Revenue

$250.00M

2023

Valuation

$4.70B

2022

Growth Rate (y/y)

40%

2022

Funding

$566.90M

2022

Valuation: $4.70B in 2022

BetterUp's $339M Series E funding round in October 2021 valued the company at $4.7B, bringing the company's total amount raised to $567M. At the time, BetterUp was growing at about 127% year-over-year and was at $125M annual recurring revenue (ARR).

By the end of 2022, BetterUp had grown to $175M, growing about 40% year-over-year—slowing down largely due to macroeconomic factors, company layoffs, and companies looking to cut down spending amid concerns about an impending recession.

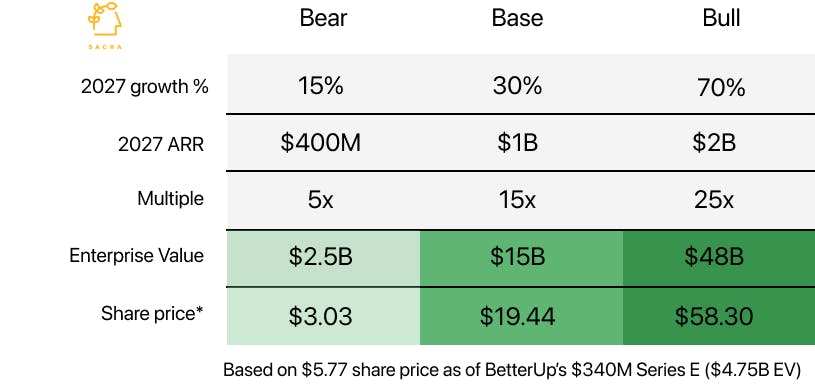

Our model has three built-in potential outcomes for BetterUp over the next 5 years:

Bull case: Our 5-year bull case has BetterUp getting to a terminal year-over-year growth rate of 70% and reaching a $48B valuation ($2B ARR at a 25x multiple).

Base case: Our base case has BetterUp getting to a terminal year-over-year growth rate of 30% and reaching a $15B valuation ($1B ARR at a 15x multiple).

Bear case: Our bear case has BetterUp getting to a terminal year-over-year growth rate of 15% and falling to a $2.5B valuation ($400M ARR at a 5x multiple).

Much of the uncertainty around these three cases depends on how well BetterUp can penetrate other parts of the learning & development market, use partnerships to expand its GTM, and maintain its large base of coaching professionals.

Scenarios: $631M to $2.7B ARR by 2028

To evaluate BetterUp's future potential, we've modeled multiple scenarios based on varying growth rates and revenue multiples through 2028. These projections account for different market conditions, the company's ability to expand its L&D market presence, and its success in maintaining its coaching network.

| 2023 ARR ($M) | $250M | ||

|---|---|---|---|

| 2023 Growth Rate (%) | 42.86% |

Based on BetterUp's current metrics, the company achieved $250M ARR in 2023 with a 42.86% growth rate, maintaining strong momentum despite market headwinds. While growth has moderated from previous years' triple-digit increases, it demonstrates resilient performance in a challenging macroeconomic environment.

| Multiple | Valuation |

|---|---|

| 1x | $250M |

| 5x | $1.2B |

| 10x | $2.5B |

| 15x | $3.8B |

| 25x | $6.2B |

Based on 2023 ARR of $250M, valuations span from $250M at a conservative 1x multiple to $6.25B at an aggressive 25x multiple. The 15x multiple valuation of $3.75B suggests moderate market expectations, while staying below the company's peak $4.7B valuation from 2021.

| 2028 Growth Rate | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| 10.0% | $250M | $335M | $424M | $503M | $573M | $631M |

| 15.0% | $250M | $338M | $436M | $534M | $632M | $727M |

| 20.0% | $250M | $342M | $449M | $567M | $695M | $834M |

| 30.0% | $250M | $348M | $475M | $635M | $835M | $1.1B |

| 45.0% | $250M | $359M | $516M | $745M | $1.1B | $1.6B |

| 50.0% | $250M | $362M | $530M | $785M | $1.2B | $1.8B |

| 55.0% | $250M | $365M | $544M | $826M | $1.3B | $2B |

| 65.0% | $250M | $372M | $573M | $911M | $1.5B | $2.4B |

| 70.0% | $250M | $375M | $587M | $955M | $1.6B | $2.7B |

Revenue projections through 2028 span from $631M at a conservative 10% growth rate to $2.7B with aggressive 70% growth. This represents a 2.5x to 10.8x increase from 2023's $250M ARR, with the base case 30% growth scenario reaching $1.1B in revenue.

| 2028 Growth Rate | 1x | 5x | 10x | 15x | 25x |

|---|---|---|---|---|---|

| 10.0% | $631M | $3.2B | $6.3B | $9.5B | $15.8B |

| 15.0% | $727M | $3.6B | $7.3B | $10.9B | $18.2B |

| 20.0% | $834M | $4.2B | $8.3B | $12.5B | $20.9B |

| 30.0% | $1.1B | $5.4B | $10.8B | $16.3B | $27.1B |

| 45.0% | $1.6B | $7.8B | $15.6B | $23.5B | $39.1B |

| 50.0% | $1.8B | $8.8B | $17.6B | $26.3B | $43.9B |

| 55.0% | $2B | $9.8B | $19.6B | $29.5B | $49.1B |

| 65.0% | $2.4B | $12.2B | $24.4B | $36.6B | $61B |

| 70.0% | $2.7B | $13.5B | $27.1B | $40.6B | $67.7B |

Projected 2028 valuations range from $631M at conservative estimates (10% growth, 1x multiple) to $67.7B in aggressive scenarios (70% growth, 25x multiple), with mid-range scenarios like 30% growth at 15x multiple yielding a $16.3B valuation - representing significant potential upside from current levels.

Bear, Base, and Bull Cases: 8x, 12x, 18x

To provide a focused analysis of BetterUp's potential trajectories, we've developed bear, base, and bull case scenarios. These account for key variables including market penetration success, coaching network scalability, and the company's ability to navigate economic headwinds while maintaining enterprise client growth.

| Scenario | 2028 Growth Rate (%) | Multiple |

|---|---|---|

| Bear 🐻 | 20% | 8 |

| Base 📈 | 35% | 12 |

| Bull 🚀 | 45% | 18 |

Growth projections range from a conservative 20% with 8x multiple in the bear case to an optimistic 45% with 18x multiple in the bull case, reflecting varying expectations around BetterUp's ability to scale its coaching network, penetrate new markets, and maintain enterprise growth amid economic uncertainty.

| Bear 🐻 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $250M | $342M | $449M | $567M | $695M | $834M |

| Growth | 42.86% | 36.71% | 31.43% | 26.15% | 22.72% | 20% |

| Base 📈 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $250M | $352M | $489M | $670M | $911M | $1.2B |

| Growth | 42.86% | 40.74% | 38.93% | 37.11% | 35.94% | 35% |

| Bull 🚀 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|---|

| Revenue | $250M | $359M | $516M | $745M | $1.1B | $1.6B |

| Growth | 42.86% | 43.43% | 43.93% | 44.42% | 44.74% | 45% |

Our bear, base, and bull cases for BetterUp reflect varying scenarios of market penetration, competitive dynamics, and growth sustainability through 2028

- In the bear case, BetterUp's growth declines to 20% with pressure on L&D budgets, reaching a $6.7B valuation ($834M revenue on an 8x multiple)

- In the base case, the company maintains strong market leadership with 35% growth, achieving a $14.8B valuation ($1.2B revenue on a 12x multiple)

- In the bull case, BetterUp successfully leverages AI and global expansion to maintain 45% growth, reaching a $28.2B valuation ($1.6B revenue on an 18x multiple).

| Scenario | 1. Bear 🐻 | 2. Base 📈 | 3. Bull 🚀 |

|---|---|---|---|

| 2023 ARR | $250M | $250M | $250M |

| 2023 Growth Rate (%) | 43% | 43% | 43% |

| 2023 Multiple | 8 | 12 | 18 |

| 2023 Valuation | $2B | $3B | $4.5B |

| 2028 Revenue | $834M | $1.2B | $1.6B |

| 2028 Growth Rate (%) | 20% | 35% | 45% |

| Multiple | 8 | 12 | 18 |

| 2028 Valuation | $6.7B | $14.8B | $28.2B |

The uncertainty around these three cases depends primarily on BetterUp's ability to navigate L&D budget pressures, maintain coach retention, expand through strategic partnerships, successfully leverage AI for productivity gains, and capitalize on the growing corporate mental health and professional development market.

- In the Bear case: Economic headwinds continue to pressure L&D budgets, coach retention issues persist, and the shift back to in-person training severely limits BetterUp's growth, leading to only modest penetration of the corporate training market.

- In the Base case: BetterUp maintains its leadership position in digital coaching while successfully expanding through strategic partnerships (like Salesforce and Walmart), though faces some competition from players like CoachHub in key markets.

- In the Bull case: BetterUp successfully leverages AI to improve coach productivity, expands globally through strategic acquisitions, and becomes the dominant platform for corporate mental health and professional development as remote work becomes permanent for many companies.

These final valuations present a wide range of potential outcomes for BetterUp. The bear case projects a $6.7B valuation by 2028, while the base case reaches $14.8B and the bull case hits $28.2B, demonstrating significant potential upside from current levels despite market uncertainties.

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.