Revenue

$330.00M

2025

Valuation

$11.00B

2025

Funding

$281.00M

2025

Growth Rate (y/y)

380%

2024

Revenue

Sacra estimates ElevenLabs hit $330M in annual recurring revenue (ARR) in 2025, up 175% year-over-year from $120M at the end of 2024.

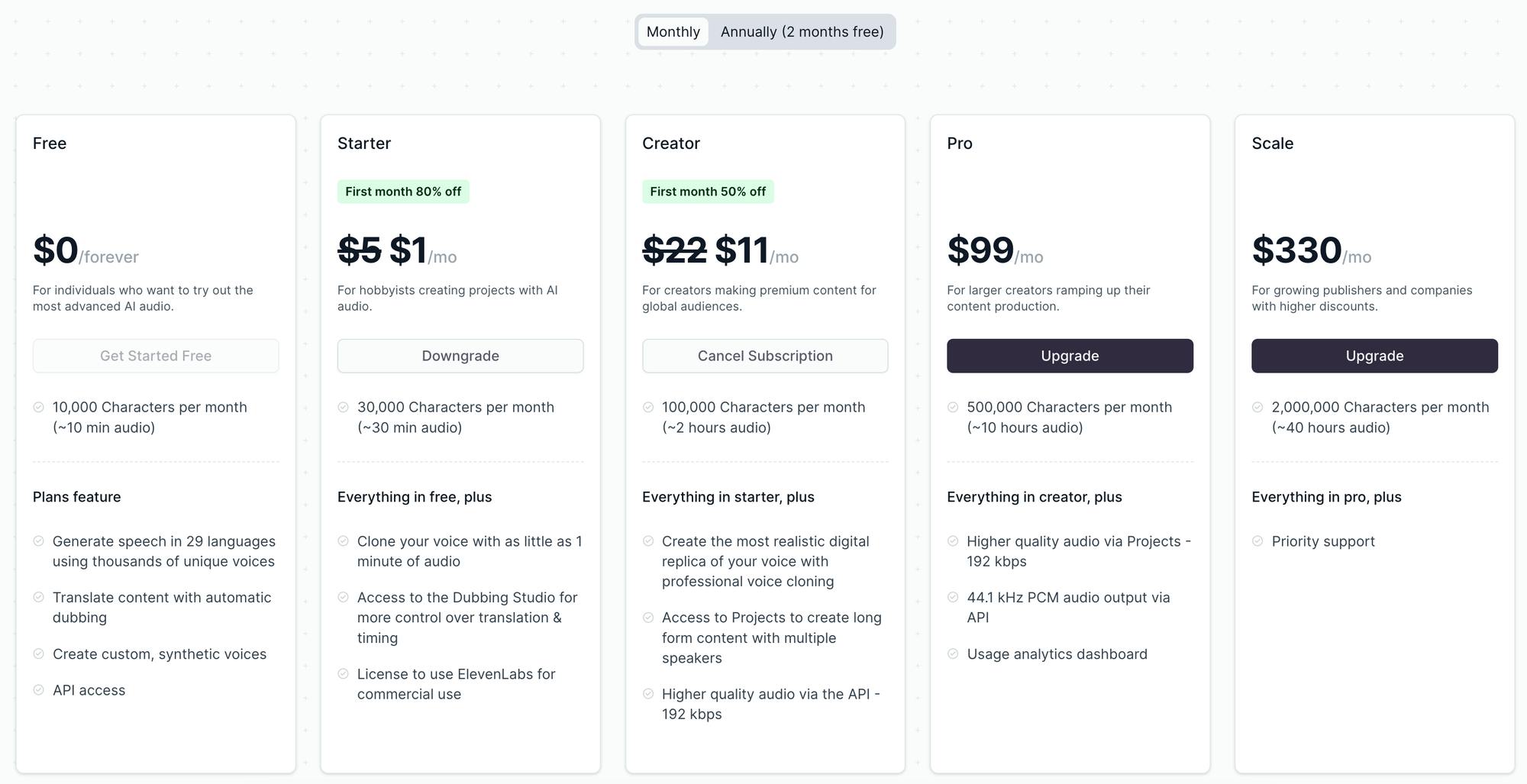

ElevenLabs generates revenue primarily through its AI voice platform, which is used by 41% of Fortune 500 companies. Key enterprise customers include media companies (Washington Post, TIME), gaming studios (Paradox Interactive), and publishing houses (HarperCollins). The company employs a freemium model with premium tiers starting at $22 for creator accounts and custom enterprise pricing based on usage volume.

Like Runway did in AI video, ElevenLabs is moving from foundation model to application layer and building the Adobe Creative Cloud ($13B in yearly revenue) for AI-generated audio, with Sacra estimating ElevenLabs crossed $90M in annual recurring revenue in October 2024, up 260% YoY.

Aggressively colonizing long-form audio editing (Descript), video dubbing (Premiere Pro), voiceovers (Adobe Audition), the AI voice marketplace (Envato), and content consumption (Spotify), ElevenLabs has been able to close enterprise deals with big publishers like Time and HarperCollins, raise their effective revenue per API call by 20%, and increase incremental consumption.

ElevenLabs’ largest enterprise contracts have reached $2M, and the company reports its revenue per employee remains high, with a focus on maintaining efficiency as headcount is projected to reach 400 by year-end 2025.

Valuation & Funding

As of February 2026, ElevenLabs raised $500M in a Series D round led by Sequoia Capital at an $11B valuation, with Sequoia partner Andrew Reed joining the board. The round more than tripled the company's January 2025 valuation of $3.3B from a $180M Series C. Andreessen Horowitz and Iconiq participated in the latest round, alongside new investors including Lightspeed Venture Partners, Evantic Capital, and Bond. The company is preparing for an eventual IPO, though no target date or underwriters have been disclosed.

Previously, in September 2025, ElevenLabs launched a $100M staff tender offer at a $6.6B valuation backed by Sequoia, Iconiq, and Andreessen Horowitz. Before that, the company raised at a $3.2B valuation in a round led by Iconiq and A16Z, and hit a $1.1B valuation in January 2024 following an $80M Series B round co-led by Andreessen Horowitz, Nat Friedman, and Daniel Gross.

ElevenLabs has raised over $781M to date.

Product

Before ElevenLabs (founded 2022), voice developers were limited to generic text-to-speech voices like Siri (through SiriKit) and Alexa (Alexa Skills Kit)—ElevenLabs opened the floodgates with their AI model for generating audio across 1,000+ synthetic, human-sounding voices that could speak in 32 different languages.

ElevenLabs found product-market fit allowing content creators to upload a 30 second voice sample and generate an instant clone, giving access to the tool for free and charging a monthly subscription fee based on the number of minutes of audio generated (~$0.16 per minute).

The core product uses proprietary deep learning models to generate remarkably human-like speech from text, with the ability to clone voices from just one minute of sample audio. Users can input text and receive audio output that maintains natural pauses, breathing patterns, and contextual emotional expression. The technology achieves this through advanced compression (100x better than MP3) while preserving key voice features.

ElevenLabs has since expanded into multiple product areas: Speech Synthesis for text-to-speech conversion, AI Dubbing Studio for automated video/audio translation across 29 languages, and a Voice Library marketplace where voice creators can monetize their voices. The platform is now used by major media companies like The Washington Post and TIME, gaming studios like Paradox Interactive, and publishing houses like HarperCollins.

Beyond consumer-facing tools, the company has expanded into enterprise voice and chat agents used in customer support, training, and sales, with CEO Mati Staniszewski describing the enterprise agents business as a key growth driver. The company has also signaled interest in building products that extend beyond voice into video.

ElevenLabs has expanded into music generation with ElevenLabs Music (launched August 2025), an end-to-end model that turns text prompts into full songs—vocals and instrumentation—whose outputs are pre-cleared for commercial use. The company has also built an Iconic Voice Marketplace (launched November 2025) featuring licensable voices from personalities including Michael Caine and Matthew McConaughey, with Caine's voice available for projects like narration and the marketplace listing additional voices across classic film, literature, and sport. McConaughey, who also invested in the company, is using ElevenLabs to deliver a Spanish-language edition of his "Lyrics of Livin'" newsletter.

Business Model

ElevenLabs is a subscription SaaS company that monetizes through tiered pricing based on the volume of text-to-speech characters processed, with plans ranging from free (10,000 characters/month) to enterprise-level custom solutions. The company has achieved $90M in annual recurring revenue as of October 2024, up from $25M at the start of the year, demonstrating exceptional growth in the AI voice technology market.

The core business model centers on providing high-quality AI voice synthesis and cloning capabilities, with a focus on preserving emotional range and natural speech patterns. Their technology enables content creators, publishers, and enterprises to generate human-like voice content at scale. The company's premium plans, starting at $22/month for creators, include advanced features like professional voice cloning and higher quality audio output.

What sets ElevenLabs apart is their proprietary research and development approach, maintaining an elite team of seven researchers who focus exclusively on audio AI advancement. This specialization has allowed them to achieve superior voice quality compared to big tech competitors who treat audio as a secondary priority.

Their platform includes a voice marketplace where creators can monetize their voice profiles, creating network effects that strengthen their competitive moat.

Competition

ElevenLabs operates in a market that includes AI voice synthesis providers, traditional dubbing services, and enterprise AI platforms developing audio capabilities.

Large technology platforms

OpenAI, Meta, Google, and Microsoft have developed voice synthesis capabilities within their broader AI platforms. However, these companies treat audio as a secondary focus rather than their core offering.

OpenAI represents the most significant potential competitor due to its research capabilities and resources, though it has not yet released a dedicated voice product.

Specialized voice AI companies

AI voice agents have strong product-market fit as a 70% cheaper replacement for humans across support calls, appointment bookings, and restaurant reservations—they’re being built on an emerging horizontal stack of tools like Cartesia (Index Ventures) for text-to-speech, Deepgram ($86M raised, Madrona Ventures) for speech-to-text, and Hamming ($750K raised, YC S24) for testing.

Companies use multiple different speech-to-text providers, mixing and matching depending on latency, cost (ElevenLabs is 5x as expensive as Cartesia per-minute), and developer experience—all of these tools are now converging on the common feature set of speech-to-text, text-to-speech, and real-time conversational AI.

Traditional dubbing and voice services

Professional dubbing studios and voice talent agencies continue to serve high-end media and entertainment clients.

These services offer human-quality results but at significantly higher costs ($100+ per minute) and longer turnaround times compared to AI solutions. Some agencies are beginning to explore AI voice cloning, with SAG-AFTRA recently partnering with Replica Studios to establish guidelines for AI voice work.

TAM Expansion

The company's core text-to-speech and voice cloning technology positions it well to capture the growing audiobook market, currently valued at $5B and expected to reach $35B by 2030.

With 41% of Fortune 500 companies already using their platform, ElevenLabs can expand from content creation into enterprise communications, including AI-powered call centers, training, and sales. Their ability to maintain voice consistency across languages gives them a unique advantage as companies seek to globalize their communications.

ElevenLabs has tailwinds from the rapid growth in AI-enabled content creation and increasing demand for localized media, with opportunities to expand into adjacent markets like enterprise communications, healthcare, and education.

Audio content explosion

ElevenLabs has demonstrated early success in healthcare applications, helping patients who have lost their voices maintain their ability to communicate.

Healthcare and accessibility

The company's multilingual capabilities and context-aware speech generation create opportunities in the $17B language learning market.

This opens up opportunities in the $25B assistive technology market, including applications for ALS patients, stroke recovery, and aging populations. Their technology's ability to preserve emotional expression and personality in synthesized voices positions them uniquely in this space.

International expansion

Education and language learning

ElevenLabs is expanding internationally into markets including India, Japan, Singapore, Brazil, and Mexico, representing large, growing markets for AI voice technology with significant demand for multilingual content and localization.

Risks

Their technology can power AI tutors that help students practice conversation in any language while maintaining natural intonation and cultural nuances. Early partnerships with educational technology platforms suggest strong product-market fit in this vertical.

Three critical risks facing ElevenLabs:

Regulatory and ethical backlash: ElevenLabs' voice cloning technology has already been used to create controversial deepfakes, including fake robocalls impersonating President Biden. Despite implementing safeguards, the company remains vulnerable to misuse that could trigger strict regulations or platform bans.

Voice actor ecosystem disruption: The company's push to create a voice marketplace could alienate professional voice actors and unions, similar to the SAG-AFTRA strikes against AI in film.

While ElevenLabs offers revenue sharing, their current compensation model of platform credits rather than cash payments may prove insufficient to build sustainable relationships with talent.

Quality-cost trade-off at scale: ElevenLabs' competitive advantage stems from superior voice quality achieved through intensive research and computation.

Over time, they may be forced to compromise on quality to reduce computing costs. This could erode their key differentiator against big tech competitors like OpenAI who have vastly greater resources for AI research and development.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.