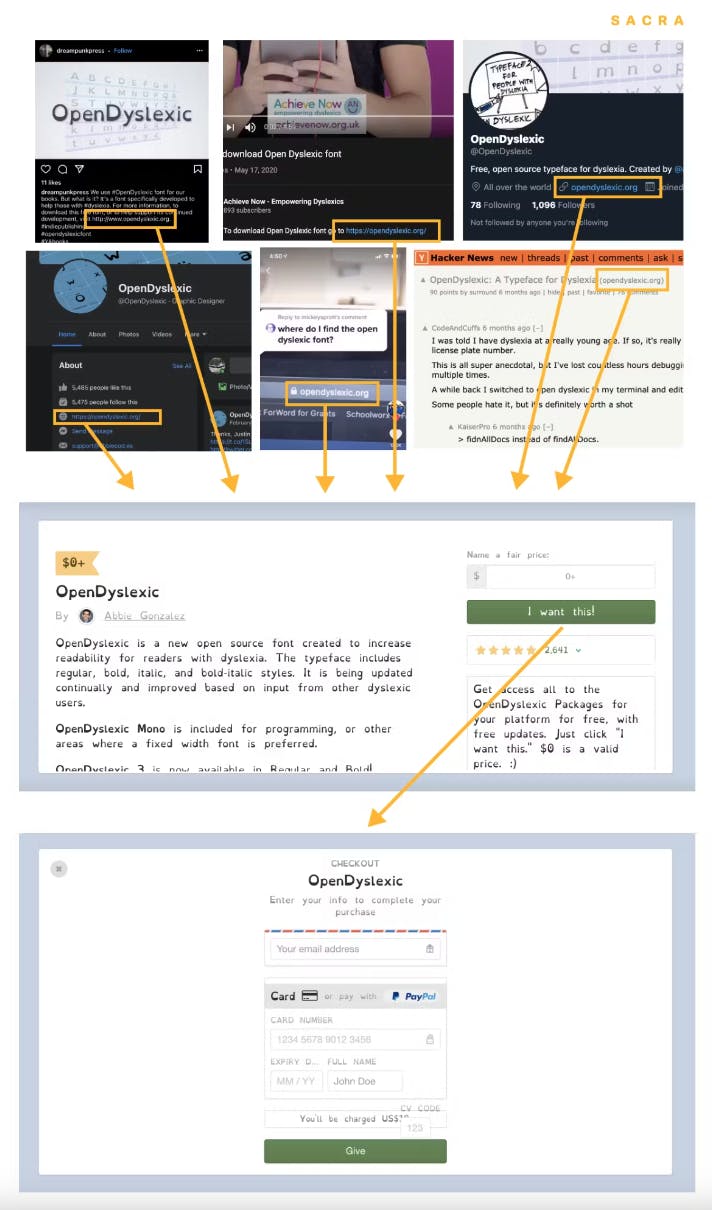

Creators upload their product to Gumroad, add a name, preview image and product description, and then accept payments through credit cards or PayPal.

Creators can put their Gumroad link anywhere in order to bring people to their personal checkout: in their TikTok bio, in a pinned message in their Discord community, in an email, and so on.

Business Model

Gumroad generates revenue through a flat 10% transaction fee on every sale made through its platform, eschewing monthly subscription fees in favor of a pay-as-you-go model that aligns with creators' variable sales volumes.

The pricing structure is straightforward: for each sale, Gumroad takes 10% of the transaction value, plus payment processing fees (2.9% + $0.30 for Stripe, or 3.49% + $0.49 for PayPal).

This model is particularly attractive to new or small-scale creators who may not have consistent sales volumes, as they only pay when they make money. For a $100 sale, a creator would net $86.80 after Gumroad's fee and Stripe's processing fee.

The company has additional revenue streams that complement its core offering.

The Gumroad Discover feature allows creators to boost their product rankings for a minimum 30% fee, providing an upsell opportunity for those seeking increased visibility.

Furthermore, in-app sales through Gumroad's mobile application incur a higher 40% fee due to app store charges, creating another revenue channel.

Competition

Gumroad has two products—a SaaS platform that lets creators upload and sell content, and a marketplace that allows people to find new content creators.

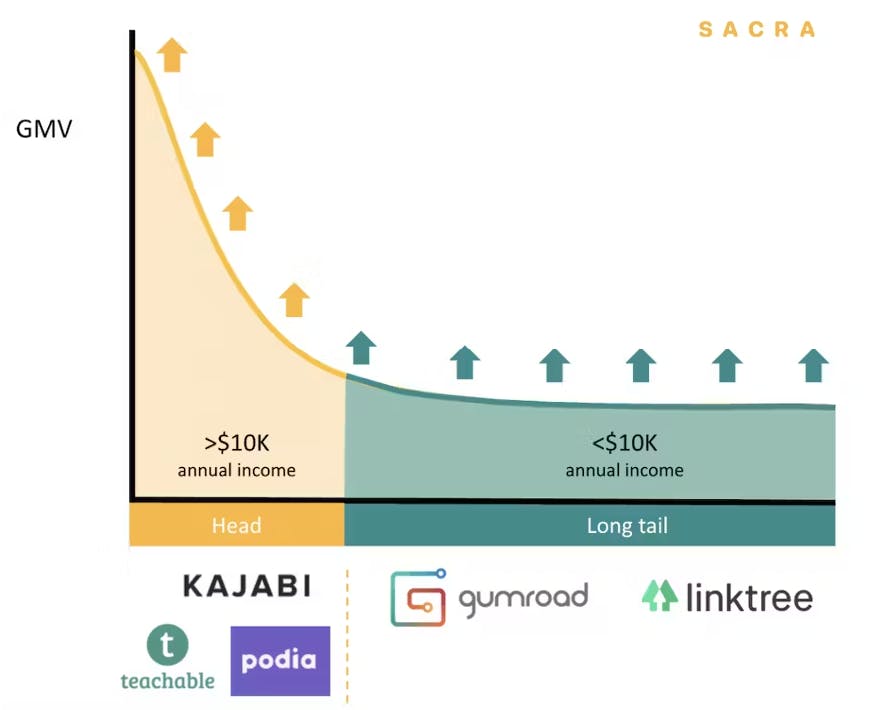

All-in-one creator platforms has been a significant trend with Kajabi, Teachable, Podia, Circle, Stan and Beacons all going in this direction. All-in-ones offer custom websites, landing pages, email marketing, and more. Compared to all-in-one platforms, Gumroad's feature set is more minimalistic.

Gumroad monetizes like a marketplace, charging a 10% take rate on each transaction. Because the marketplace doesn’t drive a meaningful amount of demand, however, they have to continually add more creators to grow their GMV.

Once creators are making more than $4K per year, the transaction fees a creator is paying to Gumroad are equivalent/beyond what they’d pay for a more fully-featured SaaS platform for creators like Stan.

In other words, even though Gumroad monetizes on GMV, it’s set up to attract low-GMV creators—who have been benchmarked churning as high as 20% a month—and gradually lose its high-GMV creators.

The downside risk is that Gumroad has two lines of business: 1) a SaaS platform that isn’t fully-featured, and 2) a marketplace that doesn’t drive discovery.

This positioning creates competitive as well as core business challenges for Gumroad.

However, within the creator economy, Gumroad serves a slightly different segment and purpose than the all-in-one platforms.

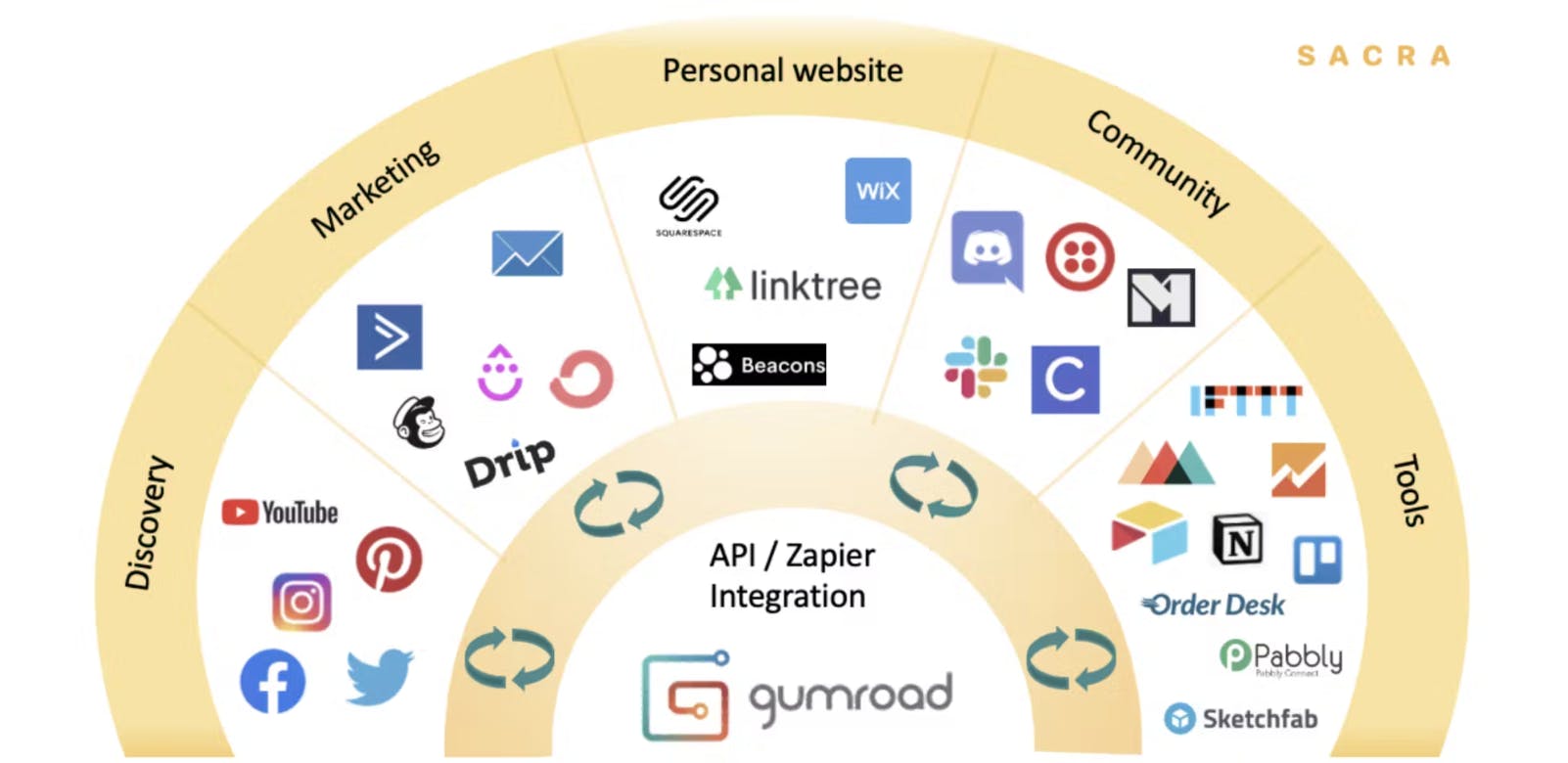

Where those platforms are designed for bigger creators, Gumroad is designed to be for the masses. No matter what discovery mechanisms a creator uses (TikTok, YouTube, Instagram) or marketing tools they rely on (ConvertKit, Ghost, Mailchimp), or how they built their community (Slack, Discord), Gumroad can function as their product page and checkout function.

It is fully interoperable, which makes it adaptable not just to the needs of their creators but to changes in the creator economy itself.

TAM Expansion

Many of the newest wave of creator economy tools have taken an Apple-like approach to the customer experience, building a product that takes care of as many creator needs as possible. Gumroad has gone in a more Android-like direction, building a product focused entirely on checkout but designed to be interoperable with as many other creator tools as possible.

Gumroad’s focus on the checkout experience means that its long-term strategic trajectory looks less like that of Podia or Teachable and more like a Bolt or Shopify.

Gumroad grows the GMV on their marketplace and the GDP of the creator economy itself by continuing to build a better checkout for creators.

Where Gumroad sits in the toolchain—at the point of monetization—gives it three primary levers it can pull to do that:

More interoperability: Integrating natively with more 3rd-party providers so that customers can e.g. buy via Gumroad buttons embedded in emails or other apps

More conversions: Helping merchants create more sales by leveraging data gained from operating at large scale

More products: Enabling creators to monetize in more ways, such as services, experiences, and crypto-assets like NFTs

Building the best checkout for creators has the potential to grow Gumroad into a big business while at the same time not compromising Gumroad’s dedication to creator-alignment. If anything, it strengthens it further: the more that Gumroad can help its creators monetize, the more money Gumroad will make.

In addition, Gumroad is investing its substantial positive cash flow ($9M in profit in 2023) in building the Gumroad family of businesses—Flexile for contractor payroll ($36K ARR), Helper for customer support, and Iffy for API-based content moderation.

This software stack has the potential to assemble into a vertical software suite for creators who share its philosophical approach to building companies—1-person startups with part-time contractors compensated in cash, equity, and dividends, combining flexible work with the ability to share in the company’s asymmetric upside.

Risks

1. Pricing strategy backfire: Gumroad's recent shift to a flat 10% fee could backfire by driving away high-volume creators who were previously paying much lower rates.

While intended to boost profitability, this move risks alienating Gumroad's most valuable customers.

The company may see continued GMV decline if creators migrate to competitors with more favorable pricing for established sellers.

2. Loss of differentiation: As Gumroad expands into website building and email marketing, it risks losing focus on its core checkout functionality.

This shift towards becoming a generalist platform could dilute Gumroad's unique value proposition in an increasingly crowded creator economy landscape.

The company may struggle to compete effectively against specialized tools in each category while no longer standing out for its original purpose.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.