Revenue

$800.00M

2023

Valuation

$6.84B

2022

Funding

$641.00M

2022

Growth Rate (y/y)

50%

2022

Revenue

Sacra estimates that Automation Anywhere hit $640M in annual recurring revenue at the end of 2022, up 50% from $427M at the end of 2021.

Valuation & Funding

Automation Anywhere was valued at $6.84 billion as of 2022. Based on 2022 revenue of $640M and valuation of $6.84B, the company traded at a 10.7x revenue multiple. The company has raised $641 million in total funding. Automation Anywhere has established strategic partnerships with major companies including IBM, SAP, and Accenture, though specific investment details from these partnerships are not publicly disclosed.

Business Model

Automation Anywhere charges for access to its cloud SaaS RPA products and on-premises software via yearly contracts. Today, the percentage of Automation Anywhere’s revenue that comes from cloud deployments has risen to roughly 80%.

Automation Anywhere charges based on the number of software robots deployed to automate tasks and the number of employees internally at the company interfacing with and using those robots—as such, it’s indexed on how much work a company is using Automation Anywhere for and how widely it’s being used across departments.

Automation Anywhere has two primary sales motions: direct sales into larger organizations via its sales team, and channel partnerships with companies like Accenture, Deloitte, EY, KPMG, IBM, SAP, and others.

A team of sales engineers and account managers helps to support enterprise deployments of Automation Anywhere—in total, we estimate that roughly 5% of revenue comes from professional services, a similar breakdown to comparable RPA player UiPath.

Sacra estimates gross margins of around 80%, with the majority of cost of revenue being accounted for by sales engineers, account managers and the overall cost of professional services.

An important measure of the strength of an enterprise SaaS company is their ability to retain and grow revenue from existing customers. As revenue compounds at scale, consistent expansion can generate businesses with huge amounts of cash flow—in 2017, Automation Anywhere reported a bookings expansion rate of 282% and an existing customer renewal rate of 99.5%.

Automation Anywhere lands-and-expands by solving an initial problem for enterprises, then growing the amount of processes that they help automate over time—this means an increased number of robots and an increased number of teammates interacting with those robots.

Product

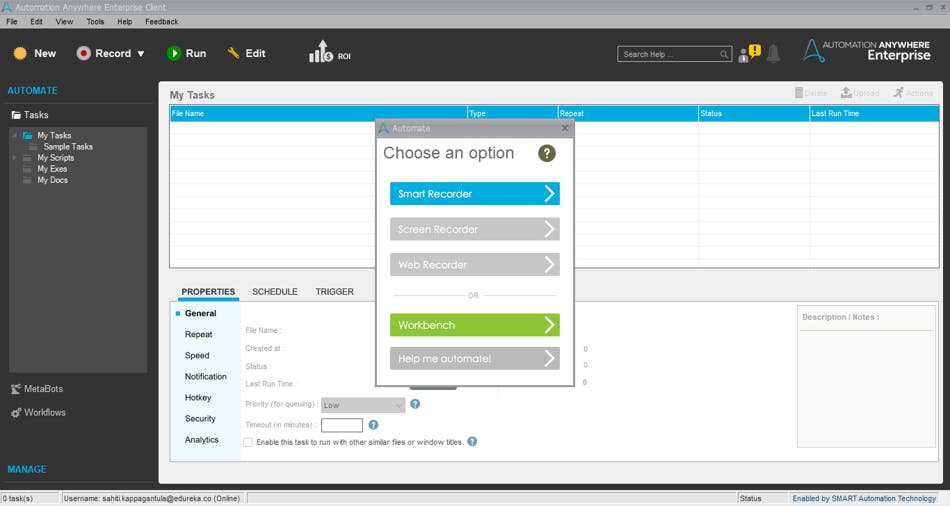

Automation Anywhere’s core product is a platform that allows companies to create software robots that can perform employee-like tasks like copying data from one type of file and application to another, extracting data from documents, updating fields, moving fields, and so on.

The software robots that are part of Automation Anywhere can be trained by observing the behavior of a human employee, then set to perform that same task autonomously. Robots can further be manually customized by software developers on staff. OCR technology allows Automation Anywhere’s robots to gather visual information and extract the text and meaning from it for use in automations.

Automation Anywhere has integrations built for every major enterprise software platform, like Salesforce, MuleSoft, Google Workspace, SnapLogic, Apigee, Workato, ServiceNow, and others—so that users of Automation Anywhere can pull in data from all of those applications and use built-in connectors to act on them via API.

Competition

Startups

Automation Anywhere’s biggest competitors among other RPA upstarts are UiPath (NYSE: PATH) which is valued at over $9B, and Blue Prism, which sold to Vista Equity Partners for roughly $1.5B in September 2021.

About 60% of the Fortune 500 is reportedly a customer of UiPath, and 70% of revenue comes from existing customers, evincing a formidable land-and-expand dynamic typical of top SaaS companies.

Public incumbents

Over the last several years, SAP, Salesforce, Microsoft, IBM have all built their own RPA capabilities, acquired RPA companies, or formed partnerships with RPA companies.

For example, Salesforce acquired RPA platform Servicetrace in August 2021, folding it into MuleSoft to keep their customers from using other RPA platforms like Automation Anywhere. Similarly, in 2018, SAP acquired the European RPA company Contextor SAS, while Microsoft acquired the low-code RPA platform Softomotive in 2020.

What we’re seeing is a rush on the behalf of the big software incumbents to capitalize on the rise of RPA—but it’s not necessarily a zero-sum game. The presence of many vendors can be a win for customers who don’t want to lock themselves down with any one RPA platform.

TAM Expansion

The total RPA market, which is worth roughly $3B today, is expected to continue to grow at a rate of 20% year-over-year—propelled in large part by the growing proliferation of SaaS and increased IT complexity as well as the growing cost of human labor around the world.

IT complexity

SaaS tools today represent 70% of the tech stack of the average company, but the proliferation of cloud-based software across the enterprise has also brought an unprecedented amount of complexity.

Total spend on SaaS is expected to hit about $200B by the end of 2023. The upshot of this massive growth and complexity is that companies will either need to train more people to manage workflows that cross over many different kinds of applications—or they will need to buy software that will help their existing employees better manage the sprawl.

RPA platforms like Automation Anywhere are specifically designed to help those enterprises at the far end of IT complexity—who are dealing with up to thousands of software point solutions across both cloud and hybrid environments.

Cost of human labor

The cost of hiring was rising before the pandemic, but COVID amplified the existing trends in hiring that are moving more companies toward hiring abroad, using AI, and paying for RPA platforms to help automate existing business processes.

With inflation at 7%, wages rose in 2021 more than they ever had before. With 4M+ Americans quitting their jobs during COVID’s “Great Resignation”, this has all created the environment for an extremely tight job market.

More companies are already leaving their leases and moving to remote work full-time as a way of controlling costs, and some are replacing workers in high cost of living areas with workers in areas with a lower cost of living as a result.

Risks

The launch of large language models (LLMs) like GPT-4 that can use natural language inputs to interact with external software tools and trigger actions (rather than merely return text) threatens the core use case of RPA platforms: helping businesses automate the execution of repetitive tasks.

We’ve already seen companies like MIcrosoft begin to incorporate their own LLMs into their product suites, with ChatGPT finding its way into Word, Excel and PowerPoint. It’s no stretch to think that LLM technology could be integrated into many of the everyday software tools that people use at work, like Salesforce, and that it could enable the kinds of automations that RPA tools handle today.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.