Revenue

$82.00M

2025

Valuation

$1.25B

2024

Funding

$243.00M

2024

Revenue

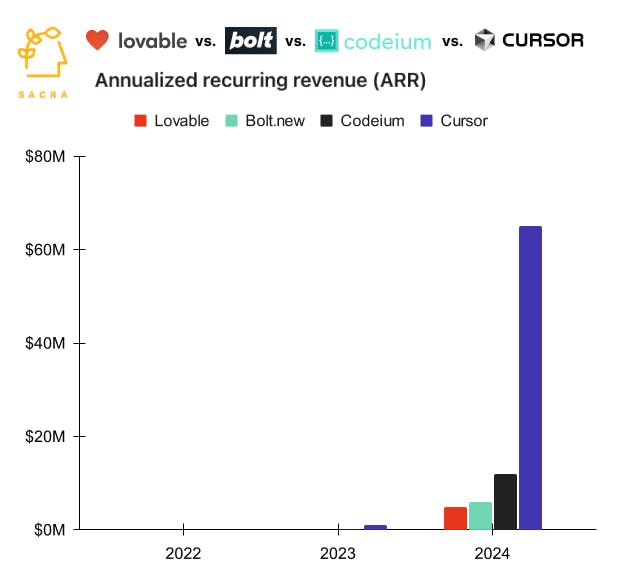

Sacra estimates Codeium hit $82M ARR in July 2025, up from $40M in February 2025, at the time of its acquisition by Cognition.

The company employs a freemium model, offering a generous free tier to individual developers while monetizing through enterprise contracts ranging from $10/month for Pro users to $60/month for advanced features, with custom enterprise pricing for larger deployments.

Over 1,000 businesses use Codeium, including marquee names like Zillow, Dell, and Anduril.

Codeium expanded from 10,000 users in early 2023 to over 800,000 active developers by early 2025. The platform now processes over 100 billion tokens daily across 70+ programming languages, suggesting significant infrastructure scale and potential for continued revenue expansion.

Valuation & Funding

Codeium was acquired by Cognition in July 2025; financial terms were not disclosed. Prior to the acquisition, Codeium was valued at $1.25B following its $150M Series C round led by General Catalyst in August 2024. This was up from $500M at its Series B in January 2024.

The company raised approximately $243M in total funding since its founding in 2021, with notable investors including General Catalyst, Kleiner Perkins, and Greenoaks.

Product

Codeium was founded in 2021 by MIT graduates Varun Mohan and Douglas Chen, initially as Exafunction—a GPU optimization company. In 2022, they pivoted to focus on AI-powered developer tools.

Codeium found product-market fit as an AI coding assistant for enterprise development teams, particularly those working with large, complex codebases across multiple programming languages and development environments. The product gained rapid adoption among companies like Dell and Zillow by offering seamless integration with existing development workflows.

The core product functions as an intelligent coding companion that provides contextual code suggestions directly within developers' preferred IDEs. As developers type, Codeium analyzes the entire codebase to offer relevant code completions, documentation, and explanations. For example, when a developer starts implementing a new feature, Codeium can suggest appropriate patterns based on similar implementations elsewhere in the codebase.

In late 2024, Codeium expanded its offering with Windsurf, an AI-native IDE that deepens the integration between development environment and AI assistance. The platform includes Cascade, an advanced AI system that can understand complex development contexts and execute multi-step coding tasks while maintaining developer control over the process. Both products emphasize enterprise-grade security and support deployment options ranging from cloud-based to fully on-premises installations.

Business Model

Codeium is a freemium SaaS company providing AI-powered developer tools, with a core business model centered on enterprise subscriptions while maintaining a generous free tier for individual developers. The company monetizes through a tiered pricing structure, offering a free plan with basic features, a $15/month Pro plan with advanced capabilities, and a $60/month Pro Ultimate plan with unlimited premium model access.

The company's enterprise offering includes self-hosted deployments, enhanced security features, and custom integrations across 40+ development environments. This flexibility in deployment options, combined with support for 70+ programming languages, allows Codeium to serve both security-conscious enterprises and individual developers effectively.

Codeium employs a product-led growth strategy, using their free tier to drive bottom-up adoption within organizations. Their enterprise sales motion typically begins with organic developer usage, followed by team-wide adoption and eventual enterprise-wide deployment. This approach has proven particularly effective in highly regulated industries where traditional top-down sales approaches often struggle.

The company's competitive advantage stems from their infrastructure-first approach, enabling them to offer enterprise-grade features like self-hosting, custom model deployment, and advanced security controls while maintaining competitive pricing through operational efficiency.

Competition

Codeium operates in the rapidly growing AI-powered developer tools market, which spans multiple segments from code completion to full development environments.

Enterprise AI coding platforms

GitHub Copilot dominates this segment with approximately 1.8M paying users and $400M ARR as of late 2024. Backed by Microsoft's distribution advantages, Copilot focuses on IDE plugin functionality and code completion. Magic AI, having raised $320M in 2024, differentiates through custom foundation models like LTM-2-mini. Both companies target large enterprise customers with comprehensive security and compliance features.

AI-native IDEs

This emerging category includes Cursor ($65M ARR, growing 6,400% YoY) and newer entrants like Replit Agent. These platforms aim to replace traditional IDEs with AI-first development environments. Cursor focuses on individual developers and smaller teams, while Replit targets educational and collaborative coding use cases.

No-code AI development

Vercel's v0 and Bolt.new ($4M ARR) represent a distinct approach, enabling non-technical users to describe and deploy applications through natural language. Bolt.new achieved significant early traction, reaching $20M ARR within two months of launch by focusing on integration with existing development tools and platforms.

The market shows increasing specialization, with companies either pursuing deep integration with existing developer workflows or attempting to fundamentally transform the development process. Enterprise security requirements and deployment flexibility have become key differentiators, particularly for companies serving regulated industries or government clients.

TAM Expansion

Codeium has tailwinds from the rapid enterprise adoption of AI development tools and increasing developer costs, with opportunities to expand into adjacent markets like non-technical development automation and enterprise development workflow optimization.

Enterprise AI development platforms

The developer tools market is experiencing unprecedented growth as enterprises seek to reduce development costs and increase productivity. With over 27 million professional developers globally and average costs exceeding $150,000 per developer annually, Codeium's ability to automate up to 50% of code creation represents a $2T+ efficiency opportunity. Their recent expansion from IDE extensions to the Windsurf platform demonstrates their capability to capture larger portions of the development workflow.

No-code development automation

Codeium's AI capabilities position them to expand into the rapidly growing no-code development market, estimated to reach $45B by 2025. Their existing enterprise relationships and deep understanding of codebases create natural expansion opportunities for enabling non-technical teams to build and maintain applications. The recent launch of Cascade shows early success in bridging technical and non-technical development workflows.

Development workflow optimization

Beyond code generation, Codeium can expand into the $15B+ development workflow optimization market. Their ability to process over 100 billion tokens daily and analyze entire codebases enables them to offer sophisticated services around code review, security analysis, and technical documentation. The self-hosted deployment option particularly appeals to security-conscious enterprises, representing a significant portion of the Fortune 500 that still maintains on-premise development environments.

Risks

Commoditization of AI models: Codeium's initial differentiation came from their proprietary infrastructure and models, but they now rely heavily on frontier models like Claude for core functionality. As these models become increasingly commoditized and accessible, Codeium's technical advantages may erode. Their value proposition could become primarily about UI/UX, which is more easily replicable by competitors. This risk is particularly acute given Microsoft's distribution advantage with GitHub Copilot and VSCode.

Enterprise adoption friction: While Codeium has built enterprise-ready infrastructure from day one, their free-first GTM strategy may create friction in enterprise sales. The dramatic price differential between their free tier and enterprise contracts could make price negotiations challenging. Their focus on individual developer love might conflict with enterprise priorities around standardization and control. The need to support legacy systems and multiple IDEs also increases operational complexity.

Dependency on developer workflow patterns: Codeium's product strategy assumes current software development workflows will persist. If development patterns shift dramatically (e.g., toward natural language programming or low-code platforms), their deep IDE integration could become less relevant. Their investment in IDE-specific features could become technical debt if the industry moves toward different paradigms.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.