Revenue

$9.00M

2023

Valuation

$250.00M

2024

Funding

$68.00M

2024

Product

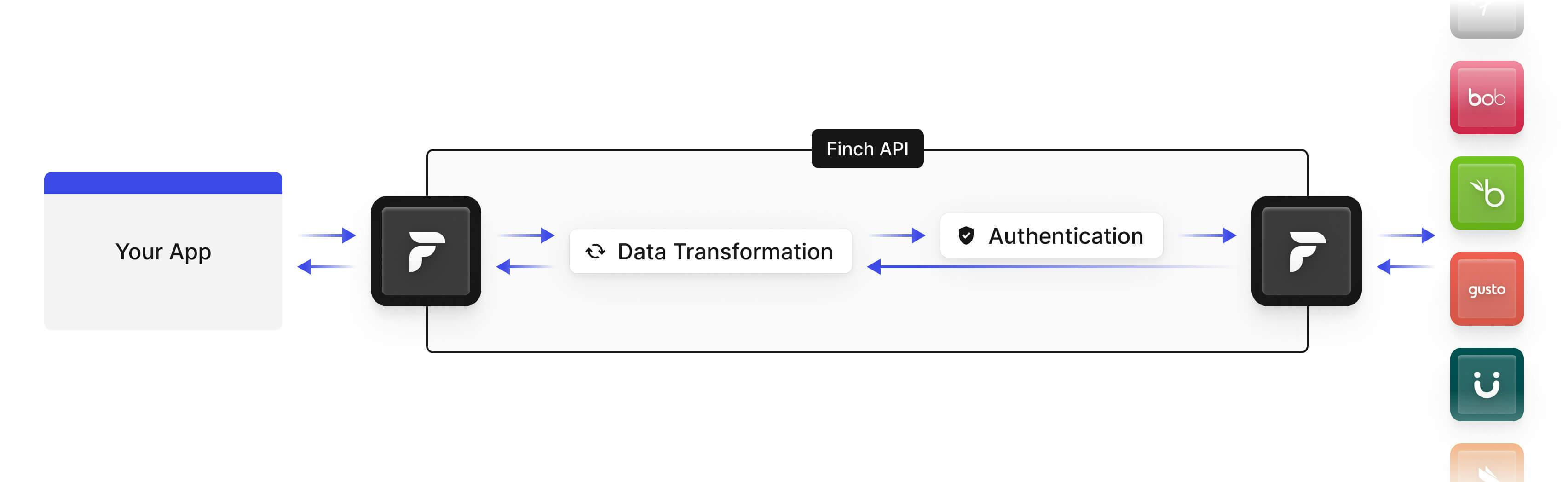

Finch was founded in 2020 by Jeremy Zhang and Ansel Parikh in San Francisco to address the fragmentation problem in employment systems. The company's vision was to create a unified API for HR and payroll data, streamlining access to employee information across multiple platforms.

Finch quickly gained traction by offering a solution to a critical pain point for benefits providers and B2B fintech companies. These businesses needed to integrate with numerous HR and payroll systems, a process that traditionally required building 40-50 individual connectors to achieve 75% market coverage. Finch's unified API, connecting to over 200 employment systems, eliminated this need.

The company found product-market fit with customers like Human Interest, a 401(k) provider. Human Interest uses Finch to automate connectivity for 60% of their customer base, replacing manual processes for employee data and payroll deductions. This success story exemplifies the value Finch brings to the market.

Key features of Finch's product include:

1. Unified API: Standardizes employment data across different providers.

2. Extensive Integration: Connects to over 200 payroll and HRIS systems.

3. Bi-directional Sync: Allows reading and writing of data, including deductions and contributions.

4. Security: Emphasizes data protection with encryption protocols like TLS 1.2 and AES 256-bit.

Finch's rapid growth is evident in its metrics: over 10,000 employers and 1 million employees connected, processing 5 million daily API calls. The company's revenue increased 12x between funding rounds, signaling strong market traction.

Business Model

Finch is a B2B SaaS company that provides a unified API for employment systems, focusing primarily on HR and payroll data integration.

The company generates revenue through a usage-based pricing model, charging customers based on the number of API calls made and the volume of employee data processed.

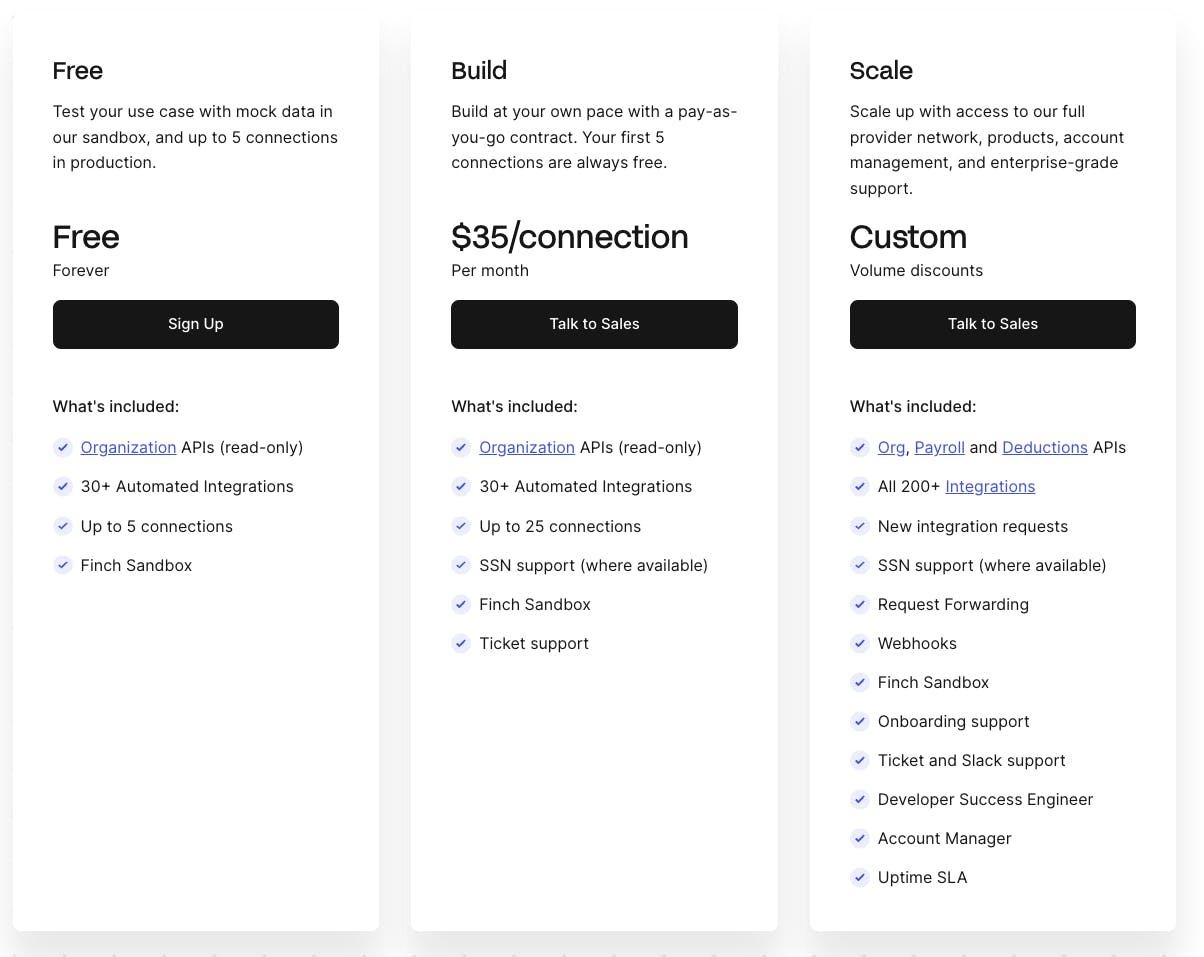

Finch has three tiers:

Free Plan: The first 5 connections are always free. This plan allows businesses to test their use case in Finch's sandbox environment with mock data or up to 5 live employers.

Build Plan: After the first 5 connections, each additional connection costs $35 per month. This plan is pay-as-you-go, allowing businesses to scale at their own pace. It includes access to organization APIs (read-only) and is suitable for testing and early-stage development.

Scale Plan: For businesses that need more than 25 connections, Finch offers the Scale plan. This plan includes volume discounts with an annual contract, access to the full provider network, products, account management, and enterprise-grade support. It also unlocks live support for troubleshooting and dedicated developer success team members.

At its core, Finch's business model addresses the fragmentation in the HR and payroll software market by offering a standardized interface to access data from over 200 different systems.

This allows Finch's customers, typically benefits providers and HR tech companies, to streamline their integration processes and reduce development costs. The company's pricing structure aligns with the value it provides, as customers pay more as they scale their usage and derive greater benefit from the service.

The company's competitive advantage lies in its extensive integration network and its ability to provide a single, standardized interface for a highly fragmented market. By solving the complex problem of data standardization and connectivity, Finch creates significant barriers to entry for potential competitors.

Competition

Finch competes in the employment data infrastructure and API integration space, with its primary focus on providing a unified API for HR and payroll systems. The competitive landscape can be divided into three main categories:

Employment Data API Providers

Finch's most direct competitors are companies specializing in employment data APIs. These include:

Atomic, Pinwheel, and Argyle: These companies focus primarily on income and employment verification, targeting the consumer-facing side of payroll data access.

While they operate in a similar space, Finch differentiates itself by focusing on employer-to-system connections rather than employee-to-system connections. This allows Finch to serve a different set of use cases, particularly for B2B fintech companies and benefits providers.

Merge: A more direct competitor to Finch, Merge offers a unified API for various business systems, including HR. However, Finch's specialization in employment systems and its deeper integration with over 200 payroll and HRIS providers gives it an edge in this specific vertical.

General API Integration Platforms

Finch also competes with broader API integration platforms that cover multiple sectors beyond just employment data:

MuleSoft, Boomi, and Workato: These platforms offer more comprehensive integration solutions across various business systems. While they provide flexibility, Finch's focused approach on employment systems allows for deeper, more specialized integrations and functionalities specific to HR and payroll data.

Jitterbit and Codat: These companies specialize in different areas (Jitterbit in complex integrations, Codat in financial data), but may overlap with Finch in some use cases. Finch's advantage lies in its specific focus on employment data and its ability to provide more tailored solutions in this domain.

Embedded Payroll Infrastructure Providers

The third category includes companies building embedded payroll systems:

Check, Zeal (by Gusto), and PrismHR: These companies provide white-labeled payroll solutions for vertical SaaS companies. While they operate at a different layer of the stack, they are both potential partners and competitors for Finch.

Finch's API can integrate with these embedded payroll systems, potentially enhancing their offerings. At the same time, as these companies create more fragmentation in the payroll space, they increase the value of Finch's standardization services.

TAM Expansion

Finch has tailwinds from the increasing fragmentation of HR and payroll systems and the growing demand for unified employment data access. It has the opportunity to grow and expand into adjacent markets like benefits administration, workforce management, and financial services for employees.

Employment Data Infrastructure

Finch's core business of providing a unified API for employment systems addresses a critical need in a highly fragmented market. With over 6,000 different HR and payroll systems in the U.S. alone, Finch's ability to standardize and streamline access to employee data positions it as a crucial infrastructure layer.

As more specialized HR tech solutions emerge, the need for Finch's integration capabilities will likely increase, driving growth in its core market.

The company can expand horizontally by integrating additional employment-related systems beyond HR and payroll, such as benefits, time and attendance, and recruiting platforms. This expansion would increase Finch's value proposition and addressable market, potentially positioning it as the central hub for all employment-related data.

Vertical Expansion into Financial Rails

Finch has the opportunity to move deeper into the financial infrastructure of employment systems. By expanding its capabilities in areas like processing reimbursements and handling more complex payroll operations, Finch could capture a larger portion of the value chain. This vertical expansion aligns with the company's existing strengths in data standardization and integration, while opening up new revenue streams.

Application Layer and Distribution

As Finch's ecosystem grows, the company has the potential to leverage its position as an infrastructure provider to expand into the application layer. With thousands of applications and benefits providers built on top of Finch, the company could evolve into a distribution channel for various employment-related services. This expansion could mirror the trajectory of other successful API companies, allowing Finch to capture more value from its ecosystem.

Risks

1. Market Fragmentation Challenges: Finch's value proposition relies on integrating a highly fragmented market of 6,000+ HR and payroll systems. While this fragmentation creates opportunity, it also poses significant technical and operational challenges.

If Finch struggles to maintain integrations across a rapidly evolving landscape of systems, it could undermine its core offering and erode customer trust. The company may need to continually invest heavily in engineering resources to keep pace, potentially impacting profitability.

2. Disintermediation by Major Players: As Finch gains traction, major HR/payroll providers like ADP or Workday could view it as a threat and develop their own API solutions or restrict access.

This could cut Finch off from critical data sources and limit its market reach. To mitigate this, Finch may need to rapidly expand its value-add services beyond basic API connectivity.

3. Data Security and Compliance Risks: Handling sensitive employee and payroll data across multiple systems exposes Finch to significant security and compliance risks. A major data breach or compliance failure could severely damage Finch's reputation and growth prospects.

While the company has implemented security measures, the constantly evolving nature of cyber threats and regulations in this space requires ongoing vigilance and investment.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.