Revenue

$150.00M

2022

Valuation

$4.00B

2024

Funding

$535.00M

2024

Growth Rate (y/y)

76%

2022

Valuation & Funding

ClickUp reached a $4 billion valuation following its $400 million Series C round in October 2021, led by Andreessen Horowitz and Tiger Global Management. The company has raised a total of $535 million across 4 funding rounds.

With reported 2022 revenue of $150 million, this implies a revenue multiple of approximately 27x at the time of its last valuation. The company serves over 100,000 paying customers and counts Lightspeed Venture Partners and Meritech Capital Partners among its key investors.

Product

ClickUp was founded in 2017 by Zeb Evans and Alex Yurkowski, initially as an internal tool to solve their own productivity software frustrations. The founding team had previously run a social media marketing company where they found themselves using 15 different productivity tools across their 25-person team, leading them to build a unified platform for their own use.

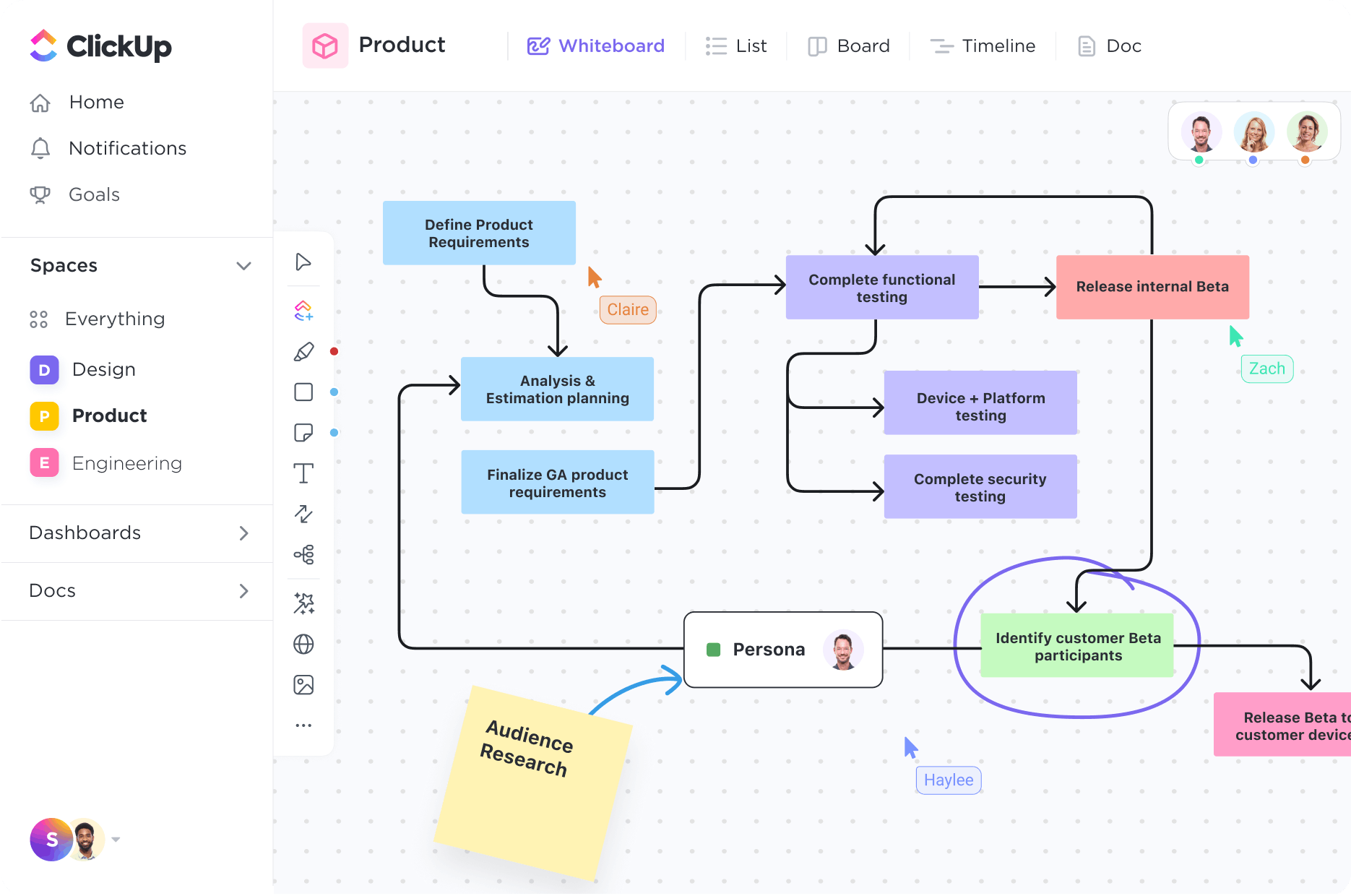

The core product is a flexible work management platform that allows teams to organize and track all their work in one place. Users can switch between different views of the same data—from Kanban boards to lists to Gantt charts—while maintaining a single source of truth. For example, an engineering team might track sprints in a board view while their product managers prefer a list view, all working from the same underlying data.

What distinguished ClickUp from competitors was its flexibility and customization. Rather than enforcing specific workflows, ClickUp allows teams to configure the platform to match their existing processes.

The platform has since expanded beyond basic project management to include docs, whiteboards, chat, and time tracking. A key innovation was building time tracking directly into the platform, which attracted service businesses and agencies who needed to track billable hours. The product also includes AI-powered features for automating routine work like writing project updates and generating meeting summaries.

In November 2025, ClickUp launched its 4.0 redesign with new AI assistants. The update introduced proactive AI agents in chat and Brain in the sidebar, enterprise AI search via its Qatalog acquisition, and SyncUps with live video, transcription, and notes.

Business Model

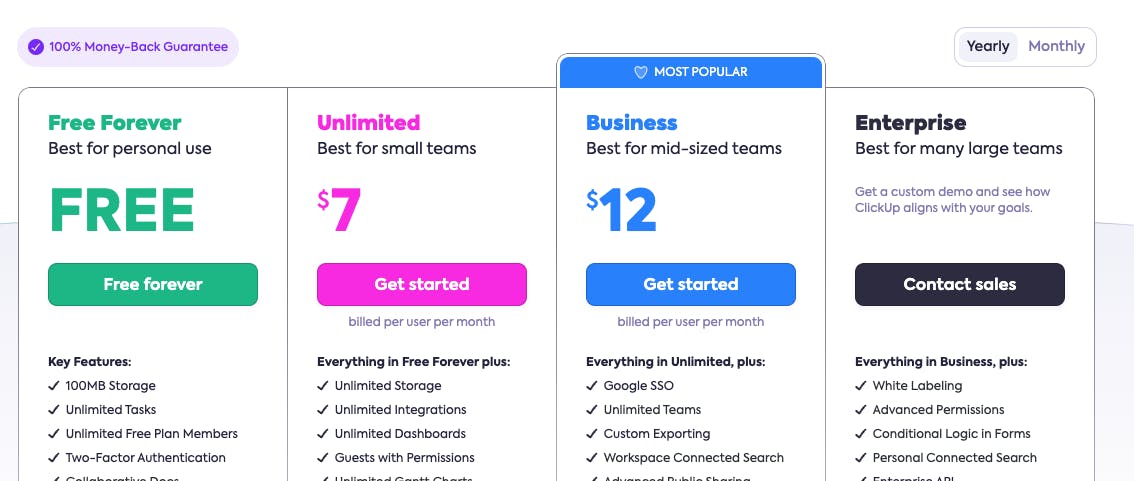

ClickUp is a subscription SaaS company that offers an all-in-one productivity platform, combining project management, docs, chat, and collaboration tools. The company generates revenue through a tiered subscription model based on per-seat pricing, with plans ranging from free to enterprise-level offerings.

The core pricing strategy starts with a free tier to drive adoption, followed by an Unlimited plan at $7/user/month (annually) that includes essential features like unlimited storage and native time tracking.

The Business plan at $12/user/month adds advanced features like resource management and private docs, while the Enterprise plan offers custom pricing with enhanced security and dedicated support. ClickUp also monetizes through a $5/user/month AI add-on that can be purchased alongside any paid plan.

ClickUp has built an efficient customer acquisition motion, primarily driven by SEO and content marketing, achieving profitability after hitting $10M ARR.

Competition

ClickUp operates in the work management and productivity software market, which spans multiple categories including project management, document collaboration, and team communication tools.

Enterprise productivity suites

Microsoft and Google dominate this category with their integrated productivity bundles (Microsoft 365 and Google Workspace).

These platforms offer core document creation, storage, and collaboration capabilities that many companies consider essential infrastructure. Microsoft has expanded into project management with Loop and Planner, while Google offers simpler task management through Tasks.

Their key advantage is massive distribution through existing enterprise relationships, though their project management offerings remain relatively basic compared to specialized tools.

Project management

This segment includes established players like Asana, Monday.com, and Atlassian (Jira).

Asana focuses primarily on task and project management with an emphasis on simplicity and user experience.

Monday.com has pursued a similar trajectory to ClickUp by expanding beyond project management into a broader work platform, achieving faster revenue growth than Asana through this approach.

Monday.com's revenue grew to $730M in 2023, up 41% year-over-year, while maintaining better profitability metrics than competitors. Jira dominates software development project management but has struggled to expand beyond technical teams.

Best-in-breed tools

A range of specialized tools serve specific collaboration needs: Notion for documents and wikis, Miro for whiteboards, Slack for chat, and Lattice for goals and performance management.

These tools often excel in their specific domains but create data silos and context-switching costs for users. Some, like Notion, have expanded their feature sets to compete more broadly in the productivity space.

The market shows signs of consolidation pressure, with customers increasingly seeking to reduce their number of tools.

This is evidenced by Monday.com's success in selling to enterprises and ClickUp's growth through offering multiple capabilities in one platform. The traditional strategy of building best-in-breed point solutions is being challenged by platforms that can deliver good-enough functionality across multiple categories while reducing integration complexity and costs.

TAM Expansion

ClickUp has tailwinds from the broad shift toward digital workplace collaboration and has the opportunity to grow and expand into adjacent markets beyond its core project management functionality. The company's flexible platform architecture and proven ability to ship new products quickly positions it well to capture expanding segments of the productivity software market.

Enterprise communication & collaboration

ClickUp's recent launch of enterprise chat functionality signals its expansion into the broader workplace communication market.

While Slack and Microsoft Teams dominate this space, ClickUp has a unique advantage in offering deeply integrated chat within its work management platform.

This allows for contextual communications tied directly to projects, tasks and documents - addressing a key pain point of context-switching between separate tools.

The enterprise collaboration software market is projected to reach $50B+ by 2025, presenting a significant expansion opportunity.

Vertical-specific solutions

ClickUp has found strong product-market fit with engineering teams, marketing departments, and professional services firms.

The company can leverage this foundation to build deeper vertical-specific capabilities. For engineering teams, this could mean expanding further into the $12B application lifecycle management market currently dominated by Atlassian.

For professional services, ClickUp's time tracking and resource management features position it to capture more of the $16B professional services automation market.

AI-powered productivity

The company has moved quickly to integrate generative AI capabilities, launching features for automated task creation, project updates, and knowledge base search.

ClickUp's universal data model connecting work across tools positions it uniquely to build AI-powered automation and insights.

The company can expand into emerging categories like AI-powered project planning, predictive resource allocation, and automated workflow optimization. This represents a greenfield opportunity as the market for AI-enhanced productivity tools is still nascent.

Risks

1. Feature Bloat Trade-off: ClickUp's "one app to replace them all" strategy creates inherent product complexity. While the company has succeeded in building a flexible platform, each new feature addition increases the risk of degrading performance and user experience - as evidenced by their significant technical challenges in 2022 that required re-architecting their platform. The company must constantly balance comprehensiveness with usability, risking either falling behind specialists in specific verticals or becoming too complex for mainstream users.

2. Enterprise Migration Challenges: While ClickUp has successfully grown through product-led growth and SMB adoption, their pivot toward enterprise (now 30% of revenue) presents unique risks. Their flexible, customizable platform - a strength in SMB - could become a liability in enterprise where IT departments often prefer standardized workflows and strict governance. The company's engineering-heavy, fast-shipping culture may need significant adjustment to meet enterprise requirements for stability and predictability.

3. Category Convergence Risk: ClickUp's success has validated the market for all-in-one productivity platforms, attracting increased competition from both point solutions expanding their scope (Notion, Asana) and tech giants (Microsoft, Google) enhancing their productivity suites. As the category matures, ClickUp's early-mover advantage in comprehensive functionality could erode, potentially forcing them to compete more on price or specific vertical features rather than platform breadth.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.