Revenue

Sacra estimates Beacons hit $3.7M in annually recurring revenue in January 2021, growing at an extraordinary rate of 209% month-over-month during Q4 2020. The company achieved this growth through a highly efficient viral growth loop, with 90% month-over-month user growth resulting in 70,000+ users generating 5 million weekly page views.

Beacons operates on a freemium B2C SaaS model, with its "Entrepreneur plan" priced at $10/month. The company faces high gross revenue churn of 16-18% monthly, significantly above competitor ConvertKit's 5% monthly churn. However, their low customer acquisition costs maintain favorable LTV/CAC ratios between 4-11x, even with relatively low freemium conversion rates of 0.5%.

The company generates revenue primarily from creators using their platform to monetize through multiple channels including merchandise sales, tips, and referrals to platforms like Patreon and OnlyFans. Their mobile-first approach has helped capture significant market share from traditional website builders.

In Sacra's base case projections, Beacons was expected to reach $2M in annually recurring revenue by end of 2021, driven by expansion to 1M users and improved freemium conversion rates. The company's strategic position at the intersection of creator discovery and monetization presents significant potential for revenue diversification through additional creator economy services.

Product

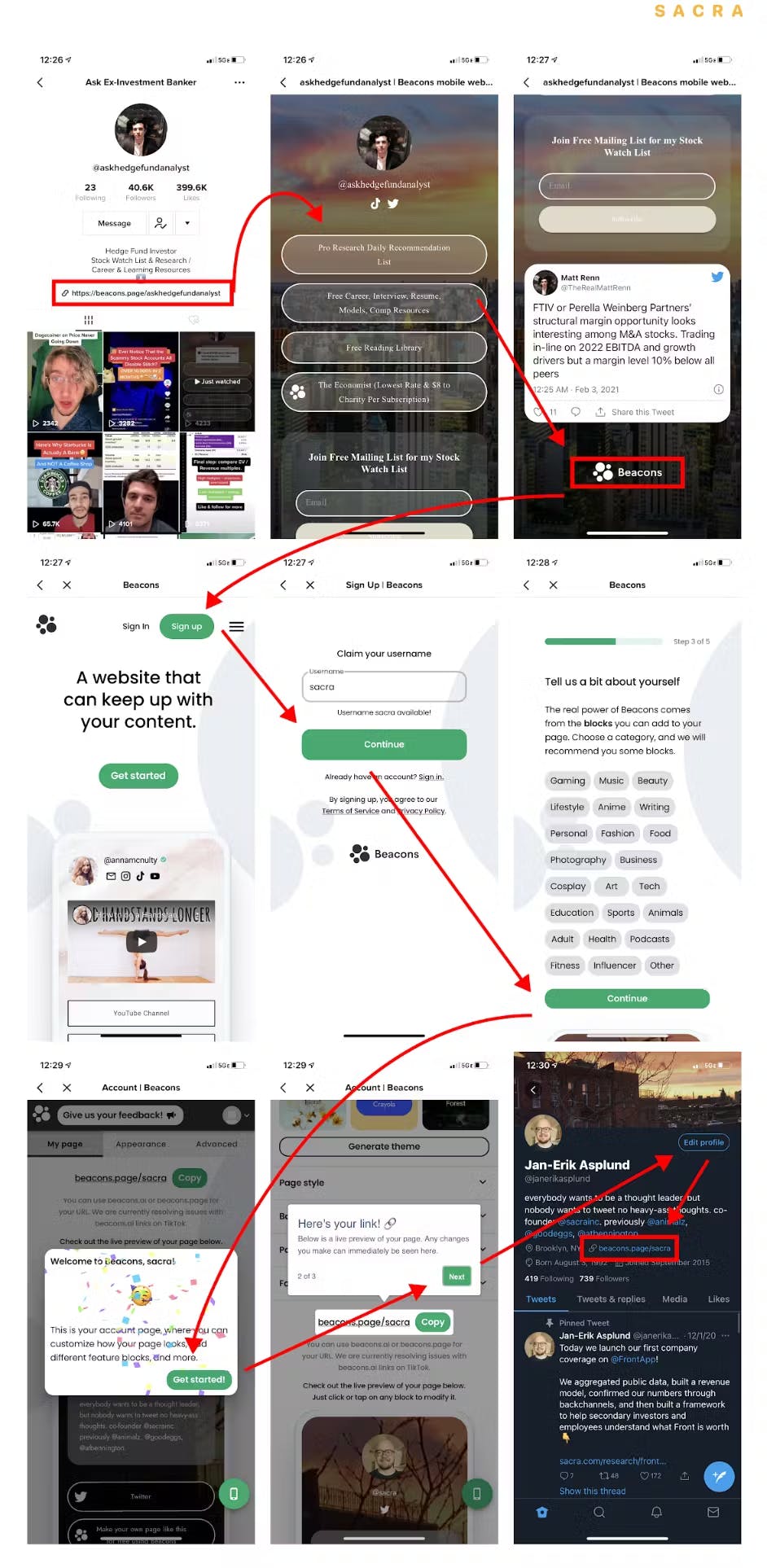

Beacons was founded in 2020 by Neal Jean, Jesse Zhang, and Greg Luppescu as a mobile-first website builder for content creators.

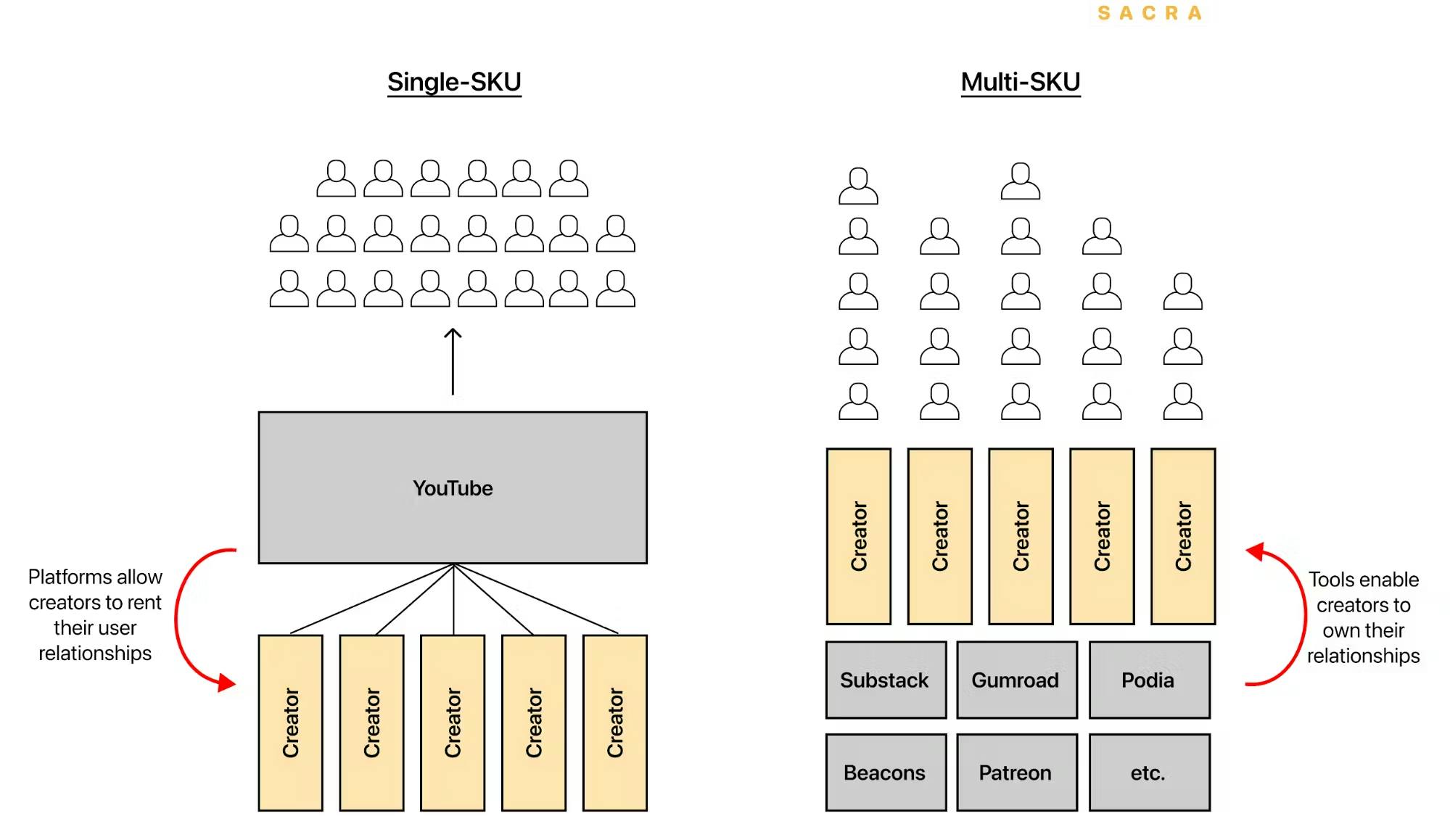

Beacons found product-market fit as a "link-in-bio" tool for multi-SKU creators who needed to bridge the gap between their social media presence and various monetization channels. These creators typically maintain presences across platforms like TikTok, Instagram, and Twitter, while monetizing through multiple products and services.

The core product allows creators to generate a mobile-optimized landing page from their social media profiles in under 5 minutes. When a creator connects their social accounts, Beacons automatically generates a customized page using their most engaging content and existing links. This page becomes their hub, accessible through the single link allowed in their social media bios.

Creators use Beacons to consolidate their various offerings - from merchandise to course downloads to fan donations - in one mobile-friendly destination. The platform's block-based architecture allows creators to embed rich media, accept payments via Stripe integration, capture email addresses, and link out to other platforms where they monetize their following.

Beyond the core link-in-bio functionality, Beacons has expanded to offer tools for email marketing, brand outreach, invoicing, and audience analytics - creating an integrated suite of business tools specifically designed for the modern creator economy.

Business Model

Beacons is a subscription SaaS company that helps creators monetize their social media following through a mobile-first website builder and storefront platform. The company's core product allows creators to turn their single "link in bio" on platforms like Instagram and TikTok into a comprehensive monetization hub.

The platform operates on a freemium model with tiered pricing. A free plan includes basic features with a 9% transaction fee on sales. Paid plans range from $10/month to $50/month, with higher tiers eliminating transaction fees and adding features like unlimited email sends, video hosting, and dedicated support. Creators can also purchase individual pro features à la carte at $10-13/month per feature, or opt for bundled offerings like the $24/month Marketing Bundle.

Beacons differentiates itself by focusing specifically on multi-SKU creators who sell various products and services across different platforms. Their block-based website builder enables creators to quickly set up storefronts, accept payments, capture emails, and embed multimedia content. The platform serves as a bridge between social media discovery and downstream monetization, helping creators own their audience relationships rather than remaining dependent on social platforms.

The company's growth is driven by viral loops where users discover Beacons through other creators' pages and then create their own, leading to organic user acquisition with minimal marketing spend.

Competition

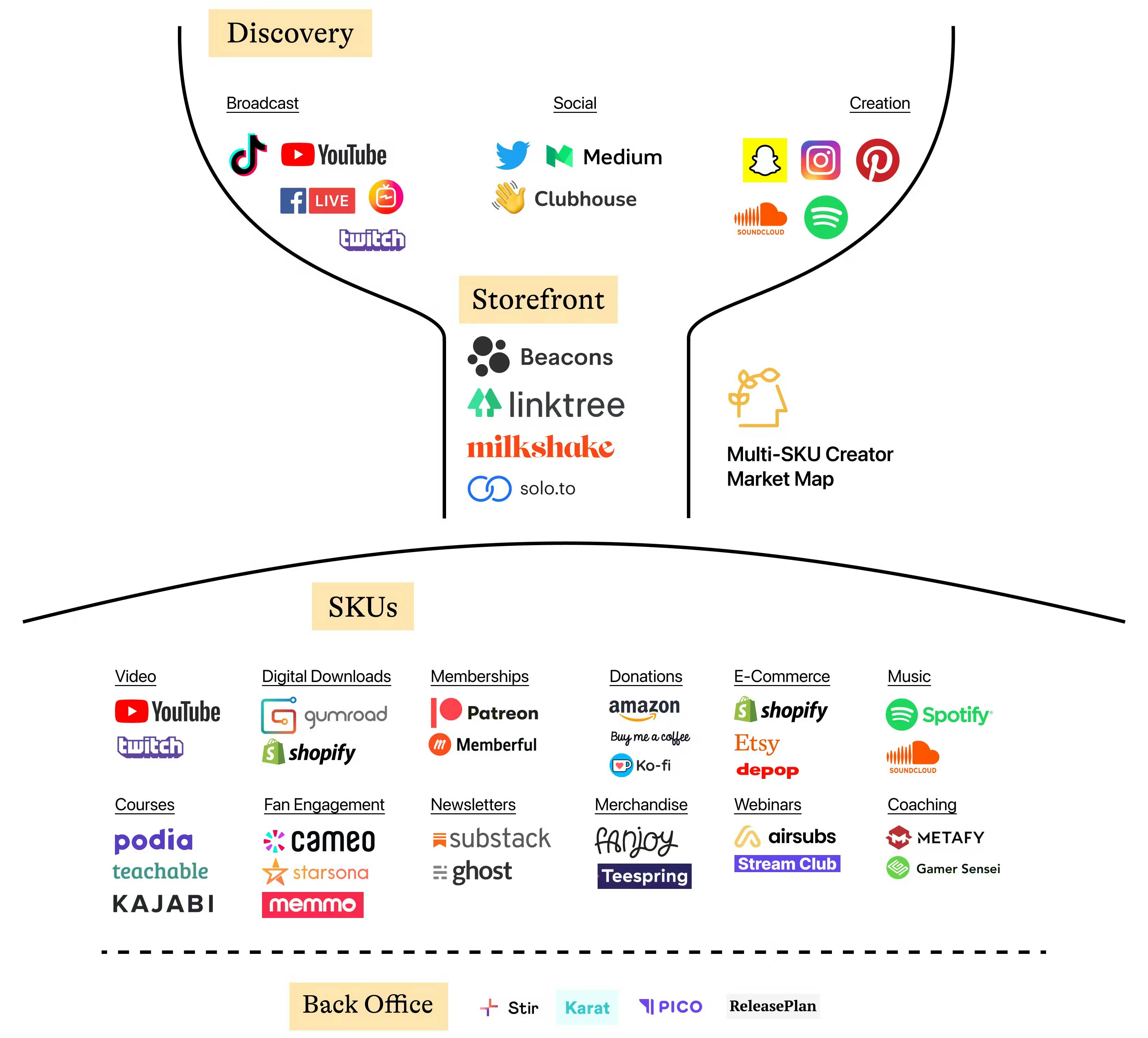

Beacons operates in a market that includes link-in-bio tools, website builders, and vertical SaaS platforms for creators, with different competitors focusing on distinct segments of the creator economy.

Link-in-bio tools

Linktree dominates this category with 31M users and $33M ARR as of 2022, growing 29% year-over-year. Other competitors include Linkfire ($2.7M raised) focusing on musicians, Koji ($36M raised) emphasizing gaming creators, and Snipfeed ($6.4M raised) targeting content creators. These companies primarily differentiate through vertical-specific features and integrations.

Website builders and commerce platforms

Traditional website builders like Squarespace ($1.7B), Webflow ($2.1B), and Wix ($15B+) have begun adding creator-focused features and templates. Shopify launched Linkpop specifically for social commerce, integrating inventory and checkout directly into a mobile-first website generator. These platforms offer more robust website building capabilities but lack the mobile-first, creator-specific focus of link-in-bio tools.

Vertical SaaS for creators

Newer entrants are building comprehensive creator business platforms. Stir ($20M raised) focuses on creator finances and sponsor management, while companies like ConvertKit provide email marketing tools specifically for creators. These platforms typically charge higher monthly fees ($29-299) compared to link-in-bio tools ($5-24) but offer more extensive business management features.

The market is evolving from simple link aggregation toward full-stack creator business platforms, with companies increasingly competing on their ability to help creators own their audience data, manage multiple revenue streams, and integrate with various monetization channels.

TAM Expansion

Beacons has tailwinds from the creator economy's shift toward multi-SKU business models and has the opportunity to expand into adjacent markets like vertical SaaS for creators, mobile-first website building, and payment facilitation.

Creator economy infrastructure

The creator economy is evolving from single-platform monetization to diversified revenue streams across multiple platforms and products. Beacons is uniquely positioned at the intersection of discovery and monetization, helping creators convert social media followers into paying customers. With 50M+ creators globally compared to just 2.5M online retailers, the addressable market for creator tools significantly exceeds that of traditional e-commerce platforms.

Mobile-first website building

Traditional website builders like Squarespace ($1.7B), Webflow ($2.1B), and Wix ($15.7B) were built for desktop-first experiences. As mobile device usage now exceeds desktop by 2x, Beacons can expand from link-in-bio into a full-featured mobile website builder. Their block-based architecture already provides more functionality than simple link aggregation, positioning them to capture market share from legacy players.

Vertical SaaS and payments

By expanding beyond traffic routing into creator-specific tools like CRM, email marketing, and native checkout, Beacons can build a comprehensive vertical SaaS platform for creators. Following Shopify's playbook, they could generate significant revenue through premium tiers and payment processing fees. With Shopify generating 75% of revenue from payment facilitation at a 2.9% take rate, Beacons could tap into the growing creator economy GMV while maintaining alignment with creator interests.

Risks

Platform dependency: Beacons' entire business model relies on social platforms continuing to allow a single link in bio. If platforms remove this feature or build native alternatives, Beacons loses its primary distribution channel. TikTok has already accidentally flagged Beacons links as dangerous before, showing how platform changes can immediately impact the business. The company's attempt to diversify across platforms helps but doesn't eliminate this fundamental risk.

High churn masking fundamental weakness: At 16-18% monthly revenue churn, Beacons is losing customers faster than sustainable SaaS businesses. While rapid new user acquisition currently masks this issue, if acquisition slows before churn improves, growth could quickly reverse. The company's low price point and freemium model make it particularly vulnerable to casual users churning.

Commoditization of link-in-bio: With 40+ competitors including Linktree, Koji, and Shopify's Linkpop, the core link-in-bio product is becoming commoditized. While Beacons is expanding into creator tools, larger platforms with existing creator relationships could more easily expand into this space. The company's low pricing leaves little room for margin compression if competition intensifies.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.