Revenue

$225.00M

2023

Valuation

$6.30B

2025

Funding

$1.10B

2025

Growth Rate (y/y)

13%

2025

Revenue

Sacra estimates that DataRobot hit $225M in annual recurring revenue (ARR) at the end of 2023, up 13% year-over-year. As of 2024, the company serves over 1,000 organizations worldwide.

The company operates primarily on a subscription SaaS model, with over 90% of revenue coming from recurring subscriptions.

Valuation & Funding

DataRobot was last valued at $6.3 billion in its Series G round in July 2021, when it raised $300 million. The round was led by Altimeter Capital and Tiger Global Management, with participation from Morgan Stanley Counterpoint Global, Franklin Templeton, and ServiceNow Ventures.

The company has raised approximately $1.1 billion in total funding across multiple rounds. Earlier rounds include a $206 million Series E in September 2019 led by Sapphire Ventures, with participation from Tiger Global, NEA, Meritech Capital, and Intel Capital.

Other investors throughout DataRobot's funding history include Sutter Hill Ventures, which participated in earlier rounds.

Product

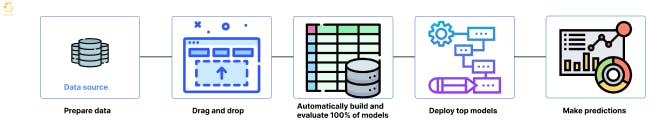

DataRobot is an AI platform that unifies predictive machine learning, generative AI, and model operations into a single enterprise suite. The platform serves both technical data scientists and business analysts who need to build, deploy, and monitor AI applications without extensive coding.

The core workflow starts in DataRobot's Workbench, a browser-based studio where users connect data sources like Snowflake, Amazon S3, or SQL databases. The system profiles incoming data and runs dozens of machine learning algorithms in parallel, ranking models by performance and providing explainability features like bias detection and SHAP values.

For generative AI, users access a playground environment where they can choose from foundation models including OpenAI, Anthropic, Llama 3, and NVIDIA NIM containers. They can prototype prompts, build retrieval-augmented generation pipelines, and convert these into versioned AI agents with guardrails and cost tracking.

The Registry functions as a Git-like catalog for every model, dataset, prompt, and application artifact, with immutable versioning and permission controls. The Console deployment layer turns any model or agent into real-time, batch, or streaming endpoints with single-step deployment, supporting A/B testing and automated retraining.

AI Observability provides continuous monitoring for model performance, data drift, latency, token spend, and security issues like prompt injection attempts. The platform can automatically intervene with policy-based actions such as blocking requests or routing to fallback models.

DataRobot's AI Governance module runs regulatory compliance checks against frameworks like the EU AI Act and NIST Risk Management Framework, automatically generating audit documentation and evidence packages for enterprise compliance teams.

In November 2025, DataRobot expanded the Agent Workforce Platform with enterprise lifecycle controls for AI agents, adding templates for CrewAI, LangGraph, and LlamaIndex, built-in evaluation and guardrails, agent identity with delegated access, and autoscaling across cloud and on‑prem. The platform now ships with a gallery of NVIDIA NIM microservices integrated via NVIDIA AI Enterprise to accelerate inference and governance in regulated environments. These additions strengthen DataRobot’s positioning as an operational control plane for multi‑agent applications inside large enterprises.

Business Model

DataRobot sells a B2B SaaS enterprise AI platform via subscriptions to large organizations across government and commercial sectors. The go-to-market follows a land-and-expand motion, typically starting with specific departments or use cases before expanding across entire organizations.

The platform is available as a cloud-hosted SaaS solution or as self-managed on-premises deployments for customers with strict data sovereignty requirements. This dual deployment model enables coverage of regulated industries such as financial services and government agencies that restrict or prohibit cloud-based AI services.

DataRobot's pricing combines subscription fees with consumption-based elements, particularly for compute-intensive workloads like large language model inference and training. Orchestration capabilities dynamically route workloads to the most cost-effective compute resources across different cloud providers and on-premises infrastructure.

Switching costs rise once customers build AI workflows and governance processes on the platform. A unified approach to predictive and generative AI increases lock-in as organizations standardize on a single platform for model development, deployment, and monitoring rather than managing multiple point solutions.

In August 2025, DataRobot launched an SAP Endorsed App on the SAP Store, expanding enterprise distribution and validation.

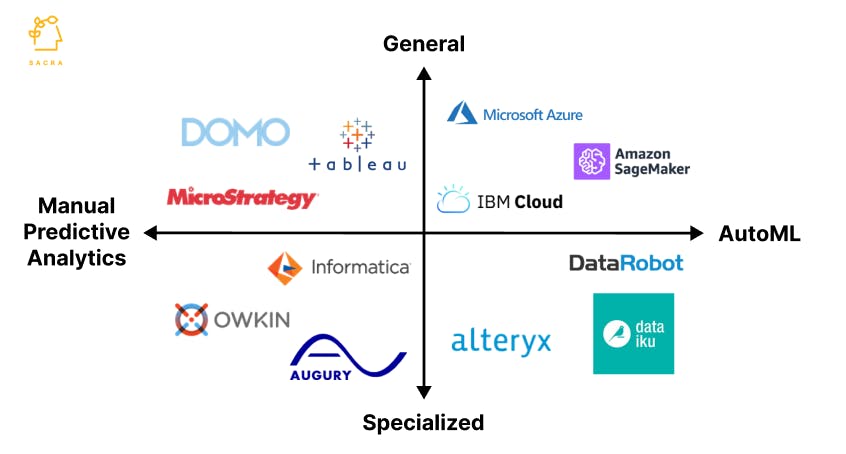

Competition

Vertically integrated hyperscalers

Amazon Web Services, Google Cloud, and Microsoft Azure represent DataRobot's most formidable competitive threat through their integrated AI platforms. AWS SageMaker benefits from deep integration with the broader AWS ecosystem and has reduced GPU pricing by 45%, making model training more cost-effective at scale.

Google's Vertex AI leverages the company's foundation models like Gemini and offers native multi-agent development capabilities. Microsoft Azure AI Foundry integrates tightly with Azure DevOps and the broader Microsoft enterprise stack, reducing friction for existing Microsoft customers.

These hyperscalers compete on infrastructure cost, native cloud integration, and bundled pricing that makes it difficult for independent platforms to match on total cost of ownership.

Independent AI platforms

Dataiku competes directly with its LLM Mesh and agent creation capabilities, positioning itself as a governed AI platform for business users. The company has focused heavily on multi-LLM routing and cost optimization across thousands of models.

H2O.ai targets regulated industries with its on-premises Enterprise h2oGPTe offering, emphasizing sovereign deployment options and air-gapped installations. Domino Data Lab has added governance automation and evidence collection features to compete on compliance requirements.

These independent platforms differentiate through specialized features, industry focus, or deployment flexibility that hyperscalers cannot easily replicate.

Data and analytics incumbents

Databricks and Snowflake represent an emerging competitive threat by bundling AI capabilities directly into their data platforms. This lakehouse approach eliminates the need to move data to external AI platforms and provides native integration with existing data workflows.

Traditional analytics vendors like SAS and IBM are also adding AI capabilities to their existing enterprise relationships, though they typically lag in modern AI features and user experience.

TAM Expansion

Agentic AI applications

DataRobot's July 2025 launch of its Agentic AI Platform expands the company's addressable market from model builders to AI application builders across business functions. The platform enables enterprises to construct, debug, and govern multi-agent applications with built-in evaluation and guardrails.

The Agent Workforce Platform targets use cases as a control plane for managing fleets of AI agents, similar to how Salesforce functions as the system of record for customer relationships. This addresses a market in digital employee orchestration that extends beyond traditional machine learning use cases.

These agentic capabilities allow DataRobot to capture application-layer revenue on top of its existing MLOps subscriptions, increasing the revenue potential per customer.

Governance and compliance

The phased implementation of the EU AI Act creates new compliance requirements for high-risk AI systems, which increases demand for governance tooling in European markets. The platform's built-in compliance modules provide automated documentation and bias testing aligned to prescriptive governance workflows.

Similar regulatory frameworks emerging in other jurisdictions create additional expansion opportunities as enterprises seek centralized platforms to manage AI governance across multiple regulatory regimes.

Vertical market expansion

DataRobot's integration of domain-specific NVIDIA NIM containers for applications like protein folding, optical character recognition, and supply chain optimization enables expansion into specialized vertical markets. These pre-built AI capabilities reduce the technical barriers for industries that previously had limited machine learning adoption.

The company's $249 million Department of Defense contract and new St. Louis office are evidence of expansion into government markets where AI governance and on-premises deployment capabilities are required.

Risks

Hyperscaler competition: Amazon, Google, and Microsoft bundle AI platform capabilities with infrastructure at prices independent vendors cannot match, and offer native integration with existing enterprise cloud investments. As these hyperscalers lower GPU costs and expand their AI tooling, DataRobot faces pressure on both pricing and feature parity.

Market maturation: The enterprise AI platform market is rapidly commoditizing as basic AutoML and model deployment capabilities become baseline features, reducing DataRobot's differentiation and pricing power. Open-source alternatives and cloud-native tools make it easier for enterprises to build AI capabilities in-house rather than purchasing comprehensive platforms.

Regulatory complexity: While AI governance can create opportunities, the evolving and fragmented nature of AI regulations across different jurisdictions could create compliance burdens that outweigh the benefits, particularly for a platform that serves global enterprises with varying regulatory requirements.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.