Revenue

$1.00M

2023

Funding

$4.70M

2024

Product

Ampersand was founded in 2022 by Lauren Long and Ayan Barua. Long previously led Firebase Extensions at Google, while Barua was formerly VPE at G2 and co-founder/CTO of Siftery.

The core product of Ampersand is a platform that enables SaaS companies to build deep, flexible integrations with systems of record like Salesforce and HubSpot.

Unlike unified API approaches that standardize data schemas, Ampersand focuses on standardizing patterns of interaction while allowing for customization to meet specific customer needs.

Key features include:

1. A declarative framework using YAML configuration files to define integration details

2. Orchestration of reads, writes, and event subscriptions to third-party APIs

3. Embeddable UI components for customer-facing integration setup and management

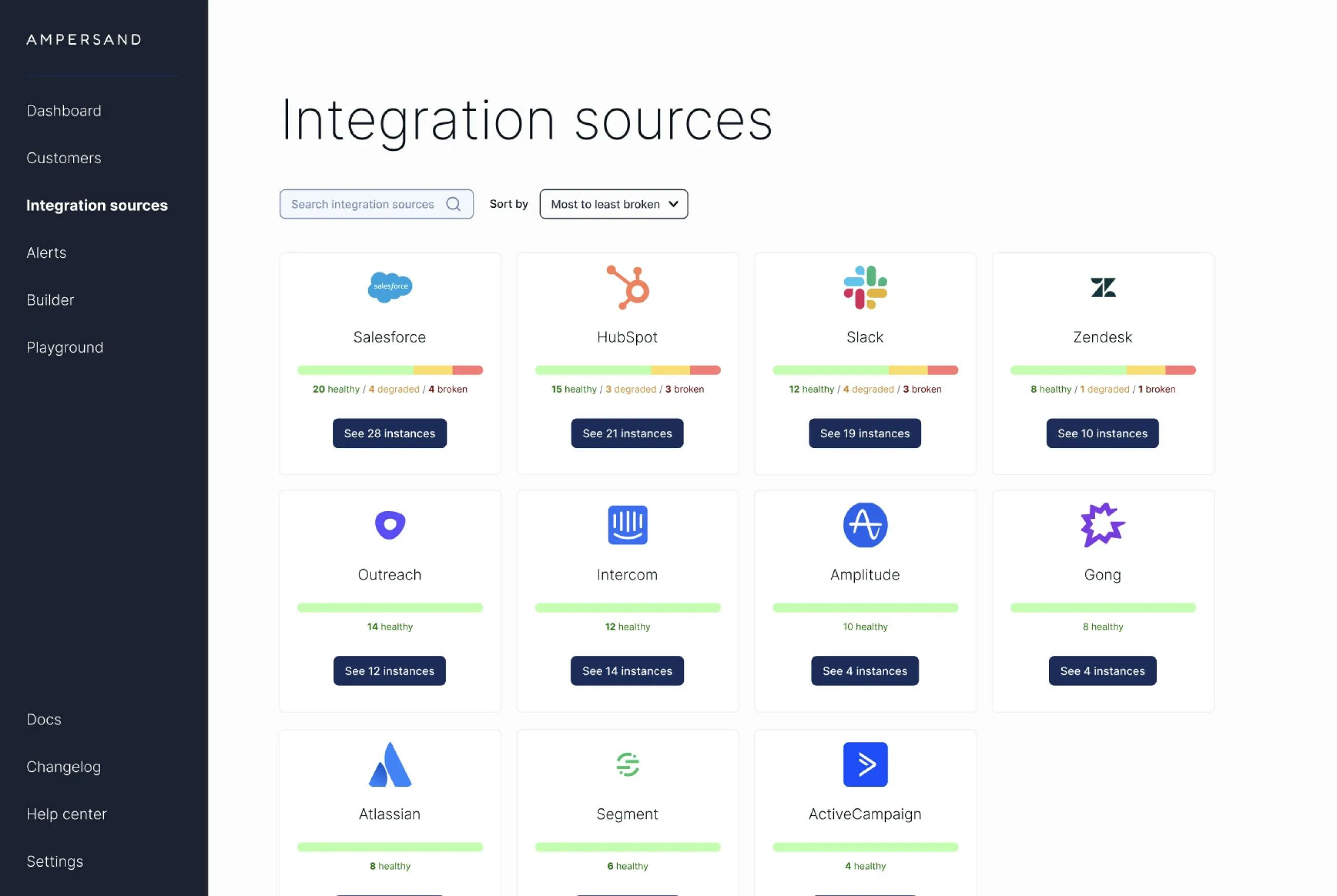

4. A management console providing visibility and troubleshooting capabilities

5. Automated handling of common integration challenges like credential refreshing and API rate limiting

Ampersand differentiates itself from unified API providers by offering more flexible, customer-configurable integrations. Rather than forcing a common schema across different tools, Ampersand allows developers to define separate integrations for each service while standardizing interaction patterns.

The platform is designed to reduce the engineering resources required for building and maintaining custom integrations for the enterprise. It aims to address pain points such as dealing with custom objects/fields, scalability issues, and monitoring challenges that often arise when companies build integrations in-house.

Business Model

Ampersand is a developer platform for SaaS integrations, operating on a usage-based pricing model.

The company generates revenue by charging customers based on the amount of data processed and delivered through their platform, measured in gigabytes. This approach aligns costs directly with the value customers receive, offering flexibility and scalability for businesses of all sizes.

At its core, Ampersand solves the complex challenge of building and maintaining integrations between SaaS products and popular CRM systems like Salesforce and HubSpot.

Ampersand offers a free tier that allows potential customers to start building integrations at no cost, with pricing kicking in once usage exceeds 1 GB of data delivered monthly.

Competition

Ampersand competes with several categories of players in the SaaS integration space, each offering different approaches to solving the challenges of connecting disparate software systems.

Universal APIs

Companies like Merge, Cyclr, and Zapier offer unified APIs that abstract away the complexities of individual integrations. These platforms provide a single API that developers can use to connect with multiple services.

While unified APIs excel in standardizing data across multiple sources, Ampersand positions itself as a solution for deeper, more customized integrations. Ampersand's focus on depth rather than breadth allows it to handle complex enterprise scenarios that may involve custom objects, fields, and large data volumes - use cases that unified APIs might struggle with due to their standardized approach.

Integration Platform as a Service (iPaaS)

Traditional iPaaS providers like MuleSoft, Dell Boomi, and Workato offer comprehensive integration solutions for enterprises. These platforms typically use visual, drag-and-drop interfaces for building integrations.

Ampersand takes a different approach by offering a code-first platform with a declarative framework. This allows for more granular control and better fits the workflow of SaaS engineers who prefer to work directly with code.

Native SaaS Integrations

Many SaaS companies choose to build integrations in-house, dedicating engineering resources to create and maintain connections with other systems. Ampersand competes with this approach by offering a more efficient alternative that reduces the maintenance burden and allows companies to focus on their core product.

By providing features like automatic credential refreshing, rate limit management, and detailed telemetry, Ampersand addresses many of the pain points associated with custom-built integrations.

TAM Expansion

While Ampersand has initially focused on the go-to-market stack, particularly CRM integrations, the company has significant potential to expand its total addressable market (TAM) by moving upmarket and extending its capabilities into enterprise resource planning (ERP) systems and the modern data stack, particularly Snowflake.

ERP

The ERP market represents a significant expansion opportunity for Ampersand. ERP systems are often at the core of enterprise operations and are notoriously complex to integrate with other business systems. Key aspects of this expansion include:

1. Handling increased complexity: ERP systems like SAP or Oracle typically involve more complex data models and business logic than CRMs. Ampersand would need to enhance its platform to handle these intricacies.

2. Supporting on-premises deployments: While cloud-based ERPs are growing, many enterprises still use on-premises ERP systems. Ampersand may need to develop capabilities to integrate with these non-cloud environments.

3. Industry-specific solutions: Many ERP implementations are tailored to specific industries. Ampersand could develop expertise in high-value verticals to differentiate its offering.

Data stack

As enterprises increasingly rely on data warehouses and lakes for analytics and business intelligence, integrating with the data stack becomes crucial. Ampersand could expand in this direction by:

1. Building connectors for popular data warehouses: Developing deep integrations with platforms like Snowflake, Google BigQuery, or Amazon Redshift.

2. Enabling real-time data synchronization: Enhancing its platform to support streaming data integration scenarios, which are becoming more common in modern data architectures.

3. Supporting data transformation: Adding capabilities to not just move data between systems, but also transform it in transit to meet the needs of target systems or analytics use cases.

Risks

1. API Dependency: Ampersand's core value proposition relies on integrating with third-party APIs, which it does not control. Changes to these APIs, especially major platforms like Salesforce or HubSpot, could disrupt Ampersand's service. While Ampersand aims to abstract away API complexities, significant changes may still require updates to their system, potentially causing service interruptions or increased development costs.

2. Market Education Challenge: Ampersand's approach differs from existing unified API solutions, potentially requiring significant market education. Convincing developers to adopt a new integration paradigm, especially when alternatives exist, may prove challenging and slow adoption rates. This could impact growth projections and require higher than anticipated sales and marketing spend.

3. Enterprise Sales Complexity: As Ampersand targets larger enterprises, they may face challenges in scaling their sales process. Enterprise sales cycles are typically longer and more complex, requiring different skills than selling to startups or SMBs. Ampersand may need to invest heavily in building an enterprise sales team and adjusting their product offerings, potentially straining resources and delaying profitability.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.