Revenue

$250.00M

2023

Valuation

$4.70B

2022

Funding

$566.90M

2022

Growth Rate (y/y)

40%

2022

Revenue

Sacra estimates that BetterUp’s annual recurring revenue (ARR) hit $175M in 2022, up 40% from $125M at the end of 2021. BetterUp hit $100M in ARR in July of 2021.

BetterUp doubled its revenue from February 2020 to February 2021, as companies around the world looked for ways to remotely manage their teams’ professional and personal development as offices emptied out and cities went on lockdown.

In 2022, we estimate BetterUp's growth fell to 40% year-over-year companies dropped their spending on learning & development as many conducted layoffs amid fears of a global recession. Companies with up to 999 employees dropped their spend in 2022, while the number of hours trained per employee fell across the board. Large companies in particular dropped the number of hours employees spent in training from 78 hours per employee in 2021 to 46 hours per employee in 2022, per data from Training magazine.

Valuation & Funding

BetterUp's $339M Series E funding round in October 2021 valued the company at $4.7B, bringing the company's total amount raised to $567M. At the time, BetterUp was growing at about 127% year-over-year and was at $125M annual recurring revenue (ARR).

By the end of 2022, BetterUp had grown to $175M, growing about 40% year-over-year—slowing down largely due to macroeconomic factors, company layoffs, and companies looking to cut down spending amid concerns about an impending recession.

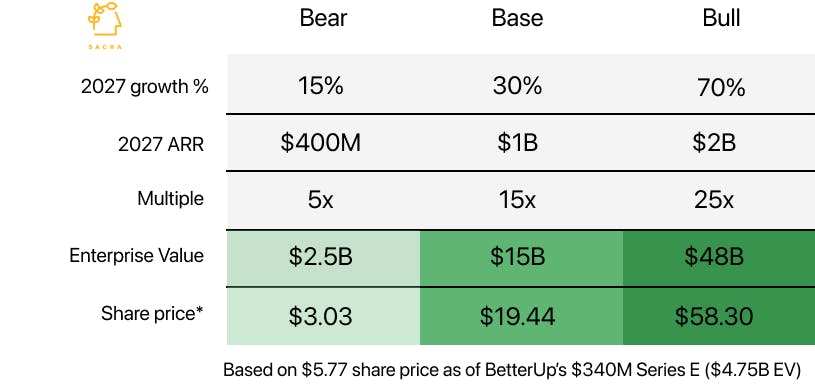

Our model has three built-in potential outcomes for BetterUp over the next 5 years:

Bull case: Our 5-year bull case has BetterUp getting to a terminal year-over-year growth rate of 70% and reaching a $48B valuation ($2B ARR at a 25x multiple).

Base case: Our base case has BetterUp getting to a terminal year-over-year growth rate of 30% and reaching a $15B valuation ($1B ARR at a 15x multiple).

Bear case: Our bear case has BetterUp getting to a terminal year-over-year growth rate of 15% and falling to a $2.5B valuation ($400M ARR at a 5x multiple).

Much of the uncertainty around these three cases depends on how well BetterUp can penetrate other parts of the learning & development market, use partnerships to expand its GTM, and maintain its large base of coaching professionals.

Product

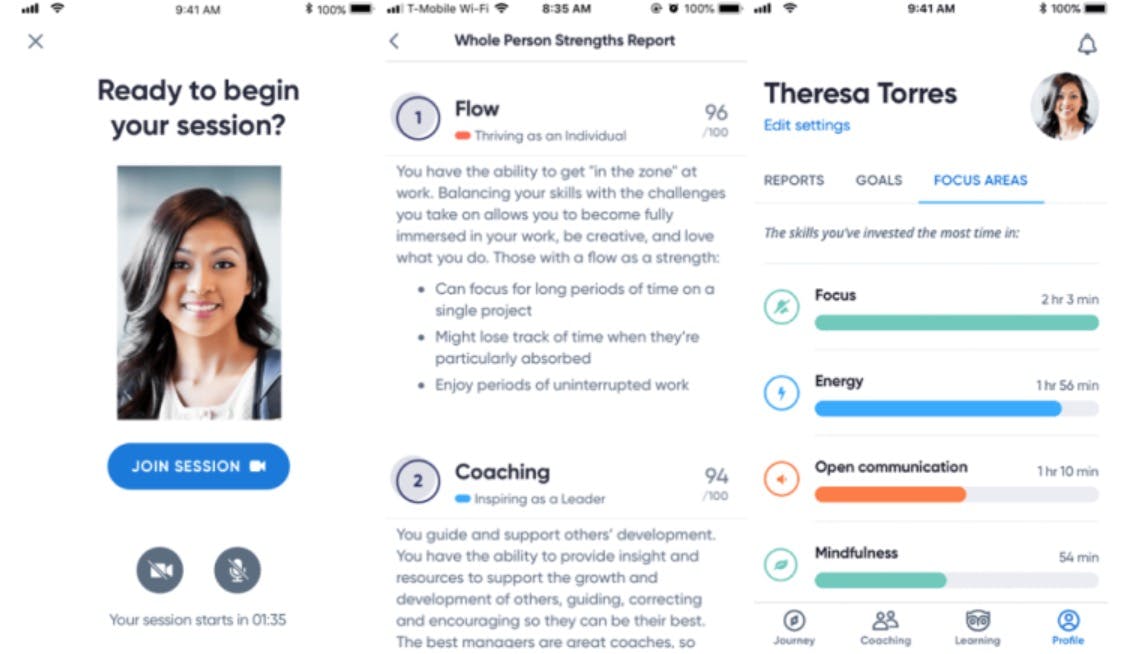

BetterUp is a basic SaaS app akin to an “Uber for coaching”. It allows users to exchange messages and upload files to be shared with their coach, access various educational resources, choose session times and schedule/reschedule sessions with their coach, and access reminders about upcoming meetings.

The coaches that BetterUp hires provide the coaching, mediated through the platform.

The big distinction between BetterUp and traditional means of corporate education and training is BetterUp’s focus on the personalized, 1:1 coaching session rather than the workshop/seminar paradigm that relies on all employees receiving the same basic kind of information.

The BetterUp coaching process begins with a 20 minute intake call, after which users can choose from a list of “matched” coaches.

There are two core BetterUp services: BetterUp Care, which is more focused on overall mental fitness and coaching for mental health, and BetterUp Lead, which is more focused on leadership development.

The product is used by companies like Google, the FAA, Workday, and ABInBev.

In July 2025, BetterUp renamed its Care offering to BetterUp Ready, reflecting a proactive, growth-oriented focus. The company also advanced its AI coaching with BetterUp Grow Roleplay V2, adding voice-based practice, configurable conversation styles, and instant feedback to help members prepare for high‑stakes discussions. These updates broaden the platform beyond 1:1 sessions to continuous, AI‑supported development between live coaching.

In October 2025, BetterUp introduced a Human + AI Coaching for All suite centered on BetterUp Grow. The release added real‑time coaching inside Slack and Teams, calendar‑based prompts, and a Role Play Library with instant feedback. It expanded language support to 100+ languages and unified reporting across AI and human coaching, with pilot integrations to Workday performance data and configurable “guardian” HR agents for policy‑aligned guidance.

Business Model

BetterUp charges on a monthly subscription basis for access to 1:1 video coaching sessions, their content library, and other resources for individuals. BetterUp has both B2B and B2C options.

Individuals can sign up for BetterUp for $71 per/mo (1 session per/mo), $119 per/mo (2 sessions per/mo), or $223 per/mo (4 sessions per/mo).

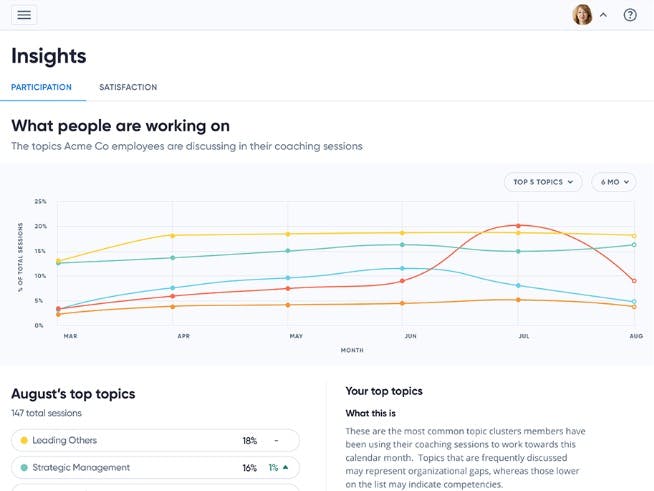

Companies can sign up for BetterUp to give access to their employees as a personal and professional perk or as part of an internal development program.

BetterUp fundamentally allows companies to extend learning & development opportunities to many more people inside the organization by reducing the cost of training by a magnitude compared to traditional executive coaching services that would charge companies roughly $2K-$3K per session.

BetterUp started out as a coaching platform and destination, but in the last 2 years, BetterUp has increasingly looked to grow their distribution by partnering with other platforms like Salesforce (see BetterUp's sales-centric, BetterUp Sales Performance, listed on AppExchange) and Walmart (see "BetterUp for Caregivers", exclusively available to Walmart.com users).

This API-like strategy of allowing other products and businesses to incorporate BetterUp into their own products benefits the businesses—by giving their users and customers access to BetterUp's coaching interface and 3,000+ professional coaches—and it also benefits BetterUp by using these platforms as top-of-funnel to drive additional revenue.

Competition

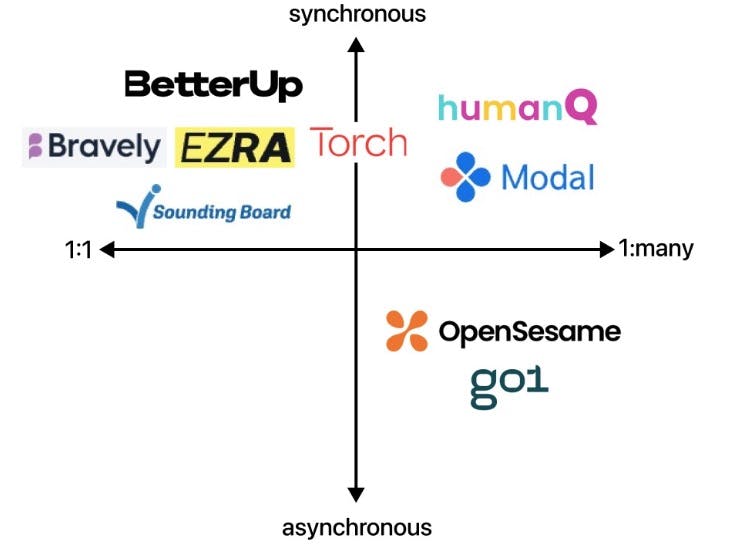

BetterUp is currently the leader in the market of online professional coaching platforms that includes companies like CoachHub, Torch, SoundingBoard, Bravely, Ezra, and Pluma (Skillsoft). BetterUp has also raised by far the most money at $566.9M—more than CoachHub at $333.5M, Torch at $87.8M, and Bravely at $18M.

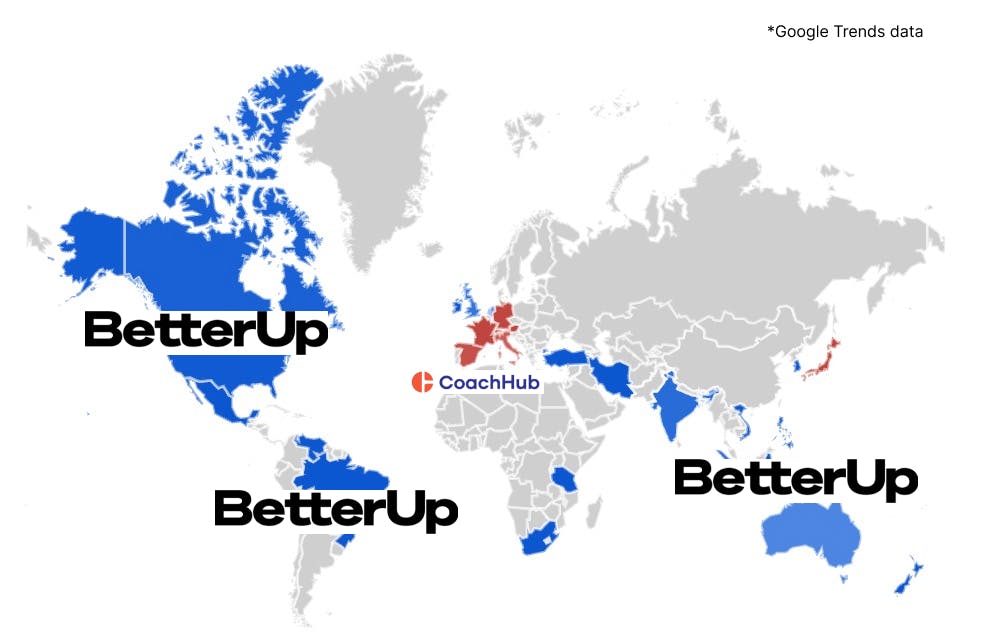

BetterUp has 3,000+ coaches providing support across 70 countries and they are used by 600 organizations. The closest player to BetterUp’s scale currently is the more Europe-centric CoachHub. CoachHub recently raised a $200M Series C with plans to expand more aggressively to the Asia-Pacific region.

For BetterUp, continuing to hire more coaches in time zones around the world (particularly in Western Europe, where CoachHub has the biggest advantage over BetterUp) and perhaps making strategic acquisitions in the world of international coaching platforms will be critical to competing with CoachHub for the global market.

The last several years have seen waves of consolidation in the space, with Torch merging with Everwise, Pluma being acquired by Skillsoft, and CoachHub acquiring two smaller online coaching platforms—the French MoovOne, the Austrian Klaiton, and WBECS.

BetterUp also competes with platforms like Modal, Hone, and HumanQ that provide cohort-based learning for technical and work-based skills, DEI, health, and leadership & development. Instead of 1:1 coaching tailored to an individual, these platforms index on small classes on topics like “building trust”, “leading change,” and “managing conflict”.

Other platforms like Go1 aggregate content from various other platforms for learning—Blinkist, PluralSight, CloudSwyft, and many other sources—and provides it to organizations so that they can access all of it without negotiating individual agreements with each content platform.

TAM Expansion

BetterUp has a massive addressable market with its current product—last year, companies in the United States alone spent roughly $100B on training and development, of which BetterUp’s revenue represents about .1%.

There are a few core tailwinds that have helped BetterUp grow revenue roughly 3x over the last 2 years:

The move to remote: Overall corporate learning & development budgets fell for the first time in a decade in 2020, as companies scrapped in-person trainings and began to seek out remote and online options that could act as a replacement.

As companies continue to move towards remote and hybrid-remote working styles, abandoning their office rents, budget is freed up that can be spent on learning & development programs—like BetterUp—that can help ensure that working remotely doesn’t lapse their employees’ professional and personal development.

Focus on mental health: The pandemic brought with it a society-wide normalization of discussing mental health that has seen manifestation in the uptick of spending across companies on coaching programs like BetterUp.

An Oracle study in 2020 reported that mental health was a big focus as far as what companies should be doing for 76% of employees, and 71% of HR managers agreed that they would invest more in mental health with bigger budgets.

The same way that diversity, equity and inclusion (DEI) became a hot-button topic for corporations circa 2019 and has since blossomed into a roughly $10B per year industry, mental health has the potential to be the next big source of corporate spend.

Artificial intelligence: A survey of 1,000 K-12 teachers in February 2023 found that 51% had used ChatGPT as a tool to help them do their work—grading papers, coming up with lesson plans, writing letters to parents. etc—and 40% were using it on a weekly basis.

While a fully AI coach may be some ways away, BetterUp has a major opportunity in helping their existing professional coaches best make use of ChatGPT, GPT-4, and other large language models (LLMs) in their work.

By giving their coaches a GUI-in-the-front, AI-in-the-back toolset for interacting with LLMs, they could enable each coach to serve more people, serve them more effectively, and get more work done in less time, improving the overall economics of the business while potentially giving them a wedge to expand into more and more of the learning & development market.

Risks

A few key risks for BetterUp’s business from our research:

Retaining coaches: Many online coaching platforms—including BetterUp and CoachHub—are changing coach pay structures and asking their coaches to take pay cuts as they look to get profitable. Labor disputes have resulted—disuputes which could result, long-term, in the best coaches going to other platforms or working independently.

Shift to in-person: Since COVID, many companies have gone back to working in office—whether full-time or on a hybrid basis. As they do, it’s possible that investments they made in and around their remote workforce will fall by the wayside as they return to in-person learning & development.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.