Questions

- Would you say banking as a service is the same as an issuer processor? Sometimes these two terms are used interchangeably...

- So banking as a service is broader and the issuer processor is one segment within?

- If we think about companies like Synapse, Marqeta, Productfy, Unit, Bond, would you say all these companies are banking-as-a-service or issuer processors?

- What’s hard to build in the 2.0 model?

- Some companies in this 2.0 world start to achieve higher growth. What do you think about the competitive dynamics and market structure?

- You were describing this underlying tension, how for BaaS platforms to be competitive, they need to focus on a very narrow dimension; whereas, their FinTech partners, for them to be competitive, they need to offer a lot of products to attract the end consumers. Is that right?

- So you touched on customer mix and who would be ideal clients to serve. If we switch back to FinTech. Do you see a trend where larger consumer-facing FinTech would want to capture more of the value chain? And in order to do that, they will build more in-house?

- Could you please speak about the global partner network, i.e. what kind of partnerships do companies need in order to expand their footprint?

Interview

Would you say banking as a service is the same as an issuer processor? Sometimes these two terms are used interchangeably...

Technically no. It's a little bit broader. The processor or an issuer can actually be even something like a bank itself. So the banking as a service, in general, is an abstraction layer over an existing bank that includes technology software, APIs, and usually sits on top of a bank core. There's a few cores out there, right? Jack Henry, Fiserv, FIS.

Some banks have tried to build it. A lot of technology companies are building it, but it's a little bit different than a processor or as an issuer. A banking-as-a-service solution can be a processor or can be an issuer, but it's a larger set, I would say.

So banking as a service is broader and the issuer processor is one segment within?

Yeah. Issuer processors are essentially all those defined roles within banking. An institution can be an issuer and processor. And with that, they can have banking-as-a-service features that enable that. But the term issuer processor is not related to banking-as-a-service. In general, it relates to the types of roles that an institution plays within the financial transaction. The banking-as-a-service layer, if you will, can actually encompass being an issuer processor to make it easier, essentially, to do.

If we think about companies like Synapse, Marqeta, Productfy, Unit, Bond, would you say all these companies are banking-as-a-service or issuer processors?

Good question. Marqeta is definitely a processor. They are basically the company that initially partnered with a bank. They built card rails. They integrated with Visa and MasterCard, a bunch of other networks. And they're basically taking the role of processor, but they're making it easier for other FinTechs or non FinTechs to take a card to market. So in some ways they are a processor, but they're also a banking-as-a-service provider because they're making it easier versus your traditional processors in the banking space that may not necessarily have easy to use integration layers on top.

So in Marqeta's case, the notion of a banking-as-a-service is that you're essentially making it or trying to make it easier for non-bank companies to launch financial products. If you're a processor and you have a layer on top and you're between them and the bank, you are a banking-as-a-service provider. In Marqeta's case, they happened to be a processor, making it easier to get cards to market.

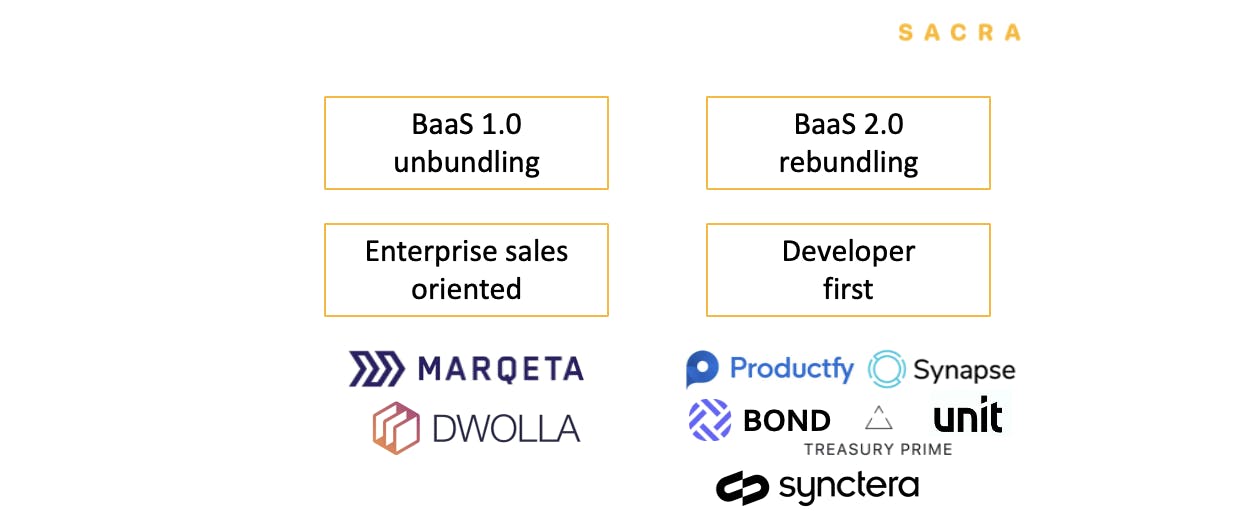

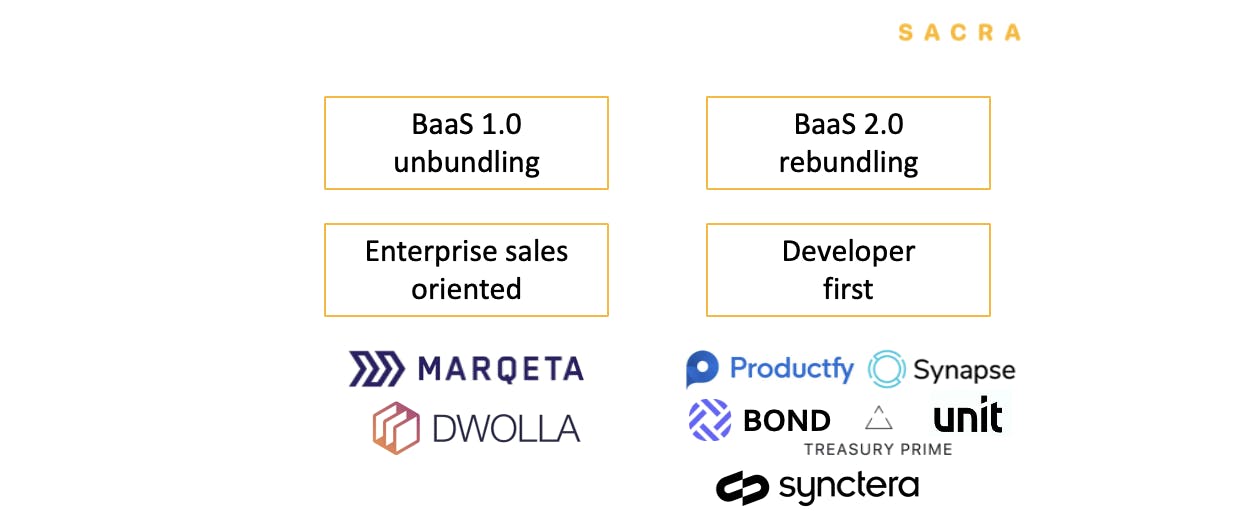

And that's essentially the first model of banking-as-a-service, which is do one thing easily and get out to market. If you actually look at Dwolla, Dwolla is also a sort of a 1.0 banking-as-a-service provider, they have the bank and they make ACH easier. Because essentially you don't have to go to a bank partner to do ACH. You can go to Dwolla and they're very easy to integrate widgets and modules and things like that. So any layer where it's an abstraction layer, is essentially banking-as-a-service.

How do they play their roles within banking-as-a-service, designate them as processors? In Dwolla's case, I believe they're a payment processor. And then if you want them to start your e-commerce company and build on top of Dwolla, you're using Dwolla essentially as a payment processor, but you're basically not a payment processor, you're just basically an e-commerce or a FinTech.

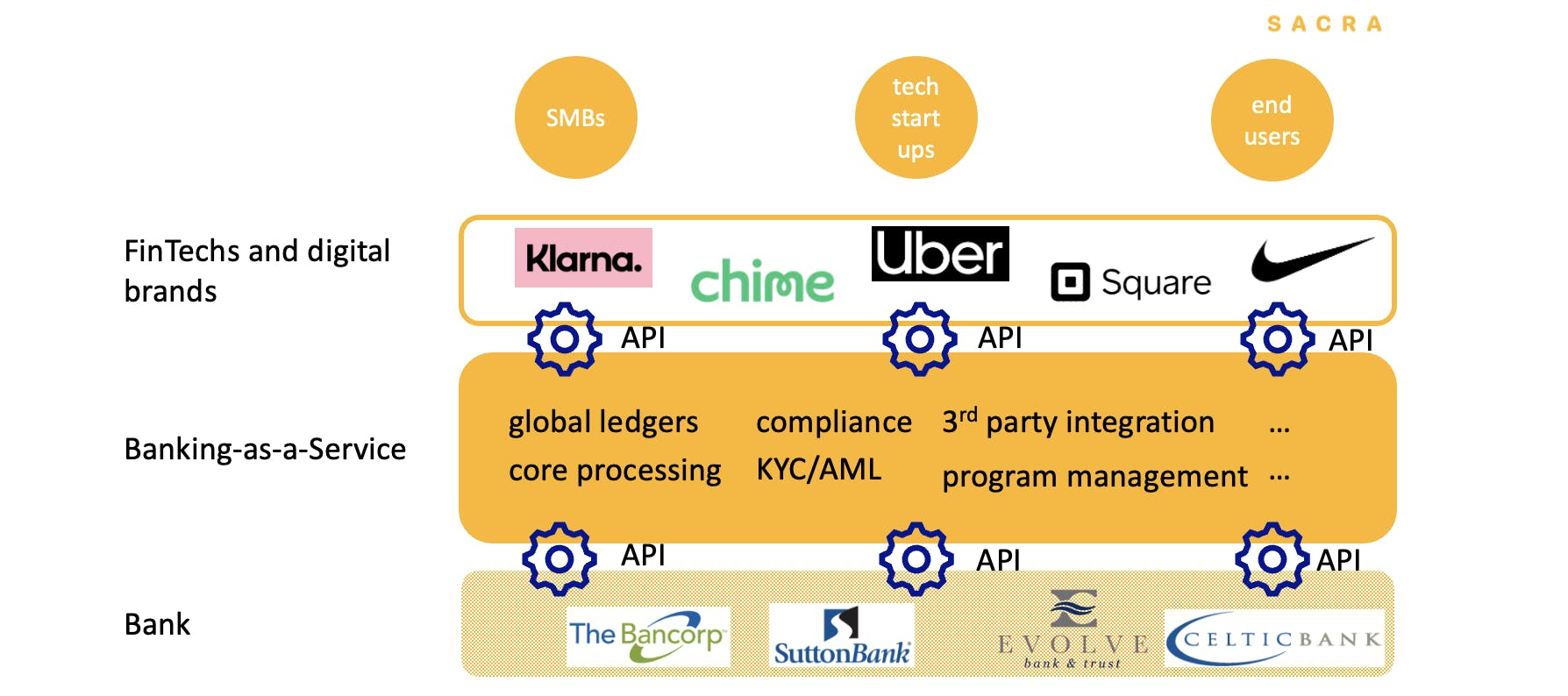

So banking-as-a-service is a higher layer here. Within that, the goal of banking-as-a-service is making it easier. It's really hard today to talk to a bank because banks are hard to talk to. They don't have good technology and they have a bunch of compliance and program requirements. If you are starting here and you want to build a FinTech site for making it easier for men and women, between 20 and 30 years old in New York to save money with their credit cards, you focus on that. You partner with banking-as-a-service, they plug into the bank. So you don't have to basically figure out all the bank stuff and you can focus on your business.

Now, if you need a processor, because you want to issue or launch a debit card, you need Marqeta. If you want to handle payments, you need Dwolla, right? So they each have their different roles within the banking-as-a-service, but essentially you would go to them for those certain things.

Now the 2.0 banking-as-a-service model is now like Unit, Synapse, Productfy, which try to be all of them. We will basically be a processor, payment company, bank accounts, even lending, they'll try to aggregate all of them into a single platform. That's the 2.0 version, which is the 1.0 version is Marqeta, Dwolla doing one thing pretty well. The 2.0 version is everyone saying, "Well, if you come to me and you're trying to build your FinTech app, you need payments, you need bank accounts, you need debit cards, you might even need rewards for crypto currency." Whatever that is, I'll give you this layer here, and then you focus on what you want to build. And we'll basically just aggregate everything for you into a bunch of APIs that you guys can basically use. So that's the 2.0 model, we are now building on top of the banks. We're also plugged into Marqeta so that you don't have to go to Marqeta and Dwolla and Visa, MasterCard, whatever. And so that's our layer, which is, we are the 2.0 layer, which essentially all in one, if you will.

What’s hard to build in the 2.0 model?

All of it. It's all very hard. I mean, it's hard on a bunch of sides, which is you have to integrate compliance as a service. You can't just launch something. There are certain requirements with regulations. So number one.

The technology is challenging because you have to plug into a bank system that's very old school. It's old file feeds, legacy architecture at banks. You have to translate that into a modern API for FinTech's to build off of.

And then you have to integrate the compliance into your solution. So that if you are wanting to basically launch your financial storefront, you would basically be safe from regulation because you're not an expert either in banking or regulation. And we have to take care of both of those things. And we have to bake in those rule sets programmatically into our operations. On one side we have bank operations. We're basically becoming a bank layer on top of a bank.

And so you're essentially building a 2.0 Bank layer that encompasses all the operations that banks have to do by regulation. Every day, this file must be sent out by 1:00 PM. If there are errors, this must happen. If a customer comes to you and says, "Hey, I didn't pay for this." Right? This gets initiated with us, we go to MasterCard. MasterCard goes to the store, "Hey, did this customer pay for this?" Yes? No?

So there's a lot of these mechanisms that go from us to the bank, us to the FinTech, and then the FinTech, your storefront you have a bunch of customers, what happens when they basically have issues? And how do we handle them? Who handles support? How do you print out all the cards? How do the cards get printed out in mails? Who sends out the bank statements every month as required? So a lot of it comes down to the technology, the regulatory and making the experience as consumer friendly as possible. And it's a design and an architecture challenge at the same time.

And you don't have that much money to do it with. You only have about a year, a year and a half to figure it all out before you run out of money.

Some companies in this 2.0 world start to achieve higher growth. What do you think about the competitive dynamics and market structure?

I don't think anyone's actually reached scale yet. I think there's a difference between companies that have reached some scale. Treasury Prime and Unit, each have actually a handful of customers. In fact, in Unit's case, they raised about 51 million. They have about six clients.

This is actually more of an issue with the capital markets right now, which is the money is looking for a deal. If you are looking at this 10 years ago, all these companies would actually be still at seed stage. We wouldn't be at series B or series C. So there's more money flooding in, but the market validation and scalability is still not necessarily figured out.

Now, I think Synapse is the farthest along because they've raised earlier and they've come out to market later, but you can do a Google search on them and see what issues they've had. I know they've had some issues.

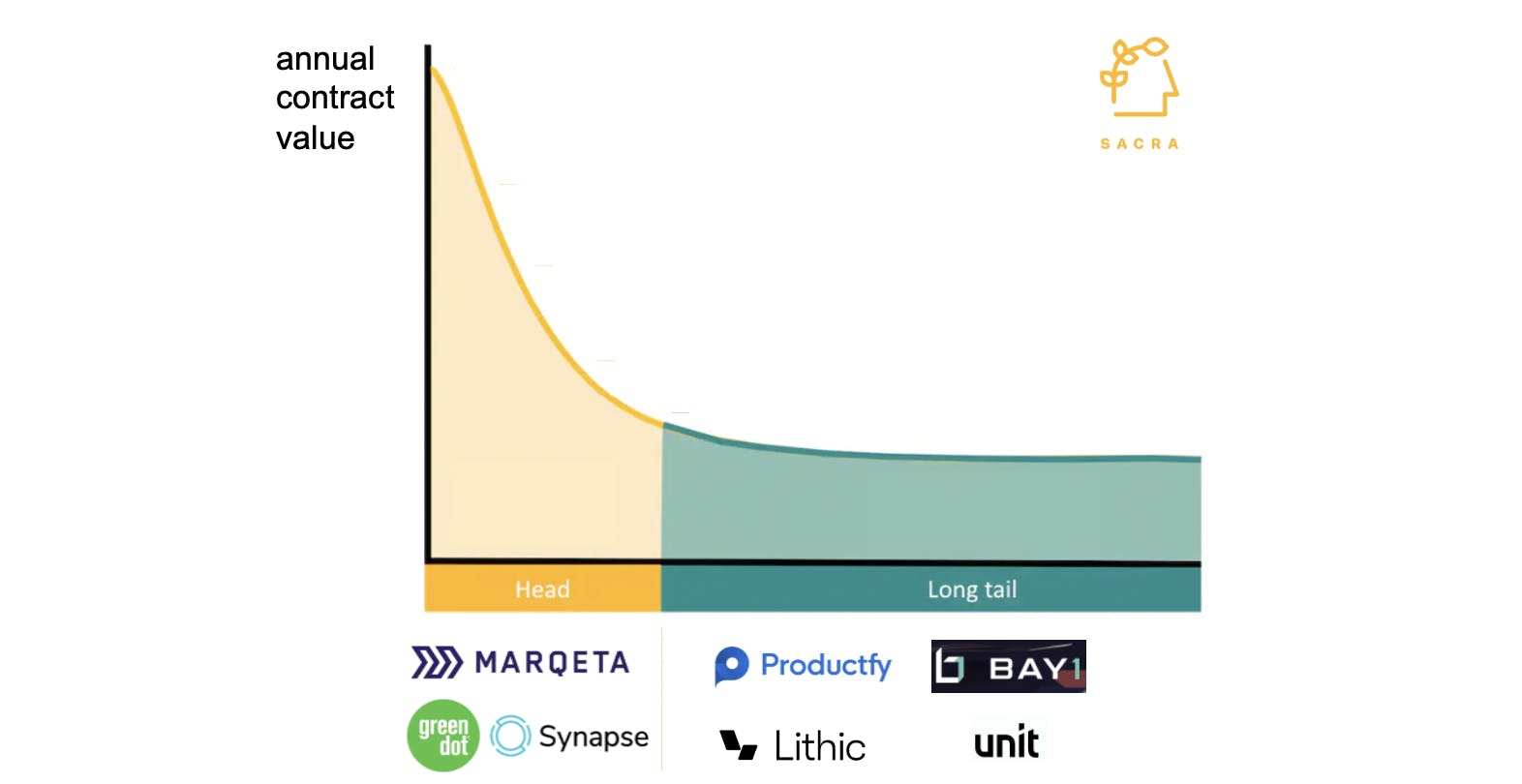

Galileo essentially came out and said, "We will do this thing right here," If you want to do something here or something here, we can't handle it, right? And the challenge right now is the market says, "Well, if everyone does this, then how do you compete with your competitors, right? So the challenges is that if all these banking as a service providers are trying to scale, what happens with scale is that they constrain what you can do.

If you're a FinTech and you're trying to compete, you want to come to us and say, "I want to do exactly this thing, because I know what it is going to take to compete." And if we can't do it, then you will basically go and have to basically find your own bank partner. This is basically the biggest, I think, challenge with any scalable platform is once you scale, you remove competitive advantage. If you want to compete, you build your own program.

And if you are trying to figure out how the ecosystem scales, you actually have to reconcile this. But I would say that in my mind, there are no market leaders right now. And for banking-as-a-service, there are companies that have a lot of mind share, but not as much traction as you would see in other circumstances like Square.

All these big FinTechs that you would ask, "Well, why don't they have a banking-as-a-service provider if it's so tough?" It's because they have to have complete control over almost every aspect of their program. And because of that, they have to basically go directly to a bank. If you're a banking-as-a-service provider, if you take on Square, like Marqeta, you'll only have one large client because they will manage your roadmap with all the requirements that they have.

The bigger question is how scalable is banking-as-a-service? Honestly, I'm just being transparent here, which is at some threshold, you become a banking-as-a-service provider. And at what point do you become a tech vendor? And I think that's the biggest issue that you have to think about, but I don't think that there's any banking-as-a-service vendor out there that truly is a market leader, because either you become a very high-end professional services company like Green Dot or Q2 or Synapse, or you try to basically do what Galileo and Unit and Productfy are doing, which is aggregate the long tail, all the hundreds of thousands of FinTechs, and basically try to monetize on the 10 to 20% of them that are going to start to grow up and become larger and larger and larger.

You were describing this underlying tension, how for BaaS platforms to be competitive, they need to focus on a very narrow dimension; whereas, their FinTech partners, for them to be competitive, they need to offer a lot of products to attract the end consumers. Is that right?

I would say, not necessarily a lot of products, but a more innovative program. So for instance, mostly FinTech is about bending the rules, not breaking them, right? And so how do you scale a program that bends the rules? You come out with your own, you study what other companies have done, and you basically build your business model off of the next most risky model that you think is safe enough. And there's no middle ground to really think about and you have to convince someone that this is basically possible.

Now, anytime you want to do that, if you go to a banking-as-a-service provider, they'll say, "Well, we have this. Right? Well, you want this, how do we get there?" Now, if a banking-as-a-service provider is large enough, they will start to expand over time.

But my question is, are we expanding fast enough to catch up to the market? When you look at what's happened in the last year, you have COVID, which basically blew up the market and then Crypto, which is blowing up the market and if you see all these trends happening in a year, how do you market size every single year make sure you catch up with what the trends are?

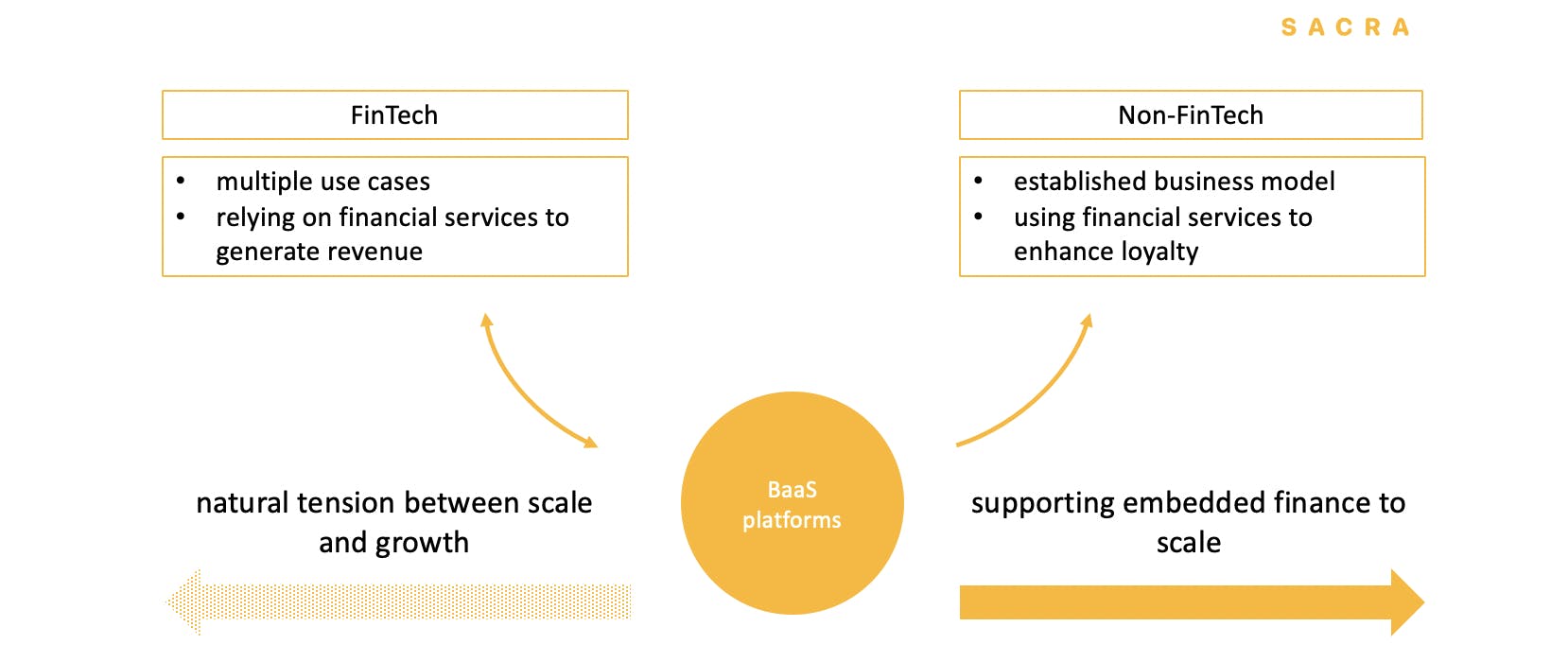

On one hand, if you have to fund the FinTech, you want to fund a FinTech that actually captures where the market is going to be in six months or a year, right? That's where your funding mechanism is. Your BaaS vendors would like to be here, but they have to build for multiple use cases. They can't just build for your single use case. So if your single use case has a larger addressable market, then the BaaS provider will build for it. But then the question is, where's your differentiator if you build into that program? That's one of the challenges, if you're really innovative, you should go to a bank partner and convince them.

The second thing I will say is that, that's also why for a lot of banking-as-a-service, the whole go to market is essentially not FinTech itself. It's actually what they call financial services moving to the edge, which is I've got a standard set of features and I'm going to go to Nike, or Nordstrom. And they don't really care about innovating in FinTech because they already know who their consumers are and they already make a lot of money on this.

If you add a debit card here, it'll increase my brand loyalty. I can run a rewards program… So another slice of banking-as-a-service is different financial services are moving to the edge.

So we know that FinTech is important, but we see the inherent challenges with the model, with just FinTech. The model needs to move towards, can we actually work with companies like Nike or Nordstrom or non FinTechs? Because they're not looking to innovate too much on financial services. They're looking at financial services as a cross marketing opportunity, not as a revenue generating line of business. So that's why I think some of the movement is there and you will see some companies, they don't call themselves banking-as-a-service, but that's essentially where they're going, they're going over there because they see that, that's where potentially this model will actually scale.

So you touched on customer mix and who would be ideal clients to serve. If we switch back to FinTech. Do you see a trend where larger consumer-facing FinTech would want to capture more of the value chain? And in order to do that, they will build more in-house?

They might want to. I guess, the question is, do they want to become a FinTech? I think the other way around is more like the Green Dot model where they're a bank and they want to capture more of the value chain through banking-as-a-service. I can't imagine that non-financial services or non FinTech companies want to become more like a FinTech because it's just not within their culture and it's not inherent to their business model to actually do it that way.

Could you please speak about the global partner network, i.e. what kind of partnerships do companies need in order to expand their footprint?

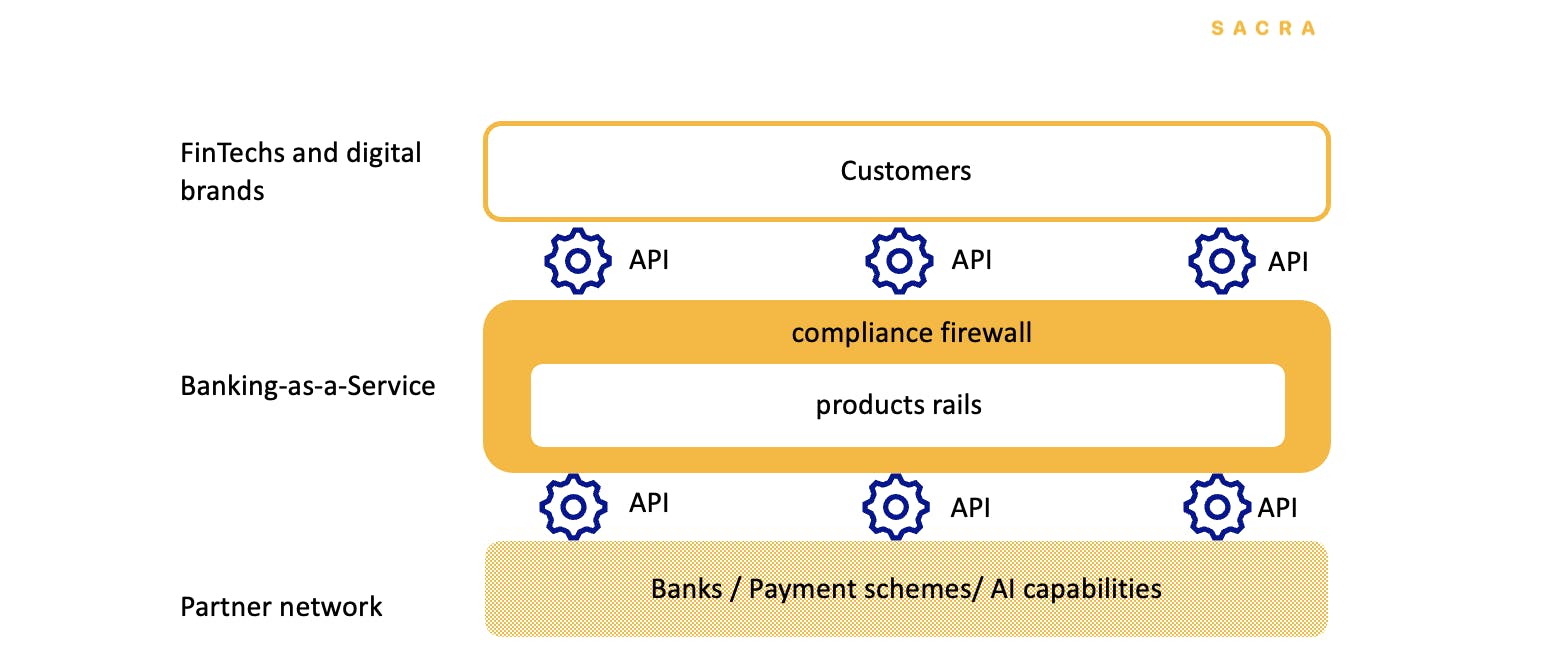

I think the first thing is probably cross-border payments. You need a sender, a receiver, and originator. And if it's outside of the US or international, then you have that mechanism to facilitate that. I think that's the biggest thing.

And I think getting all those types of banks set up is challenging because then you're actually probably setting up domiciles entities in other countries. And you're sort of trying to route funds via those entities into existing payment networks and existing payment rails.

So I know that there's a bunch of banking-as-a-service in India, Europe, even South America that actually have a lot less regulation and are actually more advanced. I think they're the ones that are going to go global, not necessarily for the US but they will probably be able to basically go cross border faster, because they're probably going to build a network of low regulatory countries' faster than a highly regulated US-based banking as a service provider can spread out into other types of jurisdictions.

Disclaimers

This transcript is for information purposes only and does not constitute advice of any type or trade recommendation and should not form the basis of any investment decision. Sacra accepts no liability for the transcript or for any errors, omissions or inaccuracies in respect of it. The views of the experts expressed in the transcript are those of the experts and they are not endorsed by, nor do they represent the opinion of Sacra. Sacra reserves all copyright, intellectual property rights in the transcript. Any modification, copying, displaying, distributing, transmitting, publishing, licensing, creating derivative works from, or selling any transcript is strictly prohibited.

Nan Wang

Nan Wang