Revenue

$27.00M

2023

Valuation

$11.00B

2021

Growth Rate (y/y)

4%

2023

Funding

$963.00M

2021

Valuation: $11.00B in 2021

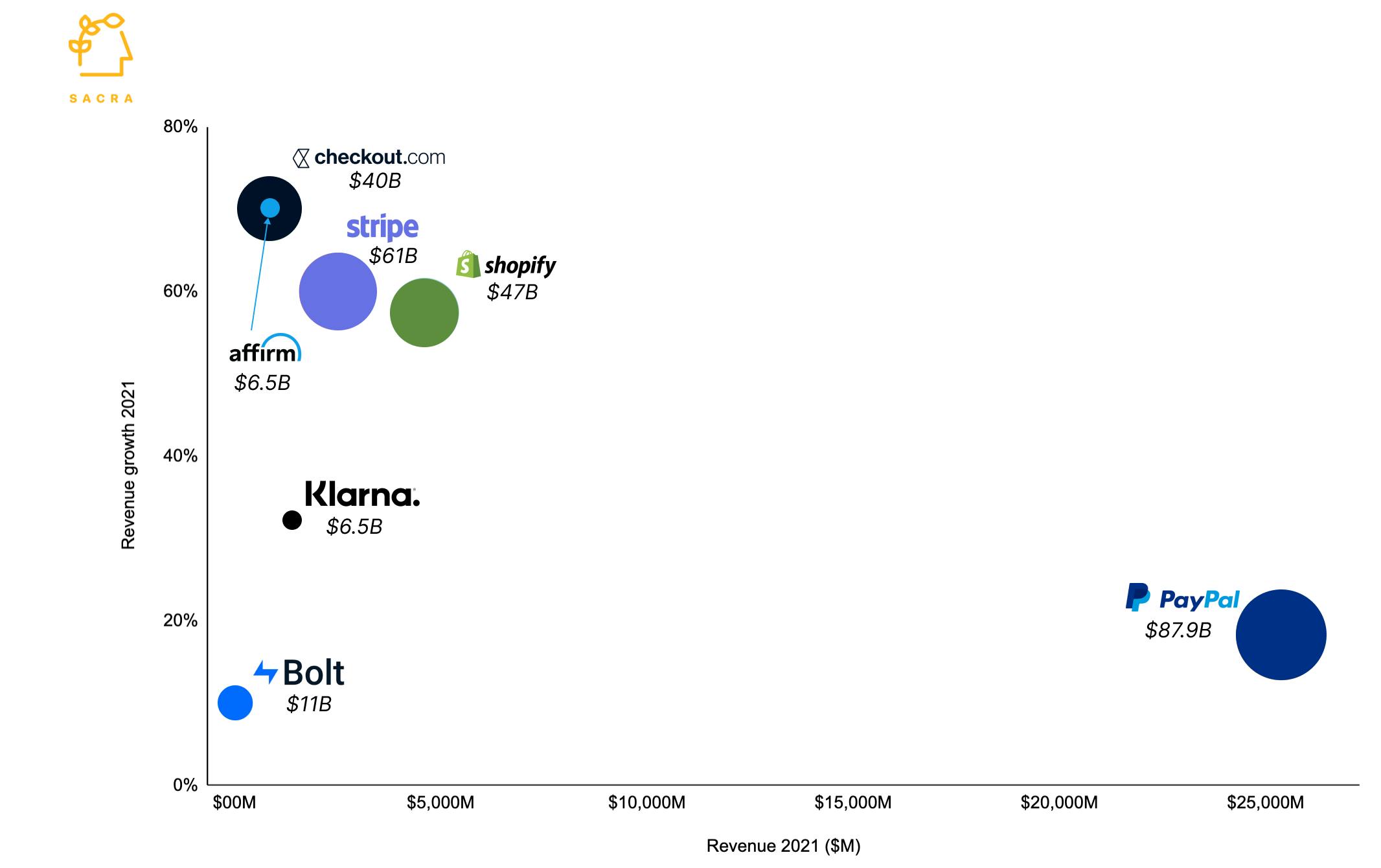

Valuation, revenue and growth rate as per publicly available information. Size of bubble indicates valuation.

Bolt has raised $963M from investors like General Atlantic, Westcap, Activant Capital, and Tribe Capital. It was last valued at $11B for a valuation/revenue multiple of 392x. Almost all of Bolt’s competitors, private or public, have seen their valuation dip significantly in the last few months. For instance, Fidelity marked down Stripe’s valuation by 35% from a high of $95B. Similarly, PayPal and Affirm have lost 63% and 82% of their market cap, respectively. The valuation/revenue multiple is much lower for all of Bolt’s competitors with PayPal at 3.5x, Shopify at 10x, Stripe at 25x, and Checkout.com at 47x.

Scenarios: $30M to $72M ARR by 2028

To evaluate Bolt's future potential, we analyze multiple scenarios projecting revenue growth through 2028. These scenarios consider various market conditions, competitive dynamics, and growth trajectories, incorporating different revenue multiples to estimate potential valuations in the evolving fintech landscape.

| 2023 Revenue ($M) | $27M | ||

|---|---|---|---|

| 2023 Growth Rate (%) | 4.38% |

Bolt's modest 4.38% revenue growth in 2023, reaching $27M, reflects challenging market conditions. This performance is notably lower than competitors, highlighting potential scaling challenges as the company seeks to establish its position in the competitive one-click checkout space.

| Multiple | Valuation |

|---|---|

| 1x | $27M |

| 5x | $135M |

| 10x | $270M |

| 15x | $405M |

| 25x | $675M |

Based on current revenue of $27M, valuations range from $27M at 1x to $675M at 25x multiple. These multiples reflect a more conservative outlook compared to Bolt's previous $11B valuation, aligning closer with current market conditions and peer companies like PayPal (3.5x) and Shopify (10x).

| 2028 Growth Rate | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| 1.0% | $27M | $28M | $29M | $29M | $30M | $30M |

| 1.5% | $27M | $28M | $29M | $29M | $30M | $30M |

| 2.2% | $27M | $28M | $29M | $30M | $30M | $31M |

| 3.3% | $27M | $28M | $29M | $30M | $31M | $32M |

| 5.0% | $27M | $28M | $30M | $31M | $33M | $34M |

| 7.8% | $27M | $28M | $30M | $32M | $35M | $37M |

| 12.2% | $27M | $29M | $31M | $34M | $38M | $43M |

| 19.2% | $27M | $29M | $33M | $38M | $44M | $53M |

| 30.0% | $27M | $30M | $35M | $43M | $55M | $72M |

Revenue projections through 2028 span from $30M at 1% growth to $72M at 30% growth, representing potential outcomes ranging from minimal expansion to aggressive scaling. Even the most optimistic scenario suggests more modest growth compared to Bolt's historical valuations and peer benchmarks.

| 2028 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 1.0% | $30M | $150M | $299M | $449M | $749M |

| 1.5% | $30M | $152M | $304M | $457M | $761M |

| 2.2% | $31M | $156M | $312M | $467M | $779M |

| 3.3% | $32M | $162M | $323M | $485M | $808M |

| 5.0% | $34M | $171M | $341M | $512M | $853M |

| 7.8% | $37M | $187M | $373M | $560M | $933M |

| 12.2% | $43M | $214M | $428M | $642M | $1.1B |

| 19.2% | $53M | $264M | $528M | $791M | $1.3B |

| 30.0% | $72M | $358M | $715M | $1.1B | $1.8B |

Projected 2028 valuations range from $30M at conservative growth/multiple assumptions to $1.8B in the most optimistic scenario (30% growth, 25x multiple). Even the highest projection falls significantly below Bolt's previous $11B valuation, reflecting a more realistic outlook aligned with current market conditions.

Bear, Base, and Bull Cases: 4.5x, 6.5x, 8.5x

To provide a comprehensive view of Bolt's potential trajectories, we examine bear, base, and bull case scenarios using multiples of 4.5x, 6.5x, and 8.5x respectively. These cases reflect varying market conditions, competitive dynamics, and execution capabilities while maintaining alignment with current fintech valuations.

| Scenario | 2028 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 2% | 4.5 |

| Base 📈 | 4% | 6.5 |

| Bull 🚀 | 6% | 8.5 |

These scenarios reflect a significantly more conservative outlook compared to Bolt's previous 392x multiple, with even the bull case at 8.5x aligning closer to current fintech market conditions. Growth projections range from modest (2%) to moderate (6%), acknowledging the challenging competitive landscape and scaling hurdles.

| Bear 🐻 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $27M | $28M | $29M | $30M | $30M | $31M |

| Growth | 4.38% | 3.74% | 3.19% | 2.64% | 2.28% | 2% |

| Base 📈 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $27M | $28M | $29M | $31M | $32M | $33M |

| Growth | 4.38% | 4.28% | 4.19% | 4.10% | 4.05% | 4% |

| Bull 🚀 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $27M | $28M | $30M | $31M | $33M | $35M |

| Growth | 4.38% | 4.82% | 5.19% | 5.56% | 5.81% | 6% |

The growth trajectory and valuation multiples for Bolt vary significantly across our three scenarios, reflecting different levels of success in achieving network effects and competitive positioning in the fintech space

- In the bear case, Bolt's growth declines to 2% by 2028 with $31M in revenue at a 4.5x multiple, reaching a modest valuation of $139M due to intensified competition and pricing pressure

- In the base case, Bolt maintains 4% growth reaching $33M in revenue by 2028 with a 6.5x multiple, achieving a $215M valuation through moderate network effects and value-added services

- In the bull case, Bolt accelerates to 6% growth with $35M in revenue and commands an 8.5x multiple for a $300M valuation by successfully establishing itself as a comprehensive commerce platform.

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2023 Revenue | $27M | $27M | $27M |

| 2023 Growth Rate (%) | 4% | 4% | 4% |

| 2023 Multiple | 4.5 | 6.5 | 8.5 |

| 2023 Valuation | $122M | $176M | $230M |

| 2028 Revenue | $31M | $33M | $35M |

| 2028 Growth Rate (%) | 2% | 4% | 6% |

| Multiple | 4.5 | 6.5 | 8.5 |

| 2028 Valuation | $139M | $215M | $300M |

The uncertainty across these three cases depends primarily on Bolt's ability to achieve network effects, maintain its higher take rate amid competition, and successfully expand beyond checkout into a broader commerce platform while navigating challenging market conditions and scaling requirements.

- In the Bear case: Bolt struggles to achieve network effects amid intense competition from established players like Stripe and Shop Pay, leading to continued slow growth and forcing it to compete primarily on price, resulting in the lower 4.5x multiple that's more in line with traditional payment processors.

- In the Base case: Bolt successfully maintains its higher take rate and gradually expands its merchant base while building out value-added services, achieving moderate network effects that justify a 6.5x multiple in line with typical fintech companies.

- In the Bull case: Bolt successfully executes its vision of becoming the "Salesforce of headless commerce" by leveraging its shopper network to build a comprehensive suite of merchant tools and analytics, while significantly accelerating growth through network effects, supporting an 8.5x multiple.

These final valuations indicate a significant downward revision from Bolt's previous $11B valuation. Even the most optimistic bull case projects a $300M valuation by 2028, while the bear case at $139M reflects ongoing challenges in achieving network effects and competitive positioning in the fintech space.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.