Revenue

$104.00M

2024

Valuation

$6.00B

2024

Funding

$1.90B

2024

Growth Rate (y/y)

150%

2024

Revenue

Sacra estimates Commure hit $105M in annual recurring revenue in March 2024, growing 150% YoY. The company expects to double revenue in FY24 through a combination of organic growth and strategic acquisitions.

The revenue mix comes primarily from two key segments: Athelas' revenue cycle management and remote patient monitoring products serving thousands of healthcare providers, and Commure's enterprise software business serving major health systems like HCA Healthcare, Jefferson, and Providence. The recent $139M acquisition of Augmedix adds another significant revenue stream through medical documentation services.

Commure has over $250M in cash on its balance sheet following the Athelas merger, which valued the combined entity at $6B. The company's strategic partnerships with major health systems, including HCA Healthcare which processes over 43 million patient interactions annually, provide strong recurring revenue potential as it deploys its ambient AI platform across hospital networks.

Key growth drivers include the expansion of Athelas' RCM products launched in early 2023, enterprise-wide deployments of Commure's clinical documentation AI, and cross-selling opportunities across its growing hospital system customer base. The company maintains a robust M&A pipeline to supplement organic growth.

Product

Commure was founded in 2017 by Hemant Taneja at General Catalyst, alongside former leaders from Google, Salesforce, and Health Catalyst. The company initially launched as a developer platform for healthcare applications but pivoted to focus on enterprise healthcare software solutions.

The core product, Commure Scribe, listens to physician-patient interactions and creates structured medical notes in real-time, integrating with over 30 different EHR systems including Epic and Cerner. Physicians can focus entirely on patient care while the system handles documentation in the background, requiring minimal editing of the generated notes.

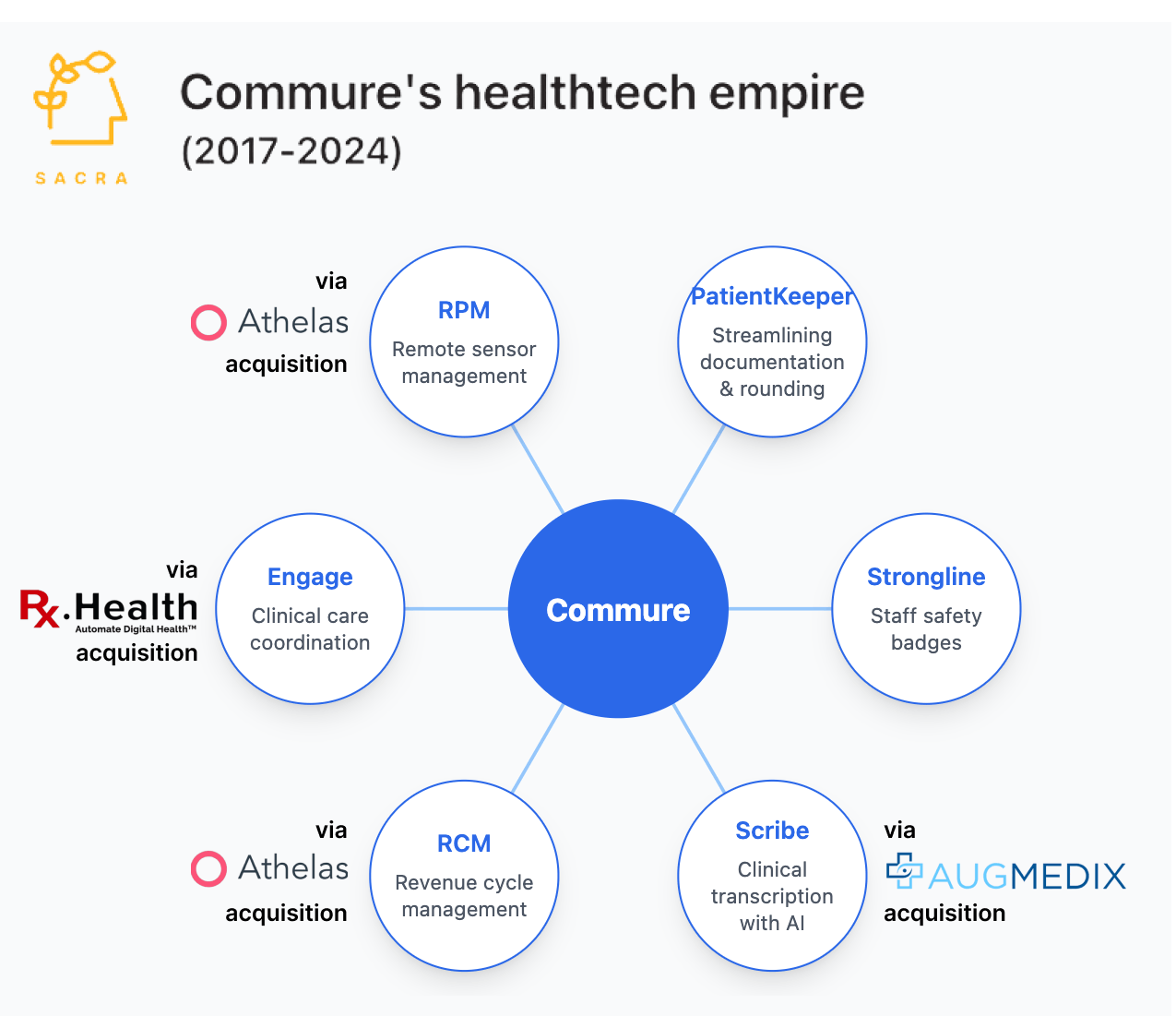

Beyond clinical documentation, Commure has expanded to offer a comprehensive healthcare operations suite. This includes staff safety solutions with wearable smart badges, automated revenue cycle management tools, and a patient engagement platform. All products are built on CommureOS, their healthcare-specific operating system that enables seamless integration across a health system's existing technology infrastructure.

Business Model

Commure is a healthcare software company that sells enterprise solutions to major health systems, monetizing through customized subscriptions for its suite of AI-powered tools and platforms.

The company's core products include ambient AI documentation (Scribe), revenue cycle management automation, remote patient monitoring, and staff safety solutions.

The company prices its solutions through enterprise-wide contracts, with annual commitments typically starting at $1 million for access to specific modules. Pricing scales based on the size of the healthcare organization and number of modules deployed. Healthcare systems can start with a single solution like Scribe for clinical documentation and expand into additional modules over time.

Commure's business model leverages strategic partnerships with major health systems like HCA Healthcare and Tenet Health to co-develop and validate new solutions before broader market rollout. This approach helps secure large, multi-year contracts while reducing sales cycles with other enterprise customers.

The company's competitive advantage stems from its integrated platform approach - healthcare organizations can deploy multiple Commure solutions that work together seamlessly, increasing switching costs over time. Its recent merger with Athelas and acquisition of Augmedix further strengthens this platform strategy by expanding capabilities in remote monitoring and clinical documentation.

Competition

Commure operates in the healthcare software and AI automation market, competing across several distinct segments focused on clinical workflow optimization and administrative automation.

Enterprise healthcare platforms

Epic Systems dominates the traditional enterprise healthcare software market with its comprehensive EHR and hospital management systems. Cerner (now part of Oracle) and Allscripts also maintain significant market share in this segment. These incumbents offer broad functionality but are often criticized for creating documentation burden and workflow inefficiencies that Commure aims to address.

Clinical documentation and ambient AI

Microsoft's Nuance leads in clinical documentation with its Dragon Medical platform. Emerging competitors include Abridge, which focuses on specialty-specific AI scribing, and Suki, which offers both documentation and virtual assistant capabilities. Recent entrant Ambience Healthcare has gained traction with its specialty-focused approach. This segment has seen increased competition as providers seek solutions to reduce physician burnout.

Revenue cycle management and automation

R1 RCM and Change Healthcare (now part of Optum) dominate traditional revenue cycle management. Olive AI attempted to automate healthcare administrative tasks before shutting down in 2023. Notable startups like Notable Health and Health Note focus on specific workflow automation niches. The RCM space has attracted significant private equity investment, with firms consolidating point solutions into broader platforms.

The competitive landscape is shifting as health systems increasingly seek integrated solutions that combine clinical documentation, workflow automation, and revenue cycle management. This has driven consolidation through acquisitions, as evidenced by Commure's purchases of PatientKeeper, Strongline, and Augmedix.

TAM Expansion

Commure has tailwinds from the massive shift toward AI-enabled healthcare automation and has the opportunity to expand into adjacent markets beyond its current focus on clinical documentation and revenue cycle management.

Enterprise AI infrastructure

The healthcare enterprise software market represents a $30B+ opportunity. Commure's ambient AI platform, validated through partnerships with major health systems like HCA Healthcare and Tenet, positions them to expand beyond documentation into areas like clinical decision support, care coordination, and operational analytics. Their acquisition of Augmedix demonstrates their ability to integrate complementary technologies and scale rapidly.

Revenue cycle optimization

Healthcare administrative costs exceed $1T annually in the US. Commure's revenue cycle management solutions already process over $5B in annual claims. By expanding their RCM capabilities to include more sophisticated prior authorization automation, eligibility verification, and denial management, they can capture a larger share of this market while delivering 10x ROI to customers through improved efficiency and accuracy.

Clinical workflow automation

The clinical documentation burden costs the US healthcare system an estimated $90B annually in physician time. Through partnerships with major health systems, Commure has proven they can reduce documentation time from hours to minutes. Their platform's ability to integrate with 30+ EHR systems positions them to expand into automated order entry, care planning, and quality measure reporting - addressing an additional $50B+ market opportunity as healthcare organizations seek comprehensive workflow automation solutions.

Risks

Integration complexity and health system inertia: Commure's strategy relies heavily on health systems adopting and integrating their solutions across multiple existing systems and workflows. The company's acquisitions of diverse products (PatientKeeper, Strongline, Augmedix) create significant technical complexity in building a cohesive platform. Health systems are notoriously slow to change established workflows, and any integration issues could severely impact adoption rates and revenue growth.

Dependence on strategic relationships: Commure's growth is heavily tied to partnerships with major health systems like HCA Healthcare and General Catalyst's health system network. If these relationships deteriorate or fail to deliver expected results, it could significantly limit the company's market access and growth trajectory. The company's $6B valuation appears largely predicated on these strategic relationships rather than current revenue metrics.

AI competitive differentiation: As ambient AI and clinical documentation become increasingly commoditized, Commure faces intense competition from both established players (Microsoft's Nuance) and well-funded startups. The company's broad product portfolio could dilute its ability to maintain technological leadership in key areas like ambient AI, where specialized competitors are solely focused on perfecting specific use cases.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.