Revenue

$100.00M

2021

Valuation

$1.00B

2022

Funding

$107.00M

2022

Growth Rate (y/y)

35%

2022

Revenue

Sacra estimates that Drift hit $135M in annual recurring revenue (ARR) at the end of 2022, up 35% from $100M at the end of 2021.

Business Model

Drift charges for access to its conversational marketing and sales platform on a subscription basis.

Drift was originally a fast-follower of Intercom, which kicked off the ‘conversational commerce’ market. Eventually, Intercom moved from a explicitly startup-friendly model to a more opaque pricing model designed to help them grow upmarket that charges the average team $731 per month. Companies like Hubspot and Drift fast followed on features and ate up the conversational commerce market.

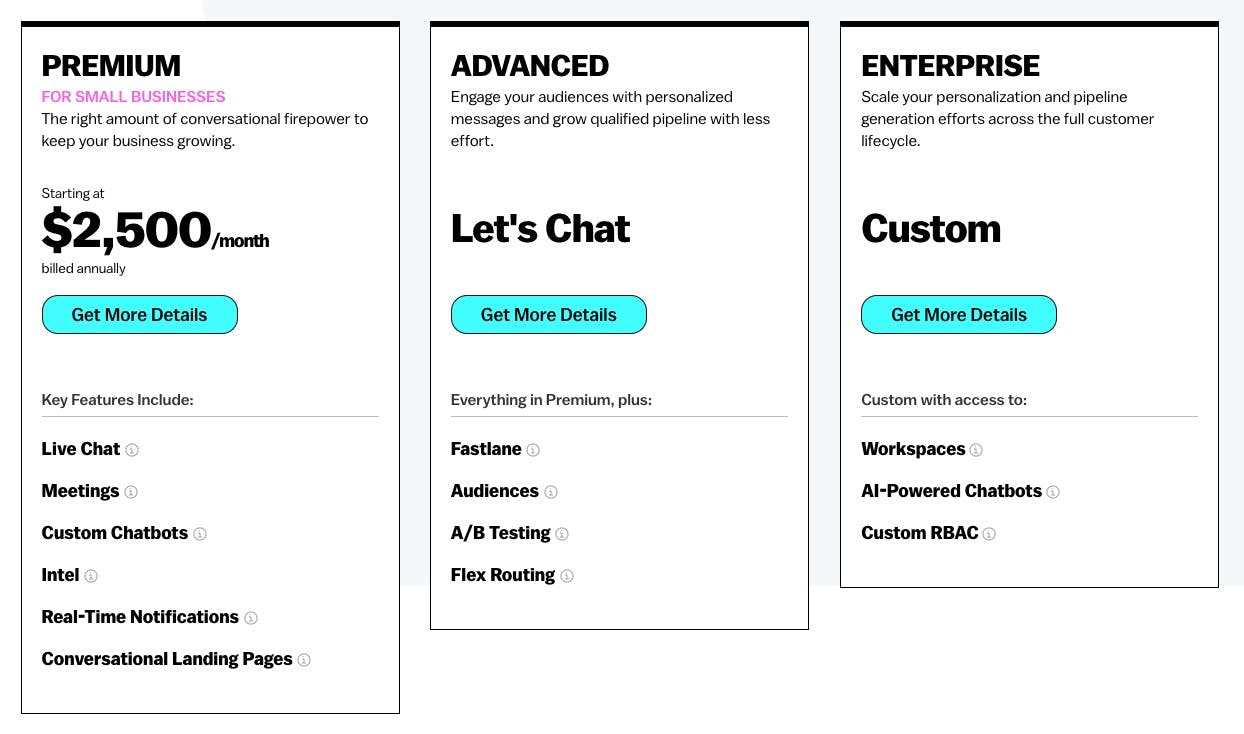

Drift’s packages now start at $2,500 per month (they removed their previously entry-level $40 per month package in 2022); users are billed annually. That puts Drift out of reach for early-stage startups which are now more likely to start with a product like Intercom, which offers a starter plan that begins at $74 per/mo for startups.

Today, Drift has three core packages: Premium, Advanced, and Enterprise. Every package has a seat limit; additional seats cost a monthly supplemental fee. The company does offer a free trial, but it only comprises basic features like live chat and calendar bookings.

Product

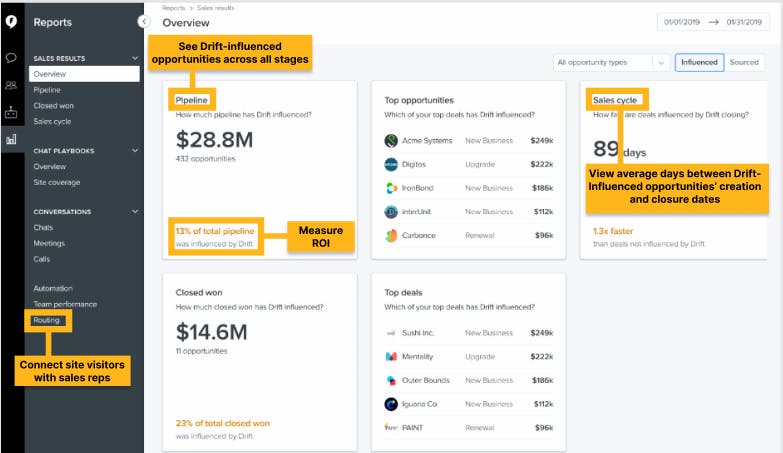

Drift at its core is a CRM with messaging and support applications built on top. To get started, users add a JavaScript snippet to their site that then starts to track every visitor to the site and what they do. They can then interact with them via targeted content, behavior-driven messages through an on-screen chatbot, and conversational support.

Other capabilities include sending personalized videos, managing the entire sales process in one place, and receiving real-time visibility into target accounts.

Drift offers various playbooks, which are customized workflows that guide site visitors and connect them to sales teams. For instance, the inbound sales playbook uses announcements, sliders, and takeovers to pick out prospects and send them invitation emails. Lead generation and productivity tools are also commonly used by Drift’s customers to generate and qualify leads. They provide insights for different types of consumers that increase engagement.

Competition

The market for B2B marketing and sales products is large and fragmented, with enterprise-focused suites (HubSpot, Salesforce), SMB-centric marketing tools (MailChimp, ConvertKit) offering messaging products roughly comparable to those of more B2C and mobile-focused players (Braze, Iterable) and technical, product-driven companies (Customer.io).

These enterprise-focused suites like HubSpot and Salesforce but also companies like Zendesk and Freshworks provide a more complete suite of services, from operations management to community forums. They often sell to corporates looking to consolidate their marketing and sales stack.

Drift was a fast-follower behind Intercom, originally eating up Intercom’s customer base, but in recent years Intercom has maintained an entry plan for startups just getting into sales while Drift has removed its startup plan—today, the lowest-cost Drift plan charges $2,500 per month.

Companies with a heavier mobile presence might look to products like Customer.io, Iterable, or Braze as part of a multi-channel marketing and product strategy, as opposed to a Drift which is more focused on serving web-centric B2B SaaS companies.

TAM Expansion

Steadily growing market: Changing consumer preferences caused by the COVID-19 pandemic have heightened interest in digital channels and a rising number of SMBs are embracing SaaS to retain clients.

58% of U.S. consumers have abandoned a brand because of poor service, and this trend isn’t going anywhere, as more than 65% of people hold higher expectations for service today than they did three to five years ago. Thus, companies like Drift, which are helping businesses strengthen customer relationships, have significant headroom to grow.

Enterprise suite: In line with the changes in Drift’s pricing indicating a shift upmarket, the company is launching features that position it better against competitors like HubSpot for big enterprise contracts.

For example, in 2022, Drift introduced digital deal rooms to extend the functionality of the product from a lead-gen chatbot to a DocuSign-like alternative to actually closing deals.

International expansion: In 2022, Drift setup operations in Guadalajara, Mexico, its sixth global location, to cover the Latin America market. The company already has presence in EMEA, with customers in those regions seeing a 47% increase in ARR YoY.

Risks

High pricing: Drift becomes prohibitively expensive very quickly. Most of the important features, such as 24-hour support and automation, are only available at the enterprise level. Also, companies with multiple teams and route leads and conversations among them must select the enterprise plan.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.