Revenue

$276.00M

2024

Valuation

$10.00B

2025

Funding

$3.90B

2025

Growth Rate (y/y)

82%

2024

Stock Price

$29.17184

2024

Revenue

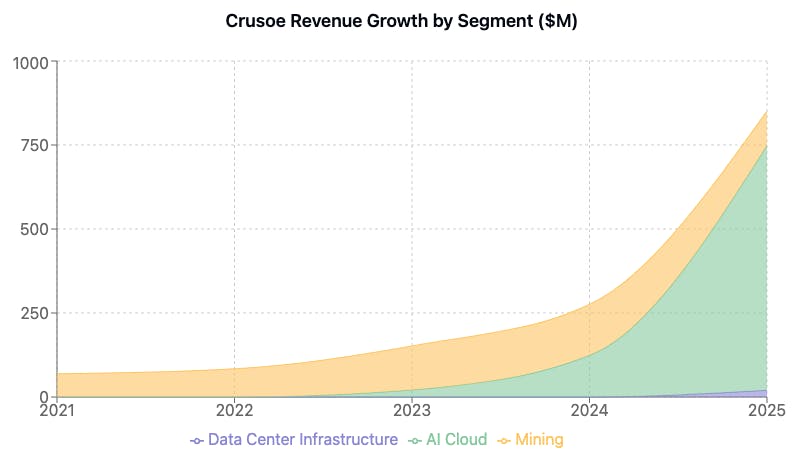

Sacra estimates Crusoe hit $276M in revenue in 2024, up 82 YoY%, driven by explosive growth in its GPU cloud operations.

Crusoe projects that it will grow revenue to ~$500M in 2025, driven largely by their role in OpenAI's $500B Stargate project. In January 2025, Crusoe announced the first phase of its flagship Abilene, Texas campus is live and running on Oracle Cloud Infrastructure, with the first two buildings energized within a year of construction starting in June 2024. Oracle began delivering the first NVIDIA GB200 racks in June 2025, and the planned campus will include eight buildings at completion.

Financing for the Abilene project includes $9.6B of debt from JPMorgan and $5B of equity from Crusoe and Blue Owl, with the facility expected to be fully operational by mid-2026 under a 15-year lease. Separately, Newmark arranged a $7.1B construction loan led by J.P. Morgan for Blue Owl, Crusoe, and Primary Digital Infrastructure to fund Phase 2 of a $15B joint venture for a 1.2-gigawatt AI data center campus in Abilene.

Since the original announcement of the Crusoe-Oracle deal in January, the scope of the Abilene campus project has expanded—the project is now expected to bring Crusoe $250M of revenue for 2026, up 25x from $10M in earlier projections for the project, with 700+ MW live by December 2026.

In September 2025, OpenAI & Oracle announced the expansion of the Stargate initiative with five new U.S. data center sites, targeting a combined 7 gigawatts of capacity and marking a $400 billion investment push to accelerate AI infrastructure buildout.

In 2023, roughly 80% of Crusoe's revenue came from Bitcoin mining, but a growing percentage (about 14%) came from serving compute over the cloud to AI companies via Crusoe Cloud.

Crusoe Cloud grew to roughly 45% of revenue in 2024 with rising demand for compute, while Bitcoin mining fell to ~55% of revenue. In late 2024, Crusoe announced NYDIG would acquire Crusoe's bitcoin mining operation, including the Digital Flare Mitigation business, representing a strategic exit from crypto mining to focus entirely on AI cloud infrastructure. Sacra estimates that Crusoe Cloud will represent the vast majority of Crusoe revenue in the coming years.

Key customers of Crusoe today include Sony, Databricks, Codeium, Together AI, Luma AI, and Playground AI, while the company works with oil & gas partners like Exxon, Devon, and Lancium to secure access to the stranded natural gas that powers their datacenters. The company operates 86 mobile data centers across 30 sites in major U.S. oil fields plus Argentina, processing over 10 million cubic feet of gas daily.

Valuation & Funding

In October 2025, Crusoe announced the initial close of an anticipated $1.375B Series E at an expected valuation exceeding $10B, co-led by Mubadala Capital and Valor Equity Partners. The round was oversubscribed, and Crusoe disclosed that Crusoe Cloud bookings grew approximately 5x in the first three quarters of 2025 versus the prior year, with its power pipeline exceeding 45 GW. Total funding raised since founding reached approximately $3.9B.

Previously, Crusoe was valued at $2.8B following their $600M Series D round in 2024, led by Founders Fund with participation from NVIDIA, with that round closing at a price of $29.17184/share. That valuation represented a 10.2x multiple on their $275M revenue for 2024.

In late 2024, Crusoe divested its bitcoin mining operation to NYDIG, marking a strategic shift to focus entirely on AI cloud infrastructure. The sale included the Digital Flare Mitigation business comprising 425+ modular data centers totaling 250+ MW across 7 states and 2 countries, with approximately 135 employees transferring to NYDIG.

Notable investors beyond the Series D participants include Fidelity, Mubadala, Ribbit Capital, and Long Journey Ventures.

Product

Crusoe was founded in 2018 by Chase Lochmiller and Cully Cavness as a cryptocurrency mining company that used "stranded" natural gas from oil wells—gas that would otherwise be burned off or "flared"—to power their mining operations.

They innovated by building modular data centers that could be deployed directly at oil well sites, converting what was previously wasted energy into computing power.

In early 2023, AI companies faced a critical bottleneck: getting access to the scarce GPU compute needed to train and run their models.

At the time, traditional cloud providers like Google Cloud Platform and Microsoft Azure had 6+ month waitlists for H100 GPUs, while prices on the spot market reached as high as $8/GPU/hour.

Having already developed the capabilities to run large-scale GPU operations in remote locations with sustainable power sources, they were well-positioned to serve this newly-exploding market.

With this shift, Crusoe pivoted their GPU infrastructure and expertise from crypto mining to AI cloud services. In late 2024, Crusoe completed its strategic shift by divesting the bitcoin mining operation to NYDIG, exiting cryptocurrency mining entirely to focus on AI cloud infrastructure.

Crusoe Cloud

Crusoe's core product is a cloud platform that provides GPU compute infrastructure optimized for AI workloads. A typical customer interaction flows like this:

1) Customer signs up for Crusoe Cloud and selects their compute needs across different GPU options (H100, L40S, MI300X)

2) Gets instant access to bare metal or virtualized instances with 3200 Gbps InfiniBand networking

3) Uses standard tools (CLI, REST APIs, management console, Terraform) to deploy and manage workloads

4) Scales compute up or down based on needs, with billing down to the second

What made Crusoe sticky was how it mapped to real AI development journeys.

A typical startup building an AI product might start with exploratory model training on a few GPUs ($2-3/GPU/hour), scale up to distributed training across dozens of GPUs for their main model as they hit product-market fit, deploy inference endpoints for serving models in production, and add specialized compute for fine-tuning and optimization.

Crusoe runs all of these functions across their integrated infrastructure, with optimized networking and purpose-built data centers. Rather than cobbling together solutions from different providers, everything lives in one platform with consistent performance and support.

In August 2025, Crusoe acquired Israeli GPU management startup Atero for $150M in cash and stock, establishing its first R&D center in Tel Aviv to accelerate Crusoe Cloud's AI infrastructure development.

In November 2025, Crusoe launched Managed Inference to general availability, claiming up to 9.9x faster time-to-first-token and up to 5x higher throughput versus vLLM for specified benchmarks, enabled by its MemoryAlloy KV-cache technology. The offering includes the Crusoe Intelligence Foundry for model selection and key management, supports leading open-source and specialized models, and uses Crusoe's MemoryAlloy technology to maintain low latency at scale.

Enterprise

This base offering caught the attention of large enterprises and research institutions in 2023. Organizations like Sony Research and MIT were spending enormous amounts on AI infrastructure while struggling with power and cooling constraints. Crusoe expanded their offering with enterprise features:

Custom Deployments: Dedicated infrastructure deployments with flexible sizing and configurations. Sony uses this for their GT Sophy™ AI research project.

Sustainability Integration: Access to carbon-free compute through Crusoe's innovative power sourcing from wind, solar, and flare gas mitigation

Expert Support: Direct access to AI infrastructure specialists including veterans from Google, AWS, and NVIDIA

Global Network: Infrastructure across Texas, Virginia, and Iceland, with rapid expansion plans

This evolution from basic GPU cloud to comprehensive AI infrastructure platform has driven Crusoe's growth to over 50 active customers and ~$120M in cloud ARR by mid-2024.

Business Model

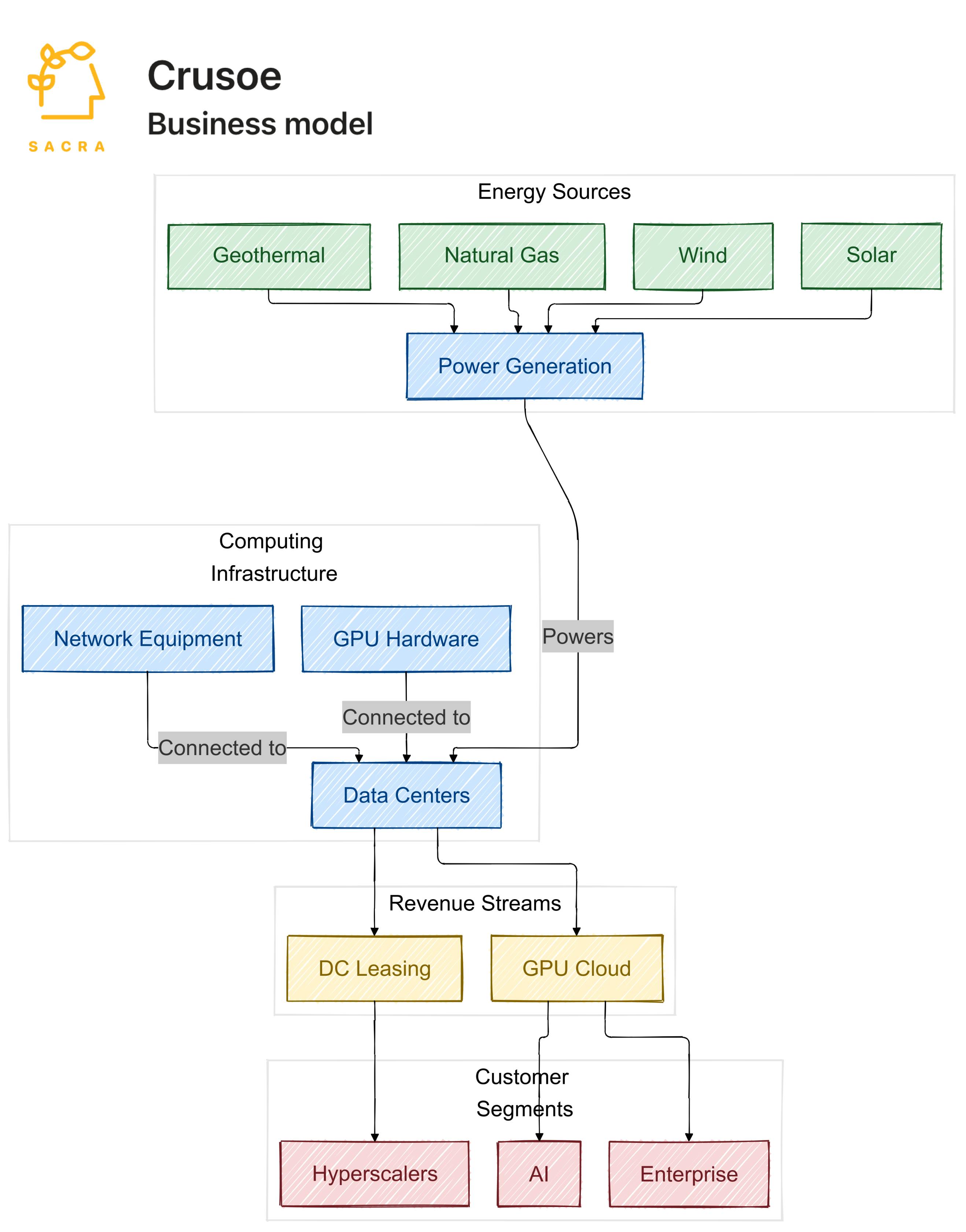

Crusoe generates revenue through multiple tiers of cloud computing services.

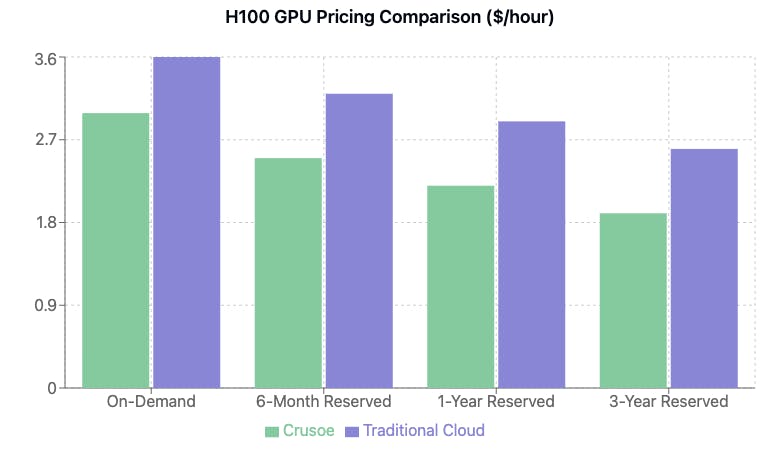

Their core offering is GPU compute, sold through flexible pricing models ranging from on-demand usage billed by the second at $2-3/hour per GPU, to reserved instances with commitments spanning 6 months to 3 years.

The longer commitments offer increasingly attractive discounts, with 3-year terms providing up to 81% savings versus on-demand rates.

Beyond pure compute, they offer infrastructure services including high-performance storage solutions, networking services, and technical support.

A growing portion of revenue comes from data center infrastructure, primarily through 15-year NNN leases, power purchase agreements, and anticipated third-party tenant revenue starting in 2025.

To illustrate the revenue model: a typical enterprise customer using 100 H100 GPUs on a 1-year commitment might generate approximately $2.23M in annual revenue, broken down as $1.93M for GPU compute (calculated at $2.20/hr × 100 GPUs × 8760 hours), $200K for storage and networking, and $100K for support services.

Cost structure

Crusoe's vertically integrated approach centers on an energy-first infrastructure model.

The major capital costs include GPU hardware purchases (H100s, MI300X, etc.), data center construction, power infrastructure, and networking equipment.

Operating costs encompass energy procurement and management, data center operations, technical support teams, and sales and customer success functions.

Unlike traditional cloud providers, Crusoe's energy-first model creates unique advantages.

They achieve lower power costs through stranded energy capture, can strategically place data centers near renewable sources, and benefit from vertical integration efficiencies in infrastructure deployment and management.

Customer acquisition

Crusoe's go-to-market strategy targets three primary customer segments. AI companies form the core market, attracted by cost-effective and sustainable compute for training and inference workloads.

Enterprise tech teams represent another key segment, valuing reliable infrastructure and competitive pricing. The third segment consists of hyperscalers, with Crusoe partnering to provide additional capacity, as demonstrated by their Oracle/OpenAI deal.

The typical sales cycle progresses through several stages: beginning with technical validation of infrastructure, moving to small-scale pilot deployments, expanding into larger GPU clusters, and culminating in long-term capacity commitments.

Unit economics

The business model benefits from several structural advantages. Infrastructure investments generate strong returns, with data centers projected to deliver 3.7x MOIC on a 10-year hold.

Multi-year customer commitments provide stable, predictable revenue streams. The vertical integration approach, particularly around energy, improves margins compared to traditional cloud providers. Additionally, ESG-focused customers may be willing to pay a premium for sustainable infrastructure.

These advantages have driven impressive growth, with revenue projected to reach $850M in 2025, up significantly from $152M in 2023. The cloud business specifically is expected to reach $728M in 2025, with cloud ARR growing from $58M in 2023 to $1.52B in 2025.

Competition

There are a few key trends to understand that are shaping the market for GPU clouds: (1) consolidation around a few key players that have the capital to win, (2) the emergence of an anti-hyperscaler Nvidia alliance, and (3) a lack of winner-take-all dynamics with the fast growth of compute needs.

From fragmentation to consolidation

The GPU cloud market is experiencing clear consolidation around three major players—CoreWeave ($12.1B raised), Crusoe ($5.4B raised), and Lambda Labs ($893M raised)—that have secured massive capital investments that dwarf smaller GPU clouds like TensorWave, Runpod, Gcore, and Lamini, which have each raised less than $100M.

This order-of-magnitude difference in funding has profound implications for the competitive landscape. The capital intensity of building GPU cloud infrastructure means this early funding advantage compounds over time, making it increasingly difficult for smaller players to compete at scale.

This funding disparity has helped create a natural market structure.

Crusoe has carved out a unique position by combining significant scale with their innovative energy-efficient approach, appealing to customers who need both performance and sustainability.

Lambda Labs has focused on building superior developer experience and tooling, making GPU cloud computing more accessible to technical users.

CoreWeave, with its industry-leading $12.1B raise, has established itself as a leader with massive GPU deployments across 28 data centers.

These differentiated positions allow each player to build deep relationships in their target segments while still benefiting from the overall market expansion.

The Nvidia alliance

The relationship between the major GPU cloud providers and Nvidia exemplifies how this market supports multiple winners.

Nvidia's dominant position in AI acceleration hardware means they're incentivized to support multiple cloud providers to (1) drive broader market adoption of their chips, and (2) encourage competition with Microsoft, Google, and Amazon who are customers of Nvidia but are also hard at work building their own chips to try to compete with Nvidia.

The partnership benefits flow both ways: Nvidia gains dedicated partners focused on expanding the GPU cloud market in different segments, while providers like Crusoe, CoreWeave, and Lambda Labs get early and preferred access to the best chips.

This symbiotic relationship helps all players optimize their infrastructure for AI/ML workloads and provide better solutions to their customers.

The challenge isn't fighting over a fixed supply of GPUs, but rather executing effectively with their allocated portion and building valuable services on top of the core infrastructure.

GPU cloud isn't zero-sum

The unprecedented growth in AI/ML workloads means success in the GPU cloud market isn't a zero-sum game.

The total addressable market is expanding so rapidly that multiple providers can achieve significant scale without directly competing for the same customers. Enterprise adoption of AI is driving demand across segments, from companies needing basic GPU access to those requiring specialized solutions and support.

The next 18-24 months will likely see continued rapid growth across the GPU cloud market.

Success for these players doesn't require taking share from competitors but rather executing effectively in their target segments while the overall market expands. The key question isn't whether they can compete with each other or larger hyperscalers, but how effectively they can scale their operations to meet surging demand while maintaining their operational advantages and distinct value propositions.

TAM Expansion

The demand for GPU compute is experiencing unprecedented growth driven by artificial intelligence workloads.

Goldman Sachs projects that data center power demand will grow at a 15% CAGR through 2030, with data centers potentially consuming 8% of total U.S. electrical power demand by decade's end, up from 3% today.

This growth translates to an incremental 47 gigawatts of power generation capacity needed to support data centers. NVIDIA's data center revenue, a key proxy for AI compute demand, grew 409% year-over-year to $18.4B in their latest quarter.

In this high-growth environment, Crusoe has positioned itself as a leading GPU cloud provider with a unique sustainable energy advantage.

The company is executing on three key vectors: rapidly expanding their GPU fleet with the latest NVIDIA hardware, securing long-term contracts with major technology customers, and scaling their sustainable energy infrastructure to power this growth.

Crusoe's energy advantage

Crusoe's competitive advantage stems from their ability to access and utilize energy sources that other providers cannot. The company has identified approximately 7 GW of potential power capacity across various sources including:

Wind: 1,508 MW under construction and an additional 1,059 MW under commercial discussion

Solar: 705 MW under construction with 951 MW in the pipeline

Flared Gas: Currently utilizing 200 MW with 140 MW additional capacity identified

Nuclear: 34 MW under construction with 800 MW under discussion

Carbon Capture: 378 MW under construction with 1,343 MW in development

Hydropower and Geothermal: 18 MW deployed with 614 MW in development

This diverse energy portfolio gives Crusoe significant runway for expansion while maintaining competitive pricing advantages. The company's ability to tap into stranded or underutilized energy sources could provide structurally lower power costs compared to traditional data center operators who rely primarily on grid power.

Crusoe continues to expand its power infrastructure through strategic partnerships and innovative approaches. The company partnered with Redwood Materials to launch the modular Crusoe Spark data center program, which is powered by second-life EV batteries and large-scale solar for faster AI infrastructure deployment. Crusoe has also expanded its atNorth partnership, growing Iceland's ICE02 campus by 24 MW to approximately 57 MW total to support cloud demand across Europe and North America.

The company's most ambitious project is Project Jade, a $50 billion investment in a data center campus in Cheyenne, Wyoming that will reach 2.7 gigawatts of capacity at full buildout—representing nearly triple Wyoming's current total power consumption and marking America's largest data center project.

Path to the public markets

Given Crusoe's rapid growth trajectory and the market's appetite for AI infrastructure companies, the company appears well-positioned for a public offering. The company projects revenue growth from $152M in 2023 to $2B in 2026, $3.6B in 2027, and $5.5B in 2028, representing a 105% CAGR from 2023-2028.

CoreWeave's planned IPO provides a useful valuation benchmark. CoreWeave expects to go public in Q2 2025 at a $35B valuation, representing roughly 7x their projected trailing twelve months revenue of $5B. This multiple reflects a significant discount to NVIDIA's 32x TTM revenue multiple, suggesting room for expansion as the market better understands the GPU cloud business model.

Risks

Power source reliability: Crusoe's unique model of using flared natural gas and renewable energy sources could face stability challenges. Their dependency on oil and gas operations for flared gas means power availability is tied to drilling activity.

Changes in drilling practices or regulations could impact gas supply. For renewable sources, intermittency issues might affect consistent power delivery to their data centers.

GPU pricing volatility: The GPU rental market has seen significant price fluctuations, with rates dropping from $8 to $2 per hour in recent months. Crusoe's substantial investments in GPU infrastructure were made during peak pricing periods.

If rental rates continue to decline after their long-term contracts expire, it could pressure margins and affect their ability to service debt.

Capital structure risk: Crusoe has taken on significant debt financing, with interest expenses projected to increase from $27M in 2023 to $297M in 2025.

Their ability to service this debt relies heavily on maintaining high GPU utilization rates and stable pricing. Any major disruption in customer demand or further price deterioration could strain their leveraged capital structure.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.