Revenue

$5.00M

2023

Funding

$27.00M

2024

Product

Alloy was founded in late 2019 by engineers Sara Du and Gregg Mojica as a side project to make automation accessible to non-technical users. Initially marketing multiple use cases, Alloy launched on Product Hunt in early 2020 and participated in Y Combinator's W20 batch, raising a $1 million pre-seed round.

Post-YC, Alloy found product-market fit by verticalizing into ecommerce automation, coinciding with the pandemic-driven ecommerce boom. The company built out a content team to educate merchants on automation and developed an automation templating system for ecommerce-specific use cases.

Alloy's "Switzerland" positioning in the ecommerce SaaS ecosystem, offering deeper integrations than competitors like Zapier, attracted both established players (e.g., Gorgias, ReCharge) and emerging apps seeking high-quality merchant leads. By 2022, Alloy had grown to thousands of customers in two years.

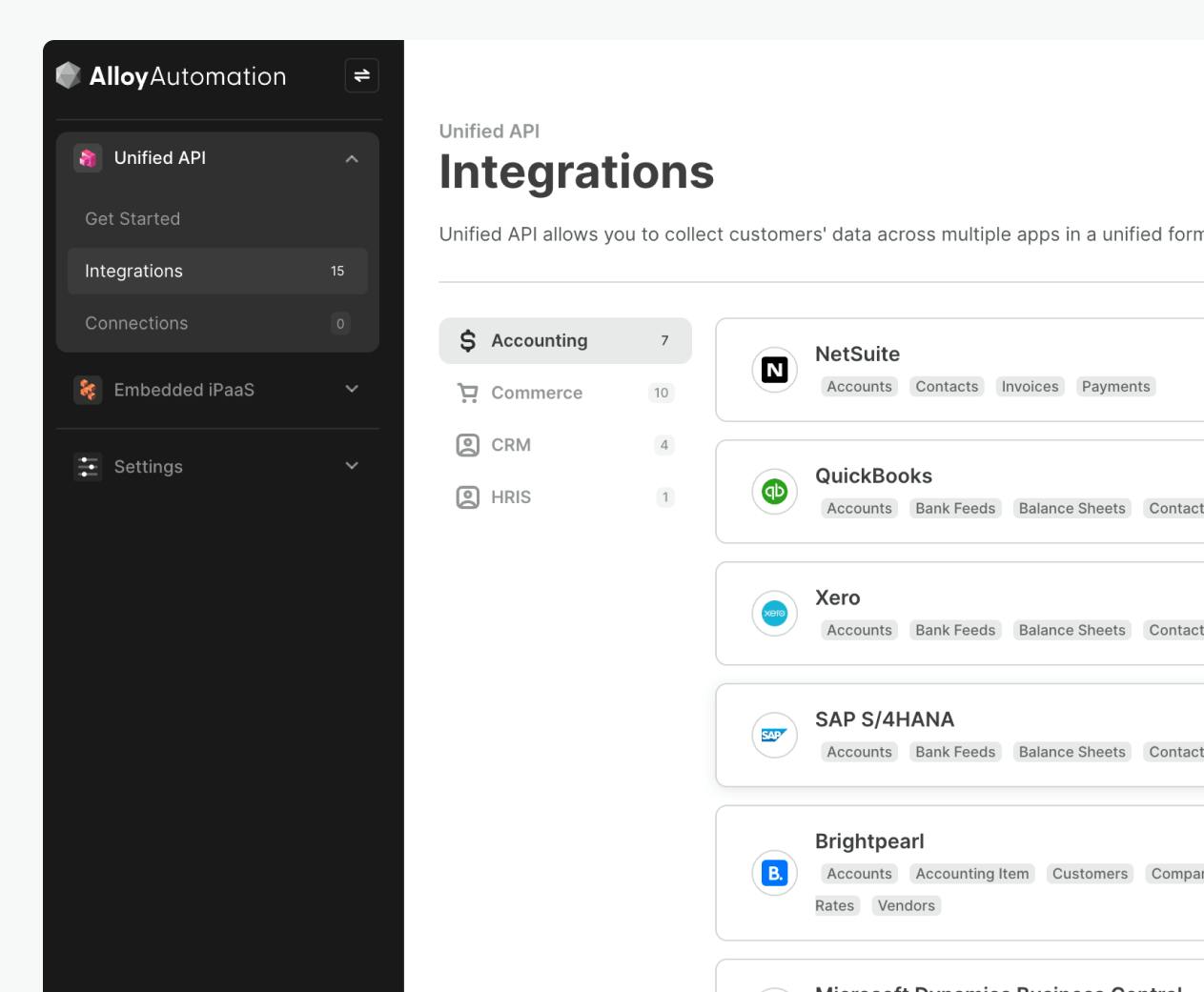

Since then, Alloy has retooled as a horizontal "universal API" platform, providing a comprehensive iPaaS and embedded iPaaS with use cases across all aspects of integration development.

Business Model

Alloy is a subscription SaaS company that provides an embedded integrations platform for engineering and product teams. The company generates revenue through a tiered pricing model based on the number of integrations and level of customization required by customers.

At its core, Alloy offers a low-code integration builder and Connectivity APIs that allow businesses to quickly integrate with their customers' critical applications. The platform's value proposition lies in simplifying and accelerating all aspects of integration development, from user customization to polling infrastructure. This approach addresses the growing need for efficient integration solutions in an increasingly fragmented SaaS landscape.

Alloy's business model has evolved from its initial focus on ecommerce automation to a more horizontal approach serving various industries. This pivot has expanded its potential market and positioned the company as a universal API provider.

Competition

Alloy competes with several players in the universal API and iPaaS (Integration Platform as a Service) space, primarily focusing on embedded integrations for B2B SaaS companies.

Universal APIs

In this category, Alloy faces competition from companies like Merge and Rutter. These platforms offer unified APIs that simplify integration with multiple third-party applications.

Merge, for instance, provides strong integration coverage in areas like HRIS and ATS systems. Alloy differentiates itself by offering more extensive customization options and a focus on user-facing, configurable integrations. While universal APIs excel at quick, standardized integrations, Alloy's approach allows for more complex workflows and deeper functionality, covering up to 80% of integration needs compared to the 20-30% typically addressed by universal APIs.

Embedded iPaaS Providers:

Here, Alloy competes with companies such as Paragon, Prismatic, and Workato. These platforms offer customizable integration experiences for B2B SaaS companies.

Alloy sets itself apart through its developer-first approach, providing more granular control over edge cases and failure handling.

This is particularly appealing to engineering teams who require deeper customization and control. Alloy's focus on enterprise integrations and its agility in rolling out new integrations quickly have helped it win customers in this space.

Traditional iPaaS and Automation Platforms:

In the broader iPaaS market, Alloy competes with established players like Zapier and newer entrants like Tray.io. While these platforms offer wide-ranging integration capabilities, Alloy's advantage lies in its specialization in user-facing, configurable integrations for software companies.

Alloy's embedded iPaaS solution allows companies to own their integrations rather than referring users to third-party platforms like Zapier.

Alloy's competitive strategy involves positioning itself as a more developer-friendly and customizable solution compared to universal APIs, while offering deeper integration capabilities than traditional iPaaS platforms.

The company's background in ecommerce automation has informed its approach to building a flexible, extensible platform that can handle complex integration scenarios.

TAM Expansion

Alloy has tailwinds from the proliferation of SaaS applications and increasing demand for seamless integrations, and has the opportunity to grow and expand into adjacent markets like enterprise workflow automation and data orchestration.

SaaS Integration Ecosystem

The explosive growth of the SaaS ecosystem presents a significant opportunity for Alloy. As businesses adopt more cloud-based applications, the need for efficient integration solutions becomes critical. Alloy's embedded integration platform allows software companies to quickly build and maintain integrations with other SaaS applications, positioning them to capture a growing share of this market.

The average company now uses over 100 SaaS applications, a 38% increase from 2020. This trend shows no signs of slowing, creating an ever-expanding addressable market for Alloy. By focusing on developer-friendly tools and a wide range of pre-built integrations, Alloy can become the go-to solution for companies looking to enhance their products with robust integration capabilities.

Alloy's potential to expand goes beyond just adding more integrations. As they build relationships with both SaaS providers and the companies using their platform, they can leverage this network to create additional value-added services. For instance, they could develop analytics tools that provide insights into integration usage and performance, helping their customers optimize their products and integration strategies.

Enterprise Workflow Automation

An adjacent market that Alloy could expand into is enterprise workflow automation. While their current focus is on enabling product integrations for SaaS companies, there's a natural progression towards helping enterprises streamline their internal processes across multiple applications.

By leveraging their expertise in connecting different software systems, Alloy could develop tools that allow non-technical users within enterprises to create complex workflows spanning multiple applications. This would position them to compete in the rapidly growing iPaaS (Integration Platform as a Service) market, which is projected to reach $61.67 billion by 2030.

Data Orchestration and Management

Another potential avenue for expansion is data orchestration and management. As companies grapple with data spread across numerous SaaS applications, there's a growing need for solutions that can unify and manage this distributed data landscape.

Alloy could leverage its integration infrastructure to build data pipelines that extract, transform, and load data from various sources into centralized data warehouses or lakes. This would allow them to tap into the booming data management market, which is expected to reach $208.87 billion by 2028.

Risks

1. Commoditization of integration platforms: As universal APIs and embedded iPaaS solutions proliferate, Alloy faces the risk of commoditization. The company's initial focus on ecommerce automation has expanded to a more horizontal approach, potentially diluting its competitive advantage.

If larger players like Zapier or emerging startups develop more robust ecommerce-specific features, Alloy could struggle to differentiate its offering, impacting growth and pricing power.

2. Dependency on partner ecosystem: Alloy's value proposition heavily relies on its extensive partner network and pre-built connectors.

However, this creates a potential vulnerability if key partners decide to build native integrations or exclusive partnerships with competitors. Alloy could mitigate this risk by continually expanding its ecosystem and deepening relationships with existing partners.

3. Scaling challenges in enterprise market: As Alloy shifts focus towards larger enterprises, it may face difficulties in adapting its product and go-to-market strategy.

The company's roots in serving smaller ecommerce businesses could result in feature gaps or support limitations when catering to complex enterprise needs. Successfully navigating this transition will be crucial for Alloy's long-term growth and profitability in the competitive iPaaS market.

News

DISCLAIMERS

This report is for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise constitutes a personal trade recommendation to you.

This research report has been prepared solely by Sacra and should not be considered a product of any person or entity that makes such report available, if any.

Information and opinions presented in the sections of the report were obtained or derived from sources Sacra believes are reliable, but Sacra makes no representation as to their accuracy or completeness. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a determination at its original date of publication by Sacra and are subject to change without notice.

Sacra accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises under specific statutes or regulations applicable to Sacra. Sacra may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect different assumptions, views and analytical methods of the analysts who prepared them and Sacra is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report.

All rights reserved. All material presented in this report, unless specifically indicated otherwise is under copyright to Sacra. Sacra reserves any and all intellectual property rights in the report. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Sacra. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any report is strictly prohibited. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of Sacra. Any unauthorized duplication, redistribution or disclosure of this report will result in prosecution.