Revenue

$224.00M

2022

Valuation

$4.00B

2022

Funding

$224.00M

2022

Growth Rate (y/y)

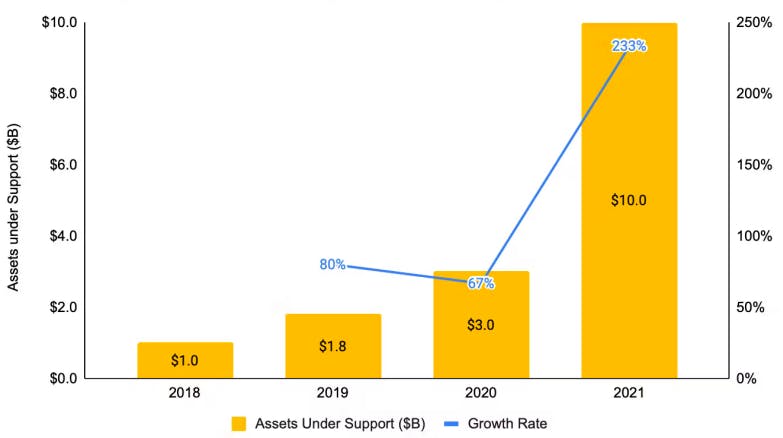

233%

2022

Financials

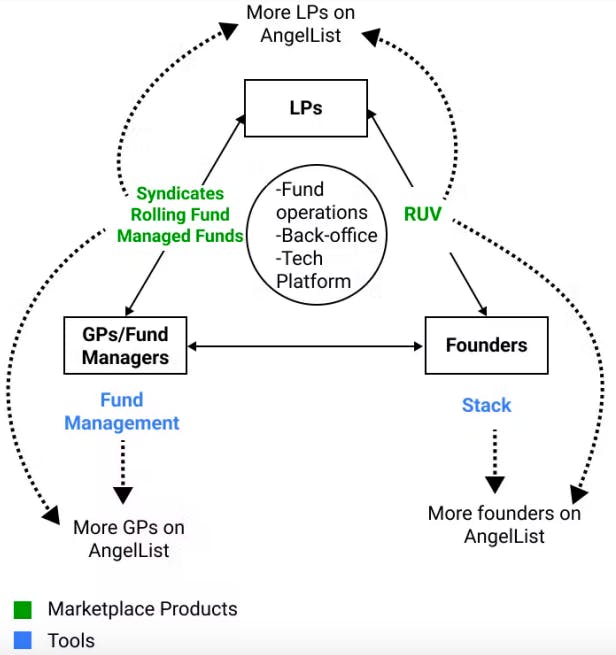

AngelList Venture, spun out of AngelList Holdings in 2020, is a multi-sided marketplace for LPs, GPs, and founders that reduces entry barriers in fundraising and investment. It monetizes through a venture fund fee structure by charging

AngelList Venture recently raised $100 million at a $4 billion pre-money valuation from Tiger Global and Accomplice, bringing their total raised since inception to $224 million.

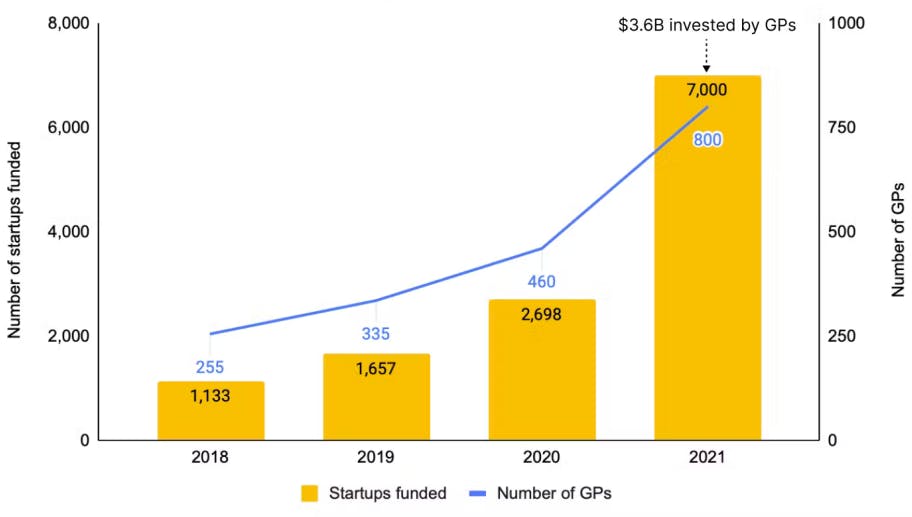

AngelList Ventureʼs Assets Under Support (AUS) has increased by 10X since 2018 at a CAGR of 115.4%, while the number of GPs on AngelList has increased from 255 (2018) to 800 (2021). This growth is driven by their productization of investing and fund raising and the tailwinds of rising private company valuations in 2021.

GPs invested $3.6 billion into 7000 startups in 2021 using AngelListʼs platform, with ~$1 billion from AngelList LPs (who discovered deals through AngelList's listings). In 2020, AngelList had 380 active funds with $3 billion in AUS. US-wide there were ~3,680 active funds, managing $548 billion, giving AngelList a share of 10% in active funds and 0.54% in AUS.

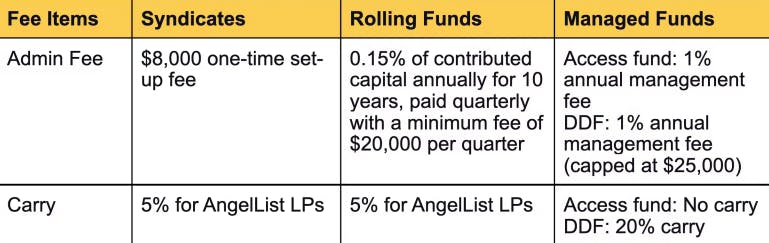

Its revenue streams are:

- Admin fee and carry from fund managers/GPs for using its platform and tools. Carry is only charged for AngelList LPs. If GPs bring their LPs, thereʼs no carry.

- Management fee and carry from LPs for AngelList-managed funds (such as Access funds and YC Demo Day Fund).

- One-time fee from founders using its products.

Product

As a tech-enabled, multi-sided marketplace for GPs, LPs, and founders that eases entry barriers into investing/fundraising AngelList Venture's products abstract away the complexities of

It has two types of products with two different goals:

Marketplace Products: These drive the transactions between GPs/LPs/founders that act as hooks to attract more participants to the platform.

Tools: These enable GPs/Founders to do their job better by avoiding legal/back-office complexities

Marketplace Products

LPs <> GPs

AngelList Venture lists GP funds on its platform, making it easy for individual investors/LPs to invest through AngelList, rather than through traditional VC funds or writing checks directly.

AngelList LPs invested >$1 billion in deals in 2021, making it an attractive source of investment for GPs beyond just the tools.

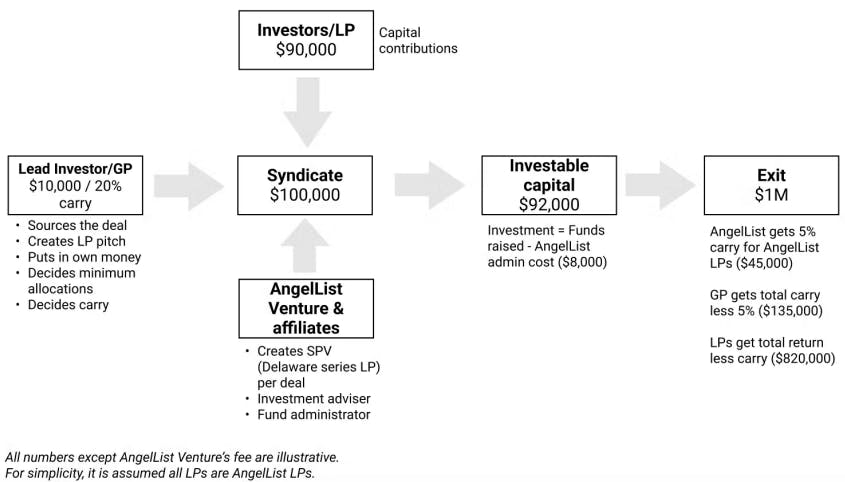

Syndicates (Launched in 2013): Syndicates are SPVs that allow an individual LP to invest alongside an experienced lead investor (GP) on a deal. A GP creates a Syndicate on AngelListʼs platform that makes it discoverable to AngelList LPs. This was AngelList Ventureʼs first LP <> GP product. Over $1.2 billion has been invested in Syndicates by LPs thus far and ~61% of it has come from AngelList LPs.

How the fund flow for AngelList Syndicates works

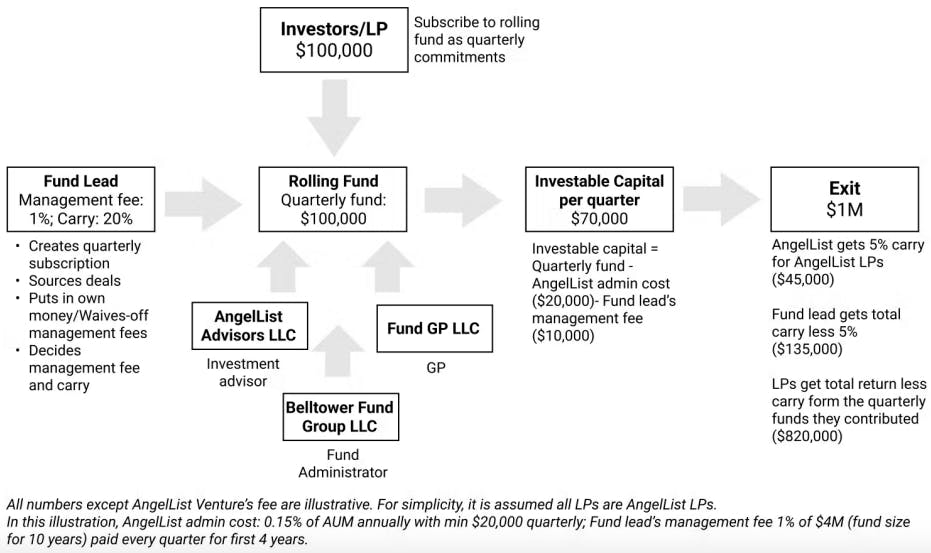

Rolling Funds (2020) allow LPs to access the deal-flow of GPs as a quarterly subscription rather than a one-time commitment. GPs can accept capital anytime during a quarter and deploy it immediately in the same/next quarter. Each quarterly fund is a new SPV structured as a Delaware series Limited Partnership, set up under a Master Delaware Limited Partnership.

How the fund flow for AngelList Rolling Funds works

Rolling Funds have seen early traction with investors/operators with strong social media reputations acting as GPs. In the first eight months post-launch, 70+ rolling funds were launched. AngelList is also an LP in several rolling funds and makes money like a traditional LP. AngelList uses the Belltower Fund Group as the rolling fundsʼ administrator to avoid conflict of interest.

Managed Funds (2015): AngelList offers funds where LPs can directly invest, managed by experienced investors from the AngelList ecosystem. These include:

- Access Fund: AngelList Access Fund invests in early-stage venture capital deals. LPs can invest through quarterly or annual commitments. Prior versions of the Access Fund have TVPI in the top quartile of venture capital funds.

- Demo Day Fund (DDF): This fund is indexed to the YC cycle and invests into YC.

Fee structure:

For the Rolling Funds, GPs typically charge LPs a management fee that is 1-2% of the total fund size. This fee is calculated for a fund duration of 10 years and paid to GPs over the first 4 years. The management fee is escrowed out of the investable capital every quarter. This money is paid directly to the GPs.

Investors/LPs <> Founders

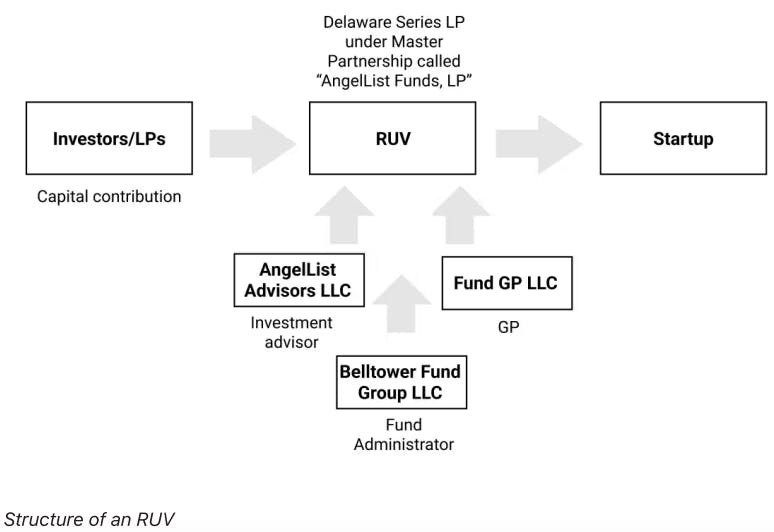

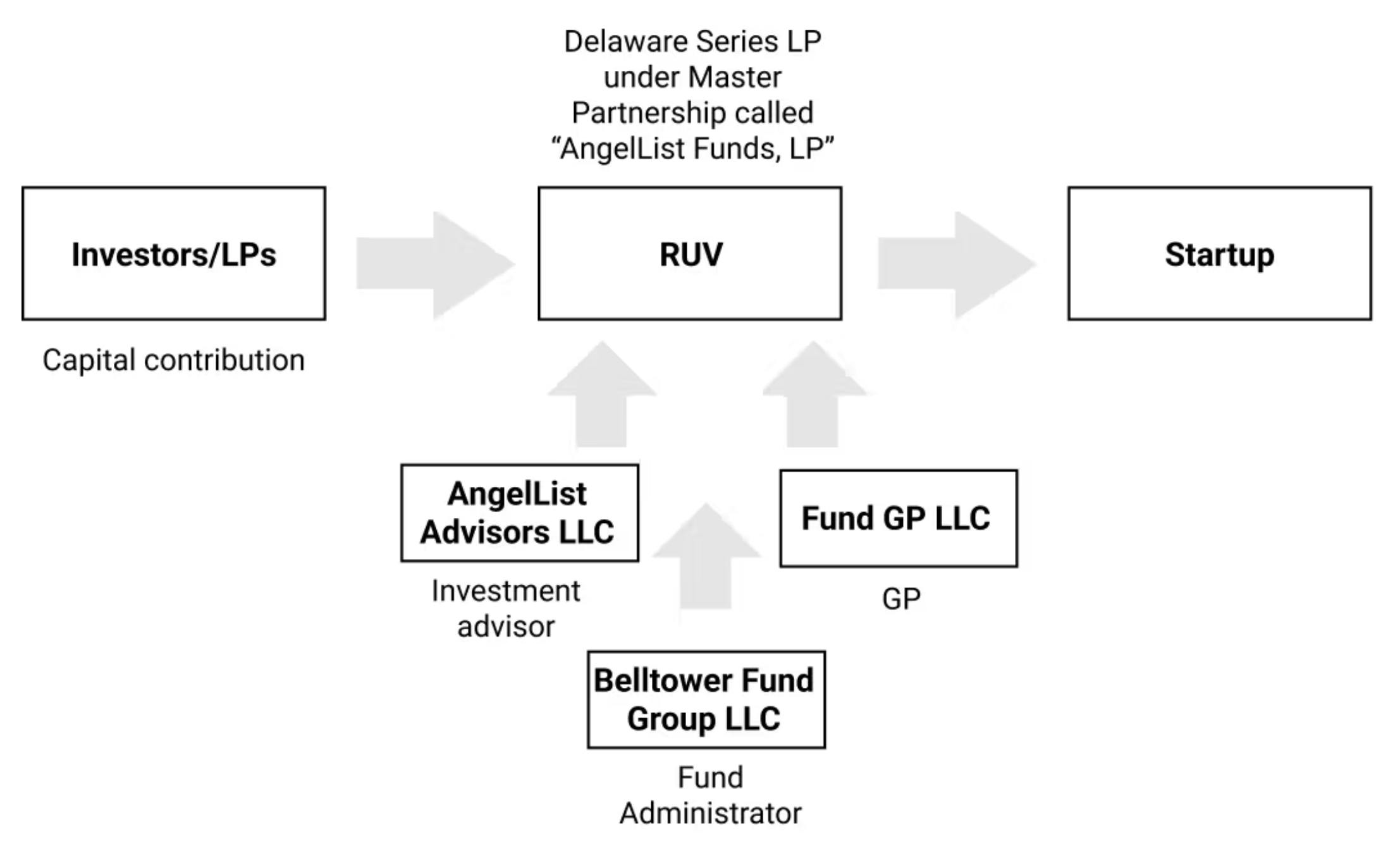

Roll Up Vehicles (2021): RUVs allow founders to consolidate allocations from up to 249 investors as a single line item on their cap table, simplifying the cap table. The fund collection and signatures process is abstracted to a single URL that founders send to investors. The deal is not published on AngelList and is accessible only to invited investors.

The RUV is structured as Delaware series Limited Partnership (SPV) under the Delaware Master Partnership of AngelList Funds, LP. The SPV is on the startupʼs cap table and has voting rights. It can proxy the voting rights to founders. AngelList offers it free to Delaware-based startups and charges $2500 to non-Delaware-based startups/startups requiring customizations.

Early traction for RUVs is from second-time founders who have experienced a messy cap table and prefer a more straightforward solution. RUVs also provide founders the ability to raise funds from potential customers. For instance, healthcare companies that sell to healthcare providers can raise RUV from them, getting their customers more deeply involved in the companyʼs success.

AngelList Venture has historically focused on LPs and only recently introduced products like RUVs for founders. RUV is a loss leader product launched to attract founders who bring new potential LPs to AngelList. Founders can themselves become LPs in the future. RUVs also allow AngelList to collect useful information about private companies that could be valuable at scale.

Structure of an RUV

Tools

Founders

Stack (2021) is an all-in-one tool that provides entity formation, cap table management, banking, hiring, and fundraising tools in a single package. Stack is free to use for founders with just a $500 incorporation cost. Stack, competes with different existing tools for wallet share such as Stripe Atlas (incorporation), Mercury (banking), Carta/Pulley (cap table), and Fairmint (fundraising).

GPs/Fund Managers

Fund Management (2017) as a product allows GPs to quickly set up and run venture capital vehicles. The software makes it friction-less to receive capital from LPs, make investments, track positions, and manage fund administration. AngelList Venture charges 1% of a fund's size (capped at $25,000 annually) and 5% carry on AngelList LPs. It also provides deep services to GPs such as KYC/AML of LPs SPV.

Competition

LPs/investors

Given AngelListʼs roots, most of the LPs are angel investors. These angel investors have a wide range of investment options such as crowdfunding portals (Kickstarter and Indiegogo), other angel investment portals (Wefunder, SeedInvest, and FundersClub), or direct investments in start-ups.

There are ~300,000 active angel investors in the US, and in 2021, ~38,000 LPs invested through AngelList Venture. Thus, ~87% of angel investors use non-AngelList investment opportunities. The average LP check size through AngelList is ~$94,000, more than the US average angel investment size of ~$76,000 (2020).

Fund management

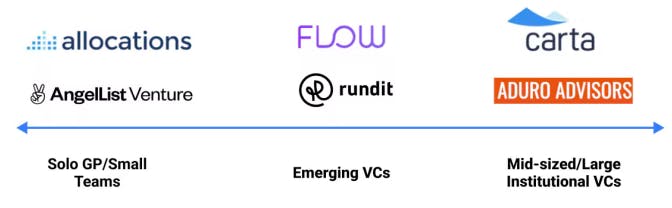

There are ~800 GPs and 380+ funds on AngelList Venture, indicating that most GPs are solo/small teams. Other companies that provide SPV formation and cloud-based end-to-end fund management include allocations.com (1000+ funds, $500M invested), Flow (8000+ LPs, $4.5B+ AUM), and Carta (500+ funds, $20B+ AUM).

Founder tools

TAM Expansion

Solo GP Tailwinds

Solo GPs have been on the rise recently. Earlier, Solo GPs used to write small checks and did not have control over a deal. However, this is changing fast. For instance, in the $100 million Series A funding of Playco (a gaming company) in September 2020, Josh Buckley (CEO, ProductHunt; solo VC) led the round with Sequoia, set the price, and took the board seat.

Solo GPs are also raising large funds—for example, Harry Stebbings ($140 million), Josh Buckley ($500 million), and Lachy Groom ($250 million). Their rise is driven by the ability of individuals to command massive distribution advantage through Twitter/Substack, maturity of VC as an asset class allowing LPs to dabble in newer vehicles, and the emergence of fund management infrastructure.

AngelList Venture is already heavily indexed on the solo GP ecosystem and has the tools and the marketplace to bring more value to them. The opportunity for AngelList Venture is to move up the stack and tap into larger solo GP funds.

An untapped opportunity in the start-up ecosystem is to unlock the cap table as leverage for founders to attract talent and provide liquidity to employees/investors. Companies such as CartaX and Pulley already provide cap table management products. AngelList maybe coming from behind in this space, but it has a unique ability to spin up SPVs and wrap them into different products rapidly. AngelList leveraged this ability to recently introduce Recurring Transfers that allow startups to offer liquidity to their employees regularly, rather than wait for a liquidity event. By creating an SPV at regular intervals that acquire shares from employees, AngelList enables the LPs to acquire an interest in this SPV. AngelList manages the entire process, and founders donʼt have to worry about the cap table complexities and management overhead of executing multiple agreements between buyers and sellers.

Secondary sales market

An untapped opportunity in the startup ecosystem is to unlock the cap table as leverage for founders to attract talent and provide liquidity to employees/investors. Companies such as CartaX and Pulley already provide cap table management products.

AngelList is coming from behind in this space, but it has a unique ability to spin up SPVs and wrap them into different products rapidly. AngelList leveraged this ability to recently introduce Recurring Transfers that allow startups to offer liquidity to their employees regularly, rather than waiting for a liquidity event.

AngelList creates an SPV at regular intervals that acquire shares from employees. The LPs acquire an interest in this SPV. AngelList manages the entire process, and founders don’t have to worry about the cap table complexities and management overhead of executing multiple agreements between buyers and sellers.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.