Revenue

$280.00M

2025

Funding

$175.00M

2024

Growth Rate (y/y)

118%

2025

Revenue

Sacra estimates Cleo hit $280M in annual recurring revenue (ARR) in July 2025, up from $185M at the end of 2024.

Cleo generated $65.9M in revenue in 2023, up 121% year-over-year from $29.8M in 2022. The company has demonstrated consistent strong growth, with revenue increasing from $8.47M in 2021 to reach its current scale.

Revenue mix has remained stable with subscription revenue accounting for 59% ($39.2M) and transaction fees comprising 41% ($26.7M) in 2023. The company maintains a nearly exclusive focus on the US market, which generates 99.8% of total revenue.

Operational efficiency improved dramatically through 2024, with the company achieving breakeven status. This follows the significant improvement in 2023, when gross margins expanded from 34% to 57% and operating losses narrowed to $16.7M from $23.2M in 2022.

Cleo's revenue is primarily driven by its consumer-facing AI financial assistant app, which has facilitated over 74 million conversations with users in 2024, representing 2.5x year-over-year growth. The company monetizes through a freemium model with premium subscriptions and transaction fees from financial products like cash advances.

Valuation & Funding

Cleo was last valued at $500 million during its Series C funding round in June 2022, led by Sofina Capital. The company has raised a total of $175M million across 11 funding rounds since its founding in 2016.

Based on Cleo's 2022 revenue of $29.8M, Cleo's 2022 Series C valued it at approximately 16.8x revenue.

Key investors include Balderton Capital, LocalGlobe, and EQT Ventures.

Product

Cleo was founded in 2016 by Barney Hussey-Yeo, a machine learning graduate who previously worked as a data scientist at a fintech company. The founder identified that while banks were pushing credit products to young consumers, they provided little guidance on financial management.

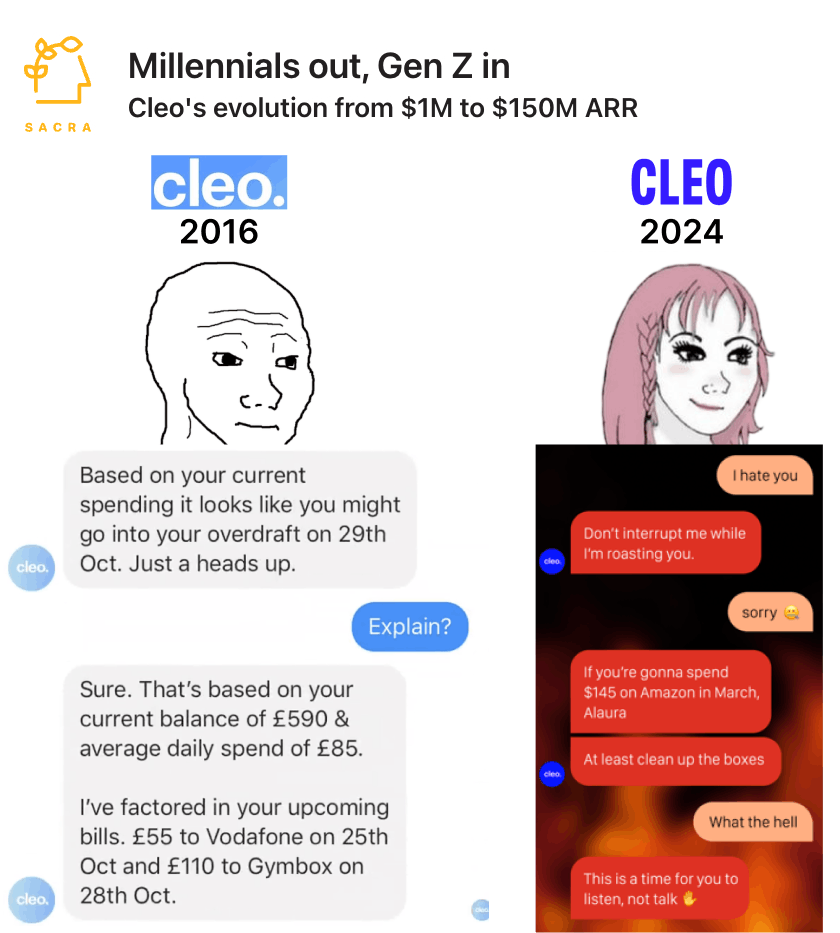

Cleo found product-market fit as an AI-powered financial assistant chatbot for Gen Z and millennial consumers, particularly those living paycheck-to-paycheck or struggling with basic financial management. The app initially launched on Facebook Messenger before expanding to a standalone application.

The core product uses natural language processing and machine learning to analyze users' banking data and provide personalized financial guidance through a conversational interface. Users connect their bank accounts, allowing Cleo to track spending patterns, upcoming bills, and potential savings opportunities. The AI assistant communicates in casual, meme-filled language that resonates with younger users, offering features like "roast mode" where it playfully criticizes wasteful spending habits.

Beyond basic budgeting, Cleo helps users avoid overdrafts by providing spending alerts and balance predictions. The app breaks down expenses by category and merchant, allowing users to set specific budget goals and receive proactive notifications about their progress. A key differentiator is the app's ability to synthesize complex financial data into actionable insights delivered through simple conversation.

The product expanded to include a savings feature that automatically calculates and sets aside affordable amounts based on spending patterns, and a credit-building program designed specifically for users new to credit.

In September 2025, Cleo added a high‑yield savings feature at 3.14% APY and clarified its banking partners. Banking services are provided by Thread Bank, and the Cleo Credit Builder Card is issued by WebBank. The app also supports early direct deposit and ATM cash access within the Credit Builder program.

Business Model

Cleo is an AI-powered financial assistant app that generates revenue through a freemium subscription model and transaction fees from financial products.

Subscription revenue (59% of total) comes from premium features like automated savings, credit building tools, and personalized financial coaching. The basic app is free, while premium tiers range from $2.99-19.99 monthly. Second, transaction fees (41% of total) are generated from cash advances up to $250 and other financial products, with fees ranging from $3.99-11.99 per advance.

Cleo's competitive advantage stems from its unique approach to financial guidance. Rather than traditional banking interfaces, it uses natural language processing and a distinctly informal, humorous tone to engage young users. The company employs comedians alongside engineers to maintain this differentiated voice. This has enabled strong viral growth and word-of-mouth marketing among its target demographic.

The company's strategic pivot to focus exclusively on the US market in 2020 has been key to its growth. While originally launched in the UK, Cleo found stronger product-market fit in the US where consumers have less robust financial safety nets and greater need for budgeting tools. The company plans to expand back to the UK and other markets as it scales, leveraging its proven engagement model and growing suite of financial products.

Competition

Cleo operates in a market that includes AI-powered financial assistants, neobanks, and personal finance management (PFM) tools, with distinct segments emerging based on target demographics and core capabilities.

Traditional PFM and budgeting apps

Mint and YNAB dominate the traditional budgeting space, focusing on detailed expense tracking and budget creation. These apps typically target financially-savvy users who want granular control over their finances. Personal Capital serves the investment-focused segment with wealth management features.

Sacra estimates that Monarch Money, another modern personal finance platform, hit roughly $25M annualized recurring revenue (ARR) in October 2024.

AI-first financial assistants

Charlie and Plum compete directly with Cleo in offering conversational financial guidance, though with different approaches. Charlie focuses on debt reduction, while Plum emphasizes automated savings. Neither has achieved Cleo's level of engagement with Gen Z users or its distinctive brand voice, evidenced by Cleo's 7M+ total users compared to competitors' smaller bases.

Neobanks with PFM features

Chime, Current, and Step have integrated basic budgeting and financial guidance features into their banking apps. While these companies have larger user bases due to their primary banking services, their PFM capabilities are typically more limited. Dave and Brigit focus specifically on overdraft protection and cash advances, competing with Cleo's salary advance feature but lacking the comprehensive financial guidance component.

TAM Expansion

Cleo has tailwinds from the growing demand for AI-powered financial services and increasing financial stress among younger generations, with opportunities to expand into adjacent markets like embedded finance, credit products, and wealth management.

AI-powered financial services

The personalized financial guidance market is projected to reach $25B by 2027. Cleo's AI technology has demonstrated strong product-market fit with Gen Z and millennials, evidenced by their 121% revenue growth to $65.9M in 2023. Their ability to analyze spending patterns and provide actionable insights positions them to capture significant market share as AI capabilities advance. The company's successful US expansion, where they now generate nearly 100% of revenue, provides a blueprint for international growth.

Credit and lending expansion

With 40% of Americans having less than $400 in savings, Cleo's existing cash advance and credit builder products could expand into a full suite of credit offerings. Their deep understanding of user financial behavior and spending patterns enables better risk assessment than traditional lenders. The company's improving unit economics (57% gross margin in 2023) and growing subscriber base create opportunities to offer personalized lending products at scale.

Embedded finance opportunities

Cleo's conversational AI interface and financial data analysis capabilities position them to white-label their technology to banks and fintechs. The embedded finance market is expected to reach $230B by 2025. Their proven ability to drive engagement through personalized insights and behavioral coaching makes them an attractive partner for financial institutions looking to modernize their digital offerings.

Risks

Key risks facing Cleo:

Dependence on third-party data access: Cleo's core functionality relies heavily on open banking and data connectivity providers like Plaid. While the US is gradually adopting open banking regulations, any disruption to data access or changes in regulatory requirements could severely impact Cleo's ability to provide personalized financial insights. The company's expansion plans into new markets also depend on the availability of similar banking data infrastructure.

AI trust and safety challenges: As Cleo deepens its use of AI for financial advice, there are inherent risks around the accuracy and appropriateness of automated guidance. Given Cleo's young, financially vulnerable user base, any perceived missteps in AI-generated advice could damage trust and trigger regulatory scrutiny. While the company employs comedians and content moderators, maintaining the right balance between engagement and responsible financial guidance at scale remains challenging.

Revenue concentration in US market: With 99.8% of revenue coming from the US market, Cleo faces significant geographic concentration risk. The company's sassy, irreverent brand voice that resonates with US Gen Z may not translate well to other markets as it expands globally. Additionally, its credit and cash advance products are specifically tailored to US financial systems, requiring substantial localization for international growth.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.