Revenue

$11.60M

2022

Funding

$13.90M

2022

Growth Rate (y/y)

346%

2022

Valuation & Funding

Copy.ai has raised a total of $19.82M across 4 funding rounds. The company's most recent funding was a $3M Convertible Note round in November 2023, led by K5 Global Technology. Previous funding rounds attracted notable investors including Wing Venture Capital, Sequoia Capital, and Tiger Global through their Series A participation. The company's seed round included investment from Atelier Ventures.

Business Model

Content marketers, social media managers, and email marketers use Copy.ai to generate copy for Facebook/Google ads, blog posts, Twitter threads, and more.

Initially, Copy.ai began as essentially a wrapper around raw GPT-3. Today, Copy.ai has 20-30 distinct fine-tuned models that operate on different parts of the content generation process.

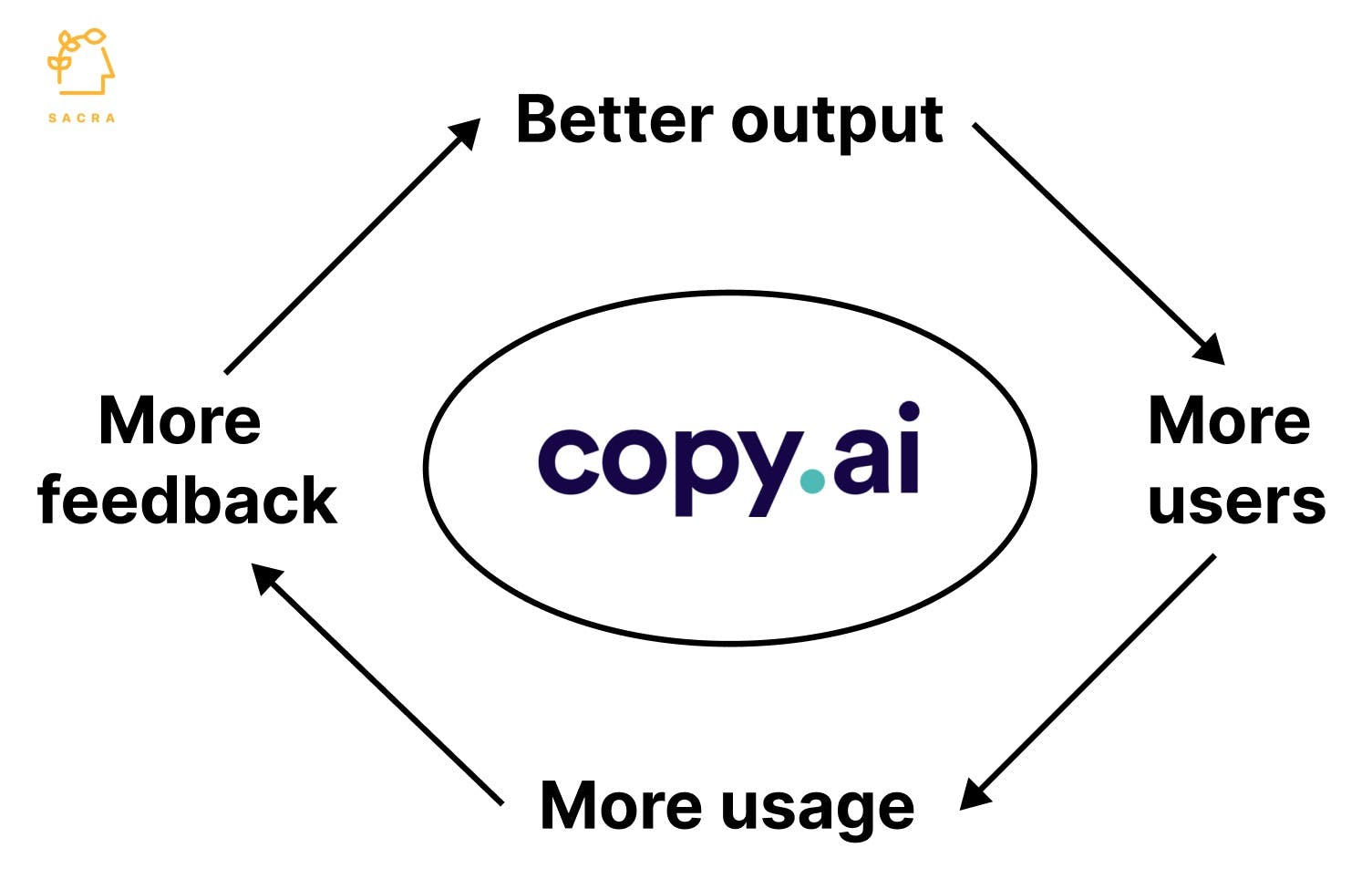

Copy.ai uses data about how users engage with the outputs of their models—whether they save, edit, rewrite, or otherwise change what came out of Copy.ai—in order to iterate on those models and improve the quality of their output.

Copy.ai’s biggest cost center (after salaries) is paying for access to OpenAI's models, load balancing, and compute facilities they rely on. Copy.ai pays OpenAI a fee every time a user generates a new word, putting a cap on margin expansion at scale.

Product

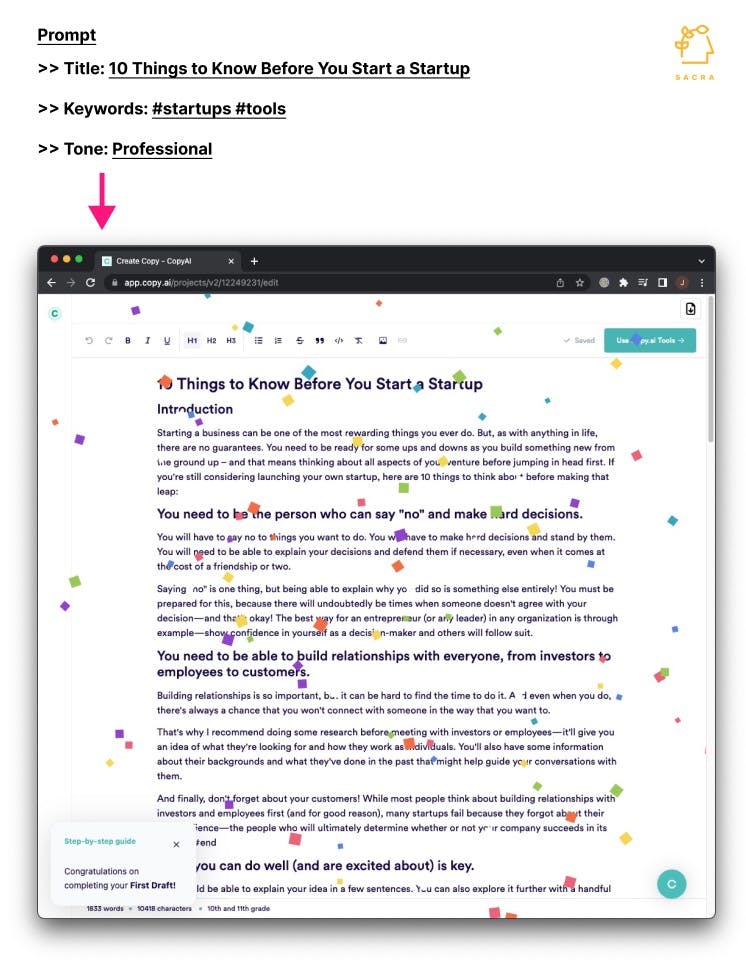

Copy.ai is a web app that allows users to quickly generate and iterate on AI-created content for websites, ads, and social media copy.

Copy.ai found initial product-market fit with freelancers from platforms like Upwork and Fiverr that used it to quickly generate blog posts and other deliverables which they could then re-sell on those marketplaces with a markup.

Independent contractors using Copy.ai like this tended to come from lower income countries where English isn’t spoken, allowing them to execute on a kind of geographical, AI-assisted labor arbitrage when working with clients in the United States and Western Europe.

Today, Copy.ai is used primarily by marketing teams and SMBs to help them create content for their websites and social channels more quickly.

Competition

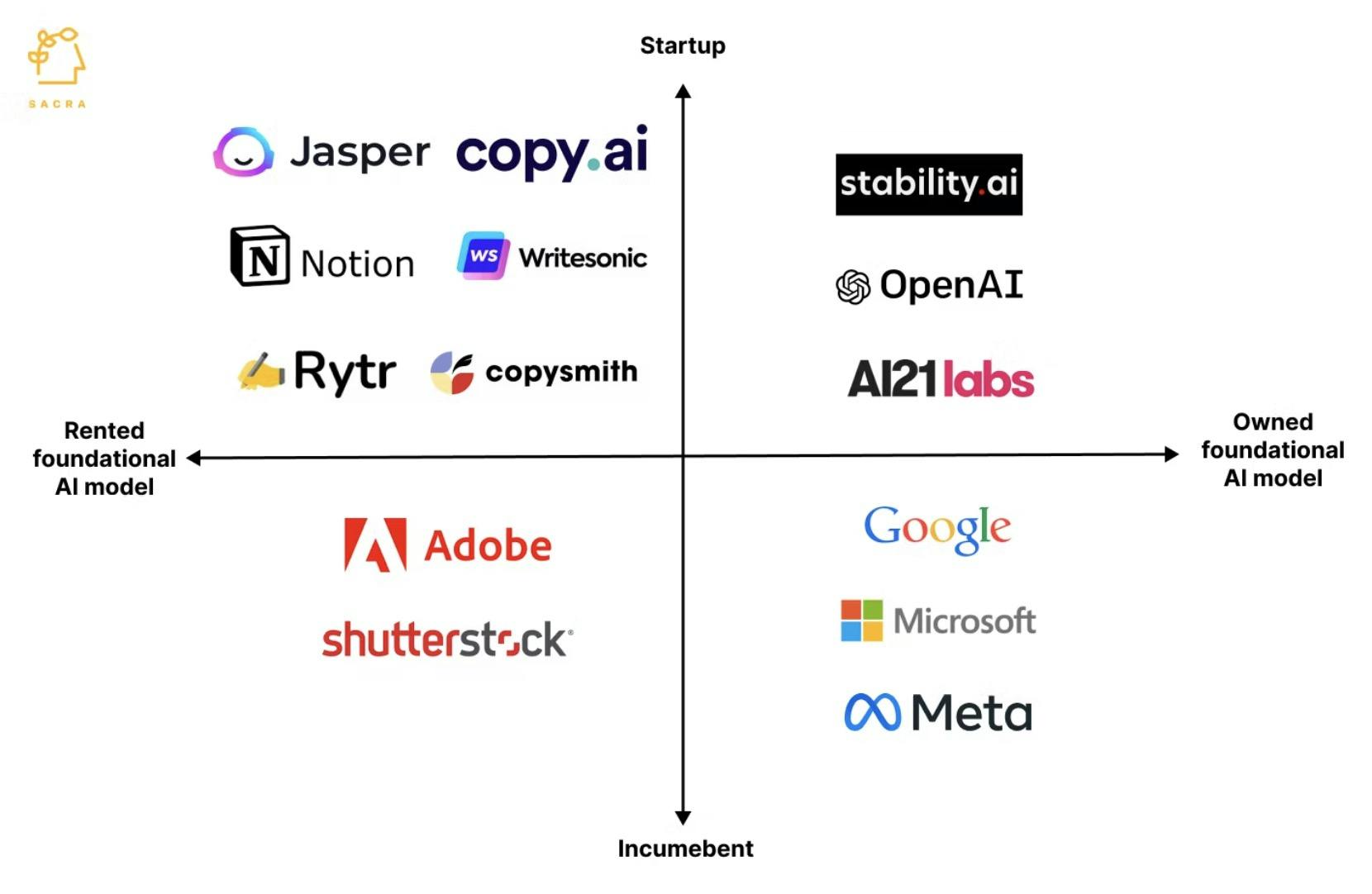

Copy.ai operates in a crowded market. ~50 text processing and ~25 image processing generative AI startups have launched in the last 12 to 18 months, most of them using foundational AI models from OpenAI ($20B) and Stability AI ($1B). Large tech incumbents like Microsoft and Google, with proprietary foundational AI models, are also integrating AI in their apps.

Generative AI startups

OpenAI and Stability AI are arming startups to build generative AI apps by letting them cheaply rent foundational AI models that rival Google and Microsoft’s models in scale.

At the same time, they are also commoditizing the application layer by making it cheap and frictionless for anyone who can code to launch generative AI apps. This gives them enough leverage to create a redux of the smartphone era, where the fat layer of iOS and Android platforms captured the bulk of the value.

However, unlike during the smartphone era, the foundational layer incumbents like OpenAI risk becoming redundant with the emergence of free, open-source language models like BLOOM that are as large as GPT-3. In August 2022, OpenAI slashed the price of vanilla GPT-3 by two-thirds, making it even cheaper for developers to test it out rather than rely on free, open-source models.

Large tech incumbents

Among the incumbents, Microsoft and Google have the biggest opportunities, given their proprietary foundational models and billions of existing software users/customers. Unlike startups, they don’t have to pay the OpenAI tax and can bundle AI assistants for near-free in their apps by spreading the model’s cost over billions of users. Microsoft’s foundational model MT-NLG has 530B parameters, and Google’s PaLM has 540B parameters, making them strong competitors to GPT-3 with 175B parameters.

TAM Expansion

Horizontal expansion

Copy.ai started off with a simple tool—a language model, trained on Wikipedia entries, designed to help marketers create copy for any product and for any audience in seconds.

Since then, they’ve launched 90+ AI tools, including generators for sales copy, ad copy, social posts, resignation letters, real estate listings, cold emails, job descriptions, and more.

While Copy.ai’s core customer base today revolves around marketing teams and SMBs, there’s an opportunity for them to expand across the organization as they eat up other use cases outside content writing and social media marketing—for example, creating collateral for and helping with basic outbound and inbound sales tasks.

Enterprise sales motion

Today, Copy.ai’s core customer base is SMBs—but they have an opportunity to drastically grow their ARPU and net dollar retention by moving upmarket into the enterprise.

In SaaS at scale, enterprise growth tends to outpace SMB growth and ultimately represent a huge and growing portion of revenue.

One advantage for Copy.ai is that as with a tool like Canva, the relevant workflow across SMBs and enterprises is relatively similar. Unlike a product like Brex where SMBs and enterprises fundamentally use the product in different ways, teams using Copy.ai to create content have the same core needs whether they’re in big or small companies.

To make this move upmarket, Copy.ai will likely need to implement key prerequisite features like SSO and SOC-2 compliance, alongside things like team collaboration, brand controls, reporting, and asset management.

Risks

Low switching costs

Copy.ai competes with AI-based copywriting products from companies like Jasper, Writesonic, Copysmith, Clickable, Ponzu, Simplified, and others.

And with products like Github Copilot and Microsoft’s new AI art generator, we’re already seeing how the biggest tech incumbents are looking to embed generative AI into their existing products.

Today, there isn’t any specific proprietary technology or network effects that differentiate Copy.ai from these different players—e.g. any factors that would make it harder for users to simply switch over to another platform.

Long-term unit economics

Once the generative AI startups move beyond early adopters, their relative lack of differentiation may force them to invest more in growth via more paid ad campaigns, bumping up CAC and putting pressure on their unit economics.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.