Revenue

$320.00M

2023

Valuation

$3.80B

2023

Funding

$930.00M

2023

Growth Rate (y/y)

-57%

2023

Revenue

Convoy's revenue peaked at $750M in 2021, growing 50% annually. However, the company experienced a significant decline, with revenue dropping to $320M in 2023. This represents a 57% decrease from its 2021 peak.

Despite previously projecting growth, Convoy struggled financially in 2023. The company's revenue collapse in the first nine months of the year fell far short of its 2022 performance. This financial downturn made it difficult for Convoy to secure additional funding or find a buyer.

After unsuccessful attempts to raise money or sell the company over a four-month period, Convoy ultimately ran out of funds and shut down operations in 2023. Prior to its closure, Convoy operated a network of 400,000 trucks and counted major enterprises such as Home Depot, Procter & Gamble, Unilever, and Anheuser-Busch among its customers.

Convoy's business model was based on creating a price arbitrage between shippers and carriers, keeping the difference as revenue. The company had previously reported profitability on a per-transaction basis.

Valuation & Funding

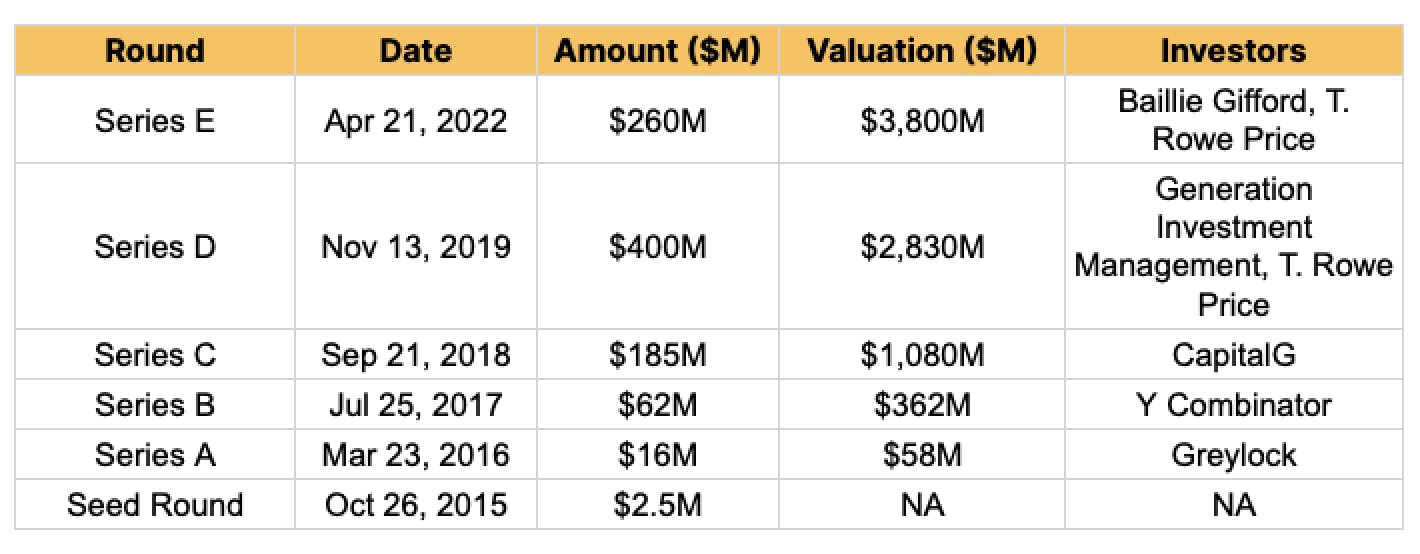

Convoy reached a peak valuation of $3.8 billion during a funding round led by T. Rowe Price and Baillie Gifford, before ceasing operations in 2023. The digital freight network raised over $1 billion in total funding throughout its lifetime.

Notable investors included prominent tech figures Jeff Bezos and Bill Gates, along with institutional investors like CapitalG (Alphabet's venture arm) and Generation Investment Management (Al Gore's investment firm). The company attracted significant capital from both strategic and institutional investors before its closure in late 2023.

After Convoy's shutdown, Flexport acquired the company's technology assets and subsequently sold the Convoy Platform to DAT Freight & Analytics in July 2025 for approximately $250 million. The sale represented a 93% discount from Convoy's peak valuation, with the proceeds helping Flexport achieve technical profitability in 2025 through the one-time gain.

Business Model

The US trucking market is worth $800B with 100k+ shippers and 1M carriers, of which 95% have less than 10 trucks. This makes it difficult for shippers to find carriers directly, and they rely on 17,000+ brokers to match loads with carriers who charge 15% to 20% per transaction.

The matchmaking is manual and effort-intensive, with an army of reps at these brokers calling/emailing carriers for each new load, spending up to 4 hours on every transaction. Furthermore, brokers are incentivized to maximize their margins rather than make efficient routes, resulting in 35% of miles driven back by trucks without freight, with a loss of $10B annually.

Convoy’s core thesis is to replace this inefficient manual matchmaking with algorithmic matchmaking. Once shippers list their freight on Convoy, its pricing algorithm shows them a price estimate for the freight and then runs an auction on the carrier side, composed mainly of the long-tail, for them to accept the freight at a lower price, with Convoy keeping the spread on the transaction as its revenue. Convoy mentions that 100% of matching in its top markets is automated, with a matching time of a few minutes.

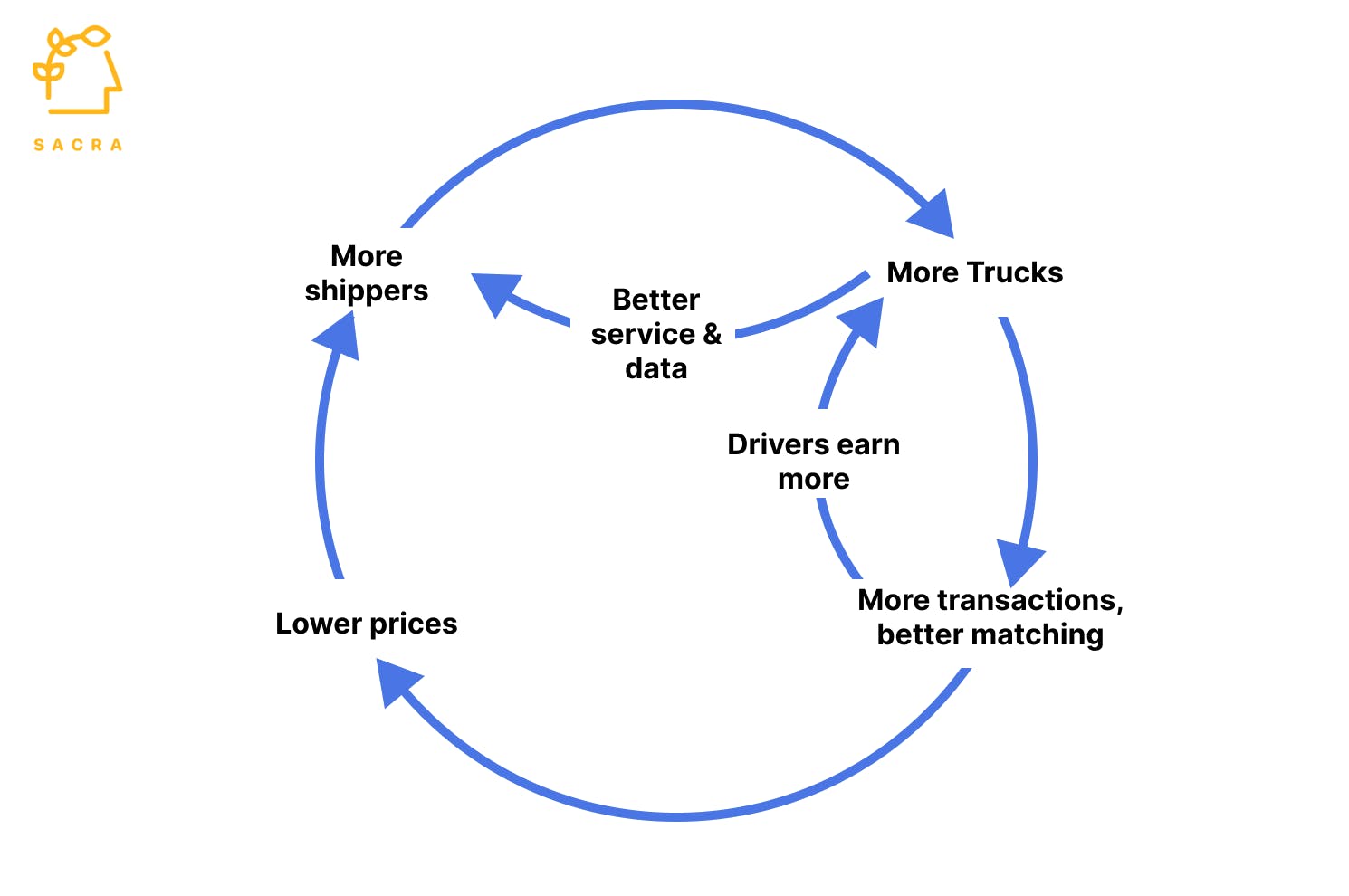

By replacing reps with algorithms, Convoy operates at lower costs allowing it to take a lower take rate than traditional brokers, leverage this low fee to attract shippers, and use the increased load volume to sign up more carriers, creating a flywheel effect. We expect Convoy to operate at a gross margin of less than 10%, like Transfix (gross margin: 6.4%) and Uber Freight (operating margin: 0.1%), as the bulk of its revenue comes from enterprise shippers who offer take rates of less than 5%.

Product

Convoy found an initial product-market fit by signing up the top 10% high-volume routes of two large enterprise shippers and using this demand to aggregate trucking companies operating on those routes. As the supply of trucking companies grew, Convoy signed up other large shippers on those routes and then expanded outwards to more shippers nationwide.

Shippers could add new loads to Convoy through their portal (primarily used by SMBs) or by integrating it with their transport management software (used mostly by enterprise shippers). Shippers also got a dashboard to track their orders live, see ETAs, get delay alerts and run analytics on historical data.

For carriers, besides a mobile app where they bid on the loads, Convoy also provided a mini SaaS that lets them manage their operations better. This included uploading invoices and other delivery-related documents, receiving payments and keeping track of past payments, tracking the live location of their fleet, and route planning. Convoy pinged the GPS in truckers' phones through its app to get their live location. Carriers also got a fuel card that gets them discounts at certain gas stations and deals on used trucks/trailers, roadside assistance, and spare parts.

Following Convoy's 2023 shutdown, DAT Freight & Analytics acquired the Convoy Platform in July 2025 and continues operating it as a neutral freight marketplace. As of July 2025, nearly 30,000 carriers use the platform app, primarily owner-operators and small fleets. The platform has added TMS integrations including Port TMS and McLeod Software's PowerBroker, allowing brokers to post loads directly with automated negotiation, booking, tracking, documentation, and payment workflows.

Competition

Traditional asset-based carriers and brokers

Convoy operated in a fragmented market and competed with companies that operate owned trucks like DB Schenker ($23B) and Schneider ($4.3B), and large traditional brokers like C.H. Robinson ($10.9B) and J.B. Hunt ($18.4B). Large incumbent brokers digitized their operations in response to digital marketplaces. For instance, C.H. Robinson booked $875M through its app/portal in 2021, up ~200% annually, though it remained less than 5% of their revenue, and they struggled to attract high-quality engineering and product talent due to their legacy roots.

Digital freight marketplaces

Uber Freight was the largest trucking digital marketplace by revenue, grossing $2.1B in 2021. It grew ~3x from 2018 to 2020 by offering enterprise customers take rates as low as 1%, undercutting its competitors. Convoy also competed with other digital marketplaces like Transfix ($1.1B revenue), attempting to replace manual broker matchmaking with algorithmic matching.

SMB broker enablement

SMB brokers lacked the talent or money to digitize their operations and were at risk of being replaced by digital marketplaces. Convoy was the only digital marketplace that let brokers list their loads on its platform and use its SaaS for matchmaking, competing with newer startups like MVMNT (raised $24.5M; backed by A16Z) that offer back-office SaaS to SMB brokers.

Post-shutdown competitive position

After Convoy shut down in 2023, DAT Freight & Analytics acquired the Convoy Platform in July 2025 and repositioned it as a neutral freight marketplace integrated with DAT's existing load board and analytics business. This shifted the competitive dynamic—rather than competing independently with Uber Freight and traditional brokers, the platform now operates as part of DAT's broader freight ecosystem, leveraging DAT's relationships with brokers through TMS integrations.

TAM Expansion

With less than 1% of the US trucking market, Convoy has a lot of growth headroom as a marketplace. In parallel, it’s evolving from a marketplace into a vertical SaaS for brokers/truckers with embedded financial services to capture additional revenue beyond the direct spending on freight movement.

Vertical SaaS

In November 2021, Convoy launched Convoy for Brokers, allowing brokers to post their loads through Convoy’s portal. Brokers get access to Convoy's portal as a SaaS for finding carriers, invoicing, and payments. Convoy gets the benefit of additional load for its carriers, access to data for shipping routes managed by these brokers, and incremental revenue by capturing net new transactions. Convoy can layer more products and create a ‘Toast for brokers’ that helps them better manage their operations.

Financial services

Convoy offers basic financial services like a fuel card and invoice factoring with free same or next-day payment to carriers and recently added a paid Quick Pay service to get the payment in 8 hours at a 1.5% transaction fee. Like other contractor management portals such as Deel and Upwork, Convoy can layer more financial services such as an Uber-like debit card, insurance, and working capital loans to the carriers.

Risks

Lack of profitability

By starting with enterprise shippers to build demand and attract carriers to its platform, Convoy compromised on its take rate and settled for low margins. In the current funding scenario, with a sharp focus on profitability, this can become a challenge in raising future funds.

Post-COVID reset

Convoy got a shot in the arm in 2021, as COVID strained the supply chain and even the largest truckers were running out of trucks, forcing enterprise shippers to shift their loads to digital marketplaces like Convoy to access the long-tail of carriers to ship their load. With COVID waning, the traditional shippers are getting surplus capacity, which can push the enterprise players away from digital marketplaces.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.