Revenue

$18.98M

2025

Funding

$10.30M

2024

Growth Rate (y/y)

134%

2025

Revenue

Sacra estimates Freed hit $19M in annual recurring revenue (ARR) in March 2025, up 134% year-over-year.

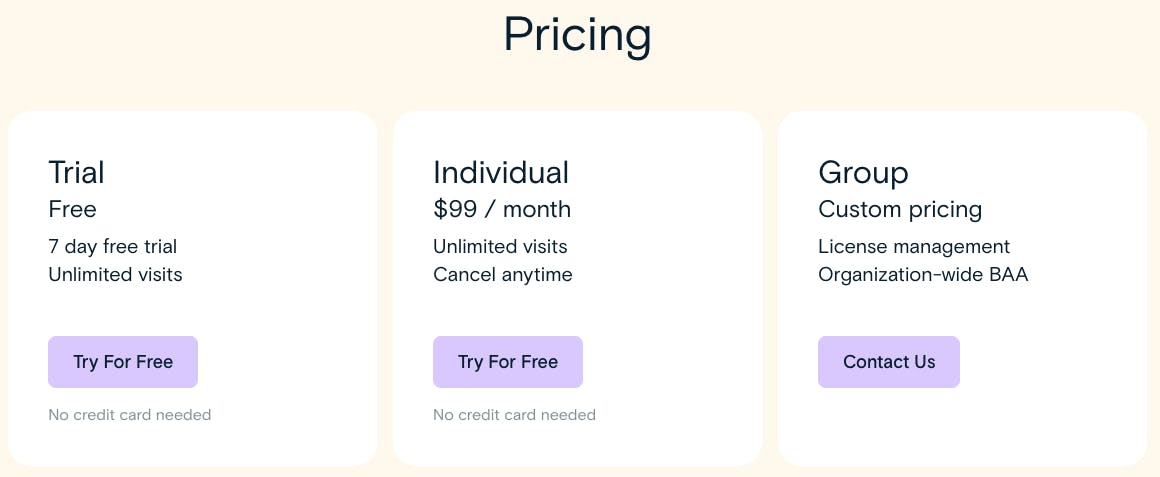

Freed operates on a straightforward SaaS pricing model at $99 per month per clinician, with roughly $1K ACV per clinician after factoring in discounts for medical students and trainees.

This pricing strategy positions them as one of the most affordable AI medical scribe solutions in the market, significantly undercutting enterprise competitors that typically charge several hundred dollars per month.

The company primarily targets the independent practice segment, which represents 47% of US clinicians. While this "bottom of the market" approach limits revenue per customer, it has enabled faster adoption and helped Freed avoid the lengthy enterprise sales cycles that characterize many healthcare technology companies.

Valuation & Funding

Freed has raised a total of $10.3M across two funding rounds. The company's most recent financing was a $7.5M Seed VC-II round in March 2024, led by Sorin Investments and Multiply Ventures, with participation from Piper Serica Fund. Previous rounds included investments from Chennai Angels and Lead Angels. Multiply Ventures has participated in both of the company's Seed VC rounds.

Product

Freed was founded in January 2023 by Erez Druk, inspired by his wife Gabby's experience as a family medicine resident struggling with documentation burden. The company launched its first product in March 2023 and reached general availability in May 2023.

The product functions as an ambient listening tool during patient visits. When a clinician starts an appointment, they simply press "start" in the Freed app (available on any device) and conduct their visit as normal.

The AI listens to the natural conversation between doctor and patient, automatically generating a comprehensive clinical note that includes the subjective history, objective findings, assessment, and plan.

When the visit ends, the clinician hits "stop" and receives a structured note within 60 seconds that can be reviewed and copied into their electronic health record (EHR).

Unlike traditional medical scribes that cost $40,000+ annually or complex enterprise solutions that require extensive training and IT approval, Freed operates as a standalone tool that clinicians can adopt immediately.

The AI learns each provider's documentation style over time, automatically formatting notes to their preferences while maintaining compliance with medical documentation standards.

The product has gained particular traction among direct primary care practices, independent specialists, and small group practices where administrative burden falls directly on physicians. These users typically see 20-30 patients per day and were previously spending 2-3 hours each evening completing documentation. With Freed, they can complete notes between visits or immediately after, eliminating "pajama time" spent charting at home.

Business Model

Freed monetizes through a straightforward subscription model, charging $99 per month for individual clinicians with unlimited usage and offering custom enterprise pricing for group practices. They also provide a 50% discount for medical residents and trainees, and a 9% discount for annual commitments.

The core value proposition is replacing traditional medical scribes (who cost ~$40K/year) with AI technology that generates clinical notes in under 60 seconds.

Freed's platform integrates with electronic health records (EHRs) through a copy-paste workflow, with deeper EHR integrations in development.

Their focus on smaller practices and standalone functionality provides a clear differentiation from enterprise-focused competitors like Abridge, which are increasingly tied to major EHR vendors through equity and revenue-sharing agreements.

Freed's bottom-up approach does face scaling challenges as practices grow beyond single doctors, necessitating business associate agreements and deeper EHR integrations.

Competition

Freed operates in the AI medical scribe market, which has attracted nearly $1B in venture funding as healthcare providers seek to reduce the estimated 3 hours per day physicians spend on documentation.

The competitive landscape breaks down into three main segments:

Enterprise AI scribes

Microsoft's Nuance dominates the enterprise market after its $19.7B acquisition, claiming 77% penetration in US hospitals. Abridge has positioned itself as Nuance's primary challenger through deep EHR integration, notably securing equity investment and revenue share agreements with Epic (38% market share in EHRs).

Ambience Healthcare ($100M raised) similarly targets large health systems with an enterprise-first approach. These players differentiate through extensive EHR integrations and compliance features required by major health systems, but command significantly higher pricing than independent solutions.

PLG AI scribes

Freed ($11M ARR) and Heidi Health ($15M raised) focus on the 47% of US clinicians in independent practices, offering standalone functionality at $99/month compared to enterprise solutions costing thousands per month.

These solutions prioritize rapid deployment and minimal training requirements, allowing individual practitioners to adopt them without IT approval.

However, they face challenges scaling beyond single-doctor practices, as even small group practices typically require business associate agreements and IT sign-off for HIPAA compliance.

Vertical and niche AI scribes

DeepCura AI and other boutique providers target specific medical specialties or EHR systems, building deep vertical expertise rather than broad market coverage.

These companies can maintain lean operations while achieving strong product-market fit within their niches.

For example, some focus exclusively on behavioral health documentation integrated with platforms like SimplePractice, while others specialize in emergency department workflows.

TAM Expansion

Freed has tailwinds from healthcare's worsening labor crisis and increasing AI adoption, with opportunities to expand beyond its current $11M ARR AI medical scribe business into broader clinical workflow automation and specialized vertical solutions.

Clinical workflow automation

The most immediate expansion opportunity for Freed lies in automating the full spectrum of clinical documentation and administrative tasks.

While their current focus on transcription addresses a $4B market (100K medical scribes at $40K/year), the total administrative burden in healthcare represents a $300B opportunity.

By leveraging their existing integration with clinical workflows, Freed can expand into pre-visit documentation, billing/coding automation, and post-visit follow-up communications.

Their early success with automated patient instructions demonstrates the potential for expansion into patient engagement and care plan management.

Specialty-specific solutions

Freed has demonstrated strong product-market fit with independent practitioners, who represent 47% of U.S. clinicians.

This creates an opportunity to develop deeper, specialty-specific solutions. For example, mental health providers have unique documentation requirements and typically operate in small practices - an ideal fit for Freed's lightweight, affordable approach. Similarly, dental practices represent another fragmented market with specialized documentation needs.

By tailoring their AI capabilities to specific verticals, Freed could command higher prices while facing less competition from enterprise-focused players like Nuance/Microsoft.

Building a platform

As Freed accumulates more clinical conversation data and deepens EHR integrations, they could expand into clinical decision support and workflow optimization.

Their ability to analyze patient-provider interactions at scale could yield valuable insights for improving care quality and operational efficiency.

While enterprise EHR vendors like Epic are partnering with companies like Abridge for AI capabilities, Freed's focus on independent practices and standalone functionality positions them to potentially become the default operating system for small healthcare providers.

This could enable expansion into areas like scheduling, billing, and practice management - addressing the full scope of administrative operations that burden independent practices.

Risks

EHR Integration Bottleneck: While Freed has found initial success with standalone functionality and copy-paste workflows, sustained growth requires deep EHR integration. Building these integrations is extremely complex - each EHR has unique data concepts, formats, and compliance requirements.

Competitors like Abridge have had to make significant concessions (equity and revenue share) to secure Epic integration. As a lean team targeting independent practices, Freed may struggle to build and maintain integrations across the long tail of EHR vendors their customers use, potentially limiting expansion.

Practice Consolidation Headwinds: Freed's focus on independent practices and small clinics ($99/month pricing, minimal IT requirements) targets a shrinking market. Industry consolidation continues to accelerate - small practices are being absorbed into larger health systems with enterprise-wide technology decisions.

This could squeeze Freed's target market over time and force them to compete more directly with enterprise-focused players like Nuance and Abridge who have deeper relationships with major health systems.

Feature Commoditization Risk: Core AI transcription and note generation capabilities are becoming commoditized as language models improve. While Freed currently differentiates through simplicity and affordability, larger competitors with more resources could match their feature set and pricing.

To maintain margins and avoid competing solely on price, Freed needs to expand beyond basic scribing into harder-to-replicate workflows - but this requires significant R&D investment that may strain their capital-efficient model.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.