Revenue

$10.00B

2021

Funding

$224.00M

2020

Valuation & Funding

AngelList raised $100 million in March 2022 at a $4.1 billion valuation, led by Tiger Global and Accomplice.

In April 2022, the company completed a $44 million follow-on round from its customer base, with 10% of fund managers on the platform participating as investors. This unusual structure—customers funding the company whose infrastructure they depend on—functions as both a retention signal and alignment mechanism.

Earlier funding included a $24 million round in 2013 with participation from Google Ventures, Kauffman Foundation, Draper Fisher Jurvetson, Kleiner Perkins, and SV Angel. The company has raised approximately $168 million in total funding.

Product

Before platforms like AngelList, launching a venture fund required engaging securities counsel, fund administrators, and accountants separately—typically $50,000-100,000 in legal fees, 4-8 weeks of formation work, and ongoing administrative overhead that made funds under $10 million economically marginal. AngelList collapses this into software: a GP can go from fund concept to accepting capital in under 48 hours for $8,000-10,000.

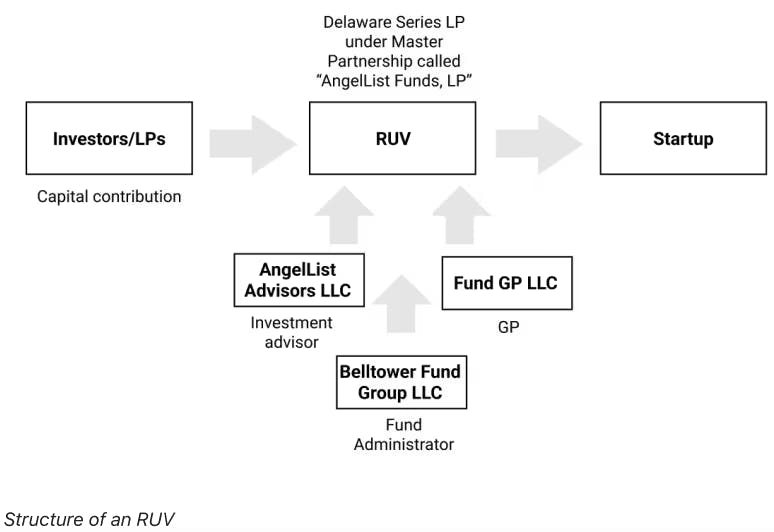

How the fund flow for AngelList RUVs works

The workflow begins with vehicle selection. A GP chooses between a Standard SPV (single investment, fixed allocation), a Syndicate (deal-by-deal with LP network access), a traditional Venture Fund (multi-year capital commitment), or a Rolling Fund (quarterly subscription).

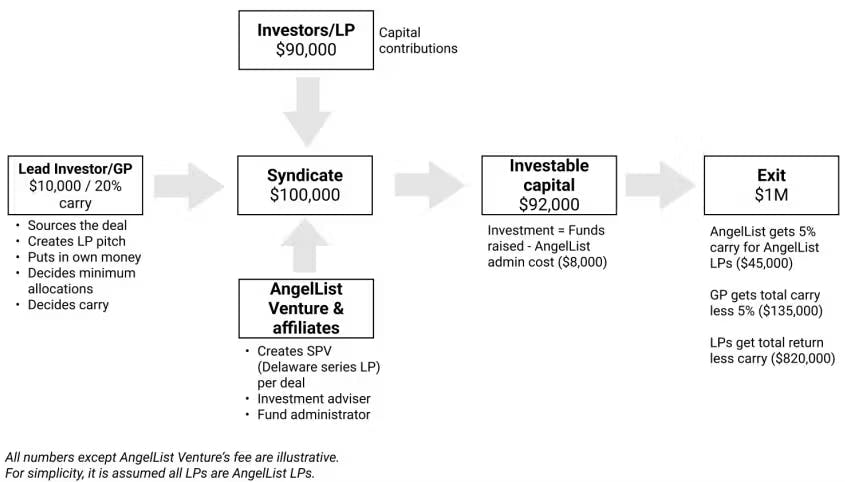

How the fund flow for AngelList Syndicates works

The platform auto-generates formation documents—operating agreements, subscription agreements, side letters—and handles Delaware registration, SEC filings, and bank account opening. A data room populates automatically with deal materials.

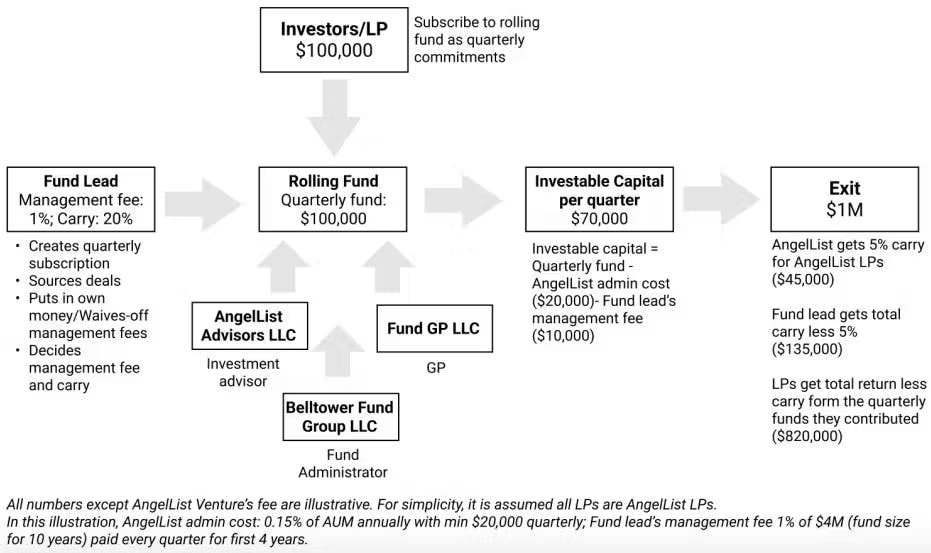

How the fund flow for AngelList Rolling Funds works

Meridian, AngelList's investor marketplace, surfaces GP deals to accredited investors whose profiles match by sector, stage, minimum check size, and geography. LPs browse a filtered feed, review deal memos, and commit with one-click e-signatures. Wire instructions generate automatically; funds flow to escrow and deploy on closing. The GP never touches paper.

For founders, Roll-Up Vehicles solve cap table bloat. A startup with 200 angel investors—each requiring individual K-1s, voting rights, and information access—can consolidate them into a single cap table line. AngelList Stack adds incorporation, cap table management, and banking services, positioning the platform as infrastructure from company formation through exit.

Back-office administration runs continuously: capital call processing, K-1 generation, GAAP valuations coordinated with third-party auditors, quarterly reporting. The system handles complex structures—parallel funds for tax-sensitive investors, blocker corporations, cross-border vehicles—as configuration options rather than bespoke legal work.

Business Model

AngelList operates a hybrid model combining SaaS-like recurring fees with transaction revenue and performance-based carry. Setup fees ($8,000-10,000 per SPV) function as one-time revenue; administrative fees (1% annually, capped at $25,000) provide recurring revenue that scales with fund size; carried interest (5% on platform-sourced capital) creates upside tied to portfolio outcomes.

The cap structures affect unit economics meaningfully. A $10 million Rolling Fund pays $25,000 in annual admin fees—2.5% of AUM going to platform infrastructure before management fees. A $100 million fund pays the same $25,000 cap, or 0.025% of AUM. This creates value at scale for larger managers while maintaining economics for emerging GPs.

COGS include cloud infrastructure, pass-through data licensing for valuations and benchmarking, and third-party service fees for audit coordination and regulatory filings. The company maintains gross margins in the mid-60s to high-70s percent range—below pure SaaS margins due to data and compliance costs, but consistent with fintech infrastructure businesses.

Network effects create expansion leverage: more fund managers attract more LPs seeking deal access; more LPs make the platform more attractive to GPs launching funds. A GP who starts with a single SPV may launch multiple vehicles annually, upgrade to complex fund structures, and add treasury services—expansion revenue without incremental acquisition cost. The company reported that 10% of fund managers participated in its 2022 customer-funded round, suggesting high engagement among core users.

Competition

AngelList competes along a spectrum from enterprise fund administrators targeting institutional allocators to automation-first startups undercutting on price. The strategic question is whether AngelList's investor network and integrated workflows create durable differentiation, or whether fund administration commoditizes as software tooling matures.

Vertically integrated platforms

Carta pursues an acquisition-driven strategy to own the private markets stack. With over $185 billion in assets under administration across 9,000 funds and SPVs, Carta acquired analytics tools Tactyc and Accelex plus loan operations provider Sirvatus to bundle fund administration with portfolio company services.

Carta's leverage is its cap table customer base—portfolio companies already using Carta for equity management create natural distribution to their investors. The company targets enterprise clients with deeper feature sets and multi-year contracts, competing less on price than on breadth.

Juniper Square focuses on real estate and private equity, claiming over 2,000 GPs on its platform after raising $130 million in Series D funding at a $1.1 billion valuation. A partnership with Nasdaq Ventures adds secondary market data and liquidity features that could attract venture managers seeking exit alternatives. Juniper Square's playbook—dominate an adjacent asset class, then expand—presents a flanking threat if venture and PE fund administration converge.

Automation-first challengers

Allocations positions itself as a lower-cost alternative with approximately $2 billion in assets under administration managed by a 40-person team. The company uses AI-generated documents and claims pricing 30-50% below AngelList for simple SPVs—potentially $4,000-5,000 versus $8,000-10,000. Sydecar targets the same emerging manager segment with streamlined fund formation.

These platforms compete primarily on speed and cost for straightforward structures. They lack AngelList's investor marketplace—a GP using Allocations must bring their own LPs—but can undercut pricing for first-time fund managers with small networks and limited capital. The risk for AngelList is that emerging managers who start on cheaper platforms develop workflows that persist as they scale.

Traditional service providers

Legacy fund administrators, law firms, and prime brokers serve larger institutional funds with white-glove service and deep regulatory expertise. They typically require minimum fund sizes of $50-100 million and lack transparent pricing or software-first workflows. These providers retain advantages for complex institutional mandates but struggle to serve the long tail of smaller funds economically.

TAM Expansion

AngelList's $171 billion in assets under administration represents a fraction of the broader private capital infrastructure market. Expansion vectors include new asset classes, geographic markets, and adjacent services that increase revenue per fund manager.

Private equity and alternative assets

The Nova acquisition expanded AngelList into private equity fund administration, targeting buyout, credit, and real asset managers with $1-80 billion in assets under management.

Private equity funds require similar infrastructure—capital calls, valuations, investor reporting—but operate with different fee structures, longer hold periods, and institutional LP bases. This market is larger than venture by AUM but has entrenched incumbents with deep institutional relationships. Nova's existing PE clients provide reference accounts for expanding upmarket.

Treasury and financial services

AngelList Treasury offers network-sweep bank accounts, money market funds, and capital call credit lines to any fund manager—including those not using core administration services. This creates a wedge into funds using competing administrators and adds revenue per customer for existing users. Treasury services represent recurring fee income less tied to fund formation cycles than core administration.

The platform's data on fund performance, capital deployment, and LP behavior creates optionality for lending products, secondary market facilitation, and portfolio analytics. Each service layer increases switching costs and wallet share.

Geographic expansion

AngelList launched an India-specific platform in September 2024 with localized compliance and regulatory capabilities. India's venture ecosystem has grown substantially, with the company already administering assets in the market. International expansion requires adapting to jurisdiction-specific fund structures, tax treaties, and investor accreditation rules—regulatory complexity that creates barriers but also moats once established.

Cross-border fund structures are increasingly common as GPs raise from international LPs and invest globally. Platforms that handle multi-jurisdiction compliance—U.S., Europe, Asia—can capture managers who would otherwise split administration across providers.

Customer segment expansion

Rolling Funds grew 400% from 2020 to 2023 with over 200 public listings, creating a recurring revenue base that churns less frequently than one-off SPV users. These subscription-style funds pay annual fees rather than one-time setup costs.

The platform reports 50% growth in assets under administration to $15 billion in 2022, indicating traction with larger managers. Solo GPs and micro-VCs represent a growing segment as barriers to fund formation decrease—emerging managers who lack existing relationships with traditional administrators and start natively on AngelList's platform.

Risks

Revenue cyclicality and timing mismatch: AngelList's 2024 revenue of approximately $80 million represents a 64% decline from 2022's $224 million, illustrating structural exposure to venture market cycles. Carried interest recognition lags exits by years, creating lumpy income. Fee revenue correlates with fund formation activity, which declined significantly in 2023-2024. Treasury services and PE administration diversify revenue streams but remain smaller contributors.

Competitive squeeze from both directions: Carta's acquisition strategy and enterprise focus creates pressure from above—larger managers may prefer integrated platforms with deeper analytics and institutional LP relationships. Allocations and Sydecar compress pricing from below, potentially capturing emerging managers before they develop scale. AngelList's investor network provides differentiation, but only for managers who need LP access rather than those with established relationships.

Regulatory complexity across jurisdictions: Fund administration operates under SEC oversight in the U.S. with different frameworks internationally. Changes to accredited investor definitions, fund structure requirements, or cross-border investment rules could require material platform modifications. The India launch and other international expansion increase regulatory surface area and compliance costs.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.