Revenue

$155.00B

2024

Valuation

$330.00B

2025

Funding

$9.40B

2025

Growth Rate (y/y)

38%

2025

Revenue

Sacra estimates that ByteDance generated $155B in revenue for 2024, up 38% year-over-year from $112B in 2023, as international operations—primarily TikTok—contributed $39B, up 63% from the year prior. Net profit was $33B. The company's growth accelerated into 2025, with Q1 2025 revenue reaching $43B (surpassing Meta's $42.3B for the same quarter) and Q2 2025 revenue hitting $48B, up 25% year-over-year.

The sustained revenue growth reflects ByteDance's success scaling TikTok internationally while ramping investment in AI infrastructure. ByteDance now operates China's leading AI chatbot Doubao and is investing up to $23B in AI infrastructure for 2026, including potential purchases of 20,000 Nvidia H200 chips, to compete with emerging leaders like DeepSeek. In parallel, the company is spending aggressively to replicate Douyin's live-commerce success abroad: TikTok Shop generated $9B in U.S. GMV in 2024 but fell short of internal targets of $17.5B.

Valuation & Funding

In August 2025 ByteDance announced a new employee share buyback program valuing the company at over $330B, offering $200.41 per share—up 5.5% from the $189.90 offered in its previous buyback in March 2025, which valued the firm at $315B (up from $171 per share a year earlier).

That figure sits well above the company's secondary market valuation of $215B as of January 2025, down from $230B in September 2024 and a peak of $400B in 2021. ByteDance has raised $9.4B from investors including Sequoia Capital China, KKR, and SoftBank Group.

At $155B in 2024 revenue, ByteDance trades at a 2.1x revenue multiple based on the August 2025 internal valuation and 1.4x on secondary markets—well below Meta's 9.5x multiple. Ownership remains split between international investors (60%), founders and Chinese investors (20%), and employees (20%). TikTok's U.S. business accounted for $27B of total revenue in 2024, or 17%, underscoring the company's exposure to U.S. regulatory outcomes.

In September 2025, President Trump signed an executive order certifying that a TikTok sale plan meets U.S. legal requirements. The deal provides that ByteDance will hold less than 20% of TikTok U.S., valued at approximately $14B, a seven-member board will include one ByteDance appointee and six Americans, and the algorithm will be retrained and monitored under U.S. control. In December 2025, ByteDance signed binding agreements to transfer control of TikTok's U.S. operations to a consortium including Oracle as part of efforts to avert a ban.

Product

ByteDance was founded in 2012 by Zhang Yiming, who identified a fundamental problem with mobile content discovery in China: smartphone users struggled to find relevant information through traditional search engines like Baidu, which were cluttered with ads and poorly optimized for mobile.

ByteDance found product-market fit with Jinri Toutiao ("Today's Headlines"), a mobile-first news aggregation app that used artificial intelligence to deliver highly personalized content to Chinese smartphone users during the country's rapid mobile adoption phase of 2012-2014.

The core innovation was Toutiao's sophisticated tracking of user behavior—from reading duration to scroll patterns to preferred reading times—to build detailed content preference profiles. This enabled the app to serve increasingly relevant content without requiring explicit user input, leading to unprecedented engagement levels. The platform attracted both users seeking personalized content and publishers looking for wider distribution.

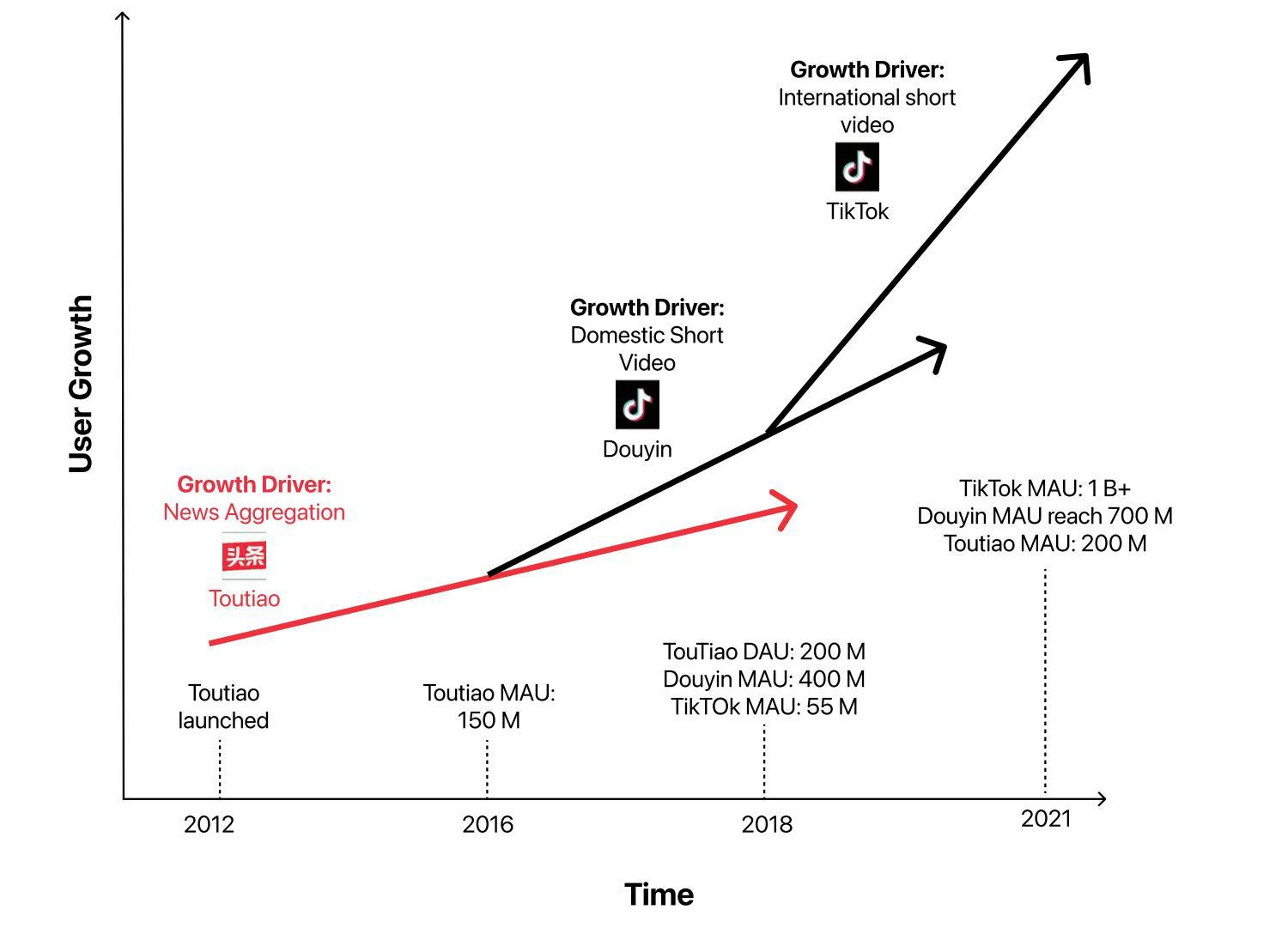

This AI-driven personalization approach became ByteDance's foundation for subsequent products. The company leveraged its recommendation engine to launch Douyin in 2016, applying the same principles to short-form video. This was followed by TikTok for international markets, which maintained the core focus on AI-powered content discovery through its signature "For You" page that serves full-screen videos based on implicit user preferences and behavior patterns.

Product-market fit

ByteDance's first product, Jinri Toutiao, was launched in 2012. CEO and co-founder Zhang Yiming had seen firsthand the challenges faced by smartphone users trying to use search to find relevant information in China, with Baidu (China's Google) in particular cramming search results full of ads. He launched Jinri Toutiao ("Today's Headlines") with the goal of using artificial intelligence to get highly-targeted content to users.

Toutiao's growth was anchored to the rise of smartphone usage in China—mobile penetration in the country went from a few percent in 2020 to 65% by 2014. Toutiao's initial competition was online news outlets like Sina and Sohu that were text-only and optimized for desktop, while Toutiao was one of the first to be intentionally designed for mobile. An influencer campaign and urgent CTAs to share content helped them grow the product to 10 million users in 90 days.

The product itself tracked users' behavior to figure out what kinds of content to show them next—everything from how long they spend reading a story to where they scroll to and what time of day they're most likely to read articles—making the platform far stickier for users. The advent of revenue-sharing for publishers, on the flip side, attracted many new creators and companies to the platform.

Over time, that recommendation algorithm and those partner relationships allowed ByteDance to begin parlaying its core competencies into other types of products—the first one being Douyin, the short-video platform that is the Chinese counterpart to TikTok.

Distribution

Bytedance uses the product-as-distribution strategy to get early traction for its apps. TikTok is one of the best mobile-based short video editing apps that allow clipping, scrubbing, and adding music from a large library. Many early creators used TikTok as a tool than a platform. All videos exported from TikTok have a watermark that further built brand awareness about TikTok and prompted users to search for it.

ByteDance promotes its new apps aggressively in its existing apps by providing them pride of place. This means instant exposure to millions of engaged users.

ByteDance invests aggressively in marketing and partnerships to generate demand. In 2018, ByteDance spent an estimated $3 million daily promoting Douyin in China, leading to rapid scale-up and reaching 150 million DAU in June 2018. In the same year, it spent ~$300 million on Google Ads alone to promote TikTok in the international markets.

AI

Since late 2023, ByteDance has accelerated its AI strategy, establishing dedicated divisions for foundational models (Seed), applications (Flow), and infrastructure (Stone).

The company has launched a suite of proprietary large language models under the Doubao brand, including Doubao-1.5-Pro, which features multimodal capabilities, long context windows, and aggressive pricing to drive adoption. Doubao has quickly become one of China's most popular chatbots, reaching nearly 60 million monthly active users by late 2024.

In September 2025, ByteDance launched Seedream 4.0, its new AI image model, claiming faster inference and improved prompt adherence, alignment, and aesthetics over Google DeepMind's Gemini 2.5 Flash Image, with pricing set at $30 per 1,000 generations for enterprise and $0.03 per image on Fal.ai.

In October 2025, ByteDance's Doubao surpassed DeepSeek to become China's most-used AI app, reaching 157M MAUs in August per QuestMobile, with a16z ranking Doubao the #4 generative AI app globally behind ChatGPT and Gemini.

Integrated tightly with Douyin, Doubao's multimodal features and viral distribution drove user migration—QuestMobile data shows ~40% of users leaving DeepSeek switched to Doubao.

ByteDance's cloud-unit, Volcano Engine, has just launched a new AI coding agent called "Doubao-Seed-Code" for as little as US $1.30 (9.9 yuan) in China for the first month—signaling an aggressive push into the developer tools market.

In December 2025, ByteDance rolled out an AI voice assistant powered by Doubao on ZTE's Nubia M153 prototype, priced at 3,499 yuan (~$495), with broader availability planned through partnerships with multiple phone makers. The company has stated it has no plans to build its own smartphone hardware.

ByteDance is dramatically scaling its AI infrastructure investment, budgeting approximately ¥160B (~$23B) in capex for AI in 2026, up from ~¥150B in 2025. About half of this budget is earmarked for AI chips and semiconductors, including a potential purchase of 20,000 Nvidia H200 chips subject to regulatory approvals, as the company competes aggressively with Chinese rivals like DeepSeek in foundation models and AI applications.

Business Model

ByteDance is an AI-powered social media and content platform company that generates revenue primarily through advertising, e-commerce commissions, and virtual gifts from live streaming. The company's core technology is its recommendation engine, which powers multiple apps including TikTok, Douyin (Chinese TikTok), and Toutiao (news aggregator).

The company monetizes through a multi-sided marketplace model. Advertisers pay to reach users through targeted ads, while content creators earn revenue shares from advertising, e-commerce sales, and virtual gifts. ByteDance takes a cut of all transactions, with advertising representing about 60% of revenue and live broadcasting accounting for roughly 26%.

ByteDance's key competitive advantage is its "middle platform" architecture - a shared technology stack including AI algorithms, monetization engines, and AR capabilities that can be deployed across all its apps. This allows rapid product development and instant scale for new offerings.

The company employs a "feature-to-product" growth strategy, testing new features within existing apps before spinning successful ones into standalone products. This approach, combined with aggressive marketing and cross-promotion across its app ecosystem, enables ByteDance to quickly scale new offerings while maintaining high user engagement through AI-driven content personalization.

Growth cycle

ByteDance’s growth strategy anchors on rapid feature introduction in existing products, isolating the winning feature from the rest, and scaling the feature to become an app, backed by heavy investment in marketing & promotions. This has allowed it to layer the users from different apps on top of existing users, compounding its user growth.

Another driver of ByteDance’s growth is its ability to rapidly scale beyond early adopters and move to mainstream users by constant innovation in features and positioning. For instance, Douyin (and its predecessor, A.me) started by targeting teens through lip-sync, music-based, edgy content. But ByteDance evolved Douyin’s positioning to ‘Record beautiful life’ and made the content library more diverse and neutral to appeal to a larger audience.

The historical key growth drivers at ByteDance

The core playbook for growth at ByteDance looks like this: Adding ideas to app as new features: ByteDance identifies potentially disruptive ideas and adds a number of them to its existing apps. The approach is to find the winner fast, scale the winner and remove the others. This is one reason why the UX of Chinese apps changes frequently. For instance, the short-form video feature was added to Toutiao’s home screen in May 2015, and in 2016, short-form videos were played over 1 billion times daily on Toutiao. This led to the launch of Douyin in September 2016.

Building supply: ByteDance builds an early content supply to avoid the cold-start problem. In the case of Toutiao, it scraped web-based news websites and reformatted content for mobile screens. It also partnered with Weibo (equivalent to Twitter in China) influencers to seed the app. When it launched Douyin, its operations team ran multiple paid partnerships - the most prominent Chinese social media influencers, existing video platforms such as Baidu-backed streaming service iQIYI, and fashion events such as Michael Kors catwalk event 2017.

Building demand: ByteDance builds demand parallel to supply to provide a high-quality signal to its AI recommendation engine. It uses notifications and share prompts aggressively during sessions. In the case of Toutiao, it allowed users to log in using their Weibo accounts, which it scraped to get early indicators of their interests and social graph. These aggressive tactics allow ByteDance to achieve early solid demand for its apps. Toutiao grew from 0 to 10 million users in just 90 days. Similarly, Douyin grew from 0 to ~2 million DAU in less than a year.

Great mobile experience by hyper-targeting content: By building an early flywheel of supply and demand, ByteDance captures large swathes of user behavior data that its AI recommendation engine utilizes to server hyper-targeted content to existing and new users. This improves users’ experience and encourages them to spend more time on the app, providing more data to the AI recommendation engine. Douyin’s 100 minutes per day usage rate is the highest of any global social app; that breaks down further into roughly 80 minutes spent on short videos, 11 minutes spent on live streaming, and the rest on the friends' page, search, messaging, and other screens.

Competition

ByteDance operates in a complex market spanning social media, content distribution, and e-commerce, with distinct competitive dynamics across Chinese and international markets.

Chinese domestic market

In China's digital advertising space, ByteDance (21% market share) competes directly with Alibaba, Tencent, and Baidu. Douyin faces competition from Kuaishou in short-form video and live commerce, while also challenging Alibaba's Tmall in e-commerce. Toutiao competes with traditional news platforms like Sina and Sohu, though these rivals remain primarily desktop-focused.

International social media

TikTok faces established Western platforms like Meta's Instagram, Snap, and YouTube. While these competitors use AI for recommendations as a feature, TikTok's core differentiation is making AI the primary product through its "For You" page. Meta and YouTube carry desktop-first technical debt, while TikTok was built specifically for mobile consumption.

Emerging battlegrounds

ByteDance is expanding into gaming through acquisitions like Moonton and C-4 Games, directly challenging Tencent's 50% market share in China's gaming sector. In search, Douyin's 20 billion monthly searches represent a growing threat to Baidu's 120-150 billion monthly searches, particularly in mobile and commerce-related queries.

The company faces unique regulatory pressures in both markets. In China, new regulations affect its education (Dali Education) and gaming (Nuverse) divisions. Internationally, TikTok encounters ongoing scrutiny and potential bans in markets like the US and India, creating opportunities for regional competitors to gain market share.

In October 2025, livestream marketplace Whatnot raised $225M at an $11.5B valuation, bringing total funding to $968M, as it expands beyond collectibles and competes more directly with TikTok’s live commerce via TikTok Shop and category players like Fanatics Live and Shein Live; Whatnot operates in nine countries, collects roughly 8% per sale, and reports viewers spending 80+ minutes/day watching live streams.

TAM Expansion

ByteDance has tailwinds from AI-driven content personalization and mobile-first social commerce, with opportunities to expand into enterprise software, gaming, and search markets globally.

AI and machine learning infrastructure

ByteDance's "middle platform" of shared AI capabilities powers personalization across all its apps, creating powerful cross-network effects. This technology stack could be monetized as enterprise software through BytePlus, competing with cloud providers in the $500B+ cloud infrastructure market. Early success with external clients demonstrates the potential for ByteDance to become a leading AI infrastructure provider.

Gaming

ByteDance began accelerating its push into gaming and upping its competition with Tencent in 2021, acquiring game companies Moonton (with its former Tencent founder) and C-4 Games.

Moonton’s Mobile Legends generated ~$900M in revenue from 2016 to 2021, and C-4’s Houchi Shoujo has become one of the best performing mobile games from China overseas.

Tencent still owns more than half of China’s domestic gaming market as of 2020, but gaming is still a big, growing, and lucrative space—the worldwide mobile gaming market grew 25.6% year-over-year in 2020 to hit $86.3 billion.

What makes ByteDance particularly well-positioned to win in gaming is its ability to create cross-app universal interest graphs of its users. ByteDance’s existing domestic (Douyin) and international (TikTok) user base consist of young-skewing audiences who already spend considerable time on its apps. By leveraging the universal interest graphs, it can hyper-target the distribution and promotion of mobile games, increasing the odds of higher downloads and engagement.

Social commerce and payments

Douyin's success in Chinese e-commerce, growing from zero to over $200B in GMV, provides a blueprint for TikTok Shop's global expansion. The integration of shopping features with short-form video creates an engaging discovery-to-purchase experience that traditional e-commerce platforms struggle to match. TikTok Shop could capture significant market share in the $5T+ global e-commerce market.

In November 2025, it was estimated that TikTok Shop sold $19B of products globally in Q3, with US sales between $4B and $4.5B, putting its scale near eBay and underscoring ByteDance’s momentum in live commerce.

Search

Monthly search traffic (millions of views)

Kuaishou was a fast follower of Douyin in the short video/live streaming space, but the data shows that Douyin is still much further along in driving demand and turning their content into a successful advertising business.

Douyin search traffic is at around 20 billion searches monthly, which is about 6x that of Kuaishou (and 2x in terms of the number of users) but about 1/6 of Baidu, which has about 120-150 billion searches per month.

Growing search is a strong tailwind for Douyin because it siphons traffic away from Kuaishou and allows them greater ability to monetize as the demand for content grows.

How quickly Douyin is leveraging e-commerce and brands to grow search, ultimately, is showing how Baidu (China’s Google) is potentially threatened by ByteDance’s rise.

International

Compared to other international and Chinese apps, TikTok (ByteDance’s main product outside of China) has a user base that is relatively under monetized and represents one of ByteDance’s biggest growth opportunities as a company. Its average revenue per MAU is the lowest in its peer group and much lower than Douyin and Kuaishou.

ByteDance’s focus for TikTok has been to drive user growth rather than monetization. But it has started moving in the direction of increased monetization.

In Dec 2021, rolled out Creator NEXT program to expand the way creators can be compensated for their work. It is also introducing new features such as live gifts, video gifts, and tips. ByteDance can leverage its experience of Douyin to unlock significant value from TikTok’s users.

In September 2025, after a year-long saga around the potential forced sale of TikTok, the White House disclosed that TikTok’s U.S. entity will lease its algorithm from ByteDance rather than acquire it outright, with Oracle overseeing retraining and data protection. The proposed deal would see TikTok U.S. managed by a new investor group including Andreessen Horowitz, Silver Lake, and Oracle, while ByteDance retains operations outside the U.S.

Risks

Geographic revenue concentration: ByteDance derives 77% of revenue from China through Douyin and Toutiao, creating extreme exposure to Chinese regulatory shifts. Recent government crackdowns on tech companies and new digital advertising rules could severely impact ByteDance's core revenue streams, while forced changes to recommendation algorithms could undermine its key competitive advantage.

TikTok regulatory pressure: The imminent U.S. ban deadline threatens 18.6% of ByteDance's revenue ($27B) and could trigger similar actions in other Western markets. Beyond direct revenue loss, regulatory actions could accelerate scrutiny globally and damage ByteDance's international expansion strategy, particularly in e-commerce. The EU issued an ultimatum in February 2026 compelling ByteDance to alter TikTok's addictive features, potentially reducing time-on-app and ad revenue while setting regulatory precedent for forced product changes that other jurisdictions may replicate.

Monetization gap: TikTok's revenue per user significantly lags behind both Douyin and Western competitors, while its e-commerce initiatives are generating substantial losses. The $500M+ projected losses in U.S. TikTok Shop and higher operational costs in Western markets suggest ByteDance's successful Chinese monetization playbook may not translate internationally, threatening long-term profitability of international operations.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.