Revenue

$1.20B

2025

Funding

$3.38B

2025

Revenue

Sacra estimates that Cursor hit $1.2B in annual recurring revenue (ARR) in 2025, up 1,100% year-over-year from $100M ARR in 2024.

Cursor is the fastest-growing SaaS company of all time from $1M to $500M in ARR, with revenue doubling approximately every two months. This growth rate surpasses previous SaaS records set by companies like Wiz, Deel, and Ramp.

The company has achieved this extraordinary growth through a combination of individual developer subscriptions and an expanding enterprise presence. While historically most revenue came from individual developers paying $20-40 per month, Cursor has recently introduced enterprise licensing to capture larger team deployments at higher price points.

The company's AI-powered code editor has seen widespread adoption among developers, with users from prominent tech companies like OpenAI, Midjourney, Perplexity, and Shopify. This success has attracted significant acquisition interest, including from OpenAI, though the company has declined these offers.

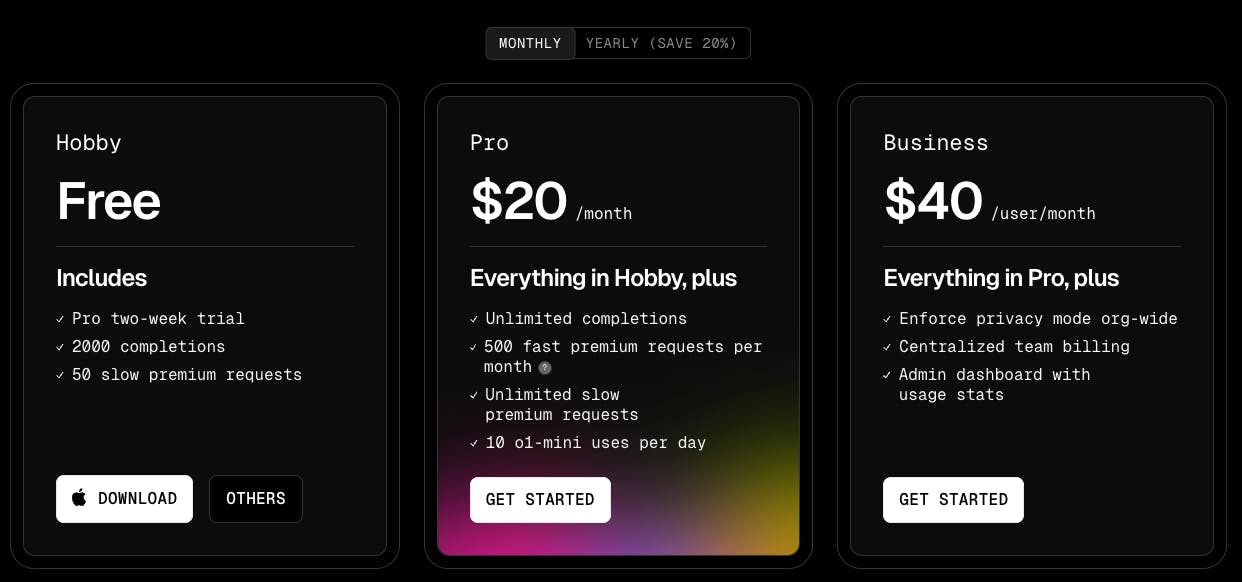

Cursor generates revenue through a tiered subscription model, starting with a two-week free trial before converting users to either a $20 Pro plan or $40 monthly business subscription. The recent introduction of enterprise licensing is expected to drive higher average contract values as more companies adopt the platform for their engineering teams.

Valuation & Funding

In November 2025, Cursor raised $2.3 billion in a round that valued it at $29.3 billion.

Cursor previously reached a $9.9 billion valuation in June 2025 after raising its Series C, having previously closed a $105 million Series B at a $2.5 billion valuation in December 2024 and a $60 million Series A at a $400 million valuation in August 2024.

Thrive Capital and Andreessen Horowitz have co-led multiple rounds, with other investors including OpenAI Startup Fund, Index Ventures, Benchmark, and notable angels like Stripe co-founder Patrick Collison, former GitHub CEO Nat Friedman, and Dropbox co-founder Arash Ferdowsi.

Product

Cursor was founded in 2022 by Michael Truell, Sualeh Asif, Arvid Lunnemark, and Aman Sanger while they were students at MIT. The editor builds on VS Code and extends it with AI capabilities.

As developers type in Cursor, pressing Tab autocompletes the current line of code. Subsequent Tab presses predict and implement the next logical edits, whether that's modifying code further down in the current file or jumping to a different file to make related changes.

Developers can also interact with their codebase through a chat interface. They can @-mention specific files to provide context, ask questions about implementation details, or request changes. The AI suggests edits that appear in a diff view for review and quick application. In composer mode, Cursor can execute a series of coordinated changes across multiple files while maintaining developer oversight.

For frequent, latency-sensitive operations like code completion and editing, Cursor has developed fine-tuned, specialized Mixture-of-Experts (MoE) models that process large amounts of context while generating relatively small outputs.

In October 2025, Cursor launched Cursor 2.0 with its first proprietary coding model, Composer, described as a “frontier” coding model that is 4x faster than similarly intelligent models and built for low‑latency, multi‑step agentic coding, alongside a new multi‑agent interface that runs parallel agents via git worktrees or remote machines and adds native browser‑based testing to review and verify changes.

Business Model

Cursor monetizes through a tiered subscription model targeting individual developers and enterprise teams.

The product follows a freemium model with three tiers. The free tier offers limited access to AI features including 2,000 monthly code completions. The Pro tier ($20/month) provides unlimited code completions and premium AI model access. The Business tier ($40/user/month) adds enterprise features like centralized billing, admin dashboards, and enhanced privacy controls.

Cursor's competitive advantage stems from its deep integration with leading AI models like GPT-4 and Claude, while maintaining compatibility with the VS Code ecosystem. The editor differentiates itself by incorporating knowledge of a developer's entire codebase to provide contextually relevant suggestions that match their coding style.

The company employs a product-led growth strategy, allowing developers to start with the free tier and naturally upgrade as their usage increases. Enterprise expansion occurs organically as individual developers advocate for team-wide adoption, driving the shift to business accounts with centralized management and security features. This bottom-up adoption model has helped Cursor gain traction at innovative companies like OpenAI, Midjourney, and Perplexity.

In August 2025, Cursor updated its billing to shift Teams agent usage from fixed credits to variable, usage‑based request costs. The company also adjusted limits for Auto on individual plans to contribute to included monthly usage at competitive token rates. These changes align pricing with agent workload as tasks move from quick queries to multi‑file, end‑to‑end implementations.

Competition

Three fundamental shifts are transforming the AI-assisted development landscape and creating both opportunities and challenges for Cursor's market position.

GitHub + Microsoft bundlenomics

Large incumbents like GitHub/Microsoft are leveraging their massive install bases and cloud infrastructure to embed AI assistance deeply into existing workflows. GitHub Copilot's estimated $300M+ annual revenue demonstrates the power of this integrated approach.

More importantly, GitHub's enterprise relationships and existing security compliance give them an enormous advantage - many companies simply block new development tools like Cursor for security reasons, defaulting to GitHub's vetted solutions.

This enterprise lock-in extends beyond just security. GitHub's bundle of services (version control, CI/CD, issue tracking, Copilot) creates a compelling integrated value proposition that's hard for standalone tools to match. When enterprises are already paying for GitHub Enterprise, adding Copilot becomes a much easier decision than adopting a new vendor.

Shift from tools to agents

The market is evolving beyond simple code completion toward autonomous development agents, but with a crucial distinction in approaches.

Cursor's recent launch of Composer represents their vision of agentic workflows - it remains fundamentally an IDE-first experience where developers maintain control while AI handles complex multi-file edits and implementations.

This stands in sharp contrast to platforms like v0 from Vercel, Bolt.new, or Wordware which aim to convert natural language directly into applications.

These tools target non-developers or citizen developers, essentially trying to remove the need for traditional programming. Cursor instead focuses on accelerating professional developers' workflows, keeping them in control of the development process while eliminating tedious tasks.

This positioning reflects a fundamental split in the market: tools that aim to replace developers versus tools that aim to augment them. Cursor's approach recognizes that complex software development requires human judgment and expertise, even as AI takes on more of the implementation details.

Platform risk from OpenAI & Google

The most significant competitive threat may come from the model providers themselves. OpenAI is reportedly working on their own development tool, which could leverage their full stack of AI capabilities.

Their ChatGPT macOS app already includes Terminal and XCode integration, showing clear intent to move into the development space. As the provider of key coding models like GPT-4i, they could potentially offer deeper integration and capabilities than third-party tools.

Google’s $2.4 billion deal to license Windsurf’s code‑agent IP and bring its CEO and R&D leads into DeepMind gives it a turnkey IDE stack to bolt onto Gemini Code Assist and Android Studio, collapsing the gap between model provider and developer workflow tool in a single step.

With first‑party control over Gemini’s weights, Google can ship Windsurf‑style auto‑completion, debugging, and autonomous “fix‑it” agents as default features in Chrome‑hosted DevTools and Cloud consoles, instantly reaching millions of developers and undercutting Cursor’s paid extension value proposition.

TAM Expansion

Cursor is evolving from an AI-powered code editor into a comprehensive development environment that aims to transform how software is built.

Their vision extends beyond code completion to become the central hub where developers spend their entire day, integrating terminal operations, testing, debugging, and deployment into a unified AI-assisted experience.

The recent launch of Composer, which coordinates complex multi-file changes while maintaining developer control, demonstrates this broader ambition. Meanwhile, investments in enterprise features and custom models for specific development tasks show how Cursor is positioning itself for broader organizational adoption.

Developer productivity platform

The immediate TAM for AI coding assistance is substantial. As software continues to eat the world, the global shortage of developers has created a productivity crisis that companies are willing to spend significantly to solve. GitHub Copilot alone is generating over $300M in annual revenue.

Cursor's ability to understand entire codebases and adapt to individual coding styles positions it to capture significant market share from both individual developers and enterprises seeking productivity gains. By improving developer productivity by even 20-30%, Cursor could capture significant value given average developer salaries of $150K+.

Beyond core development, Cursor has potential to expand into adjacent areas like technical documentation and code review, while serving additional personas like data scientists and DevOps engineers.

M&A value

Cursor could represent significant strategic value for several types of potential acquirers.

Cloud providers might acquire Cursor to improve their developer experience, while development platform companies like Atlassian or GitLab might see it as a way to compete with GitHub's Copilot advantage.

AI companies might view Cursor as a way to own a key application of their technology while gaining valuable training data and direct access to developers—an increasingly influential user base.

The combination of massive market opportunity, multiple growth vectors, and strategic value creates significant upside potential as development workflows increasingly center around AI assistance.

Risks

OpenAI dependency and competition: Cursor's core product heavily relies on OpenAI's technology, while OpenAI is simultaneously expanding ChatGPT's coding capabilities. This creates a precarious position where a key supplier is also becoming a direct competitor. OpenAI could limit access, raise prices, or further enhance ChatGPT to directly compete with Cursor's features.

Developer workflow disruption: Cursor's value proposition depends on seamlessly integrating AI into existing developer workflows without causing friction or interruption. If developers find the AI suggestions disruptive or experience performance issues, they may revert to traditional IDEs. The challenge of maintaining speed and reliability while processing entire codebases through AI is technically complex.

Enterprise adoption barriers: Large companies often have strict security policies about sending code to external AI services. Cursor's cloud-based architecture may face resistance from security-conscious enterprises, limiting expansion beyond individual developers and smaller teams. This could constrain growth in the enterprise market where the highest-value customers typically reside.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.