Revenue

$200.00M

2021

Valuation

$3.00B

2022

Funding

$525.00M

2022

Growth Rate (y/y)

100%

2022

Revenue

Revenue estimated using publicly available information.

Forter made roughly $200M in 2021, a 100% increase over 2020. Forter makes money by taking a percentage of the GMV it approves for its customers. In 2021, it processed $250B worth of GMV, a 2.5X increase over 2019. Forter has processed over $500B worth of GMV to date—among the highest for any fraud prevention tool focused on online retailers.

Valuation & Funding

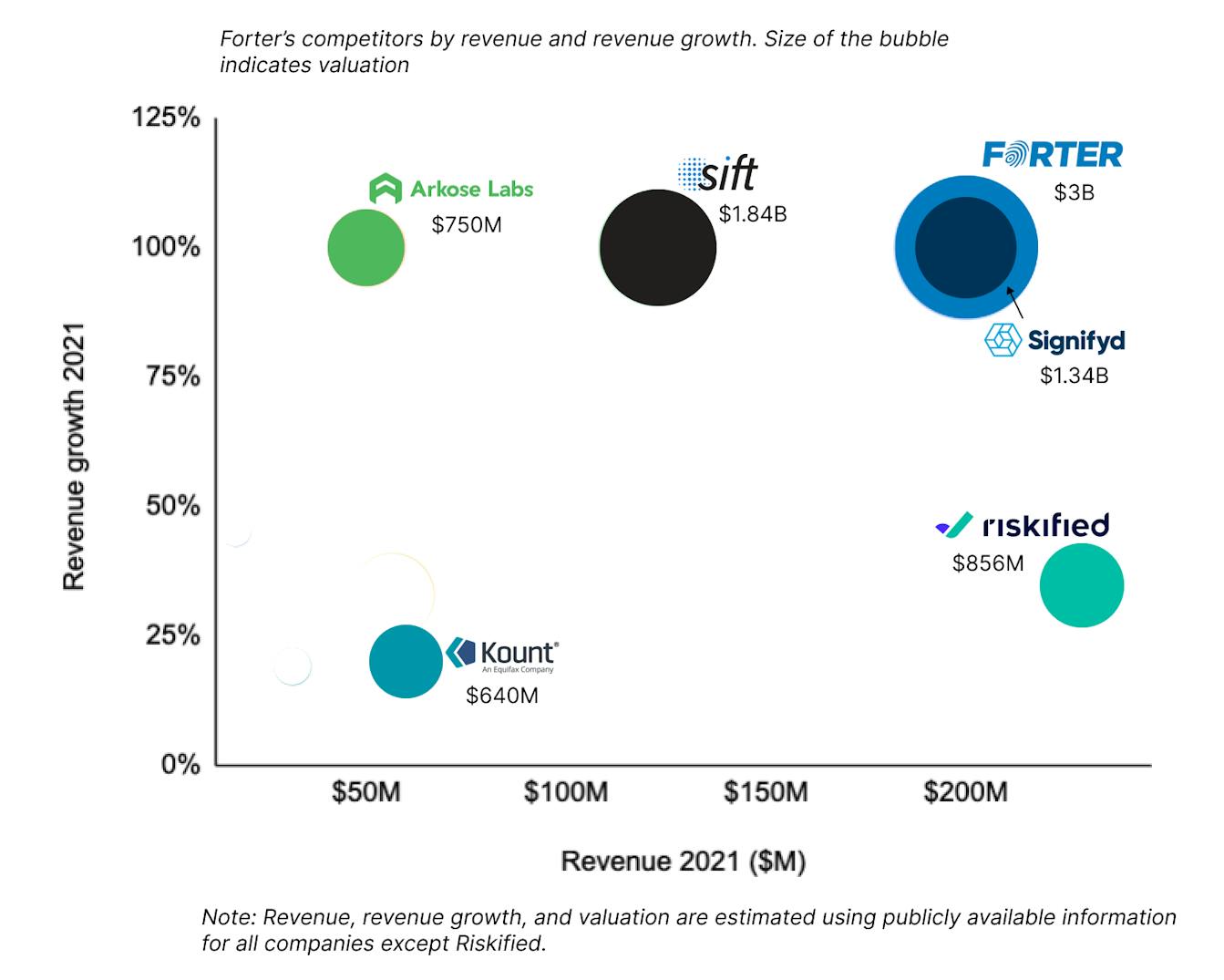

Forter has raised $525 million from investors such as Bessemer Venture Partners and Sequoia Capital. It was last valued at $3 billion, making it one of the most valuable companies in the online fraud detection market. One of its closest publicly listed competitors, Riskified, has a market cap of $856 million with a revenue of $229 million. Its valuation/revenue multiple is 3.7—less than four times that of Forter. Another significant competitor Sift is valued at $1.84 billion with a revenue of $122 million.

Forter's competitors by revenue and revenue growth. Bubble size indicates valuation. Figures estimated using publicly available information.

Product

Online retailers lose a significant amount of money to fraud. Fraudsters use stolen credit cards or login credentials to conduct fraudulent transactions, which result in chargebacks retailers have to bear when they are disputed by genuine users. In 2021, online retailers lost $20B in chargebacks—a figure expected to increase to $52B by 2025. The bigger issue is sales lost as retailers tune their fraud prevention systems too aggressively in response: blocking legitimate transactions, causing direct revenue loss, and frustrating genuine users. In 2021, online retailers lost $443B of potential revenue in the US alone due to such false declines.

Forter is a SaaS tool that uses AI to distinguish fraudsters from genuine users. Retailers connect Forter to their websites using a snippet of Javascript or via integrations available for platforms like Shopify, Salesforce Commerce, and Adobe Commerce. On mobile, they can integrate Forter’s SDK into their apps.

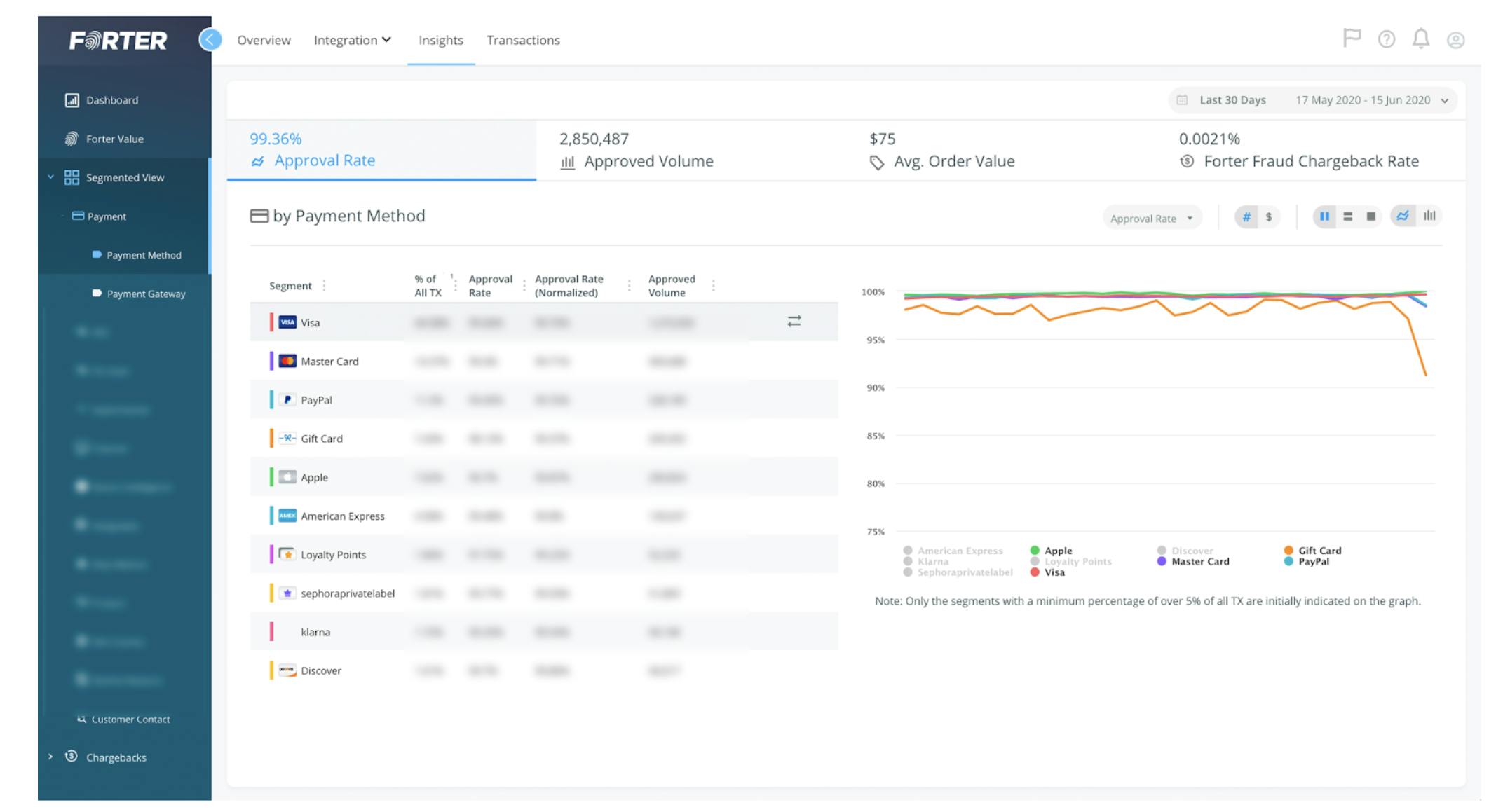

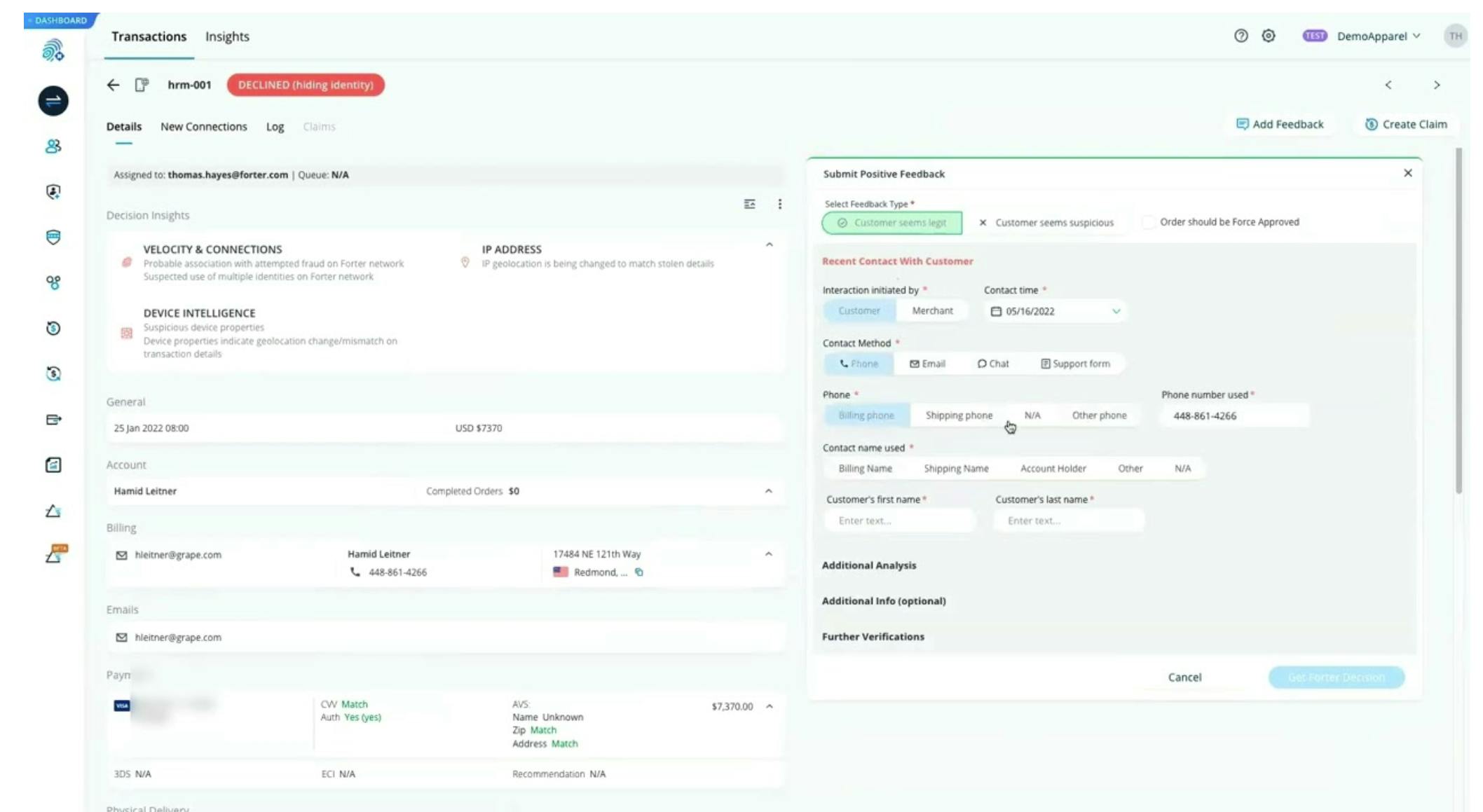

Once connected, Forter’s AI engine learns a retailer’s customer profile by analyzing live or historical data. It then starts collecting user data such as device information, location, mouse movements, cart behavior, IP address, and user credentials. When an action takes place—like a new account or payment being created—Forter searches through its database of a billion digital personas (collected from across its various customers) to check for any patterns that indicate fraud. It then approves or blocks the transaction in real-time with an option for retailers to override the transaction. Every transaction is fed back into the database, improving the accuracy of Forter’s AI engine.

Forter’s products can be categorized into three buckets: payments, identity management, and policy.

Payments

Forter’s payment solution reduces a retailer’s chargeback rate by rejecting fraudulent transactions at checkout before they are sent to the payment gateway for authorization. It also helps improve transaction approval rates by routing transactions to payment gateways with higher chances of approval.

Identity management

Forter matches the behavior and attributes of both new and returning users to its persona database to verify that they are genuine users. This helps retailers in preventing account takeovers where thieves steal credentials and use existing accounts to make fraudulent purchases.

Policy

Fraudsters often exploit retailers' promotion, return, or refund policies to make money. For example, they might report that an item was not received even after receiving that item, or create multiple accounts to take advantage of certain discounts. Forter surfaces such users by tracking them from the moment of account creation and declining the transactions when detected.

Forter's portal showing different payment methods

Forter's dashboard view for a transaction showing the reason for decline

Competition

Forter competes with two types of companies. One is the fraud detection companies. The lines between checkout protection, identity management, and user authentication have blurred in the last few years. Many of the companies in this space have launched complementary, adjacent features in a land grab to cover as much of the typical user journey as possible. Many companies in this group, including Forter, now emphasize improved conversion and increase in sales rather than just fraud reduction.

As a tool that lives at the point of sale, Forter also competes with checkout companies that offer in-house fraud prevention tools, including payment gateways such as Stripe and Adyen and one-click checkout companies like Bolt.

Fraud detection companies

Riskified

Riskified is one of the largest online fraud detection companies focused on ecommerce, having raised a total of $229M. It processed $89B GMV in 2021. Like Forter, it makes money by charging a percentage of GMV processed. Its products are similar to Forter and cover payment, account takeover, and policy abuse frauds. Riskified listed in July 2021 at a $4.3B market cap.

Signifyd is similar to Forter and Riskified with its focus on ecommerce and its use of an AI engine to detect fraud. It has raised $411M from FIS, Bain Capital Ventures, Menlo Ventures, and American Express Ventures and was last valued at $1.34B. It processes over $100B GMV annually, covering account takeover, payment, and policy abuse frauds.

Kount (part of Equifax)

Kount started as a digital identity management platform that expanded into other types of fraud, such as chargebacks and bot detection. It raised $80M from CVC Capital Partners before being acquired by Equifax in 2021 for $640M. Kount analyzes 32B+ transactions every year and has a database of 600M+ email addresses and 1B+ devices/IP addresses. It has the upside of integrating its digital identity database with Equifax’s physical identity database for identity management to move into categories beyond ecommerce.

Sift

Sift works across multiple industries such as hospitality, ecommerce, entertainment, and fintech. It processes over $250B worth of transactions every year. It has grown revenue 3X over the last three years and raised $156M from the likes of Union Square Ventures, Insight Partners, Stripes, and others and is valued at $1.84B.

Checkout companies

Bolt is a checkout-as-a-service provider for medium to large ecommerce merchants. Boltʼs primary product is its wrapper around the checkout, providing a one-click experience at the consumer end while enabling merchants to maintain control of the customer experience. By integrating with Bolt, merchants have improved their conversion rates by 63% compared to using ‘checkout as guestʼ. Bolt integrates checkout fraud detection with its core product.

Stripe Radar

Stripe Radar is a fraud prevention tool used by Stripe customers to reduce card and payment fraud. Stripe processes $640B of payments annually, which means it has more a higher quantity of data to learn from vs. other fraud detection tools. As Radar sits within Stripe, it also has access to better transaction information and a vast distribution network. However, Radar only works when checkout happens using Stripe—it doesn't support other payment providers.

TAM Expansion

Tailwinds

Forter has a lot of headroom to grow in the ecommerce market. The global ecommerce market’s GMV was $4.9T in 2021, which gives Forter approximately 5% of the market. While the COVID fueled ecommerce spike may be easing out, the market is still expected to grow at a CAGR of 11% to reach a GMV of $6.8B in 2024, providing a strong tailwind to Forter.

Scale

Forter processed $250B GMV in 2021 and has processed $500B GMV to date, giving it some of the highest processed volume in the entire fraud detection market. As Forter processes more transactions, the size of its database increases and each transaction makes the AI model better at predicting future transactions. This data flywheel coupled with Forter’s scale could provide it a powerful advantage over other players at scale.

Platform

Online retailers are increasingly looking for tools that provide an integrated experience across the user journey instead of relying on different point solutions for different tasks. Forter has added tools for identity management and policy abuse to take advantage of this shift. Taking this further, Forter can become a platform that integrates output from third-party tools to give its customers all fraud-related information in a single portal.

Risks

New payment security standards

Forter's solutions could be disintermediated by new payment security standards. For example, the EU's Second Payment Services Directive (PSD2) shifts the liability for fraudulent transactions from retailers to banks, meaning retailers don’t have to bear chargebacks for many types of transactions. This directly impacts demand for Forter's payment solutions, and post-PSD2, there has indeed been a decline in GMV from EU customers for Forter's competitors.

Payment companies offering fraud prevention

Since Stripe processes $640B of payments annually and Adyen processes around $590B, their fraud detection tools have a much more extensive database of previous transactions than Forter. Also, their fraud prevention tools ingest data from many more sources than is possible for Forter as a 3rd-party tool. If Stripe or Adyen were to start aggressively building out their fraud prevention solutions, it could affect Forter's market leadership position.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.