Revenue

$22.00M

2021

Valuation

$2.00B

2022

Funding

$640.00M

2022

Growth Rate (y/y)

21%

2022

Revenue

Note: Revenue and growth rate estimated using publicly available information

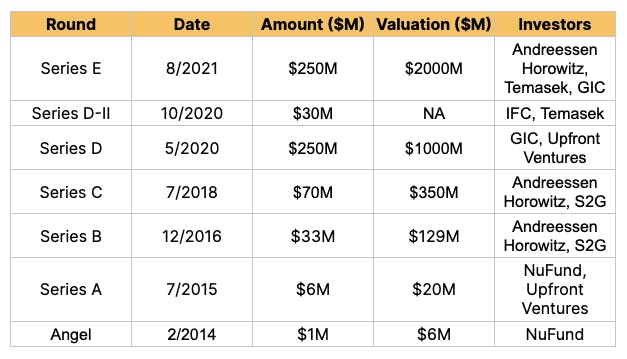

We estimate Apeel’s 2021 revenue at $22M, up 21% from 2020. Apeel makes money by selling their edible coating powder along with application equipment and an onsite service team to growers and suppliers. We estimate that its customers primarily pay for the powder, with Apeel bearing the cost of the rest of the bundle to gain traction in the market. Companies similar to Apeel that make specialty powder/coating typically have a 60% gross margin. However, as Apeel’s cost of goods sold includes the cost of equipment and onsite team, we expect its gross margin to be lower.

Valuation & Funding

Note: Valuation, revenue, and growth rate estimated using publicly available information. X and Y axes are on log scale for visual clarity. Size of the bubble indicates valuation.

Apeel has raised $640M from Andreessen Horowitz, GIC, Temasek, and celebrity investors like Oprah Winfrey and Katy Perry. It was last valued at $2B at an estimated 100x valuation/revenue multiple. Apeel is richly valued as compared to other companies in the foodtech market. Publicly listed Agrofresh has a 0.5x multiple with $166M revenue, and privately held Hazel Technologies has a multiple of 24x with $10M revenue. Misfits Market, the largest food waste prevention marketplace, has a multiple of 9x with $225M revenue.

Business Model

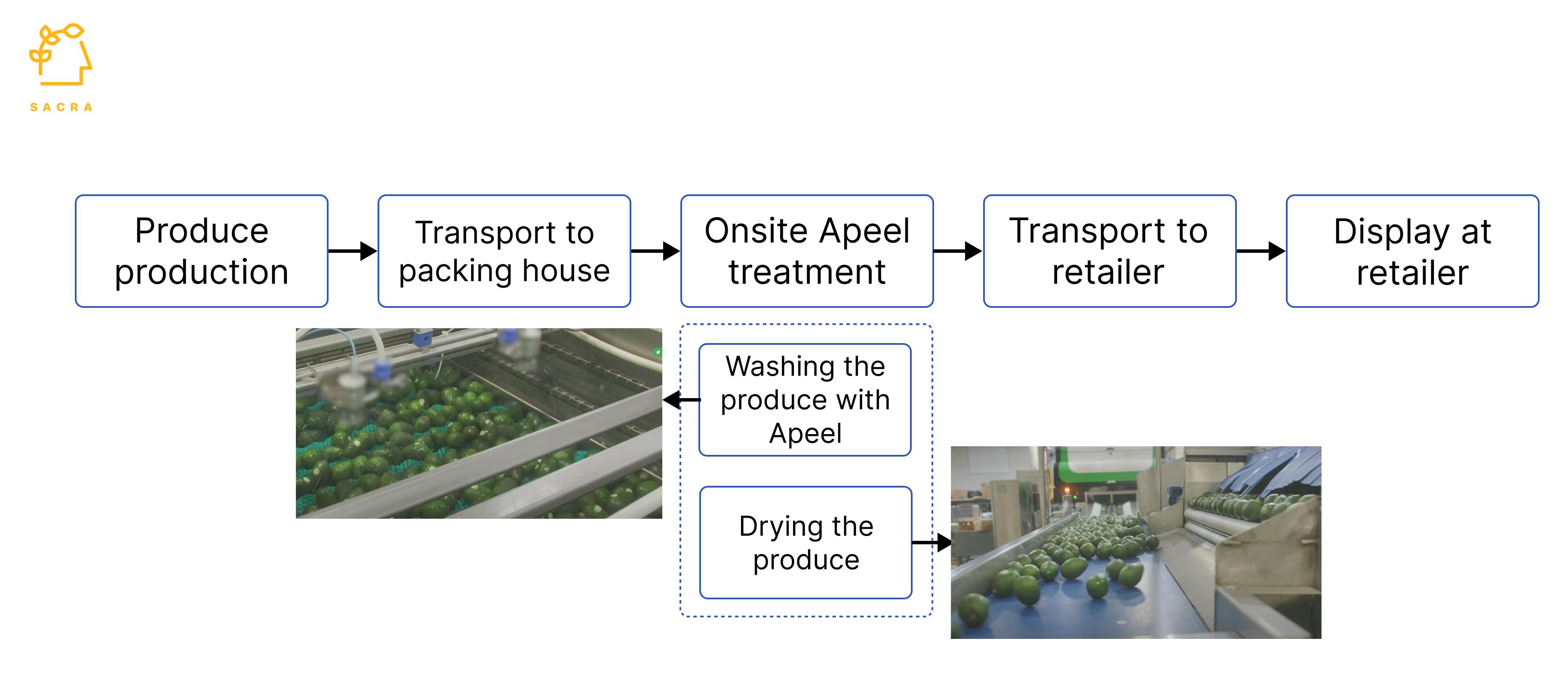

Apeel has developed a plant-based powder that, when mixed with water and applied to fruits and vegetables, increases their shelf life. Apeel’s onsite servicing team embeds within a customer’s packing house to operate equipment, apply the coating to fresh produce, maintain quality standards, and collect data.

Apeel’s main customers are global growers and suppliers of fresh produce. 50% of its 26 supplier customers are in the US, with another 25% in Europe. 60% of these suppliers use Apeel for avocados, and 25% for citrus fruits such as limes and oranges. Apeel also sells to retailers such as Costco, Kroger, and Harps Foods.

Product

Apeel processes fruits and vegetable waste such as peels, seeds, and pulps to create a water-soluble powder. When fruits are sprayed with this solution, it forms a tasteless and odorless film on the surface that slows water loss and prevents oxygen from penetrating the skin, keeping the fruit fresh for longer.

This is differentiated from wax treatment, which enhances the surface appearance of fruit but doesn’t treat the underlying causes of decay.

According to Apeel, this treatment increases the shelf life of fruit by 2x to 3x without any refrigeration or controlled atmospheric storage. This is especially useful when fruits are at retailers or customers' homes. Apeel's powder is FDA approved in the US and classified as GRAS or “Generally Recognized as Safe'' for consumption.

Each fruit has its own formulation as what works for e.g. avocados doesn’t work for limes. Apeel has developed formulations for more than 12 types of produce and is available commercially for avocados, apples, and citrus fruits.

Competition

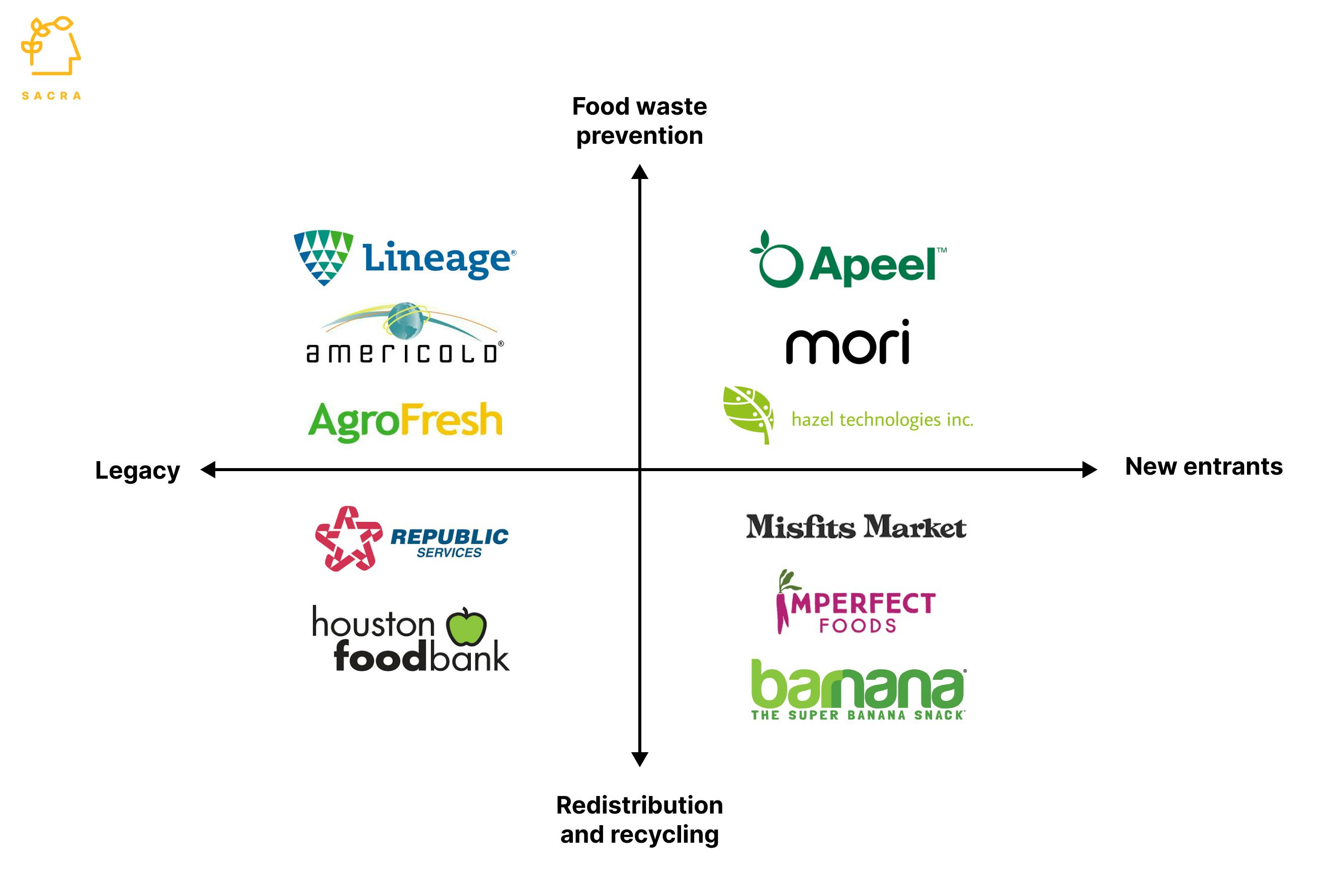

Every year, 1.3B tons of food (nearly one-third of total food produced) is lost to spoilage. In the US, 100M tons of food ends up in landfills every year, the most in the world. Within the food waste space, there are food waste prevention companies that provide solutions to prevent food from spoiling and food redistribution and recycling companies that aim to prevent end-of-life or surplus food from ending up in landfills.

Food waste prevention companies

Cold chain companies are one of the largest players in the food waste prevention category. Lineage Logistics is the largest US cold chain company with 26% of the US market and $2B+ in revenue. However, cold chains do not keep produce fresh at retailers or customers’ homes.

Many startups, including Apeel, are working on biochemical approaches to keep produce fresh without cold storage. Hazel Technologies makes a biodegradable sachet placed in fruit bins to increase fruit's shelf life, and Mori makes a plant-based coating that can be used for fruits, meat, and poultry. Only a few of these are available commercially, and many are at the R&D stage.

Redistribution and recycling companies

Various startups have emerged in the last few years that source imperfect produce (edible food that doesn’t meet aesthetic standards for retailers), surplus produce, or short-dated food items from growers and manufacturers. These include online marketplaces like Misfits Market and Imperfect Foods that sell to consumers, similar to Amazon Fresh or Instacart. Then there are food recycling startups such as Barnana that convert imperfect/surplus bananas into snacks and sell them through retailers.

TAM Expansion

Food waste prevention platform

Apeel’s business model of embedding teams at their customers’ packing houses gives it the advantage of being able to layer on new services seamlessly. Apeel recently acquired spectral imaging startup ImpactVision, which lets growers see inside their produce to understand its ripening window. Apeel will integrate it with its core application to help growers optimize their real-time sorting and shipping processes. Similar opportunities exist in fruit inspection, temperature and atmosphere monitoring, and fruit waste analytics, all of which Apeel could integrate into their package to become an end-to-end food waste prevention platform.

Category and geographic expansion

While avocados and US growers form the bulk of Apeel’s volume today, it has a large opportunity to expand across more fruits and geographies. It is already making inroads in citrus fruits and apples and is investing in formulations covering more varieties of tree fruits. It has outposts in the Netherlands, Spain, Peru, and Mexico to drive international expansion.

Risks

Ops-heavy business model

One of the biggest risks for Apeel is to scale its business profitably despite its ops-intensive model, which typically means low margins. Even with its limited footprint, it has ~400 people, most of whom are working at customer locations. As it scales, it will need to continuously add people, inflating fixed costs without margin profile improvement. This could become a challenge unless it can leverage these employees to generate more revenue by delivering more services.

Consumer demand

Most food waste prevention companies' biggest drivers are consumer demand and awareness about reducing food waste. While surveys indicate an increase in food waste awareness among consumers, in the US, food waste increased from 133B pounds in 2010 to 206B pounds in 2018. If the awareness doesn't translate to actual demand and willingness to pay, retailers may not have sufficient incentive to sign up with companies like Apeel.

Fundraising

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.