Revenue

$4.00B

2025

Valuation

$37.00B

2025

Funding

$572.60M

2025

Growth Rate (y/y)

44%

2025

Revenue

Click here for our Canva dataset.

Sacra estimates that Canva hit $4B in annual recurring revenue (ARR) at the end of 2025, up from $3.3B in August 2025 and $2.8B at the end of 2024.

Monthly active users reached 265M by the end of 2025, up from 240M in August 2025 and 180M the year prior, with over 31M paid users. This acceleration comes despite a controversial price hike on Canva Teams from $300 to $500 per year, which lifted average contract value by 66% and expanded monetization on the back of surging AI usage—now at 800M AI tool uses per month, up 700% year-over-year.

Canva's B2B business (companies with 25+ seats) reached $500M in ARR with 100% growth, representing approximately 12.5% of total revenue. The company still sees the majority of its business from North America, with continued growth in international markets. To increase paying users, Canva has introduced lower-priced subscriptions in countries like Pakistan, Uruguay, Morocco, and Jamaica.

Valuation & Funding

In late 2025, Canva conducted a share sale valuing the company at $42B, down from its $65B valuation in August 2025 and $37B valuation in July 2025.

The company has raised a total of $572.6 million across multiple funding rounds. Key investors include Blackbird Ventures, Sequoia Capital, and General Catalyst.

Business Model

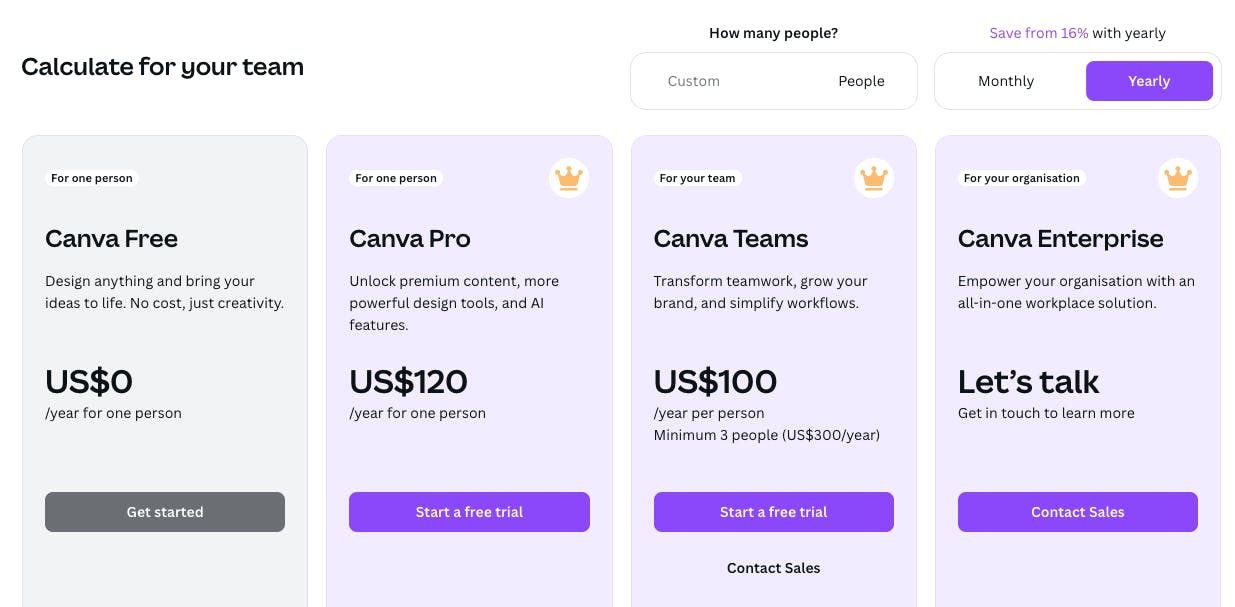

Canva is a subscription SaaS company that primarily prices based on the number of professional/enterprise and productivity features that a team needs—cloud storage, SSO, premium stock photos, post scheduling, and more.

Canva has a strong organic acquisition engine founded on SEO—they rank #1 or near #1 on Google for terms like "ai image generator", "graph maker", "resume templates", "logo maker", "photo editor", "business cards", "tier list maker", and "gif maker".

Farming the free individual users that they acquire through this SEO engine and upselling them to paid plans contracts has been a powerful growth tactic for Canva. With its focus on ease of use and increasingly broad range of use cases, now including videos, Powerpoint-like presentations, and websites, Canva is well set up to bring in free users from every part of the organization—and create maximally fertile ground for upsells.

Most of Canva's user base is on free, which is by design—Canva wants as many people as possible to use the product.

The Pro plan ($119 per year for one person) is mainly for people that want access to the advanced content library and want to collaborate with more than one fellow creator, or that need more storage—it's mainly a plan for SMBs.

Canva's enterprise offering is where they offer things like account management, access control, SSO, and bulk pricing. Canva's enterprise adoption, however, is still relatively nascent—about 10% of Canva's revenue came from enterprise plans, though we estimate that to have grown to roughly ~20% as of 2023.

Product

Canva was founded in 2013 by Melanie Perkins and Cliff Obrecht during the rapid rise of image-based social media.

As Facebook (2004) and Twitter (2006) grew and aggregated audiences in their feeds, digital marketers trying to stand out and win traffic started going multimedia, crafting preview images, infographics, and other visual collateral to go out with every new blog post, case study, or announcement.

This multimediaification of the feed created a need for companies to do some basic graphic design work for each new post—frequent but unsophisticated work that companies didn't want to spend a $30/hour designer on.

The basic feature of being able to throw text on top of images became Canva's "sepia filter"—the feature that, like Instagram's filters, got them product-market fit (5 million users in 2 years) by helping marketers create quick, branded social media graphics using free, browser-based tools.

Other products like Unsplash (2013) followed Canva by giving marketers access to high-quality, free stock photography, while on the other hand, Buffer launched Pablo (2015) to use a free social media graphic builder as lead gen for their post scheduling product.

Since then, Canva has grown to 220M monthly active users, expanding well beyond social media graphics into presentations, docs, videos, posters, billboards, business cards, and more. The company launched Canva Docs in 2023 to compete with Google Docs and Microsoft Word, while also pushing into video editing, website creation, and data visualization tools.

The company's biggest product evolution came in late 2022 with their entry into AI. They launched Magic Write (powered by GPT-3) for text generation, followed by Magic Design for instant layout generation, and Magic Edit for image manipulation. In 2023, they added Magic Switch for converting designs between formats, and Magic Media (powered by Runway) for video generation.

Canva's AI capabilities took a major leap forward with the October 2025 launch of a foundational design model that generates editable, layered designs across formats (social posts, presentations, whiteboards, websites). The same release expanded Canva AI with 3D object generation, style copy, and comment mentions, and introduced Canva Grow—a full‑stack marketing platform integrating the company's MagicBrief acquisition. The company also made Affinity free and began tightly integrating it with Canva for cross‑workflow creation.

Canva Grow has since deepened into a comprehensive video marketing suite. The platform now incorporates motion graphics and AI-driven video ad creation capabilities—brought in through the acquisitions of Cavalry and MangoAI (February 2026)—adding programmatic animation and performance-oriented video ad tooling directly into the marketing workflow. This makes Canva Grow a credible tool for performance marketers running paid video campaigns, not just organic content creators.

A key piece of Canva's platform strategy is its mini apps and website builder, which uses AI to let users create functional applications and sites. This tool has reached over 10M monthly active users and represents a strategic repositioning: Canva now describes itself as "an AI platform with a bunch of design tools" rather than "a design platform with AI tools"—a shift they frame as becoming "a cursor for design" or a "design agency in your pocket."

Canva is actively integrating with chatbots like ChatGPT and Claude, treating them as top-of-funnel acquisition platforms. By October 2025, users had over 26M conversations with the Canva app on ChatGPT, and Canva became one of the top 10 referred domains from ChatGPT. Traffic through LLM referrals now represents double-digit percentages, and the company is allocating resources to optimize for LLM search results alongside traditional SEO.

Canva's full-stack AI strategy combines three layers: (1) its own foundation model (Phoenix) through its acquisition of Leonardo AI (for $370M in late July 2025) that "autocompletes in Canva templates", (2) native AI text, image and video generation features in the app layer powered by OpenAI, Phoenix and Runway ML, and (3) an ecosystem of 120+ plugins for specialized capabilities like AI avatars and voiceovers.

Operating profitability for the past 7 years with a highly efficient product-led growth (PLG) sales motion gives Canva the free cash flow to invest heavily into AI and enterprise sales simultaneously without large, repeated capital fundraises.

Competition

Adobe

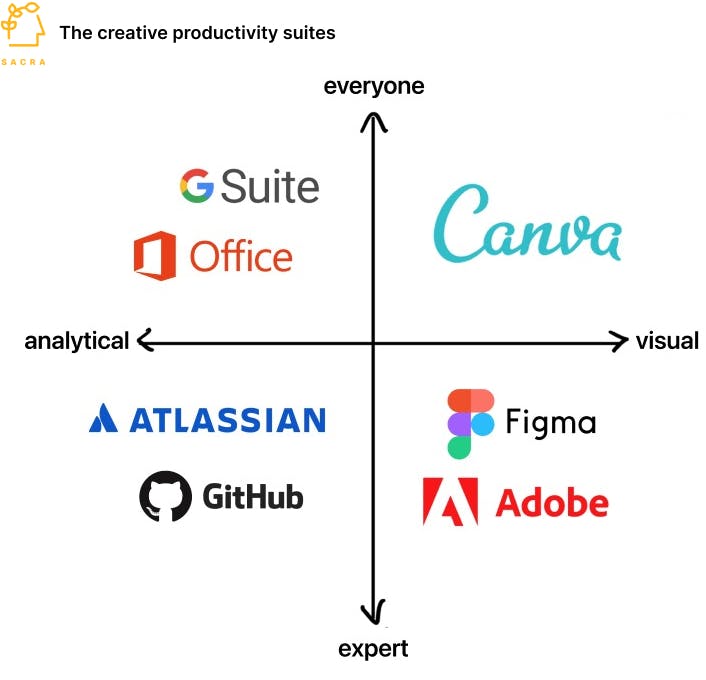

Adobe's Creative Suite, including Photoshop and Illustrator, remains the industry standard for professional designers. While these tools offer more advanced capabilities, they require significant training and are often prohibitively expensive for casual users or small businesses. Canva has positioned itself as a more accessible alternative, focusing on speed and ease of use rather than advanced editing features. This approach has allowed Canva to capture a large segment of the market that was previously underserved by complex professional tools.

In October 2025 at Adobe MAX, Adobe announced Firefly Image Model 5 with layered image editing and native 4MP image generation, rolled out Generate Soundtrack and Generate Speech (15 languages, emotion tags, leveraging ElevenLabs), introduced a browser-based multi‑track Firefly video editor waitlist, and previewed Project Moonlight plus a ChatGPT integration—steps that intensify competition with Canva’s AI-driven design and video tooling.

AI design tools

Microsoft Office and Adobe Creative Cloud—which 100M+ organizations already pay for—which are aggressively investing in generative AI via Bing Image Generator (1 billion images created so far) and Firefly (3 billion images created) to own graphic design and image creation.

The rise of multimodal LLMs like Google’s Gemini and OpenAI’s GPT-Vision that can process both text and images threatens graphic design tools like Canva by drastically undercutting human designers on price (at roughly $0.005 per image) and replacing WYSIWYG editing with natural language prompts.

Where Canva consists of a core editing technology applied to different sizes of rectangles to make everything from business cards to billboards, Gamma and Tome are forging a new interactive, responsive “mini-website” form factor that breaks free from the dimensions of physical paper and fixed screen sizes.

While ChatGPT generates text and Midjourney generates images, Gamma’s AI editor is multimodal, allowing users to generate rich cards with text, images, tables, timelines, 2x2 diagrams, and more.

Figma

Figma is a browser-based online design tool used to build mock-ups, wireframes, product diagrams, and other visual collateral primarily focused around the designer and product manager roles.

Figma's lack of direct substitutes makes it hard for teams to stop using it once they've become accustomed to its workflow. Teams use Figma for brainstorming, prototyping, user research, and to hand off the design system to developers—other tools don't do all of that.

Figma is relatively easy to self-serve into even for bigger companies because IT departments that centralize purchasing on software like Salesforce or Hubspot will devolve buying decisions on tools like Figma to the design team thanks to (1) the lower, more flexible pricing, and (2) the less sensitive files involved.

While both are bucketed as design products, only about 20% of Canva's use cases ultimately overlap with Figma's. Canva differentiates with features like video editing, presentations, and print—and from our research, teams will frequently pay for both tools with Figma being used more on the product side of the organization and Canva being used more on the marketing side.

Web-based design tools

Canva's primary competition in the free, easy-to-use, and web-native category of graphic design tools comes from companies like Visme and Snapseed offer similar drag-and-drop interfaces and template libraries for creating graphics, presentations, and social media content.

However, Canva differentiates itself through its extensive template library (over 500,000 designs) and intuitive user interface that requires minimal learning curve. Canva's Brand Kit feature, which allows users to save brand assets and apply them consistently, is a key advantage for small business users.

Content marketing platforms

TAM Expansion

Canva's expansion and transition from simple graphic design tool to enterprise productivity suite has them on a collision course not just with Adobe's Creative Cloud ($275B market cap), but Microsoft Office ($2.23T), Wix ($10B) and others.

Canva is betting big on the primacy of the rectangle, drilling down into different industries like education and different rectangle types—collaborative whiteboards competing with Figma ($400M ARR) and Miro ($17.5B valuation), slides competing with Google Slides (2B+ Workspace users), and one-page websites competing with Squarespace ($931M revenue).

Canva is stitching together this suite of rectangle-designing tools into a full suite of products, leveraging their ownership of companies' brand assets and marketing workflows to own the entire productivity suite.

Their long-term goal is to displace the traditional productivity suite of email, word processor, and spreadsheet with the visual communication tools—slides, images, and videos—that have become essential for every role in an organization, from sales & marketing and product to HR.

Canva has been aggressively pursuing international expansion, with a focus on localizing its product for different markets. The company now operates in over 190 countries and supports over 100 languages. Canva has been particularly successful in emerging markets like Brazil, India, Indonesia, and the Philippines, where it often serves as the first design tool many users encounter. This global approach has been key to Canva's rapid user growth and its ability to tap into diverse market opportunities. The company's goal of reaching 1 billion users in the coming years would represent a substantial expansion of its total addressable market.

Video marketing represents an increasingly distinct TAM within Canva's expansion strategy. Through Canva Grow—and extended by the acquisitions of Cavalry (motion graphics) and MangoAI (AI-driven video ad creation) in February 2026—Canva is pushing into paid video advertising workflows that have historically been served by dedicated creative automation platforms. For performance marketers, this positions Canva not just as a content creation tool but as an end-to-end creative production layer for paid campaigns.

Canva's long-term upside hinges on how well it can sell this platform into the enterprise with Microsoft Office ($35B ARR) and GSuite (3B+ users) standing in the way.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.